Discussions traitant de l'impact du pic pétrolier sur l'économie.

Modérateurs : Rod, Modérateurs

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 19 mars 2023, 11:59

suite de ce post du 19 fev 2023

viewtopic.php?p=2363182#p2363182

Le prospect de Cuivre de SantaCuz, Arizona, donne de nouvelles ambitions suite à de nouvelle découvertes :

Ivanhoe’s electro-pulse technology may expand Santa Cruz copper project in Arizona

Staff Writer | March 17, 2023

Ivanhoe Electric says visible copper in a drill hole suggested by the company’s new technology bodes well for adding high-margin ore to the resource at the Santa Cruz copper project in Arizona.

...........................

https://www.mining.com/ivanhoes-electro ... n-arizona/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 19 mars 2023, 12:03

suite de ce post du 12 mars 2023

viewtopic.php?p=2364550#p2364550

First Quantum resumes operations at Panama copper mine

Reuters | March 15, 2023

First Quantum Minerals, the operator of the Cobre Panama mine, has resumed operations to normal levels at the mine, gold-focused royalty and streaming company Franco-Nevada Corp said on Wednesday.

First Quantum had suspended ore processing operations at the mine on Feb. 23 after a Panama government order halted its loading permissions at the port, limiting its capacity to store copper.

Last week, the government and the miner agreed on the final text for a contract to operate the key copper mine.

The new contract guarantees a minimum annual income of $375 million to the Central American government, and will be effective for 20 years with the option to renew it for 20 more.

On Tuesday, Panama’s Maritime Authority lifted the suspension on First Quantum Minerals’ operations at the port of Punta Rincon, which the Canadian company uses to export copper concentrate from the Cobre Panama mine.

https://www.mining.com/web/franco-nevad ... nama-mine/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 19 mars 2023, 12:07

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 26 mars 2023, 16:28

Chypre était le plus grand centre de production de Cuivre de tout le bassin Méditerranéen à la fin de l' age de bronze.

Copper boosted development of most important trade hub of Late Bronze Age

Staff Writer | March 21, 202

..................

lire

https://www.mining.com/copper-boosted-d ... ronze-age/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 02 avr. 2023, 10:56

En plus de l'orpaillage illégal en Amazonie, il y a maintenant aussi de l'extraction de Cuivre illégal enAmazonie.

Illegal Amazon miners are expanding into copper as prices surge

Bloomberg News | March 31, 2023 |

lire

https://www.mining.com/web/illegal-amaz ... ces-surge/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 02 avr. 2023, 11:00

Rio Tinto fait entrer First Quantum dans le projet de mine de Cuivre Granja copper au Pérou.

Rio Tinto, First Quantum partner to move La Granja copper project in Peru to development

Staff Writer | March 30, 2023

Rio Tinto (NYSE, ASX: RIO) announced it has reached an agreement with First Quantum Minerals (TSE: FM) to form a joint venture to unlock the development of the La Granja copper project in Peru, one of the largest undeveloped copper deposits in the world.

La Granja is a complex orebody located at high altitude in Cajamara, northern Peru, that has the potential to be a large, long-life operation, with a published indicated and inferred mineral resource totalling 4.32 billion tonnes at 0.51% copper, Rio said.

First Quantum will acquire a 55% stake in the project for $105 million, and commit to further invest up to $546 million into the joint venture to sole fund capital and operational costs to take the project through a feasibility study and toward development. The transaction is expected to complete by the end of Q3 2023.

As majority owner, First Quantum will then operate the La Granja project with initial work focussed on completing the feasibility study.

Rio Tinto acquired the La Granja project from the government of Peru in 2006 and has since carried out an extensive drilling program that expanded the declared resource and understanding of the orebody, and established partnerships with host communities, local and national governments.

La Granja currently ranks as the fourth largest copper project in the world, and Peru is the world’s second biggest copper producer.

“La Granja is an exciting but complex project that has the potential to be a significant new source of the copper that is needed for the energy transition,” Rio Tinto Copper chief executive Bold Baatar said in the statement. “We are pleased to enter into this agreement with First Quantum, that will bring our combined development capabilities and deep knowledge of La Granja to progress the project.”

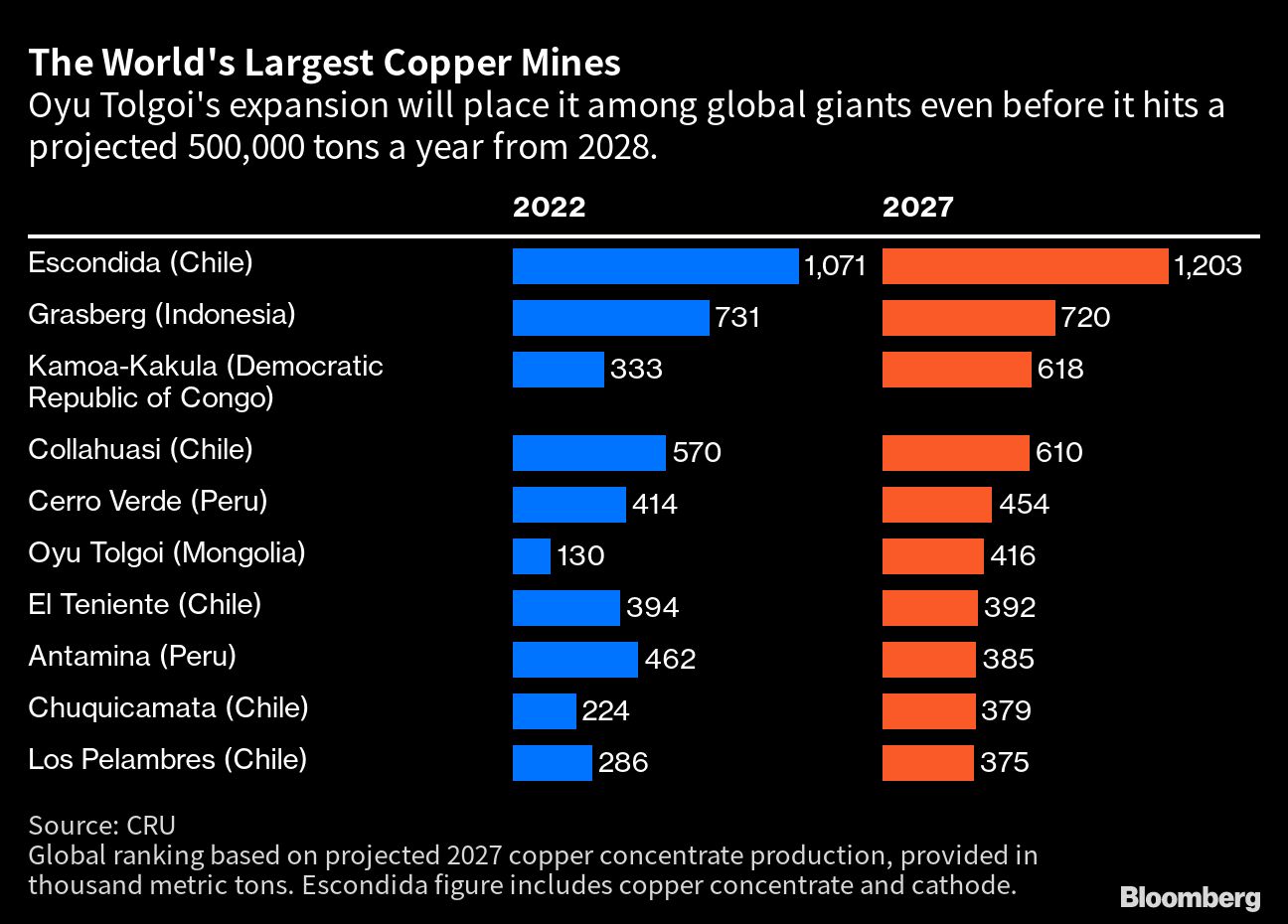

Baatar added that developing La Granja would also further strengthen Rio Tinto’s copper portfolio following the acquisition of Turquoise Hill Resources and beginning of underground mining at Oyu Tolgoi in Mongolia.

“Rio Tinto’s work on La Granja has been extensive to date and we share our partner’s view that the project has the potential to be a Tier 1 copper mine,” First Quantum CEO Tristan Pascall said. “We look forward to working together to build on this foundation, leveraging First Quantum’s core strengths in mine design, project development and community engagement to progress La Granja to the next stage.”

First Quantum has been in recent headlines over a dispute with the Panamanian government over royalties that resulted in halting operations at its giant Cobre Panama mine in February. After reaching an agreement that guarantees a minimum annual income of $375 million to the Central American government, the mine resumed operations in March.

https://www.mining.com/rio-tinto-first- ... velopment/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 02 avr. 2023, 11:10

Peru copper mines aim for output boost in 2023 after protest impact fades

Reuters | March 30, 2023 |

Peru’s copper miners hope to increase output in 2023 after recovering from the impact of major protests at the start of the year, industry executives said, despite simmering anti-government anger in the world’s no. 2 producer of the red metal.

The South American country saw a number of key mines reduce or temporarily halt production in January and February during the deadliest protests that have hit Peru in over 20 years, with the worst violence in the copper-rich Andean south.

However, protests and blockades that snarled transport to and from mines have largely been lifted, despite ongoing public anger since the dramatic ouster late last year of leftist leader Pedro Castillo. Voters are still pushing for snap elections.

“The southern (mining) corridor is operating normally, all the inventories of concentrates that the mines had are been sent to the coast,” said Víctor Gobitz, president of mining sector body SNMPE and chief executive of Peru’s top mine Antamina.

Power data from Peru’s private power sector body COES, analyzed by Reuters, shows activity at Peru’s top mines has stabilized since early March following the disruptions earlier this year, which stalled production and shipments.

That’s a boost for mines, including Chinese state-owned MMG Ltd’s Las Bambas, Glencore PLC’s Antapaccay, Hudbay’s Constancia, and Antamina, co-owned by Glencore, BHP Group Ltd, Teck Resources Ltd and Mitsubishi Corp.

Gobitz said the easing of protests and new mines coming fully online like Anglo American’s $5.5 billion Quellaveco would push up overall copper production this year.

“If we manage to resolve the issue of the mining corridor and the 100% effect of Quellaveco, then without a doubt Peru will produce more copper in 2023 than in 2022,” he said.

Peru produced some 2.44 million tonnes of copper last year, 4.8% more than in 2021 and very close to the maximum level before the global effects of the Covid-19 pandemic.

Ratings agency Moody’s said in a March report that most miners in Peru had survived relatively unscathed from the protests, though the impact would likely “delay mining company permits for projects already under construction.”

In southern Puno, the San Rafael de Minsur tin mine, the world’s fourth largest, has slowly restarted operations since March 20 after a roughly 10-week halt due to protests, though blockades continue on weekends.

A Minsur spokesperson told Reuters the mine was “on track to be operating at full capacity, but it takes some time to get there. It will depend on there being no other interruptions.”

https://www.mining.com/web/peru-copper- ... act-fades/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 02 avr. 2023, 13:43

Révision à la hausse des dépenses pour la prolongation de la mine de Cuivre Zinc de Antamina au Pérou jusqu'en 2036.

Sans nouveaux investissements la mine fermera en 2028.

Antamina mine life extension cost hiked to $2bn, CEO says

Reuters | March 30, 2023

Peru’s largest copper mine, Antamina, will spend $2 billion to extend the useful life of the deposit through 2036, up sharply from $1.6 billion previously planned, the company’s chief executive officer told Reuters on Wednesday.

Antamina CEO Victor Gobitz said the new investment figure for Antamina, co-owned by Glencore PLC, BHP Group Ltd, Teck Resources Ltd and Mitsubishi Corp, was due to higher and additional costs.

“It was due to costs on the one hand, and on the other hand because there are recurrent investments that the authorities believe should also be included in the investment figure,” Gobitz said in an telephone interview, adding he expected approval by mid-year.

Peru is the world’s second-largest producer of copper.

The lifespan of Antamina, which produced 467,905 tonnes of copper last year, is currently set to expire in 2028.

Gobitz said approval of the extension is pending an environmental impact study and should be approved by mid-year, “although we do not have control over that.”

The executive did not rule out requesting at extension beyond 2036 for the life of the mine, which is located in Peru’s central Andes and also produces silver and zinc.

“The fact that the mine is extended until 2036 does not mean that the mine is finished. In order for a new environmental impact study to be presented, an engineering study will have to be carried out to support a new expansion,” Gobitz said.

https://www.mining.com/web/antamina-min ... -ceo-says/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 08 avr. 2023, 10:12

suite de ce post du 4 mars 2023

viewtopic.php?p=2363991#p2363991

RDC : la production de cuivre a augmenté de 68 % à Kamoa-Kakula au premier trimestre 2023

Agence Ecofin 5 avril 2023

La RDC est le premier producteur africain de cuivre, mais dispose encore de millions de tonnes de réserves. Le pays cherche depuis quelques années à améliorer ses performances pour profiter de la forte demande du métal rouge et le complexe Kamoa-Kakula d’Ivanhoe s’inscrit dans cette stratégie.

En RDC, le canadien Ivanhoe Mines a annoncé le 5 avril une production de 93 603 tonnes de concentré à sa mine de cuivre Kamoa-Kakula au premier trimestre 2023, avec un record de 34 915 tonnes pour le mois de mars. Selon les calculs de l’Agence Ecofin, il s’agit d’une hausse de 68 % en glissement annuel.

« Nous sommes particulièrement satisfaits de l’amélioration des tendances en matière de récupération du cuivre, qui a permis aux usines de concentration d’atteindre des taux de récupération de 90 % en mars, ce qui a entraîné des chiffres de production record jusqu’à la fin du mois », a commenté Robert Friedland, coprésident exécutif de la compagnie.

Il faut souligner que la production de cuivre devrait encore augmenter dans les mois à venir, avec la montée en puissance progressive de la deuxième usine de traitement inaugurée fin février. Au cours du deuxième trimestre 2023, Kamoa-Kakula devrait en effet disposer d’une capacité de production annuelle de 450 000 tonnes de cuivre. Cela permettrait à Ivanhoe Mines d’atteindre la limite supérieure de ses prévisions de production (390 à 430 000 tonnes) pour 2023.

https://www.agenceecofin.com/cuivre/050 ... estre-2023

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 09 avr. 2023, 13:55

Un projet de mine de Cuivre, Zinc et Argent au Mexique :

Teck Resources, Agnico Eagle close San Nicolás copper JV in Mexico

Staff Writer | April 6, 2023

Agnico Eagle Mines (TSX, NYSE: AEM) and Teck Resources (TSX: TECK.A, TECK.B, NYSE: TECK) announced Thursday that the previously announced joint venture to advance the San Nicolás copper-zinc development project has closed.

Teck and Agnico Eagle have inked a joint venture shareholders agreement whereby Agnico Eagle, through a wholly-owned Mexican subsidiary, will take a 50% stake in Minas de San Nicolás (MSN) for $580 million. Teck and Agnico Eagle are now 50/50 joint venture partners at San Nicolás, working together to advance permitting and development of the project in the state of Zacatecas.

Two of Canada’s biggest mining companies teamed up last year in Mexico at San Nicolás — one of the country’s largest undeveloped volcanic-hosted massive sulphide deposits and among the largest globally.

Teck estimated in 2021 that San Nicolás contains proven and probable reserves of 105.2 million tonnes grading 1.12% copper, 1.48% zinc, 0.4 gram gold per tonne and 22 grams silver per tonne, or more than 2% copper equivalent.

Teck completed a prefeasibility study in March 2021 on San Nicolás, which contemplated an open-pit, truck and shovel, processing and flotation operation. The study estimated first production in 2026, a mine life of 15 years, and, during the first five years, annual production of 63,000 tonnes of copper and 147,000 tonnes of zinc in concentrate.

Average life of mine head grades, the study found, would come in at 1.13% copper and 1.49% zinc, and average C1 operating costs were pegged at 16¢ per lb. copper during the first five years of production and 44¢ per lb. over the life of mine, net of byproduct credits.

Development capital costs were forecast to run to about $842 million with a 2.6-year payback period. At $3.50 per lb. copper and $1.15 per lb. zinc, the study estimated an after-tax internal rate of return of 33%.

The companies are planning to submit an environmental impact assessment and permit application for San Nicolás in the first half of 2023 and are targeting completion of a feasibility study in early 2024.

https://www.mining.com/teck-resources-a ... in-mexico/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 09 avr. 2023, 14:54

projet de grosse mine de Cuivre et Or en Papouasie Nouvelle Guinée : le projet Wafi-Golpu

Newcrest, Harmony Gold ink deal to move Wafi-Golpu project forward

Cecilia Jamasmie | April 6, 2023 |

Newcrest Mining (ASX, TSX: NCM) and Harmony Gold (NYSE: HMY) said Thursday they have signed a framework agreement with the Papua New Guinea (PNG) government that sets key terms to jointly develop the Wafi-Golpu copper and gold project.

The memorandum of understanding (MoU) outlines the main aspects to be included in the mining development contract, a prerequisite for obtaining a special mining lease for the project, equally owned by both miners.

The granting of a licence for Wafi-Golpu has been stalled since 2019, first by the change of government in the Pacific island nation that year and, shortly after, by the global pandemic.

The MoU terms include the PNG government’s stake in the project, royalty and tax rates, permitting “as quickly as practicable”, and commitments by the JV to invest in local infrastructure and social development.

It also contains a provision for stability to underpin the significant long-term investment required to develop and operate the project.

...................

The 2018 report outlined capital costs of $2.82 billion for three block caves at Wafi-Golpu.

Average annual production over the 28-year mine life was estimated at 161,000 tonnes of copper and 266,000 ounces of gold.

.................

https://www.mining.com/newcrest-harmony ... t-forward/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 09 avr. 2023, 15:09

Un projet de mine de Cuivre en Arizona :

Arizona Sonoran receives latest permit at Cactus ahead of Q4 prefeasibility

Staff Writer | April 3, 2023

Arizona Sonoran Copper (TSX: ASCU) has received the mined land reclamation permit from the Arizona State Mine Inspector’s Office for the Cactus mine project less than four months after it applied.

The company is working on a prefeasibility study for Cactus, a porphyry copper deposit located on private land near the city of Casa Grande, and expects to release it in the fourth quarter.

“We are thrilled to have received the [permit] within three and a half months,” said Travis Snider, VP sustainability and external relations, in a news release. “Along with the other state and county agencies, these timely approvals continue to give us the confidence about our efforts to redevelop the Sacaton mine into the Cactus project.”

In a note to clients, Haywood Securities mining analyst Pierre Vaillancourt said the quick permitting time demonstrates the state regulators’ faith in the project. “The latest permit bolsters our confidence in ASCU’s ability to work with the Arizona government and move Cactus forward,” he wrote.

The Cactus project was previously known as the Sacaton mine, owned and operated by ASARCO between 1972-1984.

The property has since undergone a $20 million reclamation program under the guidance of the ASARCO Trust and the Arizona Department of Environmental Quality. The program reclaimed the majority of the property, including the tailings storage facility and the former milling facilities. An environmental baseline study was completed, and work is steadily progressing through project permitting.

After acquiring the project in 2020, Arizona Sonoran released an integrated preliminary economic assessment (PEA) in 2021, which outlined an 18-year mine operation producing an aggregate of 1 billion lb. of copper. The project has a net present value, post-tax at an 8% discount rate, of $312 million and internal rate of return of 33%.

The project contains indicated resources of 151.8 million tonnes grading 0.531% total copper (1.6 billion lb. contained copper), plus 228.9 million inferred tonnes at 0.384% total copper (1.8 billion lb. contained copper).

The mined land reclamation permit is issued at the state level through a process that governs mine sites and ensures measures will be taken to achieve stability and safety, consistent with post-mining land use objectives specified in the reclamation plan.

Arizona Sonoran has already received the aquifer protection permit and stormwater pollutant prevention permit, entitled water rights, dust control permitting, as well as general planning and zoning amendment approvals from various state and county agencies.

Only the industrial air permit remains for the company to apply for development permits needed to build the Cactus project.

https://www.mining.com/arizona-sonoran- ... s-project/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 09 avr. 2023, 15:13

prospect de Cuivre Or en Argentine :

NGEx shares shoot up 23% on new copper-gold discovery in Argentina

Staff Writer | April 4, 2023

NGEx Minerals’ (TSXV: NGEX) shares surged Tuesday on results from the first drill program at its Potro Cliffs project in northwest Argentina that reveal a potential major new copper-gold system.

Highlights from hole DPDH002, the first at the target, include 60 metres grading 5.65% copper, 2.04 grams gold per tonne and 44 grams silver from 212 metres downhole; 10 metres grading 3.7% copper, 1.51 grams gold and 259.4 grams silver from 574 metres depth; and four metres grading 5.81% copper, 2.62 grams gold and 81.5 grams silver from 150 metres depth.

The project, in San Juan province, is located between NGEx’s Los Helados copper-gold porphyry deposit to the north and Filo Mining‘s (TSX: FIL) gold-copper-silver deposit to the south, part of the prospective Vicuna District, where Lundin Group companies have been exploring since the early 2000s.

NGEx CEO Wojtek Wodzicki said in the release that the grades are some of the best he has seen in his career.

.................

https://www.mining.com/ngex-shares-shoo ... argentina/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 16 avr. 2023, 15:10

Peru will mine more copper in 2023

Reuters | April 10, 2023

Peru expects to produce 2.8 million tonnes of copper this year, a senior official said on Monday, representing an almost 15% jump from 2022, in a bright spot for the Andean nation’s top export.

Peru, the world’s no. 2 copper producer, saw output affected since December following anti-government protests and road blockades spurred by the ouster and jailing of former President Pedro Castillo.

The mining sector is now “working as normal,” Energy and Mines Minister Oscar Vera told reporters after providing the new forecast. A Reuters analysis in early March showed that major copper mines were cranking up.

The country mined some 2.44 million tonnes of copper last year, according to ministry data.

Vera added officials are also working to reduce approval times for mining projects, from about two years to about six months.

“We hope to reach that goal by the end of the year,” he said.

Through this year and next, around $7 billion in mining investments is expected, Vera said, including the expansion of the Altamina copper mine, Teck Resources’ Zafranal project and Newmont Corp’s Yanacocha Sulfuros project.

.................................

https://www.mining.com/web/peru-sees-co ... s-pending/

-

energy_isere

- Modérateur

- Messages : 89881

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

-

Contact :

Message

par energy_isere » 23 avr. 2023, 12:20

Aurubis en Allemagne qui transforme le cuivre métal en matériaux ouvragés met fin à ses nouveaux achats de cuivre de Russie.

Aurubis CEO says has stopped buying copper from Russia

Reuters | April 17, 2023

Aurubis AG, Europe’s largest copper smelter and producer, no longer buys the red metal from Russia after it let supply contracts lapse, its CEO told Reuters on Monday.

Russia’s invasion of Ukraine last year fueled a range of boycotts, sanctions and other measures against copper and other metals from the country.

Aurubis, which is not a miner, but refines and recycles copper into wire and other components, had contracts for Russian supply of the red metal that it did not renew when they recently ended, Aurubis CEO Roland Harings said on the sidelines of the World Copper Conference in Santiago, the copper industry’s largest gathering since 2019.

“We are not buying Russian copper anymore. It’s completely out of our system,” he said. Harings had asked the London Metal Exchange last October to impose a ban on Russian metal due to risk of warehouses filling up. Copper supply contracts typically end on a calendar-year basis.

Russia in 2021 – the year before the invasion – supplied Germany-based Aurubis and the entire European Union with nearly 292,000 tonnes of an 801,000 tonnes of imported copper, according to data from Trade Data Monitor.

Despite that amount, the copper market has pivoted to new sources of the red metal and Aurubis does not have supply concerns, Harings said.

“We have been able without real problems to replace the Russian copper units that we were buying with other sources,” Harings said.

Elsewhere, Harings said the broader copper market was generally healthy and noted that Aurubis is reporting strong demand, especially for cable and other products for the green energy transition.

“There are significant demands for many, many years to come for copper,” Harings said.

https://www.mining.com/web/aurubis-ceo- ... om-russia/