http://www.economicnews.ca/login.php?pa ... %20Reports

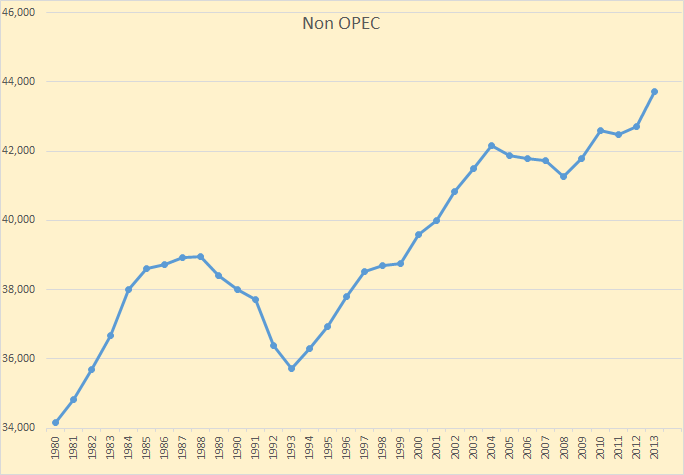

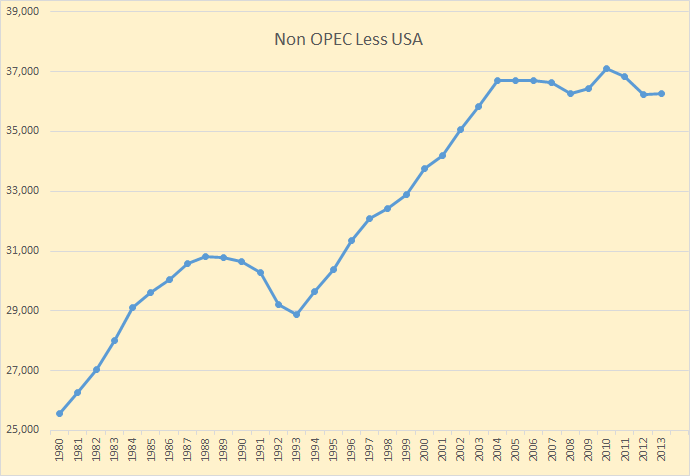

en résumé : la Russie n'a pas augmenté sur une base annuelle depuis 2 mois, le reste de l'ex-URSS ne fera que compenser les baisses de la Mer du Nord et du Mexique, la montée en 2008 au total pourrait etre juste +0,65 Mbd/j dont les 2/3 de non conventionnels. 2008 pourrait etre "le dernier hourra" de la production pétrolière non OPEP.Non-OPEC Oil Production Likely to Disappoint Over 2008, Analysts Say

11:02 03/05 (CEP News) Vienna – Non-OPEC oil producers were unlikely to improve their production over 2008, in a year when the market most needed their output to rise and make an considerable impact, analysts said on Wednesday.

Russia seems to bear the brunt of analysts’ ire. Kevin Norrish, commodities research analyst at Barclays Capital, said, “The latest data from Russia revealed that oil production was at 9.79 million barrels barrel per day (bpd), unchanged from 9.78 million bpd in January and down year-over-year for a second consecutive month.”

.....

Lehman Brothers forecast that non-OPEC supply was likely to record a growth of only 650,000 bpd or 1.3% in year-over-year terms, and would not do much to alleviate the burden on OPEC crude. Furthermore, 70% of the 650k bpd growth is coming from non-crude liquids such as biofuels, condensates synthetic crude and other conversion supplies, and only 30% from crude oil, according to a note issued by the investment bank.

Lehman believes that FSU growth, expected at 430k bpd, may make a strong contribution, but it merely offsets declines in the North Sea (-280k bpd) and Mexico (-180k bpd).

Deepwater tar sands were seen as crucial, as Brazil is expected to grow production by a further 270k bpd and an additional 170k bpd is expected from Canadian tar sands. Overall, 2008 could be the year for a “last hurrah” for the non-OPEC crude supply, but nothing more, Lehman said.

Si en plus l'Arabie Saoudite flanche, il va plus rester grand monde alors.....

Quand on a un javelin dans la main, tous les problèmes ressemblent à un T-72.

Quand on a un javelin dans la main, tous les problèmes ressemblent à un T-72.