https://www.mining.com/web/huayou-to-st ... arly-2026/Huayou to start Zimbabwe lithium sulphate production early 2026

Reuters | October 17, 2025

The Arcadia lithium mine, which began production in 2023. (Image courtesy of Huayou Cobalt.)

China’s Zhejiang Huayou Cobalt will start producing lithium sulphate during the first quarter of 2026 from its new $400 million plant in Zimbabwe, the company said on Thursday, as the African country pushes for more local processing.

The newly completed plant at Huayou’s wholly owned Prospect Lithium Zimbabwe’s Arcadia mine has capacity to exceed 50,000 metric tons of lithium sulphate annually, an executive said during a tour of the operation.

Lithium sulphate is an intermediate product which can be refined into a battery-grade material such as lithium hydroxide or lithium carbonate used in battery manufacturing.

“We will start the first production from the beginning of next year,” Prospect Lithium Zimbabwe general manager Henry Zhu told reporters.

“The quantity of the lithium sulphate should be more than 60,000 metric tons, but it will depend on the configuration of the plant, because it is brand new,” Zhu added.

Zimbabwe, Africa’s top lithium producer, has been nudging miners to process the mineral in the country in order to help lift its economy.

Huayou, which acquired Arcadia lithium mine for $422 million in 2022, commissioned a $300 million lithium concentrator in 2023.

The company and other Chinese metals firms Sinomine, Chengxin Lithium Group, Yahua Group, and Tsingshan Holding dominate Zimbabwe’s lithium mining, producing concentrates and shipping them to their home country.

The southern African country will ban the export of lithium concentrates from 2027 as it pushes for more local processing.

Sinomine has also announced plans to build a $500 million lithium sulphate plant at its Bikita mine in Zimbabwe.

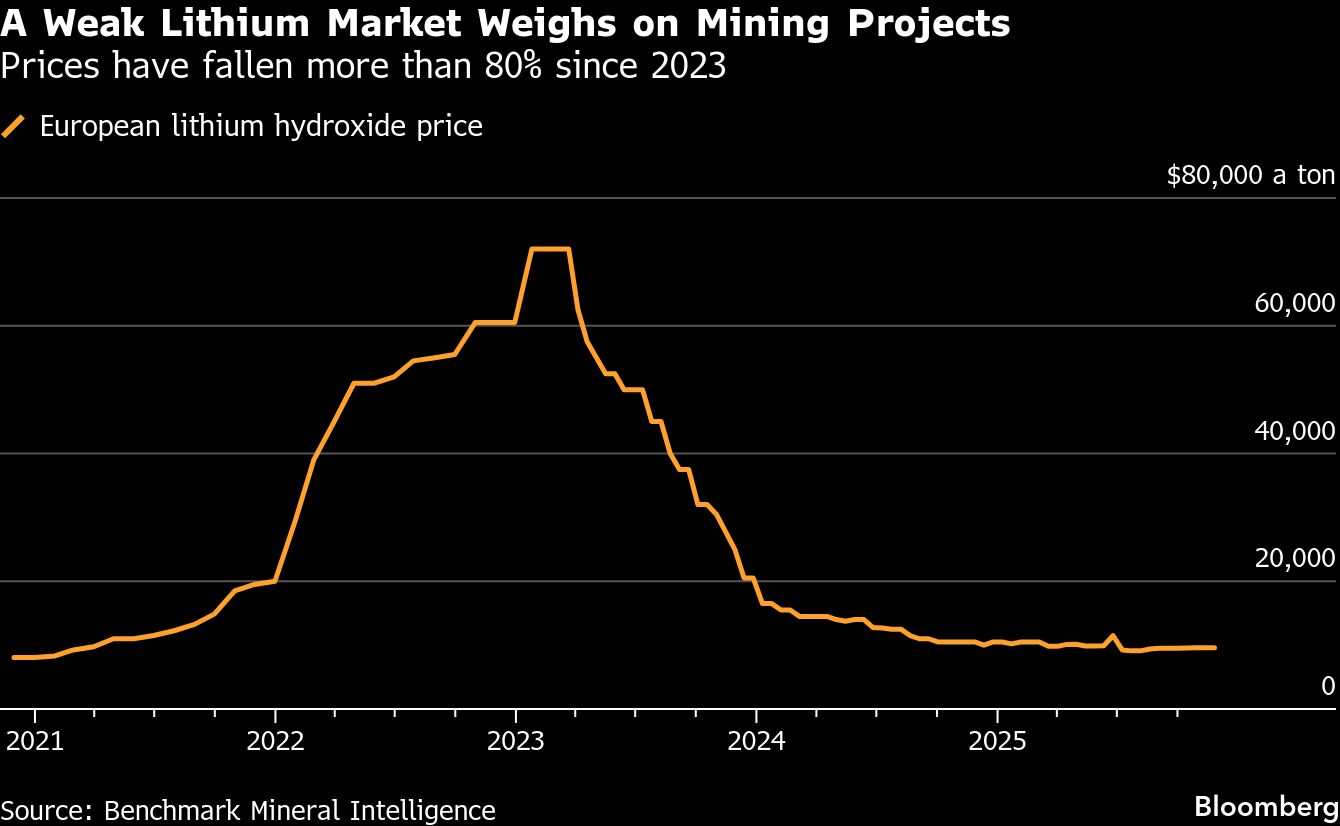

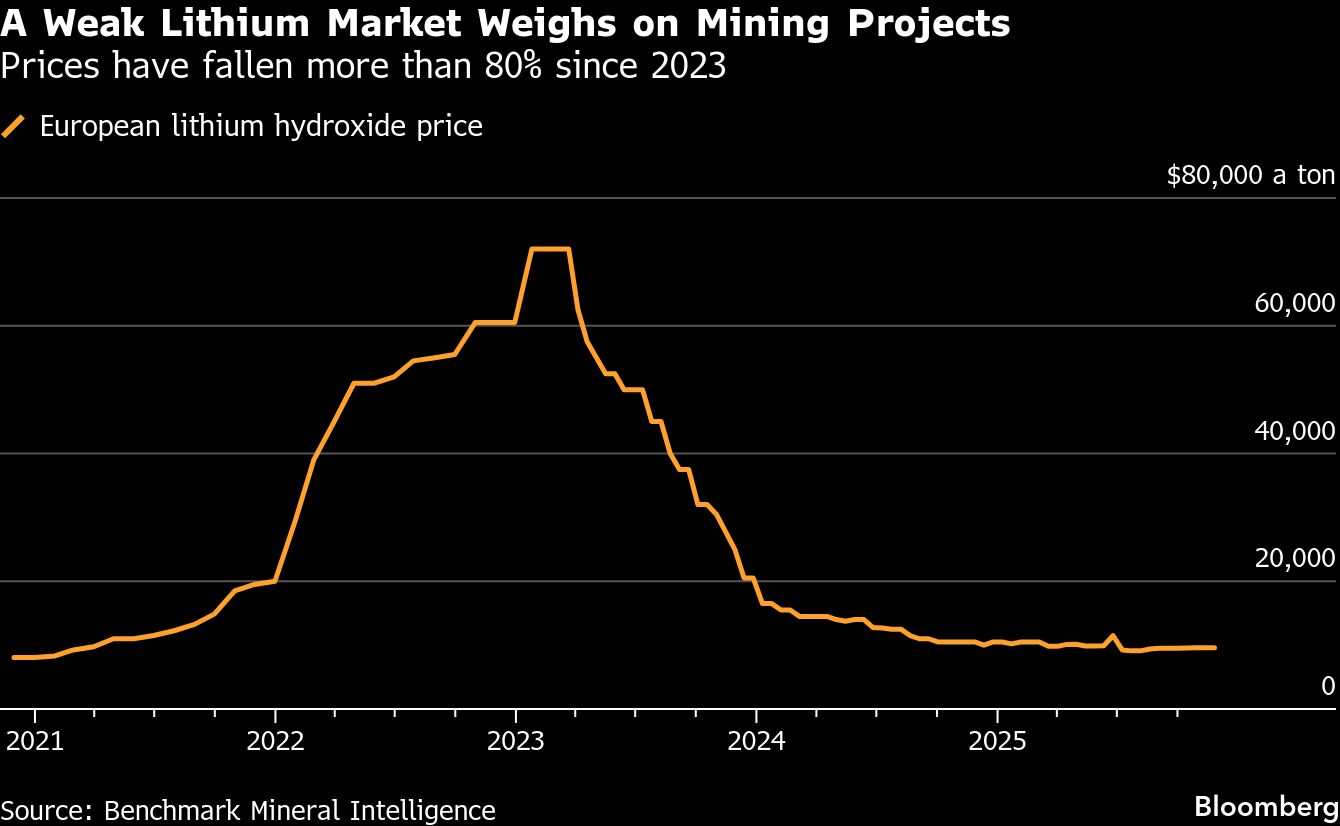

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 14 juin 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 6#p2412796

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/australian-r ... -year-end/Australian rare earth firm to select US plant site by year-end

Bloomberg News | October 24, 2025

Australian Strategic Materials Ltd. aims to choose a location for its planned US rare earths plant by the end of this year, capitalizing on President Donald Trump’s backing for the sector amid growing rivalry with China.

The firm has been in discussions with the Pentagon about funding to support a plant in America producing metal for rare earth magnets, chief executive officer Rowena Smith said in a Bloomberg TV interview on Friday. It already operates one metal plant in South Korea, and also wants to build a mine at its deposit in Australia.

“We initially, 12 months ago, shortlisted six states” for the new facility, Smith said. “We will identify our preferred state later this year.”

The Trump administration is ramping up efforts to back critical minerals projects outside China, as Beijing prepares to unleash even tighter controls on rare earths exports. Earlier this week, Washington and Canberra reached a broad agreement on joint funding for projects in Australia and the US to protect supply chains for industries from cars to the military.

ASM was not one of the initial beneficiaries, and its shares fell by about a third this week after months of volatile trading for rare earth firms worldwide. Its stock is still up by nearly 100% this year.

US states are offering “significant incentives” to build a metal plant, Smith said. The company recently raised A$80 million ($52 million) to fund company expansions, she added.

Magnets have been a focus of geopolitical tensions this year after China’s supplies slumped in the wake of a first wave of export controls. A flurry of new US magnet plants — mostly predating the recent crisis — are in the pipeline that will need supplies of refined metal and alloys to make their product.

ASM wants to build a supply chain starting from a potential mine at its Dubbo resource in Australia. That project has potential debt funding of up to $600 million from the Export-Import Bank of the United States, plus A$200 million in a letter of support from the Australian government.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Le lithium en Europe, l'exploitation du futur ? | ARTE vidéo 52 mn https://www.youtube.com/watch?v=H1umNyHn-_4

ARTE

4,54 M d’abonnés

123 575 vues 5 mai 2025 #documentaire #lithium #arte

Disponible jusqu'au 06/11/2025

Largement dépendante des importations, l’Europe cherche à développer sa production de lithium, élément essentiel à la transition énergétique. Focus sur les défis écologiques qui accompagnent cette quête d’indépendance.

Composant essentiel des batteries électriques, le lithium est devenu une matière première stratégique au cœur de la transition énergétique. À l’échelle mondiale, la demande a explosé ces dernières années et devrait encore être multipliée par cinq à sept d’ici 2030. Pourtant, près de 95 % de ce nouvel or blanc provient d’Australie, du Chili et de la Chine, plaçant l’Europe dans une situation de forte dépendance, qu’elle cherche à réduire en exploitant ses propres ressources. Or l’extraction du lithium, gourmande en eau et en énergie, soulève d’importantes questions écologiques. Comment concilier hausse de la production et respect de l’environnement ?

Les paradoxes de la transition

L’Europe peut-elle assurer son indépendance énergétique à court terme ? Du projet d’ouverture d’une grande mine dans l’Allier à une installation pilote exploitant les eaux profondes du Rhin supérieur, des initiatives en France et en Allemagne ouvrent des perspectives pour le développement d’une filière européenne du lithium. Mais le documentaire interroge également le paradoxe du lithium : bien qu’il soit utilisé pour la construction de véhicules plus propres, sa production demeure polluante et énergivore. Il faut donc imaginer des modes de production plus écologiques et des solutions plus durables, comme le recyclage des batteries.

Documentaire de Lucas Gries (Allemagne, 2025, 53mn)

#lithium #documentaire #arte

-----------------------------------

il y est question du Lithium de Beauvoir du projet Imerys , puis du lithium de saumure de la vallée du Rhin de Vulcan energy en Allemagne, puis du recyclage de batteries de voitures.

Impasse sur le projet de lithium du Portugal.

ARTE

4,54 M d’abonnés

123 575 vues 5 mai 2025 #documentaire #lithium #arte

Disponible jusqu'au 06/11/2025

Largement dépendante des importations, l’Europe cherche à développer sa production de lithium, élément essentiel à la transition énergétique. Focus sur les défis écologiques qui accompagnent cette quête d’indépendance.

Composant essentiel des batteries électriques, le lithium est devenu une matière première stratégique au cœur de la transition énergétique. À l’échelle mondiale, la demande a explosé ces dernières années et devrait encore être multipliée par cinq à sept d’ici 2030. Pourtant, près de 95 % de ce nouvel or blanc provient d’Australie, du Chili et de la Chine, plaçant l’Europe dans une situation de forte dépendance, qu’elle cherche à réduire en exploitant ses propres ressources. Or l’extraction du lithium, gourmande en eau et en énergie, soulève d’importantes questions écologiques. Comment concilier hausse de la production et respect de l’environnement ?

Les paradoxes de la transition

L’Europe peut-elle assurer son indépendance énergétique à court terme ? Du projet d’ouverture d’une grande mine dans l’Allier à une installation pilote exploitant les eaux profondes du Rhin supérieur, des initiatives en France et en Allemagne ouvrent des perspectives pour le développement d’une filière européenne du lithium. Mais le documentaire interroge également le paradoxe du lithium : bien qu’il soit utilisé pour la construction de véhicules plus propres, sa production demeure polluante et énergivore. Il faut donc imaginer des modes de production plus écologiques et des solutions plus durables, comme le recyclage des batteries.

Documentaire de Lucas Gries (Allemagne, 2025, 53mn)

#lithium #documentaire #arte

-----------------------------------

il y est question du Lithium de Beauvoir du projet Imerys , puis du lithium de saumure de la vallée du Rhin de Vulcan energy en Allemagne, puis du recyclage de batteries de voitures.

Impasse sur le projet de lithium du Portugal.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 13 juillet 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 0#p2414110

https://www.mining-technology.com/news/ ... g/?cf-viewE3 Lithium advances with phase-two drilling in Alberta

The first phase confirmed the design of E3 Lithium's DLE equipment at this scale.

October 29, 2025

Drilling under way at the demonstration facility. Credit: E3 Lithium/Business Wire.

E3 Lithium has begun drilling its lithium development well, marking phase two of its demonstration facility project in central Alberta, Canada.

This is E3 Lithium’s third lithium well drilled into the Leduc formation.

The project follows the successful production of battery-grade lithium carbonate during phase one of the demonstration programme in early October 2025.

The first phase confirmed the design of E3 Lithium’s direct lithium extraction (DLE) equipment at this scale.

The outcomes from this well will deliver further insights into reservoir performance and brine analysis, aiding in the development of the commercial lithium facility.

The company expects drilling and testing activities to extend into November and will keep stakeholders informed with updates on the operations.

The goals of the upcoming drilling phase include confirming subsurface geology by thoroughly analysing core samples and incorporating petrophysical properties obtained from comprehensive well-logging data.

Additionally, the phase aims to collect reservoir data to inform the design of commercial wellfields and facilities.

It also seeks to supply brine to ensure ongoing operation of DLE and processing equipment that was initially commissioned during phase one of the demonstration facility.

Furthermore, this phase will facilitate engineering and permitting efforts for E3 Lithium’s forthcoming commercial facility.

E3 Lithium president and CEO Chris Doornbos said: “This well kicks off the second phase our demonstration programme, another important step forward as we advance toward commercial operations. Our drilling activities provide important data to inform our continued project design and enhances our understanding of reservoir performance capabilities.”

E3 Lithium is a development company with a total of 21.2 million tonnes (mt) of lithium carbonate equivalent (LCE) in measured and indicated resources.

It has 300,000 tonnes of LCE in inferred mineral resources in Alberta and 2.5mt of LCE in inferred mineral resources in Saskatchewan.

Last month, E3 Lithium received the required regulatory permit approvals from the Alberta Energy Regulator for the second phase of the Clearwater Project Demonstration Facility.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/imerys-in-ta ... e-project/Imerys in talks to sell minority stake in lithium mine project

Reuters | October 30, 2025

Imerys is in exclusive talks with a potential investor to sell a minority stake in its lithium mine project in central France, with the specialist minerals firm confident it can conclude a deal by the end of January, its finance chief said on Thursday.

Presenting Imerys’ third-quarter results, chief financial officer Sebastien Rouge declined to give any details on the potential investor. Imerys said in July it would seek a partner for the project, whose cost has risen to an estimated 1.8 billion euros ($2.10 billion) from 1 billion initially.

($1 = 0.8575 euros)

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 28 sept 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 9#p2417129

https://www.nsenergybusiness.com/news/s ... n-project/Smackover Lithium files first inferred resource report for Franklin project

The Franklin project contains a resource of 2.16mt of lithium carbonate equivalent.

6th Nov 2025

Smackover Lithium, a joint venture (JV) between Standard Lithium and Equinor, has filed its first inferred resource report for the Franklin project in north-east Texas, US.

The Franklin project contains a resource of 2.16 million tonnes (mt) of lithium carbonate equivalent, with an average lithium concentration of 668 milligrams per litre (mg/litre).

In addition, the resource contains around 15.41mt of potash (as potassium chloride), which has recently been added to the US Geological Survey 2025 Draft Critical Mineral List.

The brine also contains approximately 2.64mt of bromide, all within 0.61km³ of brine volume.

The project area covers around 80,000 acres, with more than 46,000 acres currently leased to support the inferred resource.

Brine mineral leasing in this area has been under way since 2022.

The Franklin project has recorded the ‘highest reported’ lithium-in-brine grades in North America, including a previously measured 806mg/litre at the Pine Forest 1 well.

This maiden resource definition is a key milestone for the JV’s goal of producing more than 100,000 tonnes of lithium chemicals annually in Texas through multiple phases.

Additionally, the JV has unveiled plans for two additional projects in East Texas, which are expected to nearly triple the size of its portfolio in the state.

The principal recommendation for the next steps is to enhance the characteristics of the Upper and Middle Smackover Formation aquifers, brine chemistry, and to evaluate reserve forecasts.

This will require drilling new appraisal wells and re-entering three inactive wells to gather data for a preliminary feasibility study.

Smackover Lithium also plans to conduct direct lithium extraction tests on project brine, using insights from Standard Lithium’s demonstration plant in El Dorado, Arkansas, and the JV’s South West Arkansas project.

Last year, in May, Standard Lithium announced a partnership with Equinor for an investment of up to $160m to advance sustainable lithium projects in Arkansas.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 25 mai 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 1#p2411811

https://www.mining.com/prairie-lithium- ... -facility/Prairie Lithium begins construction on North America’s largest DLE facility

Staff Writer | November 5, 2025 |

Foundation works on Pad #1. Credit: Prairie Lithium

Australia’s Prairie Lithium (ASX: PL9) has kicked off construction on what it says would be the largest direct lithium extraction (DLE) facility in North America in the Canadian province of Saskatchewan.

Currently, the largest DLE facility is believed to be deployed by Standard Lithium (TSXV: SLI) in Arkansas. In March of 2024, the Canadian company successfully installed and commissioned the Li-Pro lithium selective sorption (LSS) commercial-scale unit supplied by Koch Technology Solutions (now Aquatech).

In comparison, Prairie’s facility would have a total of four commercial-scale DLE columns, with an anticipated arrival date of April 2026. The successful de-risking of one commercial-scale column in Arkansas over the past 18 months, combined with the high-quality brine from its lithium project, supports confidence in the technology’s performance and scalability, the company stated.

Construction on the lithium extraction facility at Pad #1 has now begun, with completion of the foundation expected in the first quarter of 2026 and building construction to follow. The application to connect the wells and facility at Pad #1 to grid power has also been submitted to SaskPower.

“The construction on our lithium extraction facility at Pad #1 is a strong step forward on our critical path to production. The groundwork we are laying now will host what we believe will be the largest known direct lithium extraction facility in North America,” Prairie Lithium managing director Paul Lloyd stated in a press release.

The scale of its facility, Lloyd added, underscores the maturity of the Prairie lithium project, where the company plans to use conventional oil and gas drilling and completion methods to access lithium-rich brine from aquifers about 2.3 km underground, and then separate the lithium from the brine using DLE technology.

The property, comprising over 345,000 acres of subsurface permits in the Duperow Formation, contains an estimated 4.6 million tonnes of lithium carbonate equivalent in measured and indicated resources.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

prospect de Lithium en Espagne :

https://www.earth.com/news/new-lithium- ... -on-china/New lithium deposit discovery could eliminate dependence on China

Jordan Joseph 10 nov 2025

A new set of drill results in western Spain points to shallow, thick zones of lithium and rubidium. At Conchas near Fuentes de Oñoro, Berkeley Energia reports continuous intervals up to about 200 feet thick.

The finding sits in a light colored granite unit and comes from a grid of holes across about 12 square miles. It puts Salamanca on the map at a time when Europe is scrambling for battery metals.

Lithium and rubidium at Conchas

Teams used reverse circulation, a drilling method that lifts rock chips to the surface with compressed air. Lead researcher Robert Behets, the Acting Managing Director at Berkeley Energia Limited, is overseeing the work.

The program also included diamond drilling, a coring method that cuts intact cylinders for testing. Those cores will feed early processing tests this quarter.

Company drilling reports 200 feet at 0.50 percent lithium oxide from the surface. Another run returned 46 feet at 0.95 percent lithium oxide from about 131 feet.

“The results of the drilling program at Conchas are very encouraging as they have confirmed the presence of shallow, thick zones of lithium and rubidium mineralisation at the Project,” said Behets.

The host is muscovitic leucogranite, a pale granite rich in muscovite mica.

Why rubidium rides with lithium

Rubidium often rides with lithium in mica rich granites because it can swap places with potassium in the crystal lattice. That makes rubidium a useful tracer, and sometimes a byproduct, in lithium systems.

An updated USGS report notes no rubidium production outside China in 2023. It also lists key uses in specialty glass, sensors, and in an atomic clock, a timekeeper that measures atom frequency for precise time.

Rubidium appears on the U.S. critical minerals list. That designation signals supply risk and strategic importance for high tech applications.

Conchas lithium is different

The Conchas granite sits within the Central Iberian Zone (CIZ), a long belt known for lithium rich pegmatites. This corridor in Spain and Portugal has produced many mica rich outcrops linked to late stage granites.

In Extremadura, researchers documented lithium bound in fine micas at the Valdeflórez site. That pattern reinforces why a mica rich granite at Conchas deserves careful laboratory work.

Berkeley plans 3D modeling of the new holes and early metallurgical test work, lab tests that show how metals can be recovered. Those steps turn assay tables into flow sheets and recovery numbers.

The company reports thicker zones toward the northeast and higher grades to the south and northwest. Both trends matter for designing drill spacing and targeting more feed for processing.

..........

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Rio Tinto met sous cocon le projet de Lithium de Jadar en Serbie :

https://www.nsenergybusiness.com/news/r ... in-serbia/Rio Tinto mothballs $2.95bn Jadar lithium project in Serbia

The Jadar project is yet to begin production and has encountered multiple setbacks in recent years, including permitting delays and local opposition.

13th Nov 2025

io Tinto has halted further development of the $2.95bn (£2.24bn) Jadar project in Serbia as part of a broader effort to streamline operations and prioritise near-term opportunities.

The decision to mothball the project was confirmed earlier this week following an internal memo circulated to staff outlining the move to place the project into “care and maintenance”, reported Bloomberg.

A spokesperson for Rio Tinto confirmed the contents of the internal note but declined to comment further.

The Jadar project has not yet begun production and has encountered multiple setbacks in recent years, including permitting delays and major local opposition.

Although the site hosts high-grade lithium resources, progress has been hindered by fluctuating government support and widespread community resistance.

The mine became a focal point during a period of broader public discontent, further complicating progress.

Rio Tinto was cited by Bloomberg in the internal communication saying: “Given the lack of progress in permitting, we are not in a position to sustain the same level of spend and resource allocation.”

The decision to mothball Jadar aligns with CEO Simon Trott’s push to simplify Rio Tinto’s structure and focus capital on growth opportunities.

.........................

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 05 avril 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 9#p2409449

La mine de Thacker Pass (Nevada) est maintenant en construction.

La mine de Thacker Pass (Nevada) est maintenant en construction.

https://www.mining.com/emerson-partners ... utomation/Emerson partners with Lithium Americas for Thacker Pass automation

Staff Writer | November 11, 2025

Lithium Americas Corp. has started construction on the Thacker Pass project in northern Nevada. Credit: Lithium Americas.

Emerson (NYSE: EMR) has secured a contract with Lithium Americas to supply its extensive automation portfolio and expert technical services for the Thacker Pass project in northern Nevada.

Emerson’s automation will facilitate the development of the mine and processing facilities at Thacker Pass, thereby enabling a US supply of lithium—a crucial raw material for batteries that power electric vehicles, renewable energy storage and data centres.

With increasing consumer adoption of electric vehicles and renewable energy, demand for lithium—often termed “white gold”—is projected to surge fivefold by 2040. The United States ranks third globally in known lithium resources, making projects like Thacker Pass important in terms of energy security and job creation.

Emerson contributes decades of mining experience and innovation to Lithium Americas, providing its comprehensive automation portfolio, an efficient approach to project execution and local technology support. This collaboration aims to ensure Thacker Pass operates safely, efficiently and reliably.

“Working with Emerson is expected to help us fulfill our purpose to safely and sustainably produce lithium from Thacker Pass,” Lithium Americas CEO Jonathan Evans stated. “Their automation technologies will help us enable North America to reduce dependence on foreign critical minerals and drive value for our stakeholders.”

Thacker Pass boasts the world’s largest measured and indicated lithium resource as well as reserves. Phase 1 of the project is expected to produce up to 40,000 tonnes of battery-quality lithium carbonate annually, sufficient to support battery production for up to 800,000 electric vehicles each year.

“Thacker Pass is a landmark project for North America’s electrification,” Emerson’s chief operating officer Ram Krishnan said in a news release. “Our goal is to help Lithium Americas start up safely and operate reliably, powering the next chapter of American innovation.”

Emerson’s integrated automation architecture includes intelligent field measurement instrumentation, process control hardware and software, final control and isolation valves, and reliability technologies. This suite aims to optimize production, enhance worker safety, reduce downtime and minimize environmental impact. Its modernization scope also emphasizes capital efficiency and lowering the project’s total cost of ownership.

Caltrol, Emerson’s impact partner in the region, will support the project with a local valve and instrument repair and service center. The facility will provide expert service and maintenance, ensuring rapid response, consistent engineering standards and emergency support. Construction is already underway, with Emerson and Lithium Americas actively preparing the site for commissioning.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/lithium-pric ... mand-boom/Lithium price surges in China after Ganfeng chairman predicts 2026 demand boom

Reuters | November 17, 2025 |

China’s lithium price surged on Monday after the chairman of major Chinese producer Ganfeng Lithium Group Co forecast demand growth of 30% or even 40% for the battery metal in 2026.

The most-traded lithium carbonate contract on the Guangzhou Futures Exchange rose 9% to close to an upper limit at 95,200 yuan ($13,401.28) per metric ton, its highest since June 2024.

The peak came after local media outlet Cailian reported the comments made by Li Liangbin in a conference speech.

Li also said demand growth could drive the lithium carbonate price above 150,000 yuan a ton, or even to 200,000 yuan.

Lithium carbonate prices have been rising recently in China, with a more than 17% rally this month, as investors predict booming demand from the energy storage sector.

Supply concerns related to the delayed reopening of CATL’s flagship Jianxiawo lithium mine in Yichun city, Jiangxi Province is also supporting the rise.

Reuters previous reported that CATL continued to tap external supplies of lithium ore to make lithium carbonate in November as the Jianxiawo mine remained closed.

Ganfeng Lithium’s shares rose 7.48%, Chengxin lithium stock was up 10.01%, and Tianqi Lithium increased by 9.87%.

($1 = 7.1038 Chinese yuan renminbi)

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 4 mai 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 8#p2410718

https://www.nsenergybusiness.com/news/g ... m-project/Geomet receives Czech state grant for Cinovec lithium project

The $416.98m (Kč 8.71bn) funding, provided by the Czech Republic’s Ministry of Industry and Trade, will support the advancement of the company’s flagship Cinovec lithium project.

Smishra 28 November, 2025

Geomet, a joint venture between European Metals Holdings (49%) and CEZ (51%), has received a grant of up to €360m ($416.98m) from the Czech Government, pending completion of administrative procedures.

The funding, provided by the Czech Republic’s Ministry of Industry and Trade under the Strategic Investments for a Climate-Neutral Economy programme, will support the advancement of the company’s flagship Cinovec lithium project.

The programme is designed to support significant investments in the production and expansion of equipment, key components and critical raw materials needed for the transition to a climate-neutral economy.

It aligns with the European Commission’s (EC) Temporary Crisis and Transition Framework and is intended to accelerate economic development and investment in strategic sectors.

The final grant amount will be confirmed upon the formal award and may be lower than the maximum of €360m.

European Metals executive chairman Keith Coughlan said: “This is a transformational milestone for European Metals and the Cinovec project. The Czech Government’s award of a grant of up to €360m represents one of the largest direct project-level funding commitments to a critical raw materials project within the EU.

“Following the previously detailed formal recognition of the project, the approval of such a significant financial contribution clearly demonstrates the support for and importance of Cinovec in the future of European electromobility.

“Coming at a time of renewed positive outlook for lithium and strong geopolitical commitment to critical raw material supply chain security, the grant confirms the significant support at both Czech Government and EU levels.”

The Cinovec project has been declared a strategic initiative by the EC under the EU Critical Raw Materials Act.

This status provides access to accelerated permitting, funding eligibility through institutions such as the European Investment Bank and “one-stop-shop” regulatory processes.

The Czech Government has also designated Cinovec as a strategic deposit, which simplifies and prioritises its permitting process under the Czech Construction Code.

The programme supports manufacturing of key components for relevant equipment, as well as production or processing of critical raw materials identified in Regulation (EU) 2024/1252, including lithium.

Its objective is to catalyse rapid and large-scale investments to strengthen European energy security, bolster supply chain resilience and enhance industrial competitiveness.

The next steps for the Cinovec lithium project include completion of administrative processes to issue the formal grant-award decision, incorporation of the grant into Cinovec’s project finance structure, ongoing coordination with the Ministry and CzechInvest on eligible-cost planning and reporting, and finalisation of construction readiness activities once remaining approvals are completed.

Geomet holds the mineral exploration licences awarded by the Czech State for the Cinovec lithium project and has received a preliminary mining permit from both the Ministry of Environment and the Ministry of Industry.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 1er dec 2024 : http://www.oleocene.org/phpBB3/viewtopi ... 2#p2403252

https://www.boursorama.com/actualite-ec ... 5156c80257Lithium : Vulcan Energy lève 2,2 milliards d'euros pour un projet majeur en Allemagne

Boursorama avec AFP •03/12/2025

La start-up australienne Vulcan Energy a annoncé mardi avoir obtenu un financement de 2,2 milliards d'euros pour développer un futur site de production de lithium en Allemagne, indispensable pour la filière européenne des batteries de véhicules électriques.

Au terme d'un montage financier impliquant de nombreux acteurs, dont le groupe de BTP Hochtief, le conseil d'administration de Vulcan Energy va donner son feu vert définitif au lancement des travaux qui doivent débuter "dans les prochains jours", a indiqué l'entreprise dans un communiqué.

Le projet dénommé Lionheart prévoit la construction d'un ensemble intégré dédié au lithium et aux énergies renouvelables, visant une capacité de production de 24.000 tonnes par an d'hydroxyde de lithium, de quoi équiper environ 500.000 batteries de véhicules électriques par an, détaille l'entreprise.

Ces batteries sont pour la plupart fabriquées avec du lithium, un matériau critique que les constructeurs automobiles européens recherchent activement alors qu'ils font face à une forte concurrence chinoise.

Vulcan va extraire le minerai très convoité de l'eau saumâtre souterraine située en profondeur dans la vallée du Rhin, près de la ville de Landau (ouest).

Il sera ensuite raffiné dans une centrale de transformation située à l'ouest de Francfort, où une installation pilote fonctionne déjà.

Le financement réunit des banques publiques et privées, ainsi que des soutiens allemands et européens, dont la Banque européenne d'investissement, principal prêteur individuel.

Le groupe allemand de BTP Hochtief, filale de l'espagniol ACS, participe quant à lui pour 169 millions d'euros, incluant l'acquisition d'actions de Vulcan Energy et un investissement direct dans le projet.

Vulcan a indiqué que des contrats d'enlèvement de lithium sont entièrement sécurisés pour les dix premières années de production avec des partenaires industriels européens, dont le géant suisse des matières premières Glencore, le groupe automobile Stellantis et belge Umicore, qui produit des cathodes pour batteries.

La phase commerciale du projet est attendue à partir de 2028, à l’issue de 2,5 ans de travaux.

L'industrie automobile allemande peine à prendre le virage de la mobilité électrique face à la concurrence chinoise, qui a pris une longueur d'avance, produisant des véhicules électriques moins chers que les géants allemands.

Les difficultés sont telles que le gouvernement allemand a demandé à l'UE revenir sur l'interdiction de la vente de véhicules neufs à moteurs thermiques en 2035.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 25 oct 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 5#p2417795

https://www.agenceecofin.com/actualites ... e-bougouniMali : Kodal annonce le premier chargement de lithium extrait de Bougouni

Agence Ecofin 01 dec 2025

Fin octobre, Kodal Minerals a annoncé le démarrage des expéditions de concentré de lithium de sa mine malienne Bougouni vers le port ivoirien de San Pedro, en vue du premier chargement vers la Chine. Une étape qui a fait suite à l’octroi du permis d’exportation par l’État en septembre.

Lundi 1ᵉʳ décembre, Kodal Minerals a annoncé le chargement de 28 950 tonnes de concentré de spodumène provenant de sa mine de Bougouni, au départ du port ivoirien de San Pedro. D’une valeur estimée à environ 24 millions USD, la cargaison est destinée à la société chinoise Hainan Mining Co Ltd, principal acheteur et partenaire de la coentreprise développant le projet.

Cet événement survient quelques semaines après que la société britannique a annoncé le démarrage des expéditions depuis le site de Bougouni vers San Pedro. Selon les détails fournis, le chargement ainsi lancé est effectué à bord d’un vraquier arrivé au port le samedi 29 novembre dernier. Kodal attend, apprend-on, le décaissement du paiement de la cargaison de la part de Hainan après la finalisation du chargement.

Bougouni est devenue la deuxième mine commerciale de lithium du Mali après sa mise en production en février 2025, derrière la mine Goulamina du chinois Ganfeng. Toutefois, Kodal et Hainan ont dû attendre environ huit mois avant de recevoir des autorités les permis nécessaires pour lancer les exportations du spodumène produit sur le site. Le lancement du premier chargement marque ainsi une étape clé vers la monétisation de la production de cette mine d’une capacité annuelle de 125 000 tonnes.

« Le chargement et l’expédition de notre premier chargement de concentré de spodumène lithique à destination de Hainan, notre partenaire de développement et d’achat, constituent une étape majeure pour notre équipe et permettront de percevoir les premiers revenus du projet. De plus, l’amélioration significative des prix du lithium ces dernières semaines se répercutera sur le prix de vente de notre concentré de spodumène, conformément aux termes du contrat d’achat », a déclaré Bernard Aylward, DG de Kodal Minerals.

En effet, après plusieurs mois marqués par une tendance baissière, les prix du lithium affichent une certaine reprise ces dernières semaines. Selon la plateforme Trading Economics, les contrats à terme sur le carbonate de lithium (produit à plus forte valeur ajoutée par rapport au spodumène) ont atteint leur plus haut niveau en 17 mois en novembre. Une conjoncture qui peut également bénéficier au Mali, qui a droit à 35 % de parts dans la mine, dont 5 % prévues pour les investisseurs locaux. Les 65 % restants sont contrôlés par la coentreprise Kodal Minerals et Hainan.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

le prix du Lithium encore assez bas sur cette fin d'année :

source : https://www.mining.com/web/imerys-seeks ... in-france/

source : https://www.mining.com/web/imerys-seeks ... in-france/