par energy_isere » 30 juil. 2022, 15:28

Australian coal output to remain flat in 2022, mainly due to scheduled closures

Output will be affected by the gradual closure of some mines but will be balanced by the commencement of other projects.

July 27, 2022

Following a 3.5% increase in 2021,

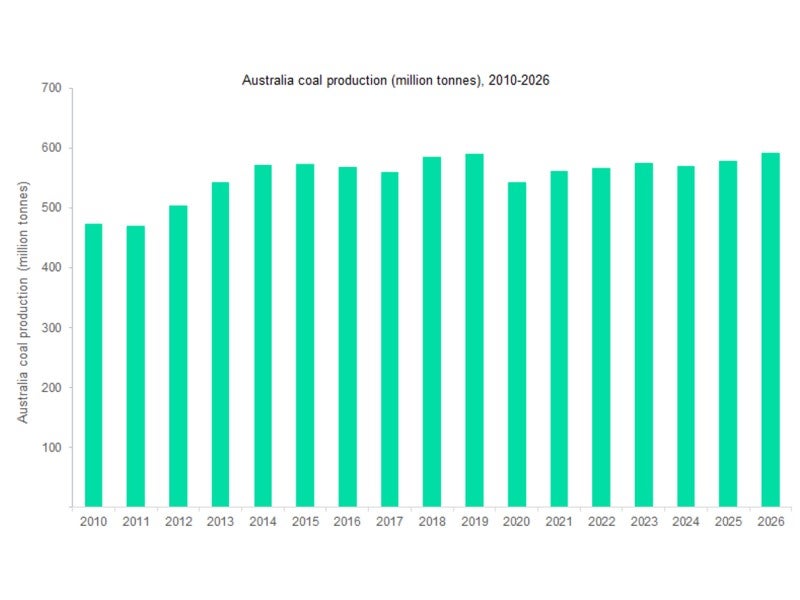

Australian coal mine production is expected to remain flat at 565.1 million tonnes (Mt) in 2022. Floods in New South Wales (NSW) and Queensland, as well as a sharp increase in Covid-19 cases, disrupted output during Q1 2022. However, production in the rest of 2022, will partially be supported by the Adani Group’s Carmichael mine in Queensland, which started production in 2021. In addition, successful completion of a complex longwall at BHP’s Broadmeadow site, as well as maintenance at its Caval Ridge plant, are expected to support production improvements.

In recent years, coal mines in Australia, particularly in the Hunter Valley, have been facing legal hurdles. As a result, proposed thermal coal projects have been withdrawn or abandoned. For instance, Shenhua’s Watermark project was cancelled in April 2021, with the NSW Government compensating the company $100m in exchange for relinquishing development rights at the site. According to Australia’s Department of Industry, Science, Energy and Resources, 37 coal projects were at the feasibility stage as of December 2021, and several of them have been postponed due to a lack of funding. Future investment decisions will be highly influenced by the push against coal-fired power generation, as the Australian Government has committed to net zero emissions by 2050.

Furthermore, the new government has set a 2030 emissions reduction target of 43% versus 2005 levels, which is a more optimistic outlook compared to the previous government’s target of 26% to 28%. It intends to accomplish this by gradually reducing the number of large-scale carbon emitters, such as energy and resource industries. However, despite this, new coal mines have recently been approved in Australia. For example, Adani’s Carmichael coal mine project in Queensland’s Galilee Basin was approved in June 2019, after nine years of political debate. In addition, Anthony Albanese, Australia’s new Prime Minister, has sworn to end the country’s climate wars, set more aggressive carbon targets and establish a federal corruption watchdog, but he has refused to phase out coal use or block the building of new coal mines.

Over the forecast period (2022-2026), Australian coal mine production is expected to remain flat at a compound annual growth rate (CAGR) of 1.1%, reaching 590.8Mt in 2026. Output will be affected by the gradual closure of the mines Muswellbrook (2022), Glendell (2022), Tahmoor Complex (2022), Duralie (2022), Werris Creek (2025) and Kogan Creek (2026), although it will be balanced with the expected commencement of projects such as the Olive Downs South mine (2023) and the Vickery project (2025).

https://www.mining-technology.com/comme ... tput-2022/[quote] [b][size=120]Australian coal output to remain flat in 2022, mainly due to scheduled closures[/size]

Output will be affected by the gradual closure of some mines but will be balanced by the commencement of other projects.[/b]

July 27, 2022

Following a 3.5% increase in 2021, [color=#FF0000]Australian coal mine production is expected to remain flat at 565.1 million tonnes (Mt) in 2022[/color]. Floods in New South Wales (NSW) and Queensland, as well as a sharp increase in Covid-19 cases, disrupted output during Q1 2022. However, production in the rest of 2022, will partially be supported by the Adani Group’s Carmichael mine in Queensland, which started production in 2021. In addition, successful completion of a complex longwall at BHP’s Broadmeadow site, as well as maintenance at its Caval Ridge plant, are expected to support production improvements.

In recent years, coal mines in Australia, particularly in the Hunter Valley, have been facing legal hurdles. As a result, proposed thermal coal projects have been withdrawn or abandoned. For instance, Shenhua’s Watermark project was cancelled in April 2021, with the NSW Government compensating the company $100m in exchange for relinquishing development rights at the site. According to Australia’s Department of Industry, Science, Energy and Resources, 37 coal projects were at the feasibility stage as of December 2021, and several of them have been postponed due to a lack of funding. Future investment decisions will be highly influenced by the push against coal-fired power generation, as the Australian Government has committed to net zero emissions by 2050.

[img]https://www.mining-technology.com/wp-content/uploads/sites/19/2022/07/Australia-Coal-Mines.jpg[/img]

Furthermore, the new government has set a 2030 emissions reduction target of 43% versus 2005 levels, which is a more optimistic outlook compared to the previous government’s target of 26% to 28%. It intends to accomplish this by gradually reducing the number of large-scale carbon emitters, such as energy and resource industries. However, despite this, new coal mines have recently been approved in Australia. For example, Adani’s Carmichael coal mine project in Queensland’s Galilee Basin was approved in June 2019, after nine years of political debate. In addition, Anthony Albanese, Australia’s new Prime Minister, has sworn to end the country’s climate wars, set more aggressive carbon targets and establish a federal corruption watchdog, but he has refused to phase out coal use or block the building of new coal mines.

Over the forecast period (2022-2026), Australian coal mine production is expected to remain flat at a compound annual growth rate (CAGR) of 1.1%, reaching 590.8Mt in 2026. Output will be affected by the gradual closure of the mines Muswellbrook (2022), Glendell (2022), Tahmoor Complex (2022), Duralie (2022), Werris Creek (2025) and Kogan Creek (2026), although it will be balanced with the expected commencement of projects such as the Olive Downs South mine (2023) and the Vickery project (2025).

[/quote]

https://www.mining-technology.com/comment/australian-coal-output-2022/