https://www.mining.com/web/chinas-coppe ... the-world/China’s copper production boom threatens to crowd out the rest of the world

Bloomberg News | November 12, 2024

Chinese copper smelters are facing pressure to rein in an expansion that’s pounding the industry’s profitability. The viability of plants across the globe may be at stake.

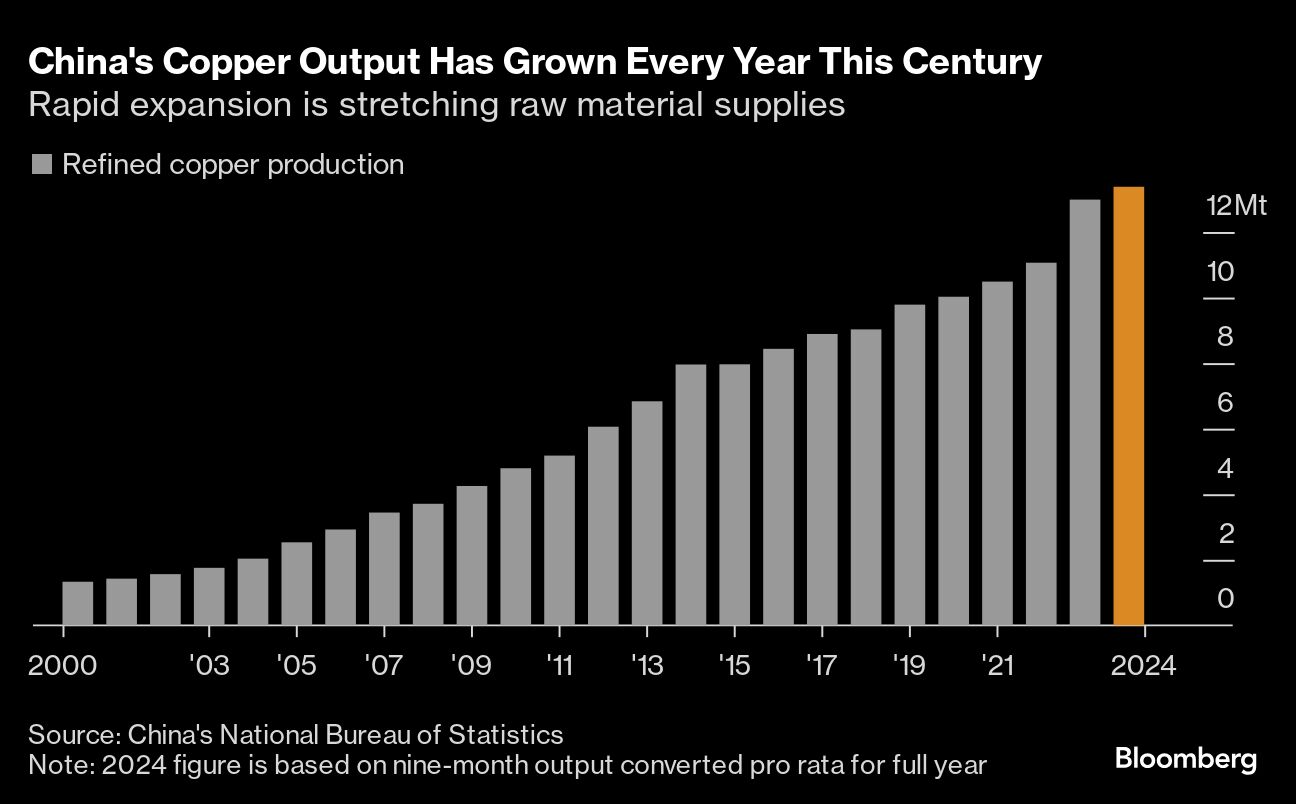

The top consumer of copper globally is on track to produce about half the world’s refined metal this year after a frenzy of smelter construction to secure supplies crucial to the energy transition. The boom in capacity has continued despite cutthroat competition for scarce raw materials that is crushing margins everywhere.

China’s excesses threaten the future of copper refining beyond its borders, said Grant Sporre, head of metals and mining research at Bloomberg Intelligence. Operations from Chile to Europe and India could be at risk, he said.

Mounting calls within the country to curb production and scale back the formidable pipeline of new plants have yet to be heeded. If the breakneck expansion continues — and forces curtailments elsewhere in the world — more output will be concentrated in China, even as western governments fret about its grip on strategic minerals.

The situation will come to a head at Asia’s biggest gathering of the copper industry in Shanghai this week, when smelters face crunch talks on the ore supply contracts that determine their margins. Miners have the whip hand at the annual negotiations because capacity is running so far ahead of global mine production.

The treatment and refining fees paid to smelters to convert ore into metal could drop to $40 a ton or less for next year, according to industry estimates, from $80 a ton in 2024. Such a settlement could lead to widespread losses. The previous low was $43 a ton in 2004, according to metals consultancy CRU Group, which has data going back to 1992.

Demand from renewables, electric vehicles and grid infrastructure is poised to balloon in coming decades. That’s spurring more investment along the copper supply chain, but smelters are far quicker and cheaper to build than new mines.

........................................

Le Cuivre

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/norilsk-nick ... -in-china/Nornickel moves closer to deal for new copper plant in China

Bloomberg News | November 12, 2024

MMC Norilsk Nickel PJSC, Russia’s biggest miner, is in advanced talks to build a large copper smelter on China’s south coast, according to people familiar with the situation.

The plant, to be located in the port city of Fangchenggang in Guangxi region, would produce 500,000 tons of refined copper a year using concentrate shipped from Russia, said the people, who asked not to be identified as the information is private. They described the move as an effort to move the final processing step closer to the world’s largest metal market.

Nornickel, as the company is known, has been exploring options for joint projects in China since at least earlier this year, motivated by deepening sanctions on Russian commodities, the firm’s president, Vladimir Potanin, said in April.

The people did not name the Chinese entity in talks with Norilsk.

Among other options, the Russian firm had previously held talks with at least two other Chinese companies about using their existing smelters to treat the Russian concentrate, the people said. That route is no longer under consideration and Nornickel is now focused on a greenfield plant, one of the people said. The plan is not yet finalized, however, and is still subject to change.

Nornickel’s press service declined to comment.

The Russian move comes as China grapples with a glut of existing refining capacity, however. Nornickel’s plan has sparked pushback from China’s own copper industry, said two of the people. Fangchenggang already has a 600,000-ton smelter run by China’s state-owned Jinchuan Group.

China’s share of global refined copper has been increasing after a frenzy of smelter construction in recent years. The capacity boom has put the industry in a predicament, as cutthroat competition for scarce raw materials crushes margins.

Nornickel is not sanctioned by the West, but the US and UK have placed restrictions on trading aluminum, copper and nickel produced in Russia, in a bid to curb President Vladimir Putin’s ability to fund his war on Ukraine.

China imported about 165,000 tons of Russian refined copper in the first nine months of the year, falling by more than one-third from the same period in 2023.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

MITSUI veut s'inviter dans le Cuivre de Zambie avec 2 milliards de dollars :

https://www.mining-technology.com/news/ ... r/?cf-viewMitsui places highest bid for stake in First Quantum’s Zambian copper mines

The divestment of stakes may ease First Quantum’s financial strain after the closure of its Panamanian copper mine due to protests.

November 21, 2024

Japanese trading company Mitsui has placed the highest bid for around a 20% share in Canadian mining giant First Quantum Minerals‘ Zambian Sentinel and Kansanshi copper mines for roughly $2bn (Y308.82bn), reported Bloomberg, citing sources familiar with the matter.

The bid surpasses a competing offer from Saudi Arabia’s Manara Minerals Investment.

The potential deal’s terms are still under negotiation. The company could opt for an alternative buyer or retain its assets.

This development comes as First Quantum seeks to alleviate financial pressures following the mandatory closure of its Panamanian copper mine last year following public protests.

The Canadian company’s shares have surged by 67% this year, amounting to a market value of around $10.8bn (C$15.08bn), with its Zambian operations contributing significantly to its copper production and revenue.

The interest in copper mines is on the rise globally, driven by the anticipated demand surge due to the metal’s critical role in electric vehicle production and renewable energy infrastructure. However, the market faces a shortage of new mining projects.

Mitsui is known for securing stakes in mines to ensure a supply of essential materials for Japan’s industries. Its bid reflects the competitive landscape where trading companies are increasingly contending with state-backed entities from regions such as the Middle East and China.

Manara Minerals Investment, with the backing of the Saudi sovereign wealth fund, has been pursuing a strategy to establish Saudi Arabia as a key player in the metals and mining sector.

The investment vehicle acquired a 10% stake in Vale’s base metal division for around $2.5bn (SR9.38bn) earlier this year.

Representatives from Mitsui, First Quantum and Manara have not provided any comments on the ongoing discussions.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

BHP va encore investir des milliards de dollars dans les mines de cuivre au Chili :

https://www.mining.com/bhp-to-spend-up- ... expansion/BHP to spend up to $14 billion on Chilean copper expansion

Cecilia Jamasmie | November 19, 2024

BHP (ASX: BHP) has outlined its ambitious plans to boost copper production in Chile, aiming to increase output by 430,000 to 540,000 tonnes per annum (tpa) based on its current operations, but the world’s largest miner is also looking into new projects.

Speaking to investors and journalists gathered in a Chile tour this week, BHP’s president, Minerals Americas, Brandon Craig, said the company’s long-term production is projected to stabilize at around 1.4 million tonnes per annum (Mtpa), a modest increase of 100,000 tonnes from current levels.

BHP, which owns and operates the giant Escondida copper mine in Chile, said the company will need to invest between $10 and $14 billion at a capital intensity of $23,000 per tonne of copper equivalent (CuEq) to achieve its growth plans.

At Escondida, the world’s largest copper mine, BHP plans to invest between $7.3 billion and $9.8 billion in new projects starting from 2028. These initiatives aim to offset ore grade declines and the upcoming closure of the Los Colorados plant.

............................

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 10 janvier 2021 viewtopic.php?p=2314938#p2314938

https://www.nsenergybusiness.com/news/k ... t/?cf-viewKGL reports 26.4% increase in underground mineral resources at Jervois copper project

An independent technical expert review of the Australian copper project will also be conducted before finalising the updated feasibility study

Refna Tharayil 25th Nov 2024

KGL Resources has announced a 26.4% increase in underground mineral resources at its Jervois copper project in Australia, following the completion of its 2024 underground drilling programme.

This growth enhances the project’s overall mineral resource estimate (MRE) and extends its mine life, which the company anticipates will further support the project economics.

The updated underground resource has increased by 4.1Mt. This expansion has resulted in significant gains in contained metals, with copper rising by 42.7kt, silver by 2.8Moz, and gold by 22.4koz.

In addition, the Jervois mineral resource has grown from 23.37Mt to 27.45Mt, an increase of 17.4% higher than the May 2024 estimate. However, the copper grade has slightly reduced from 2.02% to 1.87%.

Total contained copper now stands at 513kt, while contained silver and gold have reached 22.4Moz and 215koz, marking increases of 14.7% and 11.3%, respectively.

KGL Resources said that the 2024 drilling programme was completed ahead of schedule, which included 75 drill holes totalling 23,037m.

The company plans to extend its exploration efforts through the remainder of 2024, targeting additional near-surface resources with results expected in early 2025.

Simultaneously, KGL Resources is conducting a comprehensive review of the Jervois mineral system to refine exploration plans for the next year.

Progress has also been made on the feasibility study update for the Jervois copper project. Separate Tier 1 contractors have reviewed and updated key areas, including open-cut and underground mine designs, along with scheduling and civil works.

An independent technical expert (ITE) review will also be conducted before finalising the updated feasibility study.

KGL Resources CEO Philip Condon said: “KGL’s exploration team has conducted a successful 2024 exploration program and we are pleased to provide an updated mineral resource estimate that incorporates the results of this work.

“The program has helped add 4.1Mt to the underground resource, and increase the contained copper at the project to over half a million tonnes, representing a major milestone in the development of the Jervois Project.”

Located in the Northern Territory, the Jervois copper project was acquired by KGL Resources in 2011. The environmental approval for the project was recommended in October 2019, followed by the mining management plan approval in January 2021.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.nsenergybusiness.com/news/v ... s/?cf-viewVedanta plans to invest $2bn in Saudi Arabian copper projects

The projects will include a 400ktpa greenfield copper smelter and refinery, along with a 300ktpa copper rod facility

Refna Tharayil 27th Nov 2024

Vedanta Copper International, a subsidiary of India-based Vedanta, has announced plans to invest $2bn in copper projects in Saudi Arabia.

In line with this, Vedanta Copper International has signed a memorandum of understanding (MoU) with the Saudi Arab Ministry of Investment and Ministry of Industry and Mineral Resources.

The projects will include a 400 kilotonnes per annum (ktpa) greenfield copper smelter and refinery, along with a 300ktpa copper rod facility. The facilities are set to be located in Ras Al Khair Industrial City.

These initiatives aim to bolster Saudi Arabia’s copper production capabilities in line with the country’s Vision 2030 project.

They are also expected to reduce reliance on imports to meet domestic demand, which currently stands at 365ktpa and expected to more than double by 2035.

The copper projects are likely to generate thousands of jobs, drive the development of downstream industries, and contribute approximately $19bn to Saudi Arabia’s gross domestic product (GDP).

Besides, the initiatives are anticipated to bring about $1.3 trillion in mineral resources as well as increase the mineral sector’s GDP contribution from $17bn to $64bn by the end of the decade.

Vedanta base metals CEO Chris Griffith said: “We are thrilled and truly honoured to collaborate with the Kingdom of Saudi Arabia in its Vision 2030 initiative. Our projects will enhance the Kingdom’s self-reliance in the copper supply chain. Saudi Arabia has been a leader in oil exploration and hydrocarbons for decades.

“Now, under visionary leadership, it is poised to tap into its vast, unexplored mineral potential, as it embraces the 4th Industrial Revolution.”

The company aims to start operations at the proposed copper rod mill project with an investment of $30m. The facility is projected to commence commercial production by the Q4 of the 2025-26 financial year.

All necessary approvals are in place for the copper rod project, with construction slated to begin soon.

The investment comes at a time when global copper demand is projected to grow by 40% by 2040, said Vedanta.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 11 aout 20214 viewtopic.php?p=2396216#p2396216

The Los Azules copper project sits in the Andes Mountains at an elevation of 3,500 metres. Credit: McEwen Mining.

https://www.mining.com/web/mcewen-coppe ... argentina/

https://www.mining-technology.com/news/ ... ules-fund/McEwen Copper seeks $2.5bn funding for Los Azules mine in Argentina

The Los Azules copper project is expected to receive an environmental permit in the next four to six weeks.

November 29, 2024

McEwen Copper, a subsidiary of Canadian gold and silver producer McEwen Mining, is seeking investors to raise $2.5bn (£3.51bn) to develop the Los Azules copper mine in Argentina, reported Reuters, citing the company’s vice-president Michael Meding.

The Los Azules advanced-stage porphyry copper exploration project is located in the pro-mining province of San Juan.

The mine is projected to have average annual production capacity of 322mlb of copper cathode. It will have an operational life of 27 years, according to the updated Preliminary Economic Assessment completed in 2023.

Argentina President Javier Milei earlier launched a new incentive programme to revive activity in the mining sector following the closure of its only copper mine in 2018. The programme is attracting major industry players such as BHP.

Meding said that the Los Azules mine is expected to receive an environmental permit in the next four to six weeks.

McEwen Copper is planning to commence project construction by the end of 2025.

Meding was quoted by Reuters as saying: “We have invested more than $400m to date. And now we are looking for $2.5bn for capex [capital expenditure].”

The mine is also expected to benefit from President Milei’s Incentive Regime for Large Investments, which offers a range of financial incentives including reduced customs duties, 30 years of tax credits and the gradual relaxation of capital controls.

Stellantis and Nuton, a subsidiary of global mining giant Rio Tinto, also owns stakes in the Los Azules project.

Additionally, Argentine state-owned enterprise YPF Luz has committed to supplying 100% renewable energy to the mine, with a focus on solar power, Meding said.

“We ticked many of the boxes that make it interesting for a possible European investment,” he added.

The Los Azules copper project sits in the Andes Mountains at an elevation of 3,500 metres. Credit: McEwen Mining.

https://www.mining.com/web/mcewen-coppe ... argentina/

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/chile-aims-t ... aper-says/Chile aims to invest $83bn in mining through 2033, newspaper says

Reuters | December 5, 2024

Chile plans to invest about $83.18 billion from this year through 2033, state-run agency Cochilco said in a study cited in a newspaper report on Tuesday, an increase of 27% from last year’s estimate.

Set to be presented on Wednesday, the Cochilco report will list some 51 projects in the South American nation, which is the world’s largest producer of copper and second-largest of lithium, a key ingredient of rechargeable batteries.

Chilean newspaper Diario Financiero said Cochilco’s report did not include a recently announced $14 billion expansion plan by mining giant BHP, whose Chilean projects include Escondida, the world’s largest copper mine.

With this, it said the total investment plan could amount to nearly $100 billion.

The paper said the spending hike was driven by 11 new projects amounting to about $15.66 billion, including the expansion of Freeport-McMoRan projects, works in Los Bronces by Anglo American, and planned improvements at state-owned miner Codelco at Chuqui Subterranea, as well as a Codelco lithium project at the Maricunga salt flat.

About 52% of spending totaling $42.96 billion is pegged for projects planned between 2024 and 2026, the paper added.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 25 fevrier 2024 viewtopic.php?p=2386449#p2386449

https://www.theglobeandmail.com/investi ... mine-peru/Sierra Metals Achieves Full Throughput Capacity at its Yauricocha Mine, Peru

Sierra Metals Inc. - Business Wire - Wed Dec 4

Sierra Metals Inc is pleased to report that its Yauricocha mine in Peru has reached a full capacity throughput rate of 3,600 tonnes per day (“tpd”) since the beginning of the fourth quarter. Mine development below the 1120 level was completed on time and on budget and will extend the mine life at Yauricocha.

Ernesto Balarezo, Sierra Metals’ CEO, comments , “Since receiving operating and environmental permits to develop and mine below the 1120 level at Yauricocha earlier in 2024, the team has done a terrific job developing this new zone, and just in seven months has been able to increase the throughput to 3,600 tpd. This was all done on-time, on-budget and most importantly safely.”

Mr. Balarezo continues, “Yauricocha is now operating at full capacity, which is a 30% increase from throughput levels of December 2023. As I have previously stated, the increased capacity and corresponding lower operating costs is a game changer for the mine and for Sierra Metals.”

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining-technology.com/news/ ... n/?cf-viewAdani copper smelter expansion to reduce India’s refined copper imports

India's refined copper production currently stands at approximately 555,000 tonnes per annum (tpa).

December 9, 2024

India’s Federal Ministry of Mines has announced that the expansion of Gautam Adani’s copper smelter is set to increase capacity, potentially eliminating the country’s dependence on refined copper imports, Reuters reported.

Copper, identified as a critical mineral by India last year, is in high demand as the nation experiences rapid economic growth, according to the news agency.

Kutch Copper, part of Adani Enterprises, has commenced operations and is expected to reach its full capacity by February/March of the following year.

The $1.2bn (Rs101.64bn) plant in Mundra, Gujarat, will have an initial capacity of 500,000 tonnes (t), with plans to double this to one million by 2028–29, according to a Kutch Copper executive.

India’s refined copper production currently stands at approximately 555,000tpa, which falls short of domestic consumption of more than 750,000tpa, according to the news agency.

Consequently, the country imports around 500,000t of copper each year to bridge this gap. In the fiscal year ending March 2024, India imported around 363,000t of refined copper cathodes, with Japan being the largest supplier.

The surge in copper imports can be traced back to the 2018 shutdown of Vedanta’s Sterlite Copper smelter, which had an output of roughly 400,000t.

With the government’s push towards clean energy and electric vehicles, India’s copper demand is expected to double by 2030.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/chilean-mini ... lion-tons/Chilean mining firms see 2025 copper output at 5.4-5.6mt

Reuters | December 11, 2024

Copper production in Chile, the world’s largest copper producer, is projected to range between 5.4 and 5.6 million tons in 2025, the National Mining Association (Sonami) said on Wednesday.

Chilean mining firms also expect copper prices to range between $4.2 and $4.5 per pound next year, according to industry projections.

In September, Chile’s central bank forecast an average copper price of $4.25 per pound in 2025, slightly below its previous estimate of $4.30 per pound.

The country plans to invest approximately $83.18 billion in Mining from 2024 through 2033, a 27% increase from last year’s estimate, according to a study by state-run agency Cochilco cited in Diario Financiero.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://republicofmining.com/2024/12/23 ... r-23-2024/Codelco eyes $800M extension to keep Gabriela Mistral open until 2055

December 23, 2024

Chile’s state-owned copper producer Codelco said on Monday it has applied for an environmental permit to extend the life of its Gabriela Mistral mine by over 25 years, pushing the current closure date from 2028 to at least 2055.

The $800 million proposal aims to sustain production at the open-pit mine in Chile’s Antofagasta region, which has been operational since 2008. A key component of the plan is the transition away from using domestic land-based water by 2035. Instead, the mine will rely on third-party water sources that comply with environmental standards. In exchange, Codelco has pledged to supply an equivalent amount of water to the local community.

Vice president of corporate affairs and sustainability, Gabriel Méndez, noted the mine has utilized only 2% of the water volume stored in its permitted basin, despite having authorization to use up to 5%. He noted that the water source has no connection to local ecosystems, other basins, or external users beyond Codelco.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 15 juin2024 viewtopic.php?p=2392836#p2392836

https://www.mining-technology.com/ai/ai ... &cf-closedAI-powered mining startup KoBold Metals secures $537m in funding

KoBold plans to use the proceeds for new explorations and reinforcing its R&D efforts.

January 2, 2025

KoBold Metals, the US-based mining startup backed by billionaires Bill Gates and Jeff Bezos, has raised $537m in a Series C funding round.

Led by Durable Capital Partners and T. Rowe Price funds, this investment values KoBold at $2.96bn.

The funding will accelerate the exploration of minerals such as copper, lithium, and nickel, which are vital for technologies such as electric vehicles and mobile phones.

The company has so far amassed $1bn in total funding.

KoBold plans to use the proceeds for new explorations, advancing ‘high-potential’ projects to production, and reinforcing research and development (R&D) efforts, reported Bloomberg.

KoBold’s Mingomba copper mine in Zambia is particularly earmarked for development, with the company announcing a huge copper deposit at the site in February 2024.

Estimated to cost $2bn, the Mingomba project is expected to yield a minimum of 300,000 tonnes of copper annually from the 2030s.

KoBold CEO Kurt House said that about 40% of the new capital is planned to be spent on developing existing projects into mines with the project in Zambia receiving the majority of this investment.

Furthermore, KoBold plans to recruit data scientists from tech backgrounds and geoscientists for field surveys and data collection.

House said that the company is also planning a potential initial public offering within the next three to five years.

Breakthrough Energy Ventures managing partner Carmichael Roberts was cited by the Financial Times as saying that KoBold’s AI-driven approach to the exploration of minerals would create “a more secure, affordable, and clean energy future for all”.

KoBold collaborates with mining giants BHP and Rio Tinto on critical metal exploration initiatives in Australia and Canada.

KoBold Metals integrates expertise in geosciences with AI, machine learning, and data science to enhance and speed up the exploration process to identify the critical minerals required for energy transition globally.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/oman-makes-first ... -30-years/Oman makes first copper export in 30 years

Staff Writer | January 2, 2025

Image: Minerals Development Oman.

Oman has announced a significant milestone with the first shipment of copper concentrates, marking the resumption of copper export from the sultanate after a 30-year hiatus.

Approximately 900 tonnes of copper concentrates were shipped from the Lasail mine in Sohar, being developed by Minerals Development Oman (MDO).

This landmark achievement, said MDO, not only revives copper mining in Oman after nearly 30 years but also underscores its commitment to economic diversification and sustainability.

Matar bin Salem Al-Badi, CEO of MDO, noted the historical significance and emphasized the region’s 3,000-year history of copper mining, including the work of the Oman Mining Company since 1983.

“The export of the first shipment from the Lasail mine is a testament to our ability to transform challenges into tangible opportunities for growth,” Al-Badi said in a press release.

The processed ore at Lasail is expected to yield high-quality copper concentrates with purity levels ranging between 18% and 22%. Its average annual production is estimated at around 500,000 tonnes of copper ore.

MDO said it also has plans to start the Al-Baydha mine in Liwa by 2025-2026. Together, these mines have a combined reserve of approximately 2.78 million tons of copper ore. The first phase of the redevelopment project is expected to span 4 to 5 years.

The company said its vision extends beyond the redevelopment of the Lasail and Al-Baydha mines, and that it is actively conducting exploratory studies in nearby regions to boost copper reserves. Its plans include the Mazoon project, Oman’s largest integrated copper concentrate production initiative.