https://www.pv-magazine.fr/2022/04/21/n ... -batterie/Northvolt choisit Setúbal pour construire l’usine de conversion de lithium qualité batterie

Avec son partenaire de projet Galp Energia, le fournisseur de systèmes de batterie suédois a choisi la ville portugaise de Setúbal pour construire son usine de conversion de lithium. Celle-ci devrait débuter ses opérations commerciales en 2026 pour avancer dans la mise en place d’une chaîne de valeur intégrée des batteries au lithium en Europe.

AVRIL 21, 2022 MARIE BEYER

Le projet d’usine de conversion de lithium pour batterie de Northvolt et Galp Energia se concrétise. Le fournisseur de systèmes de batterie suédois et le groupe pétrolier portugais ont en effet annoncé avoir trouvé un site d’implantation pour l’unité industrielle prévue au Portugal.

C’est la ville de Setúbal, à quelque kilomètres au sud de Lisbonne, qui a été sélectionnée pour accueillir l’usine calibrée pour une capacité de production annuelle initiale comprise entre 28 000 et 35 000 tonnes d’hydroxyde de lithium de qualité batterie. Elle sera implantée dans le parc industriel de Sapec Bay, à proximité des utilisateurs de sous-produits, à savoir les industries du ciment et de la pâte à papier, mais également à proximité de l’actuel centre de fabrication automobile du Portugal. Selon ses développeurs, son emplacement lui permet de bénéficier « d’un bon accès aux infrastructures, aux voies ferrées et aux installations portuaires. Le site est également idéalement placé pour s’approvisionner en réactifs ».

Le projet industriel d’ampleur semble en tout cas satisfaire le maire de Setúbal, André Martins qui a affirmé : « nous sommes très fiers que notre municipalité ai été choisie et que l’on valorise le fait qu’elle dispose de zones industrielles qualifiées, d’une bonne accessibilité routière, ferroviaire et portuaire et d’un environnement urbain, social et culturel tout aussi attractif ».

La coentreprise qui porte le projet, baptisée Aurora et composée à 50-50 de Northvolt et Galp, dit vouloir intégrer l’énergie verte pour alimenter le processus de conversion.

Selon le communiqué relatif à l’opération, l’usine devrait représenter un investissement proche de 700 millions d’euros, et créer plus de 200 emplois directs qualifiés et plus de 3 000 emplois indirects dans la région. Le démarrage des opérations est prévu d’ici la fin de 2025 et le démarrage des opérations commerciales en 2026.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 13 avril 2022 : viewtopic.php?p=2341282#p2341282

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://www.nsenergybusiness.com/news/c ... as-yichun/CATL’s subsidiary acquires exploration rights to a lithium clay deposit in China’s Yichun

The deposit is estimated to contain about 2.66 million tons of associated lithium metal oxide in the 960.25 million tons of porcelain clay minerals

By NS Energy Staff Writer 22 Apr 2022

Yichun Contemporary Amperex Resources Limited, a subsidiary of CATL, won the bid for the exploration rights to a lithium clay project in Yichun, east China’s Jiangxi province at a cost of 865 million yuan (about 134.8 million U.S. dollars).

Located in Huaqiao Town of Yifeng County and Shangfu Town of Fengxin County and covering an area of 6.44 square kilometers, the deposit is estimated to contain about 2.66 million tons of associated lithium metal oxide in the 960.25 million tons of porcelain clay minerals.

Last September, CATL signed an agreement with the Yichun municipal government to jointly build a new lithium-ion battery production base and strengthen cooperation in the upstream and downstream sectors of the industry chain. The acquirement of the Yichun lithium clay deposit by Yichun Contemporary Amperex Resources Limited marks an important step of CATL’s comprehensive industry chain layout.

CATL will speed up the exploration and development of lithium mineral resources and increase the supply of lithium in a bid to bring the prices of lithium related raw materials back to a reasonable level while ensuring the security of national strategic mineral resources, and help Yichun build a new energy industry system ranging from lithium resources, lithium-ion battery materials, EV batteries to electric vehicles so as to develop the city into a sustainable lithium-ion battery hub in Asia.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Le gouvernement Mexicain nationalise le secteur du Lithium dans le pays ! Le sénat et le congrès ont approuvés.

https://www.nsenergybusiness.com/news/m ... alisation/Mexican government changes mining law to nationalise lithium industry

The government will not give any concessions, licenses, contracts, permits or authorisations pertaining to lithium reserves to private parties

By NS Energy Staff Writer 22 Apr 2022

The Mexican government has nationalised the country’s lithium industry by declaring the battery metal a public utility.

The move comes after the Mexican Senate approved the mining reform proposal put up by Mexican President Andrés Manuel López Obrador. The legislation was backed by 87 votes, while there were 20 votes against the proposal and 16 abstentions.

Earlier, the legislation was approved by the lower house of Congress.

As per a decree issued by the Mexican President, the government will not grant any concessions, licenses, contracts, permits or authorisations pertaining to lithium reserves to private parties.

Furthermore, concessions in which lithium deposits are present will be considered mining reserve areas, stated the decree.

The decree read: “It is recognised that lithium is the patrimony of the Nation and its exploration, exploitation, benefit and use is reserved in favour of the people of Mexico.

“The economic value chains of lithium will be administered and controlled by the State through the public body indicated in article 10 of this Law.”

According to the government, Mexican Geological Service will help the decentralised public body that will take care of lithium’s exploration, exploitation, benefit and use in the location as well as recognition of the geological areas in which there are probable reserves of the battery metal.

The Mexican government will be responsible to protect and take care of the health of citizens, the environment, and native peoples, indigenous and Afro-Mexican communities’ rights relating to exploration, exploitation, benefit and use of the metal and its value chains.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 13 oct 2012 viewtopic.php?p=333564#p333564

sur le site de Snow Lake : https://snowlakelithium.com/geology/

https://oilprice.com/Metals/Commodities ... g-Way.htmlJust 700 km from CentrePort Canada, Snow Lake Lithium is creating the world’s first all-electric, fully renewable lithium mine. Meanwhile, Snow Lake Resources Ltd. has commissioned a scoping study to assess the proposed creation of a Lithium Hydroxide Plant in South Manitoba. The company called the study “a strategically important step” toward creating North America’s first fully renewable, fully-electric, and fully integrated lithium processing operation.

Starting this month, the study will accelerate the company towards commercialized lithium production. It’s hoped the research will identify the technologies, innovations, skills, and potential partners required to create a world-class lithium hydroxide plant in Manitoba .

The creation of a lithium hydroxide plant would greatly impact North American industry. Specifically, it would enable the integration of a domestic supply of this critical resource. Electric car companies could improve output and potentially even lower prices.

Snow Lake Lithium currently has 11.1 million metric tons of inferred resources at 1% Li2O. The mine has further plans to expand its resources based on the current active drilling campaign.

The scoping study mentioned above will commence in April 2022 and should complete by Spring 2023. Meanwhile, Snow Lake Lithium will continue its engineering evaluation and drilling program across its Thompson Brothers Lithium Project site. Company leaders expect that the mine will transition to commercial production in late 2024.

sur le site de Snow Lake : https://snowlakelithium.com/geology/

The Thompson Brothers Lithium deposit represents only one of several lithium-enriched pegmatite dykes forming a cluster associated with the Crowduck Bay Fault. Located in a mining-friendly jurisdiction with access and infrastructure - the property includes multiple spodumene pegmatite dykes, which typically appear in clusters. Drill results show promise of significant lithium resources - suggesting that as a fully functioning lithium mine it could produce 160k tonnes per annum of 6% lithium ore concentrate over an 8 to 10 year period.

Snow Lake has a strong land position encompassing 22,386 hectares /55,318 acres.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de 2 posts au dessus au sujet de la nationalisation du Lithium au Mexique. Comparé à la nationalisation du pétrole dans le pays en 1938.

https://www.mining.com/head-of-mexico-c ... years-ago/Head of Mexico City government compares lithium nationalization to that of oil 84 years ago

Staff Writer | April 24, 2022

Following the nationalization of the lithium industry approved by the country’s Senate on April 21, Claudia Sheinbaum, head of the government of Mexico City, said during a public speech over the weekend that the decision is comparable to the nationalization of the oil industry approved during the presidency of Lázaro Cárdenas, 84 years ago.

“What did President Lázaro Cárdenas do in 1938? He nationalized oil. For what? So that oil was used for the well-being of the Mexican people and so that foreign companies would not take it away,” Sheinbaum said. “Well, what President López Obrador did is similar to what General Lázaro Cárdenas did: he gave lithium back to Mexicans.”

The government official said that prior to the approval of the new law, lithium deposits could be privatized and that many foreign mining companies would take them and give very little in return.

Sheinbaum also said that the opposition MPs who voted against the initiative betrayed their country, while those who voted for it are “nationalists committed to their country.”

The new law elevates lithium to the category of “strategic mineral,” declaring the exploration, exploitation, and use of lithium to be the exclusive right of the state. It also includes a clause allowing the state to take charge of “other minerals declared strategic” by Mexico.

Since the bill was passed, 90 days started running for the executive to create a new, decentralized body to deal with all lithium-related matters, which means that no new concessions, permits or contracts will be granted.

When announcing the approval, López Obrador said his administration will review all lithium contracts, which casts a shadow of doubt over projects already being developed in the country, including the one held by Bacanora Lithium in the country’s northwest.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://www.mining.com/rosatom-nornicke ... in-russia/Rosatom, Nornickel to develop lithium project in Russia

Cecilia Jamasmie | April 25, 2022

Russia’s state-owned nuclear power supplier Rosatom and Nornickel, the world’s largest producer of refined nickel, are fine-tuning details of a plan to develop the Kolmozerskoye lithium deposit in the country’s northwest, Sputnik radio reported.

The announcement comes about two weeks after Chile and Argentina suspended raw lithium shipments to Russia amid increasing global sanctions to Moscow linked to the invasion of Ukraine.

The country does not have any lithium mines and it could soon face extreme shortages of the battery metal if Bolivia follows the example of its South American neighbours.

While Russia could receive lithium from China, the country is also experiencing a shortage of the commodity, so the situation seems unlikely, experts say.

“We have processing capacity, but if there is no feedstock there could be a very big problem in supplying our own lithium-ion battery needs,” said Vladislav Demidov, deputy head of the Industry and Trade Ministry’s metallurgy and materials department earlier this month.

...................

Et bien ils devront développer sans aucune technologie occidentale .......

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://www.mining.com/web/top-bid-for- ... vels-call/Top bid for lithium up 140% after Musk’s ‘insane levels’ call

Bloomberg News | April 28, 2022

The highest bid for lithium at an online sale surged by 140% in just six months, an indication the stampede for supplies of the main ingredient used in electric vehicle batteries could get even more intense.

Pilbara Minerals Ltd.’s auction of spodumene concentrate — a partly-processed form of lithium — attracted a top bid of $5,650 a ton on Wednesday for a cargo of 5,000 tons. That compares with $2,350 at the previous sale in late October on the Australian miner’s Battery Metal Exchange.

The surging prices are unnerving battery makers and EV firms. Tesla Inc. Chief Executive Officer Elon Musk said this month that lithium had gone to “insane levels” and is the “fundamental limiting factor” for EV adoption, adding the car giant might consider mining or refining it directly. Contemporary Amperex Technology Co. Ltd., the world’s largest battery maker, said last week it had won exploration rights for a lithium clay deposit in China.

“The pricing received on the BMX sales trading platform is indicative of the critical shortage that exists in respect of lithium raw material supply,” Pilbara Minerals said in a statement. It’s the company’s fourth online spodumene sale.

The jump in the auction bid is roughly in line with the increase in lithium carbonate — a chemical used in battery production — in China. It started rising in the middle of last year as the global recovery from the pandemic coincided with a surge in EV demand.

The rally has lost momentum in recent weeks — prices are currently at 467,500 yuan ($71,182) a ton, according to Asian Metal Inc. — as the worsening virus outbreaks upended supply chains and clouded the consumption outlook. The auction result suggests Chinese lithium compound prices are unlikely to drop below 400,000 yuan a ton, Daiwa Capital Markets’ analysts Dennis Ip and Leo Ho said in a note.

Miners are cranking up production to meet the skyrocketing demand and also enjoying bumper profits. Chinese producer Ganfeng Lithium Co. reported a more than 600% jump in first-quarter net income from a year earlier, while Pilbara’s share price rose as much as 6.5% on Wednesday.

The Perth-based miner said it plans to hold the auctions more frequently as it ramps up production at its Ngungaju mine in Western Australia. However, it also warned that virus-related labor disruptions may result in output being in the lower half of the 340,000-380,000 ton guidance for the year through June.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 19 fev 2022 viewtopic.php?p=2337019#p2337019

https://www.agenceecofin.com/metaux/050 ... ium-manonoRDC : AVZ Minerals se rapproche de l’obtention du permis d’exploitation pour son projet de lithium Manono

Agence Ecofin 5 mai 2022

Le lithium est l’un des métaux stratégiques de la transition énergétique du fait de son utilisation dans les batteries de véhicules électriques. C’est une motivation supplémentaire pour l’australien AVZ Minerals, actif en RDC sur le projet Manono qu’il travaille à faire entrer en production.

En RDC, la ministre des Mines, Antoinette N’Samba Kalambayi a signé un décret pour attribuer un permis d’exploitation à la compagnie minière AVZ Minerals pour son projet de lithium Manono. C’est l’annonce faite mercredi 4 mai par l’australien qui entre ainsi dans un tournant décisif pour ses plans de concrétiser cet actif phare.

Il lui faudra payer les droits de surface au cadastre minier, par le biais de sa filiale Dathcom, pour que l’attribution devienne officielle. Cette dernière étape devait être bouclée d’ici quelques jours, apprend-on.

« La réception du décret ministériel d’attribution du permis d’exploitation minière ouvre la voie à AVZ pour commencer à développer ce qui est sans doute l’un des nouveaux projets miniers les plus importants au monde, qui contribuera de manière significative à la transition énergétique verte mondiale », se réjouit Nigel Ferguson, DG d’AVZ Minerals.

Une décision d’investissement finale est attendue prochainement afin de démarrer la construction de la mine Manono. Pour le moment, la compagnie s’active à mobiliser les fonds nécessaires (545,5 millions de dollars), aux côtés de son partenaire chinois Suzhou CATH Energy Technologies. Notons que les premières tonnes de spodumène de lithium sont attendues vers les derniers mois de 2023.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 13 nov 2021 viewtopic.php?p=2330366#p2330366

https://www.agenceecofin.com/metaux/060 ... m-bougouniMali : Kodal Minerals lève 3,7 millions de dollars pour faire avancer le projet de lithium Bougouni

Agence Ecofin 6 mai 2022

Au Mali, le projet de lithium Goulamina a attiré les projecteurs ces derniers mois, grâce notamment à l’arrivée d’investisseurs chinois prêts à financer la construction et la mise en service de la mine. Il ne s’agit néanmoins pas du seul actif de lithium en développement dans le pays.

La compagnie minière Kodal Minerals a levé 3 millions de livres sterling (3,7 millions $) dans le cadre d’un placement de nouvelles actions. C’est ce qu’elle a annoncé le jeudi 5 mai, précisant que les fonds permettront de poursuivre les activités préparatoires au lancement de la construction de sa mine de lithium Bougouni au Mali.

« Les fonds levés lors du placement seront utilisés pour achever le programme d’ingénierie et les importants programmes environnementaux, sociaux et d’engagement communautaire », a commenté Bernard Aylward, PDG de Kodal Minerals. Une partie du financement sera également affectée à des travaux d’exploration dans le but de fournir une prochaine mise à jour de l’estimation de ressources minérales.

Fin 2021, le gouvernement malien a validé le permis minier de Kodal Minerals, lui donnant le droit d’exploiter le lithium de Bougouni pendant 12 ans au moins. Si la compagnie n’a pas encore mobilisé les fonds pour lancer la construction de la mine, il faut tout de même rappeler que le contexte actuel devrait lui faciliter la tâche.

Depuis quelques années, la demande mondiale de lithium progresse grâce à son utilisation dans les batteries électriques, avec une hausse des prix à la clé. Ces perspectives attirent les investisseurs, notamment chinois, qui ont pris ces derniers mois des intérêts dans plusieurs projets africains de lithium, au Mali, en RDC et au Zimbabwe. Les Etats-Unis se sont également signalés avec l’accord entre l’américain Piedmont Lithium et Atlantic Lithium, compagnie active sur des projets prometteurs au Ghana.

Pour rappel, Bougouni est en mesure de livrer près de 2 millions de tonnes de concentré de spodumène, ce qui permettrait à Kodal de générer 1,4 milliard $ de revenus. Ces chiffres issus de l’étude de faisabilité réalisée en 2020, pourraient encore être améliorés non seulement à cause des prix du lithium sur une courbe ascendante depuis deux ans, mais aussi grâce à une probable augmentation des ressources minérales.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://www.mining-technology.com/news/ ... m-licence/PepinNini expands Argentinean lithium brine project with new licence

The Australian firm now has three licences in the Pocitos area of the Salta lithium brine project.

May 3, 2022

Australia-based PepinNini Minerals has secured the Tabapocitos 01 licence that expands its Salta lithium brine project in Argentina.

Located in the Pocitos area in the southern part of the Salta project, Tabapocitos 01 is situated immediately near PepinNini Minerals’ Pocitos 11 licence, as well as the site of an industrial park planned to be developed by the Salta provincial government.

PepinNini is assessing options to build a plant at the industrial park. The plant is intended for production of lithium carbonate (LIC) at a commercial-scale from the brines extracted from the wider Salta lithium project.

In a press statement, PepinNini Minerals said: “In addition to the site of the proposed industrial park, PepinNini’s Pocitos licences are well located relevant to critical road, rail and water infrastructure. This represents a significant benefit for any future project development.”

The company now holds three licences in the Pocitos area. The other two are Pocitos 11 and Tabapocitos 02.

PepinNini Minerals is planning to include brine samples from the Pocitos licences, the Incahuasi salares and Rincon, as well as other licences within the Salta Project area, in planned assessment studies for direct lithium extraction (DLE).

This would help in significant expansion of brine sources from the project for potential commercial evaluation, the company noted.

PepinNini plans to develop lithium brines resources of adequate scale from the Salta project to support the development of LIC production to cater to lithium battery markets.

Covering 147.07km², the Salta lithium brine project features five salt lakes that are situated within seven mining leases. It is located in the lithium triangle of north-west Argentina.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://www.mining.com/argentina-expect ... um-sector/Argentina expects $4.2bn investment in its lithium sector

Cecilia Jamasmie | May 10, 2022 mining.com

Construction at Caucharí-Olaroz lithium project, one of the two producing mines in Argentina. (Image courtesy of Lithium Americas Corp.)

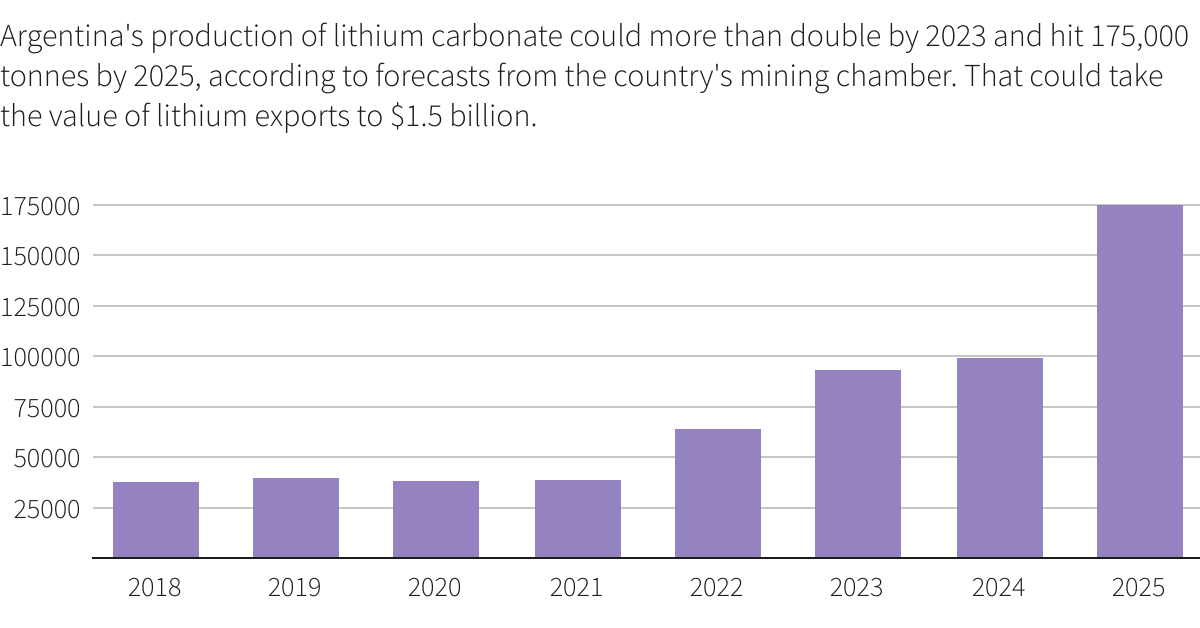

Argentina expects to receive a $4.2 billion combined investment in its growing lithium market over the next five years, which would help the country double production in 2023 to reach 175,000 tonnes of the battery metal in 2025.

The country has attracted over the past year major players, including the world’s second largest miner Rio Tinto and South Korean steelmaker Posco.

Argentina sits atop the “lithium triangle” a region shared with neighbouring Chile and Bolivia, which contains nearly 56% of the world’s resources of the metal, according to the most recent figures from the United States Geological Survey (USGS).

This means, according to productive development minister Matías Kulfas, the country has the potential to become the world’s third or fourth biggest lithium producer.

Kulfas, who participated in a round-table to discuss the sector’s potential last week, said the projected investment will be key to build the necessary infrastructure and improve efficiencies.

The minister also highlighted the need for sound policies that help spur investment in the industry without neglecting the environment.

Argentina produced 33,000 tonnes of lithium in 2020 and projects it will reach 50,000 tonnes of the battery metal this year.

Argentina’s northern provinces are emerging as a hub for greenfield lithium projects, attracting majors and juniors alike.

The nations’ lithium portfolio includes 23 projects in various stages of development, including Ganfeng Lithium and Lithium Americas’ under construction Caucharí-Olaroz. The project is expected to become Argentina’s top producer with 40,000 tonnes of lithium carbonate equivalent (LCE) a year, starting in second half of 2022.

Australia’s Orocobre and US miner Livent Corp, which have supply tie-ups with Toyota Corp and BMW respectively, operate the two producing lithium mines in the country.

* Figures in metric tonnes. ( Source: Reuters, with data from CAEM.)

Rio Tinto completed in March the acquisition of the Rincon lithium project in Salta, which holds reserves of almost 2 million tonnes of contained lithium carbonate equivalent, sufficient for a 40-year mine life.

Posco vowed to invest $4 billion in a project at a salt flat called Salar del Hombre Muerto, located on the border between the Salta and Catamarca provinces.

Australia’s Lake Resources (ASX: LKE) is also present in the area, with its flagship Kachi lithium project. The asset, which is expected to initially produce 50,000 tonnes per annum from 2024, recently secured Ford as a client.

The automaker aims to buy 25,000 tonnes annually of the white metal and represents a major bet on direct lithium extraction (DLE), a technology that filters lithium from brines and uses far less acreage than open pit mines and evaporation ponds.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Premiéres production de hydroxide de Lithium de qualité batterie pour la joint venture entre l'Australien IGO et le Chinois Tianqi en Australie :

Kwinana plant. ( Image courtesy of Tianqi Lithium.)

https://www.mining.com/tianqi-produces- ... hydroxide/

https://www.nsenergybusiness.com/news/i ... -refinery/IGO, Tianqi produce first battery-grade lithium hydroxide at Kwinana refinery.

The produced lithium hydroxide will be exported outside Australia for producing high energy density batteries for EVs and energy storage systems

By NS Energy Staff Writer 20 May 2022

Tianqi Lithium Energy Australia, a joint venture (JV) between IGO and Tianqi Lithium, has produced the first battery grade lithium hydroxide (LiOH) at its refinery in Kwinana in Western Australia.

IGO said that based on onsite laboratory tests, the JV has produced battery grade lithium hydroxide successfully and consistently over several days.

The Australian mining and exploration company said that the product samples have been verified independently.

IGO said that the process for product qualification with offtake customers will begin.

The Australian company has a stake of 49% in the JV, while the remaining 51% stake is owned by Tianqi Lithium, a Chinese mining and manufacturing company.

Through the lithium JV created in 2021, IGO has an indirect stake of 25% in the Greenbushes lithium mine in Western Australia.

IGO managing director and CEO Peter Bradford said: “We are delighted to announce this important achievement and we congratulate the joint venture team for their focus and professionalism through the progressive commissioning and trial production of Train 1 at Kwinana and the delivery of this important milestone.

“Vertical integration into downstream processing is a key plank in IGO’s strategy and we are proud to be involved in the first production of lithium hydroxide in commercial quantities in Australia.

“The joint venture’s interest in both the upstream mining asset at Greenbushes and the downstream refinery at Kwinana is emerging as a globally significant, integrated lithium business.”

The lithium hydroxide produced at the Kwinana refinery will be exported outside Australia. It will be used in the production of high energy density batteries for electric vehicles (EVs) as well as energy storage systems.

The refinery has a workforce of 200 and is anticipated to reach commercial production in the coming months after achieving product qualification. It has a nameplate capacity of 24,000 tonnes per annum.

Western Australia Mines and Petroleum Minister Bill Johnston said: “This is not only a significant milestone for the joint venture, but also for Western Australia, and it is proof of the battery-grade materials we can produce locally.

“Tianqi’s first-of-its-kind lithium hydroxide plant demonstrates Western Australia’s capacity for downstream processing in the battery value chain.”

Kwinana plant. ( Image courtesy of Tianqi Lithium.)

https://www.mining.com/tianqi-produces- ... hydroxide/

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 8 sept 2019 viewtopic.php?p=2287467#p2287467

https://www.mining-technology.com/news/ ... t-lithium/Pilbara Minerals and Calix secure grant for lithium project in Australia

The proposed demonstration facility will process lower-grade spodumene concentrate to create a low-carbon, concentrated lithium.

May 18, 2022

Australian lithium and tantalite mining company Pilbara Minerals and its partner Calix have received a $14m (A$20m) grant to fund the development of the Mid-Stream project.

Awarded by the Australian Government under the Modern Manufacturing Initiative (MMI), the grant will be used by the partners to develop a demonstration-scale chemicals facility at the project.

Earlier this month, Pilbara Minerals signed a memorandum of understanding with Calix over the Mid-Stream project, which involves the development of the demonstration facility to produce lithium salts utilising renewable energy.

The proposed demonstration facility will be equipped to process fine, lower-grade spodumene concentrate from the Pilgangoora project to create a low-carbon, concentrated lithium salt.

Pilbara Minerals said in a statement: “The objective of the Mid-Stream Project is to deliver a superior ‘value-added’ lithium raw material that outperforms across the key metrics of product cost, quality, carbon energy reduction and waste reduction/handling.”

Located in Western Australia’s resource-rich Pilbara region, the Pilbara Minerals-owned Pilgangoora deposit is said to comprise one of the world’s largest lithium resources.

Pilbara Minerals managing director and CEO Ken Brinsden said: “The Mid-Stream Project is expected to facilitate waste minimisation in key end-use markets, which decarbonises the hard-rock lithium supply chain and creates competitive ‘value-added’ products that can serve global markets directly.”

Calix managing director Phil Hodgson said: “This world-first project aims to develop a low carbon process for lithium salt production into a rapidly growing market that is increasingly demanding more sustainable practices.

The two companies are planning to sign a formal JV in the third quarter of this year followed by final investment decision on the project in late 2022 or early next year.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 23 avril 2022 viewtopic.php?p=2341959#p2341959

https://www.agenceecofin.com/metaux/250 ... d-ici-2023Zimbabwe : le chinois Huayou veut faire entrer en production le projet de lithium Arcadia d’ici 2023

Agence Ecofin 25 mai 2022

En avril dernier, l’australien Prospect Resources a finalisé la cession du projet de lithium Arcadia au chinois Zhejiang Huayou Cobalt pour 377,8 millions $. La future mine zimbabwéenne est capable de soutenir une production sur plus de 18 années.

Au Zimbabwe, la compagnie minière Zhejiang Huayou Cobalt veut investir une somme 300 millions de dollars pour accélérer le développement de son nouveau projet de lithium, Arcadia. Elle prévoit, d’après les informations relayées mardi 24 mai par plusieurs médias locaux et internationaux, que la mine livre son premier lot de spodumène et de pétalite, des minerais contenant du lithium, d’ici 2023.

La filiale du géant chinois qui pilote le projet, Prospect Lithium Zimbabwe, compte utiliser ces fonds pour construire la mine et installer une usine d’une capacité de traitement d’environ 4,5 millions de tonnes de minerai par an. L’objectif est de pouvoir produire annuellement jusqu’à 400 000 tonnes de concentré de lithium.

L’empressement de Huayou pour concrétiser cet actif peut s’expliquer par le contexte actuel où la demande du lithium est en hausse du fait de son utilisation dans les batteries de véhicules électriques. Les investisseurs sont notamment à l’affût d’opportunités dans le secteur du lithium et d’autres métaux stratégiques de la transition énergétique pour engranger des profits.

Pour rappel, le projet Arcadia héberge 42,3 millions de tonnes de réserves de minerai prouvées et probables à une teneur de 1,19 % en oxyde de lithium. Quant aux ressources minérales, elles atteignent 72,7 millions de tonnes titrant 1,06 % d’oxyde de lithium.

- energy_isere

- Modérateur

- Messages : 103103

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 9 fev 2019 viewtopic.php?p=2280357#p2280357

https://www.agenceecofin.com/metaux/240 ... tain-d-uisNamibie : AfriTin réussit à produire un concentré de lithium à hauteur teneur grâce à sa mine d’étain d’Uis

Agence Ecofin 24 mai 2022

Le projet Uis en Namibie produit de l’étain depuis 2019, mais la compagnie propriétaire veut également mettre à profit les autres ressources de l’actif comme le tantale ou le lithium. Pour ce dernier métal, le contexte est très favorable, avec la croissance du marché des véhicules électriques.

En Namibie, la compagnie minière AfriTin Mining, a annoncé le mardi 24 mai les résultats des tests métallurgiques sur du minerai prélevé à sa mine d’étain d’Uis. Elle a réussi à produire un concentré de pétalite pur jusqu’à 94 % qui sera proposé à plusieurs acheteurs potentiels, dans l’optique d’une exploitation à plus grande échelle.

« La ressource en lithium est contenue dans le corps minéralisé actuellement exploité, et le concentré de lithium sera un sous-produit de notre concentré d’étain existant. Ces résultats positifs nous permettent de progresser dans la conception et la construction d’une usine pilote de lithium à Uis », explique Anthony Viljoen, PDG de la compagnie.

Notons que c’est la société sud-africaine Consulmet qui a obtenu le contrat EPCM (Engineering, Procurement and Construction Management) de l’usine pilote en question. Sa mise en service est prévue pour le dernier trimestre 2022.

Pour rappel, le concentré de pétalite est une matière première historiquement utilisée dans l’industrie du verre et de la céramique. Il bénéficie néanmoins d’un intérêt croissant de la part de l’industrie des véhicules électriques à cause de la croissance de ce marché très demandeur en batteries lithium-ion. Les acheteurs de pétalite transforment désormais le produit en carbonate ou hydroxyde de lithium de qualité batterie.

S’aligner sur un tel marché représente donc un moyen pour AfriTin de générer à moyen terme davantage de revenus, ce qui devrait également profiter au gouvernement namibien. En plus de ces bénéfices directs, la production de lithium en Namibie pourrait éveiller l’intérêt d’autres investisseurs pour le sous-sol du pays, participant ainsi à la diversification du secteur minier voulue par Windhoek.