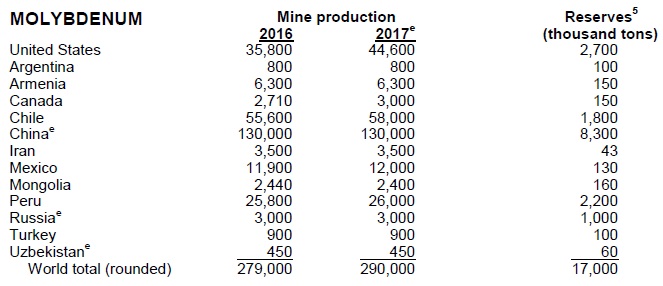

Codelco en a produit 28700 tonnes en 2017. C'est souvent un sous produit de l'extraction du Cuivre.

http://www.mining.com/web/revitalised-d ... um-prices/Revitalised demand growth to buttress molybdenum prices

Reuters | 4 days ago

Healthy demand for molybdenum rich stainless steel, especially from the oil and gas industry, plus sluggish supply growth are expected to keep the price of this minor metal riding high.

Molybdenum prices at nearly $13 a lb are at their highest since 2014, having more than doubled since Dec. 2015.

Often a byproduct of copper smelting, molybdenum's powerful anti-corrosive properties are vital for equipment used in the oil and gas sectors.

A rally in crude oil prices to around $70 a barrel from below $30 a barrel in Jan. 2016, has revived exploration and growth plans and molydenum demand.

"Molybdenum is used in exploration, drilling, production and refining," said CRU Group consultant George Heppel, adding that high prices were needed to encourage primary production from top producer China.

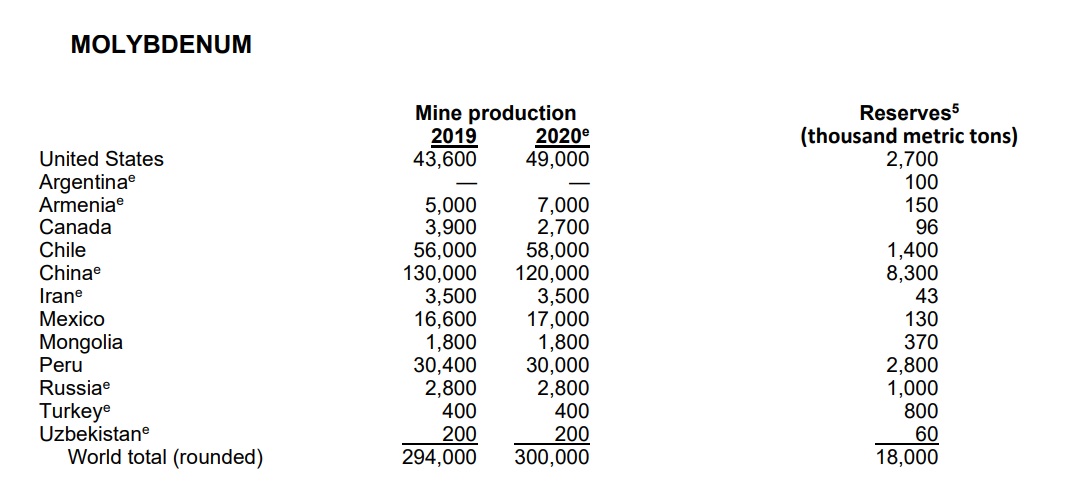

"The trend over the next 5 years is one of very low supply growth from by-product sources. In the early-2020s, we will need to see primary mines reopened to keep the market balanced."

Analysts estimate around 60 percent of global molybdenum supply comes as a byproduct of copper smelting, with most of the remainder coming from primary sources.

CRU forecasts molybdenum demand at 577 million lbs this year, of which 16 percent will come from oil and gas. That is below the historic pre-2014 average of 20 percent, but still a notable increase over recent years.

"The oil price crash back in 2014 removed about 15 million lbs of moly demand," Heppel said. "Demand now looks healthy."

Crude's slide started in 2014 when Saudi Arabia turned on the oil taps to defend market share, while molybdenum prices crashed two-thirds to below $5 a lb between August 2014 and November 2015.

Wood Mackenzie expects global oil and gas exploration spending to fall this year. But this slide masks a modest uptick in drilling activity as lower rig rates and a focused approach on well-charted basins allow firms to do more with their money.

The consultancy sees U.S. onshore producers, focusing primarily on shale gas, ramping up annual activity from $64 billion in 2017 to $90 billion in 2020.

"We're seeing a pick up in tubular goods used in the North American shale gas market," said David Merriman, a senior analyst at metals consultancy Roskill. "There's a strong correlation between moly demand and active drill counts."

CHUQUICAMATA

Molybdenum is also used to make superalloys for aerospace and lighter, higher strength steels for cars. Demand in both industries is also picking up.

"There isn't really a shortage at the moment, but supply could become a problem," a molybdenum trader said.

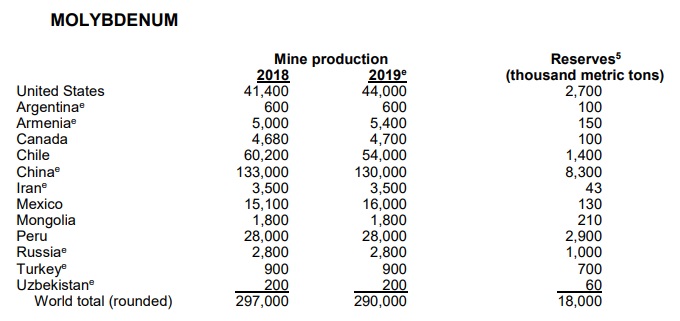

Top producers include Chile, where state-owned Codelco's 28,700 tonnes of moly output last year compares with 30,600 tonnes in 2016.

The lower production is due to the lower molybdenum grade in its Chuquicamata mine, a Codelco spokesperson said.

The Sierra Gorda mine in Chile, in which Polish copper miner KGHM has a 55 percent stake, produced nearly 36 million pounds in 2017.

A KGHM spokesperson said output this year will be 15-20 percent lower because of lower ore grades.

"In China, it's to do with cutting pollution, but with prices where they are Chinese producers may rethink shutdowns," the molybdenum trader said.

Higher prices could also incentivise the restart of the Thomson Creek mine in Idaho owned by Centerra , which also has a majority stake in Endako in British Columbia.

These two mines produced more than 29 million lbs of moly in 2014, since which time both have been on care & maintenance.

"There are no plans to restart the mines at this point in time," a spokesperson for Centerra said. "But we are updating our restart plans, to see how long it would take, how much it would cost, what personnel we would need and timings."

The Sierra Gorda mine in Chile, in which Polish copper miner KGHM has a 55 percent stake, produced nearly 36 million pounds of molybdenum in 2017.(Image courtesy of KGHM.)