Albemarle plans to build 100,000tpa lithium processing plant in US

A company executive said that the planned plant will produce as much lithium that the company currently produces

By NS Energy Staff Writer 28 Jun 2022

Albemarle lithium CEO Eric Norris revealed the company’s plans of constructing a lithium processing plant in the US with a capacity of 100,000 tonnes per annum (tpa) by 2030.

The announcement was made at the Fastmarkets Lithium Supply and Battery Raw Materials 2022 conference in Phoenix, Arizona.

The Albemarle executive said that the planned plant will produce as much lithium that the company currently produces.

According to Norris, the US-based specialty chemicals manufacturer plans to construct the lithium processing plant in the US Southeast at a place where there is rail access to a major port.

Norris said: “There isn’t enough (lithium) supply yet to supply the ambitions of the US. This (processing plant) will be essential for our success in the future.”

Albemarle is said to be in active talks with auto manufacturers on purchasing lithium supply from the facility. The company already supplies Tesla and other major auto manufacturers.

The lithium processing plant in the US will have an identical design to a processing plant that was opened recently by the company in Kemerton, Western Australia.

However, the US plant will cost less than Kemerton, where costs surged well above the company’s initial target of $1.2bn.

Norris said that Albemarle intends to self-finance the lithium processing plant, although it could apply for loans from the US Department of Energy.

The new plant will be supplied from lithium produced by Albemarle’s Kings Mountain mine in North Carolina, which is presently mothballed but could reopen as early as 2027.

Earlier this month, Albemarle opened its third chemical conversion plant in Antofagasta, Chile, which is anticipated to double its lithium production.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Un projet de long terme chez Albemarle :

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Après l' Allemagne Vulcan s'intéresse à l'Italie :

https://www.mining-technology.com/news/ ... ium-italy/Vulcan and Enel collaborate to develop geothermal lithium in Italy

The parties will undertake a joint scoping study for the Cesano geothermal lithium permit.

July 8, 2022

Vulcan Energy Resources has joined forces with Italy’s geothermal energy producer Enel Green Power (EGP) to jointly explore and develop Vulcan’s Cesano licence near Rome, Italy.

Under the agreement, the two firms will equally own the Cesano geothermal lithium permit, which has potential for lithium battery chemicals production.

The parties will undertake a joint scoping study for the licence and explore other potential geothermal lithium projects in the country.

Vulcan’s Cesano Permit comprises wells drilled by Enel Group. These wells resulted in hot geothermal brine with high lithium values.

By leveraging their respective lithium extraction and geothermal expertise, Vulcan and EGP will explore the potential development of geothermal lithium projects in the area.

...........................

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 19 juin 2022 viewtopic.php?p=2345516#p2345516

c'est finalement 1.7 milliards de dollars qui ont pu être levés :energy_isere a écrit : ↑19 juin 2022, 14:31Tianqi Lithium compagnie chinoise dont j' ai déjà parlé, par exemple: viewtopic.php?f=13&t=29527&p=2343746&hi ... i#p2343746

et qui est à la bourse de Shenzen veut maintenant s'introduire à la bourse de Hong Kong la semaine prochaine pour lever 1 à 1.2 milliards de dollars.

https://www.mining-technology.com/news/ ... hong-kong/Tianqi Lithium raises $1.7bn through IPO in Hong Kong

The deal’s joint sponsors include China International Capital, Morgan Stanley, and CMB International Capital.

July 7, 2022

Chinese mining firm Tianqi Lithium has raised HK$13.5bn ($1.7bn) upon listing its shares on the Hong Kong Stock Exchange, reported Bloomberg News citing parties familiar with the development.

The Chengdu-based firm sold 164.1 million shares at HK$82 each.

Cornerstone buyers comprise South Korea’s LG Chem and the state-owned China Aviation Lithium Battery.

Financial Times reported Tianqi Lithium chair Jiang Weiping as saying at a press convention final week: “Supply exceeded demand for most of the past two decades in the lithium industry, but that dynamic flipped in 2021 with gaining popularity over electric vehicles.

“We think it will be a far-reaching and long-term development.”

The offering’s joint sponsors include Morgan Stanley, China International Capital and CMB International Capital, according to Bloomberg News.

Tianqi’s secondary listing forms part of the ‘newest fundraising rush’ of Chinese firms involved in electrical automobile battery and materials productions as the country looks to boost its domestic production of these commodities.

Tianqi Lithium, which owns lithium mines in Australia, raised $110m through an initial public offering in Shenzhen in 2010.

The firm is engaged in lithium resource investment, lithium concentrate extraction and advanced lithium speciality compound production.

Last year, Tianqi Lithium and Australian miner Independence Group (IGO) completed a $1.4bn joint venture (JV) deal for Tianqi’s Australian assets.

The JV, in which Tianqi owns a 51% stake and IGO holds a 49% interest, focuses on the existing upstream and downstream lithium assets in Western Australia.

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 12 juin 2022 viewtopic.php?p=2345122#p2345122

sur le projet de Lithium au Portugal de Savannah Resources, le CEO démisionne, et les autorisations environnementales piétinent.

sur le projet de Lithium au Portugal de Savannah Resources, le CEO démisionne, et les autorisations environnementales piétinent.

https://www.mining.com/savannah-resourc ... -eia-step/Savannah Resources shares hammered as Portugal lithium project subject to further EIA step

Cecilia Jamasmie | July 6, 2022 |

Shares in Savannah Resources (AIM: SAV) fell as much as 35% in early trading on Wednesday after revealing the sudden exit of its chief executive and having to complete an additional environmental licensing step for its flagship Mina do Barroso lithium project in Portugal.

The company said CEO David Archer was stepping down immediately after almost nine years in the post and is being succeeded on an interim basis by Dale Ferguson, the miner’s technical director.

Savannah Resources also said that Portugal’s environmental regulator, Agência Portuguesa do Ambiente (APA), has decided that Mina de Barroso’s Environmental Impact Assessment (EIA) process should continue under Article 16. This is an intermediate and optional step in the EIA evaluation process, after which APA will make its final Declaration of Environmental Impact (DIA) decision.

....................

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 2 avril 2022 viewtopic.php?p=2340586#p2340586

lire https://www.agenceecofin.com/investisse ... a-la-chineDès 2023, le Zimbabwe augmentera ses exportations de lithium grâce à la Chine

Agence Ecofin 12 juillet 2022

Le Zimbabwe est le seul producteur africain de lithium. Alors que la RDC et le Mali s’activent pour le rejoindre, le pays d’Afrique australe poursuit le développement de ce secteur, soutenu par des investisseurs chinois voulant sécuriser leur approvisionnement en matériaux de batteries électriques.

Le Zimbabwe exportera davantage de lithium dès mars 2023 grâce au projet Zulu. C’est ce qu’a annoncé cette semaine le propriétaire du projet, Premier African Minerals (PAM) qui a signé un contrat d’approvisionnement avec Suzhou TA&A Ultra Clean Technology.

Selon le PDG George Roach cité par Reuters, l’acheteur chinois mettra 35 millions de dollars à disposition de PAM pour la construction d’une usine pilote capable de livrer annuellement environ 48 000 tonnes de concentré de spodumène. Il s’agit de la matière première utilisée ensuite pour produire de l’hydroxyde ou du carbonate de lithium, deux matériaux au cœur de la fabrication des batteries lithium-ion des véhicules électriques.

Selon une estimation conforme au code SAMREC, le projet Zulu hébergerait 20,1 millions de tonnes de ressources inférées, contenant 526 000 tonnes d’équivalents de carbonate de lithium.

Garder une longueur d’avance sur la RDC et le Mali

.....................

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Encore un exemple de la main mise de la Chine sur le marché du Lithium : Ganfeng Lithium met la main sur l' Argentin Lithea pour 962 millions de dollars.

https://www.nsenergybusiness.com/news/g ... quisition/Ganfeng Lithium to acquire Argentina-focused miner Lithea for $962m

By NS Energy Staff Writer 12 Jul 2022

Currently, Lithea owns rights to two lithium salt lakes that are located in the Salta province in the South American country

Ganfeng Lithium, a China-based lithium compounds producer, has agreed to acquire Lithea, an Argentina-focused mining firm, in a deal worth up to $962m.

The deal comes amid the Chinese firm’s pursuit of gaining access to more resources for producing critical battery metals, reported Reuters. It is being executed by Ganfeng Lithium’s subsidiary GFL International.

Currently, Lithea holds rights to two lithium salt lakes that are located in the Salta province. The lithium salt lake assets are Pozuelos and Pastos Grandes.

The Pozuelos prjects spans nearly 21,324ha. It is situated 230km west of Salta City, and 150km east of the Chilean border.

The two projects could produce lithium carbonate, which is said to be an important material for electric vehicle (EV) batteries.

In a stock exchange statement, Ganfeng Lithium said that the acquisition will bolster the layout of its upstream lithium resources as well as its resource self-sufficiency.

In Argentina, Ganfeng Lithium already has a footprint, through a stake of 46.67% in Minera Exar. The latter is the owner of the Cauchari-Olaroz lithium brine project in Jujuy province.

Lithea’s owner is LSC Lithium, which is owned by oil and gas mining company Pluspetrol Resource.

A team from law firm Mayer Brown team represented LSC Lithium in connection with the deal.

The deal is subject to receipt of relevant regulatory approvals.

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 26 juin 2022 : viewtopic.php?p=2346091#p2346091

La construction du site minier du projet Grota do Cirilo au Brésil avance bien :

La construction du site minier du projet Grota do Cirilo au Brésil avance bien :

https://www.mining.com/sigma-lithium-mi ... new-rules/Sigma Lithium’s project in Brazil to benefit from new rules

Cecilia Jamasmie | July 12, 2022

The Vancouver-based company, which has a market value of C$1.88 billion ($1.4 billion), is building the project in phases, with the initial mine on track to be commissioned in December this year.

“The continuous advance of final construction drawings towards 65% completion also allows us to plan for the total amount of bulk construction material to be utilized, potentially extending our management of our supply chains,” Calvyn Gardner, co-CEO of Sigma Lithium said.

An April feasibility study anticipated an eight-year operating life for the first phase, which it valued at $1.6 billion. Overall, the project has potential to deliver battery-grade lithium for 13 years once its built.

Sigma noted that it has obtained a requested extension of its current environmental licenses to allow for the simultaneous mining of the north pit and the south pit in phase 1.

It said the permit allows it to plan a “significant” expansion of the production capacity in phase 2 by increasing the area where the dry stacking of the tailings of the production plant is allowed.

Construction at the Grota do Cirilo lithium project in Brazil. (Image courtesy of Sigma Lithium.)

Aerial of Grota do Cirilo construction progress. (Image courtesy of Sigma Lithium.)

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 23 janvier 2022 viewtopic.php?p=2335682#p2335682

https://www.mining.com/web/lake-resourc ... legations/Lake Resources shares hit by short seller’s lithium tech allegations

Reuters | July 11, 2022 |

Short seller J Capital Research on Monday alleged that Lake Resources NL’s plan to produce lithium in Argentina is based on a process from Lilac Solutions Inc that likely does not work, the latest attack against a wave of new technologies aiming to produce the electric vehicle battery metal.

Shares of Lake, which are traded in Australia, fell 6.3% on Monday after J Capital’s report outlined several alleged missteps by Lake’s management and claimed that technology developed by Lilac is too costly to run and uses too much freshwater.

Privately-held Lilac is among the most-prominent developers of so-called direct lithium extraction (DLE) technologies aiming to extract the battery metal from brine using a range of equipment, though none have worked at commercial scale.

“Lake has hitched its cart to Lilac’s yet-to-be-proven technology,” J Capital Research said in the 17-page report. “Investors still have no evidence that the Lilac DLE technology works at scale, and if so, at what cost.”

Lilac signed a deal with Lake last September to develop the Kachi lithium project in Argentina, part of a plan to evolve from a technology company to a lithium producer. read more .

In April, Ford Motor Co signed a preliminary lithium supply deal with Lake.

Representatives for Lake could not immediately be reached for comment. J Capital declined to disclose the size of its short position.

Lilac’s technology uses ceramic beads to attract lithium in batch cycles, akin to a laundry machine, after which a water-and-acid mixture is used to wash off the metal.

J Capital alleges in the report that the beads only work for 150 cycles, making Lake’s project uneconomical.

Lilac Chief Executive Dave Snydacker said that figure is “factually inaccurate” and that his company has tested the beads at more than 1,000 cycles.

“I don’t know where they got that number from. Maybe they’re guessing,” Snydacker told Reuters, adding his company expects to deliver a pilot plant to Lake’s Kachi site by the end of the month.

“We have a high degree of confidence that our plant will be successful because we’ve supported the design with so much test work.”

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

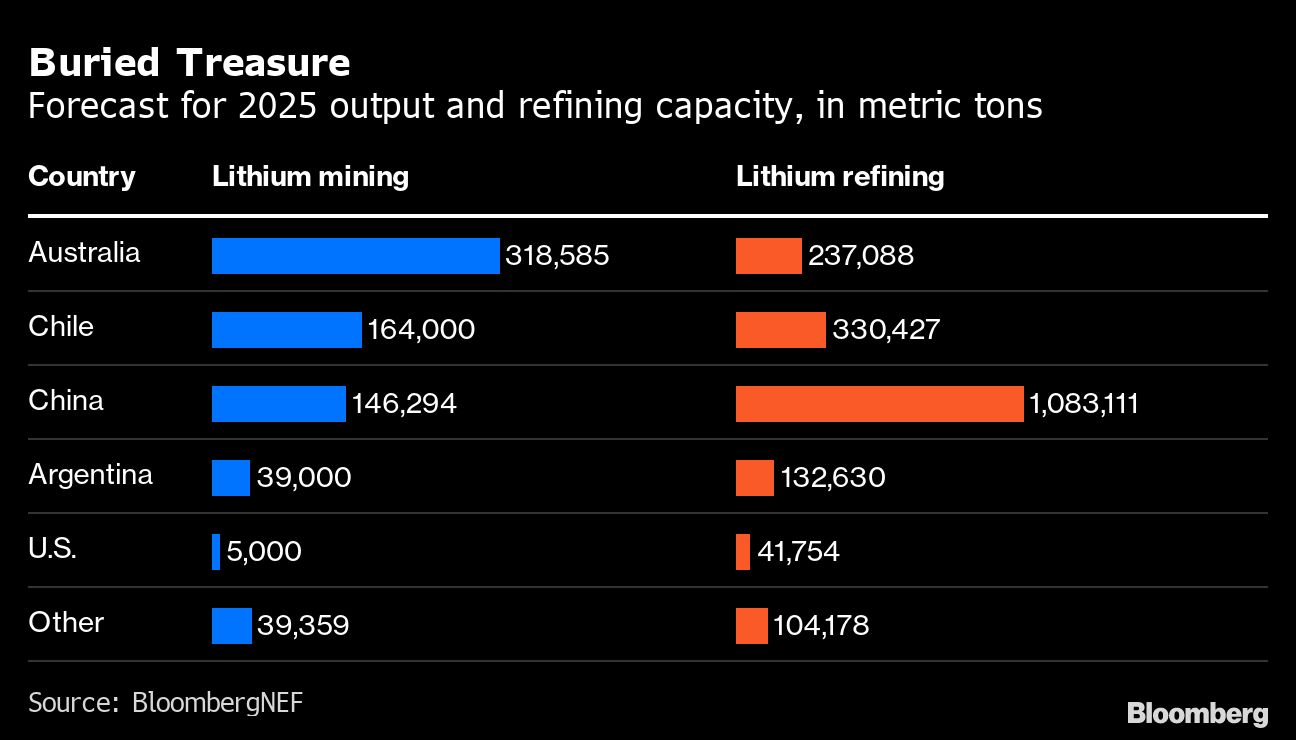

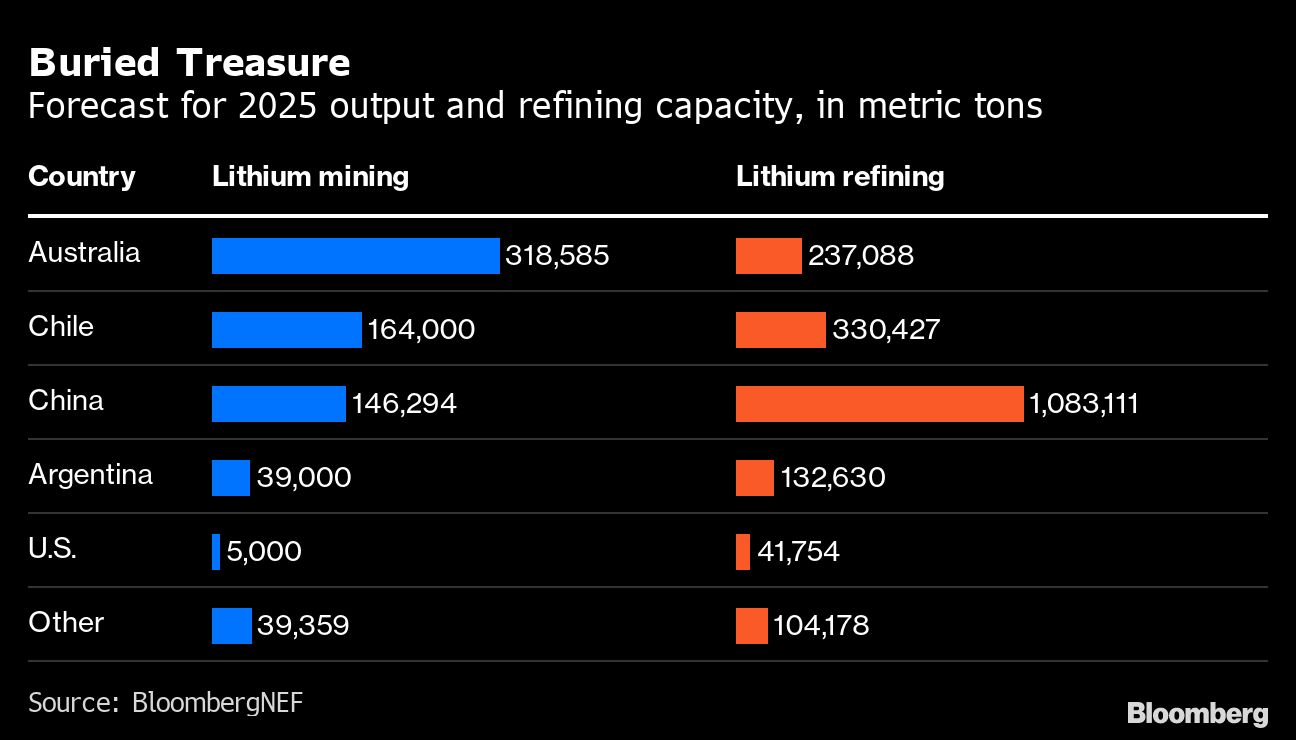

La vision de Bloomberg pour 2025 dans le Lithium, minage et raffinage :

source : https://www.mining.com/web/us-says-it-w ... ry-metals/

source : https://www.mining.com/web/us-says-it-w ... ry-metals/

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 27 mars 2022 : viewtopic.php?p=2340232#p2340232

https://www.agenceecofin.com/metaux/200 ... jet-ewoyaaGhana : Atlantic Lithium intensifie l’exploration pour améliorer l’estimation de ressources au projet Ewoyaa

Agence Ecofin 20 juillet 2022

La première mine de lithium du Ghana devrait être Ewoyaa qui est l’un des projets les plus avancés d’Afrique de l’Ouest pour ce métal. Le propriétaire Atlantic Lithium a déjà conclu un accord de financement avec l’américain Piedmont Lithium, et veut désormais accélérer les travaux sur le site.

L’australien Atlantic Lithium accélère ses travaux d’exploration au projet de lithium d’Ewoyaa, au Ghana. Il a publié cette semaine de nouveaux résultats d’analyse « encourageants » alors qu’il mène une campagne de forage à circulation inverse sur les cibles Ewoyaa Main et Grasscutter North.

Les échantillons prélevés sur ces différentes cibles ont permis de mettre en évidence des minéralisations à haute teneur de lithium. Sur le gisement Ewoyaa Main par exemple, les analyses indiquent des teneurs de 1,21 % d’oxyde de lithium pour une minéralisation s’étendant sur 46 m et de 1,08 % pour une autre qui s’étend sur 43 m.

Ces résultats laissent penser à un fort potentiel de croissance future des ressources du projet Ewoyaa. Rappelons que selon une étude exploratoire publiée en décembre 2021, l’actif peut livrer annuellement jusqu’à 300 000 tonnes de concentré de spodumène à une teneur de 6 % en lithium sur 11 ans, tout en rapportant plus de 3,4 milliards $ de revenus sur cette période.

« Notre programme d’exploration en cours montre qu’il existe un potentiel considérable de croissance des ressources et une possibilité d’extension de la durée de vie de la mine au-delà des estimations de l’étude exploratoire », a commenté le CEO par intérim Lennard Kolff.

Une étude de préfaisabilité est prévue pour le troisième trimestre 2022 sur le projet.

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 16 janvier 2022 viewtopic.php?p=2335230#p2335230

Le développement du gisement de Lithium de Kathleen Valley en Australie va commencer. Début de production en Q2 2024.

Le développement du gisement de Lithium de Kathleen Valley en Australie va commencer. Début de production en Q2 2024.

https://www.mining-technology.com/news/ ... n-lithium/Lycopodium secures EPCM contract for Australian lithium project

The Kathleen Valley lithium mine is expected to have initial production capacity of 2.5Mtpa.

July 22, 2022

Lycopodium subsidiary Lycopodium Minerals has received a contract from Australian firm Liontown Resources to develop the Kathleen Valley lithium project in Western Australia.

One of the world’s largest and highest-grade hard rock lithium deposits, the mine is expected to have an initial production capacity of 2.5 million tonnes per annum (Mtpa).

It is expected to supply around 500,000tpa of 6% lithium oxide concentrate.

Under the A$35m ($24m) contract, Lycopodium will be responsible for engineering, procurement, construction management (EPCM), pre-operational testing and commissioning services for the processing facilities and related non-process infrastructure at the Kathleen Valley project.

Lycopodium was earlier selected to carry out a pre-feasibility study (PFS), followed by value engineering assessments (VEAs), at the project site.

The firm also conducted a subsequent definitive feasibility study (DFS) and provided front-end engineering design (FEED) services.

Lycopodium managing director Peter De Leo said: “Kathleen Valley is a lithium project of global significance that will supply vital battery minerals to the burgeoning electric vehicle and energy storage industries.

“As we move towards a renewable energy future, the award of this project further strengthens our position as a premier partner in the delivery of lithium projects, and we thank Liontown for the opportunity to partner with them on this important project.”

Located in an established mining region 60km north of Leinster, and 680km north-east of Perth, the Kathleen Valley mine is expected to start production in Q2 2024.

Considered a Tier-1 battery metals asset, the project will also produce tantalum pentoxide, an essential material used in optics and electronics manufacturing applications.

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 31 oct 2021 viewtopic.php?p=2329551#p2329551

ioneer va fournir 7000 tonnes annuellement de Carbonates de Lithium pour Ford. A partir de fin 2025 de la mine de Rhyolite Ridge au Nevada.

ioneer va fournir 7000 tonnes annuellement de Carbonates de Lithium pour Ford. A partir de fin 2025 de la mine de Rhyolite Ridge au Nevada.

https://www.mining.com/web/ford-to-buy- ... ery-plant/Ford to buy lithium from ioneer for US EV battery plant

Reuters | July 21, 2022

Ford Motor Co said on Thursday it will buy lithium from ioneer Ltd’s Rhyolite Ridge mining project in Nevada and use the metal to build electric vehicle batteries in the United States.

The deal is one of the first binding agreements between a US lithium company and US automaker amid rising pressure from Washington to domestically source metals for the green energy transition and curb reliance on China.

Under the terms of the deal, ioneer will supply 7,000 tonnes of lithium carbonate annually for five years to BlueOvalSK, Ford’s battery joint venture with SK Innovation, which has a Kentucky factory.

Shipments are slated to start by the end of 2025, when ioneer and development partner Sibanye Stillwater Ltd expect the mine to open on federal land roughly 225 miles (362 km) north of Las Vegas.

“We’re really excited to be helping America’s goal of making EVs domestically,” James Calaway, ioneer’s executive chairman, told Reuters.

The Australia-based company’s shares, which began trading on the Nasdaq last month, were up 8% in midday trading.

The amount of lithium that ioneer will supply Ford is enough to make about 175,000 EVs annually, though that figure would vary depending on a vehicle’s power needs.

“Helping unlock lithium in the US will help us support localized production of battery cells going forward,” said Lisa Drake, Ford’s vice president of EV industrialization.

The Ford deal, and a similar one last year with South Korea’s Ecopro Co, are for about two-thirds of ioneer’s expected annual lithium production of 21,000 tonnes. Calaway said ioneer is in talks now to sell most of the remaining capacity in the United States.

US officials earlier this year said they would zone off 910 acres (368 hectares) near the mine site to protect a rare flower known as Tiehm’s buckwheat.

The Center for Biological Diversity, an environmental group, said Ford “needs to rethink this poor decision” to partner with ioneer and should source the metal elsewhere because of concerns about the flower’s fate.

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 10 juillet 2022 viewtopic.php?p=2346913#p2346913

Opposition contre Savannah Resources au sujet du Lithium au Portugal :

Opposition contre Savannah Resources au sujet du Lithium au Portugal :

https://www.mining.com/web/portuguese-c ... resources/Portuguese community files legal action against Savannah Resources

Reuters | July 22, 2022

A community group in a lithium-rich area of northern Portugal said on Friday it had filed a legal suit against a subsidiary of London-based mining company Savannah Resources for alleged encroachment on communal land.

In a statement, a group – the Local Community of Common Land of Covas do Barroso – accused Savannah Resources’ subsidiary Savannah Lithium of alleged “improper appropriation” of land assigned to the community for farming or hunting use near its Mina do Barroso project 145 km northeast of the city of Porto.

Savannah Resources did not immediately reply to a Reuters request for comment.

Portugal is Europe’s biggest lithium producer but its miners sell almost exclusively to the ceramics industry and are only now preparing to produce the higher-grade lithium that is in demand globally for use in electric cars and electronic devices.

The southern European nation, which has 60,000 tonnes of known lithium reserves, is central to Europe’s bid to secure more of the battery value chain and cut reliance on imports.

But projects in Portugal, such as Savannah’s, face strong opposition from environmentalists and local communities who are demanding stronger regulation and more transparency.

Much of the land thought to contain lithium in Portugal is classified as common land whose use is determined by local associations.

The Barroso community group claims Savannah Lithium, which already mines feldspar, quartz, and pegmatite in the area, broke the law by buying land based on topographical surveys it ordered that “in no way correspond to well-known (common land) limits established generations ago”.

“We were forced to resort to legal action when faced with (land purchase) deals based on records that … do not correspond to the truth,” it said, calling for those purchases to be declared annulled and void.

Savannah submitted an environmental impact assessment for an open-pit mine to Portuguese regulator APA in May 2020 and received preliminary approval a year later but said last month a “political process” was delaying its plans.

Earlier this month, Savannah’s chief executive David Archer stepped down on the same day APA told the company to complete an additional environmental licensing process for Barroso.

- kercoz

- Hydrogène

- Messages : 12985

- Inscription : 18 nov. 2007, 21:46

- Localisation : SUD GIRONDE GRAVE DE GRAVE

Re: Le lithium, une flambée en perspective?

Serbie : Encore des anti-tout qui veulent nous empêcher la transition:

https://www.radiofrance.fr/franceinter/ ... 22-7556322

https://www.radiofrance.fr/franceinter/ ... 22-7556322

L'Homme succombera tué par l'excès de ce qu'il appelle la civilisation. ( Jean Henri Fabre / Souvenirs Entomologiques)

- energy_isere

- Modérateur

- Messages : 90564

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

En Argentine, un projet dont j'avais encore jamais parlé :

https://www.nsenergybusiness.com/news/u ... ject-290m/Ultra Lithium, Zangge to invest $290m in Laguna Verde project in Argentina

By NS Energy Staff Writer 29 Jul 2022

An initial investment of $40m will be allocated towards the exploration and development of the lithium deposits at the project located in Catamarca

The Laguna Verde brine lithium project in Catamarca. (Credit: Ultra Lithium Inc.)

Argentine Minister of Industry Daniel Scioli announced that Ultra Lithium and Zangge Mining have committed an investment of $290m in the Laguna Verde brine lithium project.

An initial investment of $40m will be made in the exploration and development of the lithium deposits at the project located in the Catamarca province.

The remaining $250m investment will be made at a later stage towards the construction of a lithium carbonate processing plant.

Currently, the Laguna Verde brine lithium project is 100% owned by Ultra Lithium, a Canada-based exploration and development company.

Last month, the company agreed to divest a 65% stake in its subsidiary Ultra Argentina to Zangge Mining, a lithium and potassium producer owned by China-based Zangge Mining Investment (Chengdu).

Ultra Argentina holds the Laguna Verde property on the behalf of its Canadian parent.

As per the terms of the deal, Zangge will pay $10m to Ultra Lithium and make an investment of $40m in the Argentine brine lithium project as work expenditures. The closing of the deal is subject to regulatory approvals as well as due diligence.

The Laguna Verde comprises a new high grade lithium discovery spread over 7,569ha of land in three mining licenses. It is located to the north of Salar de Antofalla owned by Ultra Lithium and Albemarle.

The project area is said to be marked by low magnesium to lithium ratios, in the range of 0-10.2.

Exploratory sampling carried out in the past by Ultra Lithium had shown lithium values in the range of 34.2-1,270 milligrams per litre (mg/L) or parts per million (ppm), magnesium values under 1-7,920 ppm, potassium 804-15,800ppm, and boron 65-2,190ppm.