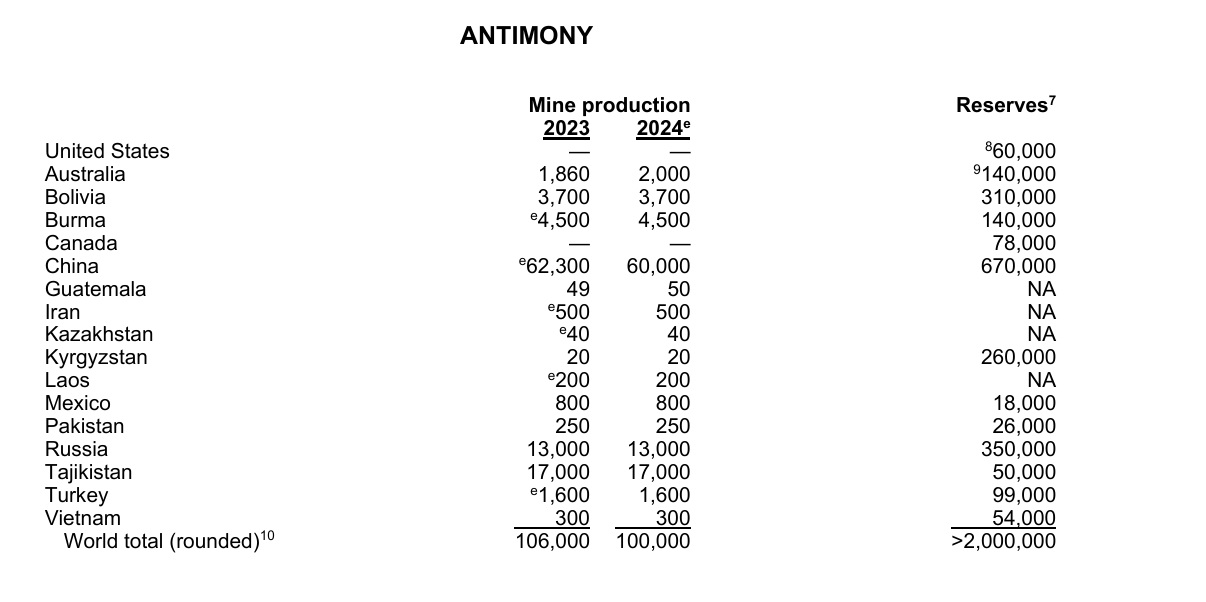

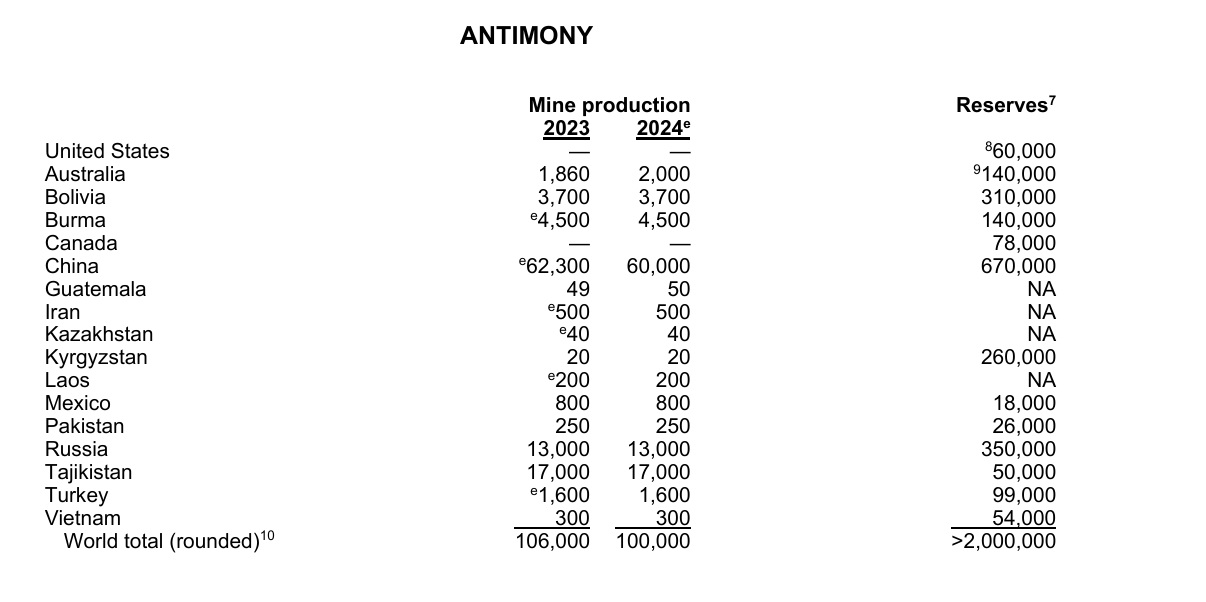

Gros réajustement de la production 2023, en particulier pour le chiffre de la Chine.

le post pour l'année d'avant : viewtopic.php?p=2396542#p2396542

Modérateurs : Rod, Modérateurs

https://www.rfi.fr/fr/podcasts/chroniqu ... -chinoisesLes prix de l'antimoine multipliés par trois après les restrictions chinoises

RFI le : 19/03/2025 Par : Marie-Pierre Olphand

L'antimoine, un métal résistant au feu et utilisé aussi bien dans les munitions que les batteries électriques, atteint des sommets. Depuis un an, rien ne semble arrêter la hausse des prix.

L'antimoine vaut aujourd'hui, en mars 2025, 54 000 dollars la tonne. C'est trois fois plus qu'il y a un an. La hausse des prix s'est accélérée ces derniers mois : mi-septembre, la Chine a décidé d'opérer un contrôle drastique sur ses exportations, puis en décembre, de les interdire.

Or, la Chine est une des sources principales d'antimoine, avec la Russie et le Tadjikistan. Officiellement, Pékin a pris cette mesure pour garantir un prix bas à ses raffineries. Mais les prix restent encore hauts dans le pays, signe que la tension est assez générale.

Risque de pénurie ?

Au printemps dernier, le déficit entre l'offre et la demande a été évalué à 10 000 tonnes. Il est parti pour durer jusqu'en 2026 au moins, selon le cabinet de conseil Project Blue, car face à une offre qui peine à suivre, la demande est importante, en particulier pour la fabrication des véhicules électriques et dans le secteur photovoltaïque.

L'autre secteur qui tire cette demande, même s'il n'est pas le plus gourmand, est celui de la défense. La guerre en Ukraine fait tourner les usines d'armement et fait grimper les besoins en antimoine, pour la fabrication des munitions. Pour ne parler que de la France, la production d'obus de 155 mm a doublé depuis le début de la guerre.

Est-ce que la reconstitution des stocks d'armement pourrait conduire à une pénurie ? C'est ce qu'avance le directeur général de la société minière, Larvotto Resources, en raison de stocks qui sont très bas. C'est a minima un facteur qui s'ajoute à une demande qui, tous secteurs confondus, reste importante.

Investissements américains

Les Américains sont, selon Project Blue, les premiers clients de la Chine pour ce qu'on appelle le trioxyde d'antimoine, une poudre dérivée du métal gris argenté qui est incorporée à divers produits pour les rendre ignifuges. Les États-Unis ont compris qu'ils allaient devoir remplacer les 10 000 à 15 000 tonnes qu'ils achetaient jusque-là en Chine. Dans cet optique, une fonderie située au Mexique et détenue par United States Antimony Corporation (USAC) a été relancée. Elle sera approvisionnée dans un premier temps en antimoine venu d'Australie.

Un projet d'extraction d'or et d'antimoine a également été validé par l'administration Biden en début d'année dans l'Idaho. Cette mine opérée par Perpetua Resources pourrait fournir un tiers des besoins annuels en antimoine des États-Unis après son ouverture, programmée en 2028.

https://www.miningweekly.com/article/hi ... 2025-05-06Hillgrove eyes 2026 production start at Australia's largest antimony mine

A definitive feasibility study (DFS) for its Hillgrove antimony/gold project in New South Wales, projecting the development into one of the Western world's foremost antimony producers.

The study outlines robust financial metrics, including a post-tax net present value (NPV) of A$694-million and an internal rate of return (IRR) of 102% under its mid-price scenario, with production slated to begin in the second quarter of 2026.

The 100%-owned Hillgrove project is expected to operate for eight years, producing an average of 85 000 oz/y gold equivalent and supplying about 7% of the world’s antimony at peak output. The DFS builds on an earlier prefeasibility study and reflects a sharp rise in confidence for the project’s economic and technical viability.

MD Ron Heeks called the publication of the DFS a “major milestone", noting the company completed it within 18 months of acquiring the project. “The DFS confirms Hillgrove as a technically sound, high-margin critical minerals project with a rapid pathway to production,” Heeks said.

At mid-price assumptions which the company describes as still conservative compared to elevated current spot prices, the project delivers average earnings before interest, taxes, depreciation and amortisation of A$250-million and post-tax free cash flow of A$128-million. The mid-case economics also reflect a total post-tax free cash flow of A$1.02-billion and an average yearly pre-tax free cash flow of A$200-million.

“The DFS delivers outstanding economics at the base case and even better at what the company firmly believes is the minimum economics that would be achieved at the mid-price commodity price scenario,” Heeks said. “These results reflect the value of the significant installed infrastructure already in place at Hillgrove and the excellent work undertaken by the Larvotto team.”

Initial capital expenditure is estimated at A$139-million, including an upgrade to the on-site minerals processing plant from 250 000 t/y to 525 000 t/y. The operation will source ore from both underground and openpit sources. Under base case pricing assumptions ($2 400/oz gold, $25 000/t antimony), Hillgrove still returns an NPV of A$280-million and an IRR of 48%, with a 26-month payback period. The mid-price case shortens that to just 11 months.

https://www.mining.com/perpetua-seeks-2 ... -in-idaho/Perpetua seeks $2 billion loan for Stibnite project in Idaho

Staff Writer | May 23, 2025

Perpetua Resources (NASDAQ: PPTA) (TSX: PPTA) has submitted a formal application to the Export-Import Bank of the United States (EXIM) for up to $2 billion in debt financing to fund construction of its Stibnite gold-antimony project in Idaho.

The request is an increase from the $1.8 billion outlined in EXIM’s 2024 non-binding letter of interest.

Perpetua attributed the higher figure to a revised estimate of job-years stemming from recent financial and engineering updates.

Earlier this week, the Boise, Idaho-based miner announced it had obtained final approval for Stibnite, a critical minerals project being fast-tracked by the Trump administration.

The Stibnite project, with its recently secured record of decision from the US Forest Service, is uniquely positioned to supply antimony, which is essential to national security and energy technology, the company said.

Antimony, classified as a critical mineral for its importance to technology, defense and energy applications, is imported into the US as there is currently no domestic production. China accounted for 60% of globally mined antimony in 2024, according to data from the US Geological Survey.

Last September, China banned exports of the metal to the US.

The Stibnite project holds the only identified antimony reserve in the US at an estimated 148 million lb. —making it one of the largest outside of Chinese control. Once in production, it could meet about 35% of US antimony demand during its initial six years of production, according to the 2023 USGS commodity summary.

Perpetua said Stibnite is also expected to host one of the highest-grade open-pit gold mines in the country, with reserves of approximately 4.8 million oz. Over the first four years of production, it is expected to produce 450,000 oz. of gold annually.

https://www.mining.com/web/nyrstar-seek ... roduction/Nyrstar seeks government funding for antimony production

Reuters | May 21, 2025

Nyrstar, owned by global commodity trader Trafigura, could potentially produce the critical mineral antimony at its South Australian processing plant but would need government support to do so, CEO of Nyrstar Australia Matt Howell said.

New supply of the strategic metal crucial to the production of ammunition, night-vision goggles, and infrared sensors is in high demand after China, the world’s biggest antimony producer, imposed export controls last year.

As part of a strategic review of Nyrstar’s Australian operations Trafigura is undertaking, Nyrstar found it would be able to produce up to 5,000 tonnes of antimony metal or antimony trioxide a year at its multi-metals processing plant in Port Pirie by adding an additional processing stage after lead smelting, the company said.

“We have the capability to produce a range of critical minerals including antimony to help meet global demand,” Nyrstar Australia CEO Howell said.

“However, it will require significant investments and support to address the unsustainable market pressures that Australian smelters are facing,” he said in a statement to Reuters on May 5.

Howell did not specify how much government funding would be necessary to support output at the Port Pirie site or when it could begin producing antimony metal.

Australia’s smelters are struggling with high domestic power costs and an oversupply of processing capacity in China that has squeezed the fees they can charge to process material.

The Australian government is offering billions of dollars in funding to support critical mineral processing.

“Antimony is defined as a critical mineral by the Australian government, which provides a pathway to access substantial government support,” a South Australian government spokesperson said. He added that complex refineries were key to the state’s economy.