il vont seulement lancer les actions déjà decidées il y a ..... 2 ans.

https://www.mining-technology.com/news/ ... ion-chile/Codelco to start lithium exploration at Salar de Maricunga, Chile

The exploration campaign will be carried out over a maximum period of ten months at the Maricunga salt flat.

17 Feb 2022

Chilean state-owned miner Codelco plans to start lithium exploration at the Salar de Maricunga salt flat in Chile’s Atacama Region by the end of next month.

The mining company received the last sector permit in January 2022 after securing an environmental permit to develop the salt flat in November 2020.

Codelco will undertake the exploration campaign at its mining property in the Maricunga salt flat, outside of the Nevado de Tres Cruces National Park, over a maximum estimated period of ten months.

Based on the concentrations of the discovered lithium, the company will determine its environmentally and economically viability to advance the project to the next development stages.

The Chilean miner expects the exploration work to unearth a high-grade reserve of lithium, an ultra-light metal, which is key for manufacturing batteries for electric vehicles, reported Reuters.

In a press statement, Codelco said: “It should be remembered that the National Policy for Lithium and the Governance of the Salars, issued in 2016, commissioned Codelco, together with the Ministry of Mining, to evaluate the feasibility of exploiting the existing lithium in the Salar de Maricunga, through public-public partnerships. private, considering the respect and care of the social, economic and environmental axes.”

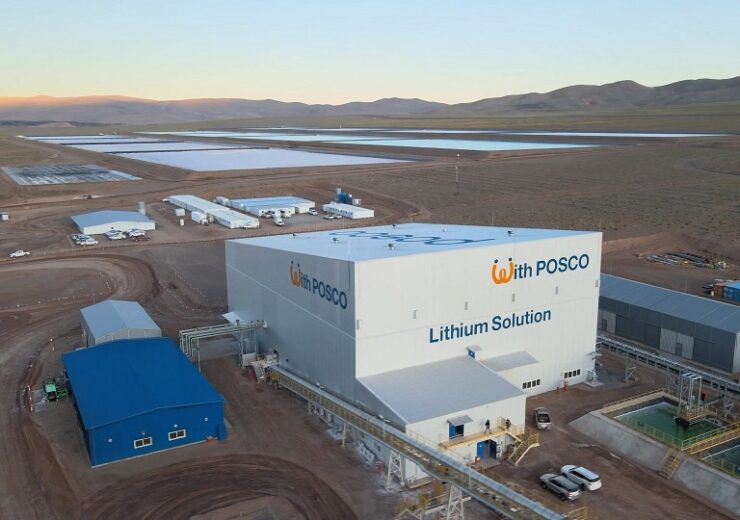

Maricunga salt flat in Chile (Image: Wikimedia Commons)

https://www.mining.com/web/codelco-to-s ... -in-march/