par energy_isere » 13 avr. 2024, 22:19

une autre vidéo de Aaron Witt, cette fois au Chili, une mine de cuivre de CODELCO.

Visiting the World's BIGGEST Copper Mines! vidéo 8 mn

https://www.youtube.com/watch?v=-TfLA_jfa0Y

Aaron Witt

290 k abonnés

64 319 vues 23 déc. 2023

Copper is among the world's most valuable metals. It's primary use—conducting electricity for billions of people.

Without it, your phone, home, and car would be worthless. And as society evolves, demand is only going in one direction. And not only is it growing, but experts expect copper demand to double within the next decade.

Which brings me to Chile... The world's largest copper producer. Mining is a cornerstone of Chile's economy, as most of what it produces ends up in many other countries worldwide.

In June, we visited CODELCO's DMH mine outside of Calama in the Atacama Desert, thanks to the help of Finning Caterpillar. It was AWESOME.

As a hard rock operation, they drill, blast, load, and haul copper ore, finally processing it into copper concentrate.

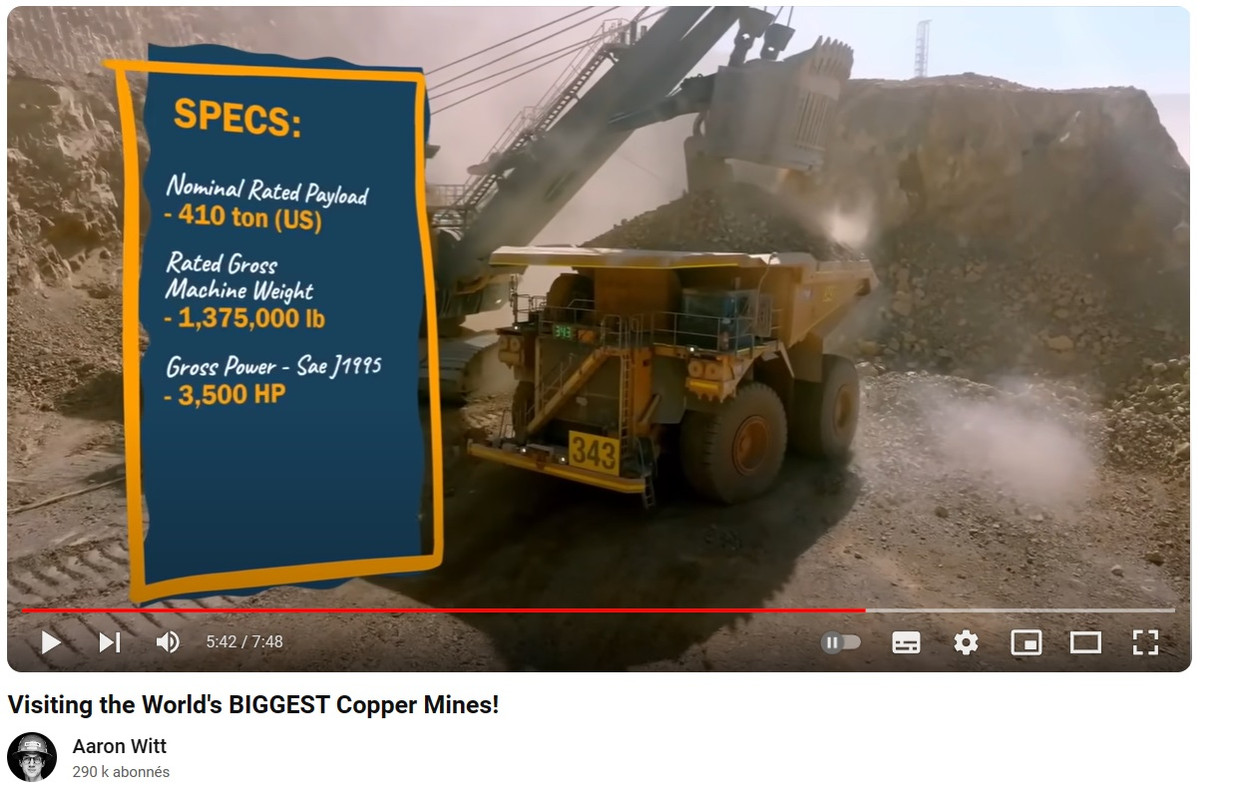

To dig the ore, they use enormous rope shovels, and to haul it, they rely on a fleet of mostly Caterpillar's largest trucks—the 797F and 798AC. This is where we began our journey...

To learn more about CODELCO, check out their website at

https://www.codelco.com/

une autre vidéo de Aaron Witt, cette fois au Chili, une mine de cuivre de CODELCO.

Visiting the World's BIGGEST Copper Mines! vidéo 8 mn https://www.youtube.com/watch?v=-TfLA_jfa0Y

Aaron Witt

290 k abonnés

64 319 vues 23 déc. 2023

Copper is among the world's most valuable metals. It's primary use—conducting electricity for billions of people.

Without it, your phone, home, and car would be worthless. And as society evolves, demand is only going in one direction. And not only is it growing, but experts expect copper demand to double within the next decade.

Which brings me to Chile... The world's largest copper producer. Mining is a cornerstone of Chile's economy, as most of what it produces ends up in many other countries worldwide.

In June, we visited CODELCO's DMH mine outside of Calama in the Atacama Desert, thanks to the help of Finning Caterpillar. It was AWESOME.

As a hard rock operation, they drill, blast, load, and haul copper ore, finally processing it into copper concentrate.

To dig the ore, they use enormous rope shovels, and to haul it, they rely on a fleet of mostly Caterpillar's largest trucks—the 797F and 798AC. This is where we began our journey...

To learn more about CODELCO, check out their website at https://www.codelco.com/

[img]https://i.postimg.cc/qRJcS75d/visitng-Chile-Copper-mine.jpg[/img]