https://www.connaissancedesenergies.org ... nse-190403Poutine et le nouveau président kazakh discutent nucléaire et défense

AFP parue le 03 avr. 2019

Le président russe Vladimir Poutine et son nouvel homologue kazakh, Kassym-Jomart Tokaïev, ont promis mercredi de renforcer encore "l'amitié" entre les deux pays, notamment dans le domaine militaire et le nucléaire, deux semaines après la démission surprise de l'ex-président kazakh Noursoultan Nazarbaïev.

"Je vais faire tout mon possible pour renforcer davantage le potentiel déjà atteint d'amitié entre nos peuples", a déclaré M. Tokaïev au Kremlin, lors de sa première visite officielle à l'étranger.

Il a fait l'éloge des relations "exemplaires" entre la Russie et le Kazakhstan sous son prédécesseur qui a été au pouvoir dans ce pays d'Asie centrale pendant environ 30 ans.

"Nous proposons d'avancer vers de nouvelles formes de collaboration", a souligné pour sa part M. Poutine après la rencontre.

"J'entends par là avant tout la construction d'une centrale nucléaire au Kazakhstan avec des technologies russes", a-t-il ajouté.

Premier producteur mondial d'uranium, le Kazakhstan envisage le lancement de sa première centrale atomique avec l'aide, notamment, de la Russie.

L'année dernière, la Russie a débuté la construction d'une centrale en Ouzbékistan, la première en Asie centrale.

M. Poutine s'est également félicité d'un renforcement des liens militaires entre le Kazakhstan et Moscou, citant la formation d'experts kazakhs en Russie.

Le choix de la Russie par M. Tokaïev pour son premier déplacement à l'étranger a été perçu par de nombreux analystes comme un gage de la continuation de la politique étrangère du Kazakhstan, allié de longue date de Moscou.

M. Nazarbaïev, 78 ans, a annoncé son départ le 19 mars. Il dirigeait le Kazakhstan depuis l'époque soviétique, d'abord en tant que premier secrétaire du Parti communiste local puis à partir de 1991 comme président de ce pays d'Asie centrale aux riches ressources en hydrocarbures. Il continuera toutefois d'occuper des fonctions clés dans le pays.

Kassym-Jomart Tokaïev, 65 ans, jusqu'alors président du Sénat, est devenu président par intérim en attendant la prochaine présidentielle prévue en avril 2020.

M. Tokaïev a été deux fois ministre des Affaires étrangères, et Premier ministre du Kazakhstan de 1999 à 2002.

Sa première décision en tant que président a été de demander de rebaptiser la capitale du pays, Astana, qui est devenue "Nur-Sultan", le prénom de l'ancien président.

Kazakhstan

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Le Kazakhstan est le premier producteur mondial d'uranium avec 40 % de la production.

Ils prévoient 22800 t en 2019.

Ils prévoient 22800 t en 2019.

http://www.mining.com/web/top-uranium-p ... power-now/Top uranium producer is gloomy about nuclear power, for now

June 5, 2019

Don’t expect an upswing in the global uranium market anytime soon.

“In our models, we don’t get excited on the demand side,” said Galymzhan Pirmatov, chief executive officer of Kazatomprom, Kazakhstan’s state-owned mining company that’s the world’s biggest supplier.

With construction of nuclear power plants at a 10-year low, uranium demand remains weak. That’s holding prices so low that mining companies have been wary of increasing production. Kazatomprom’s output will increase about 5% this year, to as much as 22,800 tons, and then will be flat in 2020, Pirmatov said Wednesday in an interview in New York. While he hasn’t yet made a decision on 2021, he doesn’t see much to get excited about, at least in the short term.

“I do believe prices are too low,” he said. Uranium has slumped 15% this year to $24.35 a pound as of Wednesday. Kazakhstan controls about 40% of the world’s supply of the metal, and Kazatomprom accounts for half of that, making it the biggest producer.

There were 55 nuclear plants under construction in the first quarter, the lowest number in a decade, according to BloombergNEF. While China is booming, with 11 of those projects, developed countries remain wary. That’s partly due to lingering concern from the 2011 Fukushima nuclear catastrophe in Japan, and partly due to high costs, Pirmatov said.

“Growth is coming from developing markets these days,” where access to electricity remains a key barrier to growth, he said. Seven of the reactors under construction are in India.

.......

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

https://www.connaissancedesenergies.org ... tan-190704Total approuve le développement d'un champ pétrolier au Kazakhstan

AFP parue le 04 juill. 2019

Total a approuvé jeudi le développement d'un champ pétrolier qu'il exploite au Kazakhstan, correspondant à un investissement de 300 millions de dollars et une "production de plus de 70 millions de barils de réserves supplémentaires".

"Total et ses partenaires ont approuvé la Phase 3 du développement du champ de Dunga situé à terre dans la Région de Mangystau" dans l'ouest de ce pays d'Asie centrale, a annoncé le groupe français dans un communiqué.

Une opération qui comprend "le raccordement de puits supplémentaires aux infrastructures existantes et l'augmentation de la capacité de traitement de l'usine de 10% à 20 000 barils de pétrole par jour en 2022" et "créera 400 emplois directs de plus dans la région, au plus fort du chantier de construction".

"Ce projet, qui présente un bas coût d'investissement au baril, permet de maximiser le potentiel du champ et de prolonger le plateau de production", a indiqué Arnaud Breuillac, directeur général exploration-production de Total, cité dans le communiqué.

Ce développement a été possible après l'approbation du gouvernement du Kazakhstan "quant à l'extension de 15 ans de l'accord de partage de production (PSA) du champ de pétrole de Dunga signé en 1994 et dont l'expiration était prévue en 2024", lit-on dans le communiqué.

Le champ pétrolier de Dunga est exploité par Total (60%), aux côtés de la compagnie publique omanaise Oman Oil Company (20%) et du groupe portugais Partex (20%). Présent au Kazakhstan depuis 1992, Total y emploie près de 380 personnes.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Kazatomprom annonce qu'il va prolonger sa réduction de production d'uranium de 20% sur 2021.

http://www.world-nuclear-news.org/Artic ... ction-cutsKazatomprom prolongs uranium production cuts

20 August 2019

Kazakhstan's JSC National Atomic Company Kazatomprom says it will continue to "flex down" production by 20% through 2021, rather than to the end of 2020 as originally planned. Full production will not resume until market conditions signal a need for more uranium, it said.

The company in December 2017 announced that it would reduce planned uranium production by 20%, compared to planned levels under Subsoil Use Contracts, over three years from January 2018. It has now said it will extend the production curtailment, in a decision which reflects the fact the uranium market is still recovering from a period of oversupply, and uranium prices remain low.

"As the largest uranium producer in the world, Kazatomprom recognises the need for global output to better align with current demand," it said.

The full implementation of this decision would remove up to 5,600 tU from anticipated global primary supply in 2021, Kazatomprom said. The company's 2021 production would remain below 23,000 tU (100% basis), which is expected to be in line with production in 2019 and 2020.

......

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Suite de ce post du 2 sept 2017 http://www.oleocene.org/phpBB3/viewtopi ... 9#p2260919

Le premier lot d'uranium d'uranium enrichi en provenance d'Oran en France est arrivé à la '' banque'' de l' AIEA au Kazakhstan.

Le prochain viendra de Kazatomprom.

Le premier lot d'uranium d'uranium enrichi en provenance d'Oran en France est arrivé à la '' banque'' de l' AIEA au Kazakhstan.

Le prochain viendra de Kazatomprom.

http://www.world-nuclear-news.org/Artic ... of-uraniumIAEA fuel bank receives first delivery of uranium

18 October 2019

The International Atomic Energy Agency (IAEA) yesterday took delivery of the first shipment of low-enriched uranium (LEU) at a purpose-built storage facility at the Ulba Metallurgical Plant in eastern Kazakhstan. The delivery marks the official start of operation of the IAEA LEU Bank, aimed at providing assurance to countries about the availability of nuclear fuel.

Canisters of LEU at the IAEA fuel bank in Ust-Kamenogorsk (Image: Kazakh Ministry of Foreign Affairs)

Last November the IAEA announced that, following an open tender, it had signed contracts to purchase LEU from Kazakhstan's NAC Kazatomprom and France's Orano Cycle. The IAEA noted the procurement was its largest since the Agency was founded in 1957.

The first LEU shipment, from France's Orano Cycle, was transported by truck to a French port, then shipped to Russia and subsequently transported to Kazakhstan by train. The entire journey took four weeks to complete. The shipment comprised 32 cylinders of LEU - sufficient for one reload of fuel for a typical light water reactor.

"With the arrival of the first shipment, the IAEA LEU Bank is now established and operational," declared IAEA Acting Director General Cornel Feruta. "It is the first time the Agency has undertaken a project of this legal, operational and logistical complexity."

The IAEA expects to receive the second LEU shipment, from Kazatomprom, by the end of this year.

The Bank is part of global efforts to create an assured supply of nuclear fuel to countries in the event of disruption of the commercial market or other existing LEU supply arrangements. It will provide an assurance of a supply mechanism of last resort for IAEA member states which experience a supply disruption owing to exceptional circumstances and are unable to secure nuclear fuel by other means. States wishing to purchase LEU from the Bank must have in force a comprehensive safeguards agreement with the IAEA and be in good standing regarding their obligations under the Non-Proliferation Treaty.

The physical reserve will hold up to 90 tonnes of LEU. The IAEA-owned and -managed 880 square metre high-security warehouse in Ust-Kamenogorsk, where the material will be stored, was officially inaugurated in August 2017.

Kazakhstan in 2011 offered to host the IAEA LEU Bank in response to an IAEA request for expressions of interest. A Host State Agreement between the IAEA and government of Kazakhstan was signed on 27 August 2015. The IAEA describes the Ulba Metallurgical Plant, where the storage facility is situated, as a licensed nuclear site with commercial scale operations and the complete infrastructure to safely and securely store, transport and process LEU. The IAEA and Russia have signed a transit agreement to enable LEU to be delivered to and from the Bank.

The establishment and operation of the Bank has been fully funded by voluntary contributions from IAEA Member States and other donors totalling USD150 million, which the agency says is sufficient to cover estimated costs for 20 years of operation.

Other assurance of supply mechanisms established with IAEA approval include a guaranteed physical reserve of LEU maintained by Russia at the International Uranium Enrichment Centre in Angarsk, Russia, and an assurance of supply guarantee for supplies of LEU enrichment services in the UK. The USA also operates its own LEU reserve.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

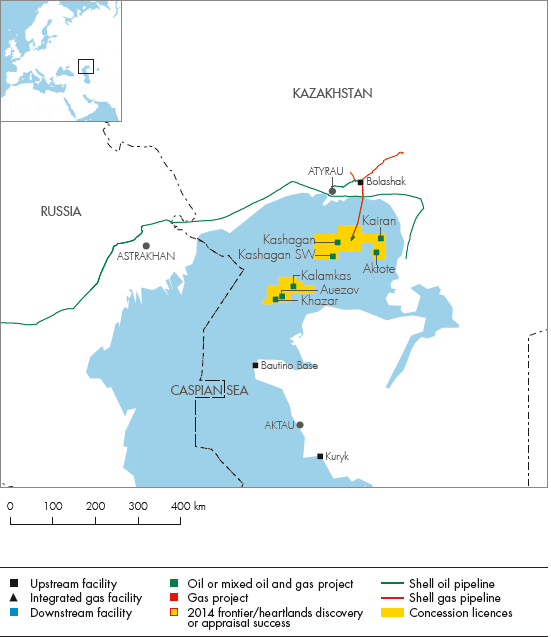

Shell veut se retirer de projets au Kazakhstan en mer Caspienne.

Sur le site de Shell

https://oilprice.com/Latest-Energy-News ... tspot.htmlOil majors are quitting two projects in the Caspian Sea in Kazakhstan because of high costs and low profitability, a unit of Kazakhstan’s state oil and gas firm KazMunayGas said on Monday.

21 oct 2019

Shell has decided to pull out of the Khazar field, and the North Caspian Operating Company (NCOC) consortium—of which Shell is a part—is quitting the Kalamkas project, according to Kazakhstan’s energy ministry.

Shell has already invested US$900 million in the Khazar project, but has faced challenging economics amid high investments.

“Our partners’ decision is based on the low profitability of these projects against the background of high capital expenditures,” Reuters quoted the KazMunayGas unit as saying on Monday.

The shareholders in the North Caspian Operating Company (NCOC) are Kazakhstan’s state oil and gas firm KazMunayGas, France’s Total, Italy’s Eni, Royal Dutch Shell, ExxonMobil, China National Petroleum Corporation (CNPC), and Japan’s Inpex.

Kazakhstan had hoped that the consortium could be working with Shell on the development of the Khazar field, which is close to the giant and already producing oil field Kashagan operated by the NCOC consortium.

But in view of the high costs—which had also plagued the development of the Kashagan field—Shell is now reconsidering its participation in the Khazar field, as oil majors continue to look for low breakeven projects for profits and returns on investment.

At Kashagan, crude oil production started in 2016 and is currently around 400,000 bpd. This makes the Kazakh field one of the largest offshore oil fields in the world.

Kashagan has reserves of 13 billion barrels of crude and in-place resources of as much as 38 billion barrels. But its development has been challenging, mainly because of climatic and geological peculiarities, and because of cost overruns that saw the final budget more than double on the initial US$20 billion to US$50 billion.

Sur le site de Shell

https://reports.shell.com/investors-han ... hstan.html

Shell Kazakhstan

We have a 16.8% interest in the offshore Kashagan field, where the North Caspian Operating Company is the operator. This shallow-water field covers an area of approximately 3,400 square kilometres. Phase 1 development of the field is expected to lead to plateau production of about 300 thousand boe/d, on a 100% basis, increasing further with additional phases of development. After the start of production from the Kashagan field in September 2013, operations had to be stopped in October 2013 due to gas leaks from the sour gas pipeline. Following investigations, it has been decided that both the oil and the gas pipeline will be replaced. Replacement activities are ongoing, with production expected to restart in 2017.

We have an interest of 55% in the Pearls PSC, covering an area of approximately 900 square kilometres in the Kazakh sector of the Caspian Sea. It includes two oil discoveries, Auezov and Khazar.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Production de pétrole au Kazakhstan depuis 2012

https://oilprice.com/Energy/Crude-Oil/H ... eaked.html

https://oilprice.com/Energy/Crude-Oil/H ... eaked.html

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Le Kazakhstan a produit 22808 tonnes d'uranium en 2019.

Perspective 2020 identique.

Perspective 2020 identique.

https://www.world-nuclear-news.org/Arti ... emain-flatKazatomprom leaves U output unchanged in 2020

03 February 2020

Kazatomprom expects its 2020 uranium output to remain flat compared to 2019, consistent with its market-centric strategy and previously announced intention to "flex down" planned production volumes through 2021. The world's biggest uranium producer, the Kazakh company covered 23% of global output of the metal in 2018.

Total uranium production for 2019 on a 100% basis was 22,808 tU - 5% higher than 2018, according to the company's operations and trading update for the fourth quarter and year ended 31 December. Attributable production was 13,291 tU which was 16% up on 2018. This increase was due to higher 2019 production levels under subsoil use contracts and was expected, the company said.

Kazatomprom announced in December 2017 it would reduce planned uranium production by 20% over three years from January 2018. With the flex down, under existing subsoil use agreements, 2020 production is expected to remain at about 22,750-22,800 tU (100% basis), and 13,000-13,500 tU (attributable basis). Without the reduction, 2020 production was expected to be around 28,500 tU (100% basis), the company said.

Group sales volumes for 2020 are expected to be 15,500-16,500 tU. Sales in excess of planned attributable production are expected to be primarily sourced from inventories, from KAP subsidiaries under contracts and agreements with joint venture partners, and from other third parties. The company continues to target an ongoing inventory level of about six to seven months of attributable production.

Kazatomprom produces uranium using in-situ leach methods from 26 deposits grouped into 13 mining assets. All of its mining operations are in Kazakhstan.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Kazatomprom va réduire sa production d' Uranium de 4000 tonnes cette année à cause du Covid19.

https://www.mining.com/kazatomprom-annu ... 00-tonnes/Kazatomprom annual output to drop by up to 4,000 tonnes

MINING.COM Staff Writer | April 7, 2020

Kazakhstan- based uranium producer Kazatomprom said on Tuesday it expects its annual uranium production volume to fall by up to 4,000 tonnes in 2020. Previous expectations were between 22,750 and 22,800 tonnes.

CEO Galymzhan Pirmatov said the company would fully meet its contractual requirements with customers and that subsidiaries are reducing staff on-site as local restrictions concerning the coronavirus outbreak take hold.

............

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

La production de pétrole du Kazakhstan baisse, ils ont prévu de couper 400 000 barils par jour dans les accords de l' OPEC+.

https://oilprice.com/Energy/Crude-Oil/T ... Spike.htmlThis Oil Nation Sees Production Drop As COVID-19 Cases Spike

By Irina Slav - May 21, 2020, Oilprrice.com

Kazakhstan’s crude oil production has fallen below 1.7 million bpd of crude and condensates, oil analytics firm OilX told Oilprice.com, noting that the giant Tengiz field has seen a jump in Covid-19 cases among workers, at 935.

The Tengiz field is one of the biggest in the country and normally produces 600,000 bpd of crude.

Kazakhstan is a member of the OPEC+ group and earlier this year agreed to cut some 400,000 bpd in oil production as part of international efforts to stymie the drop in oil prices resulting from the combination of excessive production at a time of falling demand.

Most of the Central Asian country’s cuts were to come from the Tengiz field as well as from the offshore Kashagan field in the Caspian Sea.

The situation was unique in the oil world because the operators of both Tengiz and Kashagan are supermajors: Chevron for Tengiz, and Shell, Total and Exxon as partners in Kashagan.

Kazakhstan was not alone in this unprecedented position of negotiating production cuts with private field operators. Neighbour Azerbaijan with whom the country shares the Caspian Sea’s oil riches, asked the BP-led consortium that operates the Azeri-Chirag-Guneshli offshore field system to start reducing its output from May.

Last year, the ACG group produced some 542,000 bpd. Now, BP and its partners would need to reduce this by between 75,000 bpd and 80,000 bpd to fill the country’s reduction quota, which stands at 164,000 bpd.

The total amount of daily oil output OPEC+ agreed to take off the market was 9.7 million, but OPEC leader Saudi Arabia said it would cut an additional 1 million bpd to stimulate oil prices.

The effort has worked, supported by production cuts in Norway and the United States and Canada, which have together cut somewhere between 3.5 and 4.5 million bpd in oil production since the start of the crisis.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Le fond souverain du Kazakhstan vends 6.27 % des parts de Kazatomprom.

https://www.mining.com/kazakhstan-loose ... ium-miner/Kazakhstan loosens grip on world’s top uranium miner

Cecilia Jamasmie | June 3, 2020

he Kazakhstan-based miner accounted for more than 42% of the world’s uranium output in 2019. (Image courtesy of Kazatomprom.)

Kazakhstan’s sovereign wealth fund, Samruk Kazyna, said on Wednesday it had sold a 6.27% stake in Kazatomprom, the world’s top state-owned uranium miner, for $206 million in a move that sought to take advantage of improved market sentiment.

The fund, created in 2008, said it sold the shares at $13 per global depositary receipt, a discount of about 6% to the market price. It noted it would own a 75% stake in Kazatomprom.

The sale, Samruk-Kaznya’s second since the uranium miner’s IPO, is part of an ambitious privatization plan set by Kazakhstan aimed at shoring up finances.

According to BMO analyst Alexander Pearce, the state has been targeting long-term ownership levels in line with the Organization for Economic Co-operation and Development’s (OECD) recommendations of about 15%.

Kazatomprom recently cut its 2020 output guidance because of the coronavirus pandemic. It now expects to produce about 4,000 tonnes, or 17.5% less this year. Previous estimates were between 22,750 and 22,800 tonnes.

Last year, Kazakhstan accounted for more than 42% of the world’s uranium output.

Price revival

Uranium prices have been on the rise since late March as investors worry about ongoing disruption to supply, which is divided between a handful of major companies.

Prices hit $34.25 per pound on Tuesday, about 38% higher than at the beginning of March. Such an increase consolidates the commodity’s bull market position. The last time uranium traded above $30 was in February 2016. Year to date, prices have climbed almost 40%.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Suite de 3 posts au dessus.

Kazatomprom prolonge les réductions de production d'uranium de 20 % jusqu'à 2022.

Kazatomprom prolonge les réductions de production d'uranium de 20 % jusqu'à 2022.

Kazatomprom extends uranium production cuts into 2022

19 August 2020

Kazatomprom says it will continue to "flex down" production by 20% through 2022. The company is also maintaining its 20% reduction in 2021, with no additional production planned to replace volumes lost in 2020 due to the measures taken to combat COVID-19.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Projet d'une centrale solaire de 76 MW dans le centre du Kazakhstan

https://www.neweurope.eu/article/ebrd-a ... azakhstan/EBRD and World Bank finance solar power project in Kazakhstan

Sept 18, 2020

.....

A solar power plant with a capacity of 76 MW will be built in the center of Kazakhstan. The station will have double-sided modules capable of producing solar energy from both sides of the panel. It will be one of the first completed renewable energy projects in Kazakhstan to be implemented through an auction mechanism.

.....

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Très bon 3ieme trimestre pour Kazatomprom :

https://www.kitco.com/news/2020-11-27/T ... rease.htmlTop uranium miner Kazatomprom reports 139% income jump in Q3 2020 on sales and uranium spot price increase

Vladimir Basov Vladimir Basov November 27, 2020

Kazakh National Atomic Company “Kazatomprom” (KAP) today announced its unaudited, reviewed, consolidated financial statements and notes for the three-months and nine-months ended 30 September 2020, prepared in accordance with International Financial Reporting Standards (IFRS).

KAP's comprehensive income rose to 90.869 billion tenge ($211 million) from 37.949 billion tenge in Q3 2019.

The increase in income is mainly due to an increase in sales volumes compared to the same period last year, due to seasonality and delivery schedule in 2019 and 2020; an increase in the spot quotation for uranium, which had a positive impact on the average selling price, as well as the exchange rate effect of the movement in the Tenge to US dollar.

KAP earlier reported that in Q3 2020, its attributable uranium production was 30% lower than in Q3 2019, due to the expected impact of the pandemic and the company's decreased wellfield development activity and lower staff levels throughout the second quarter.

Kazatomprom is the world's largest producer of uranium, with the company’s attributable production representing approximately 24% of global primary uranium production in 2019. KAP benefits from the largest reserve base in the industry and operates, through its subsidiaries, JVs and Associates, 26 deposits grouped into 14 mining assets. All of the company’s mining operations are located in Kazakhstan and mined using ISR technology with a focus on maintaining industry-leading health, safety and environment standards.

- energy_isere

- Modérateur

- Messages : 99163

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Kazakhstan

Suite de ce post du 2 Oct 2018 http://www.oleocene.org/phpBB3/viewtopi ... 5#p2272995

https://www.connaissancedesenergies.org ... tal-201214Le Kazakhstan annonce avoir obtenu 1,3 milliard de dollars d'un consortium pétrolier occidental

AFP parue le 14 déc. 2020

Le Kazakhstan a annoncé lundi avoir obtenu gain de cause dans un différend portant sur la répartition des bénéfices d'un champ d'hydrocarbures, un consortium de géants énergétiques occidentaux ayant accepté de lui verser plus d'un milliard de dollars.

Le champ pétrolier et gazier de Karatchaganak (nord-ouest) est exploité par le consortium Karatchaganak Petroleum Operating (KPO), composé de l'italien Eni et du néerlando-britannique Shell détenant chacun 29,25%, aux côtés de l'américain Chevron, du russe Loukoïl et du groupe kazakh KazMunaiGas aux participations plus réduites.

Dans un communiqué, le ministère kazakh de l'Énergie a annoncé que le consortium avait accepté de payer 1,3 milliard de dollars pour régler le différend et était prêt à finaliser les modifications apportées au mode de répartition des bénéfices du champ Karatchaganak.

Selon le ministère, les nouvelles conditions de l'accord devraient garantir au Kazakhstan 600 millions de dollars supplémentaires jusqu'en 2037 si les prix du pétrole restent dans la fourchette de 40 à 50 dollars par baril. Le projet est embourbé dans des conflits depuis plus d'une décennie. Le dernier en date avait commencé il y a plusieurs années, le Kazakhstan réclamant initialement 1,6 milliard de dollars. En 2018 le Kazakhstan avait annoncé que le consortium lui verserait 1,1 milliard de dollars, avant de rejeter cet accord et de réclamer davantage d'argent.

Le Kazakhstan, pays d'Asie centrale riche en ressources naturelles, est fortement tributaire des exportations de pétrole en raison d'une économie peu diversifiée.