US Returns to Being a Net Oil Exporter

by Nicholas Newman|Rigzone December 30, 2019

Two factors could directly affect the future level of US crude exports.

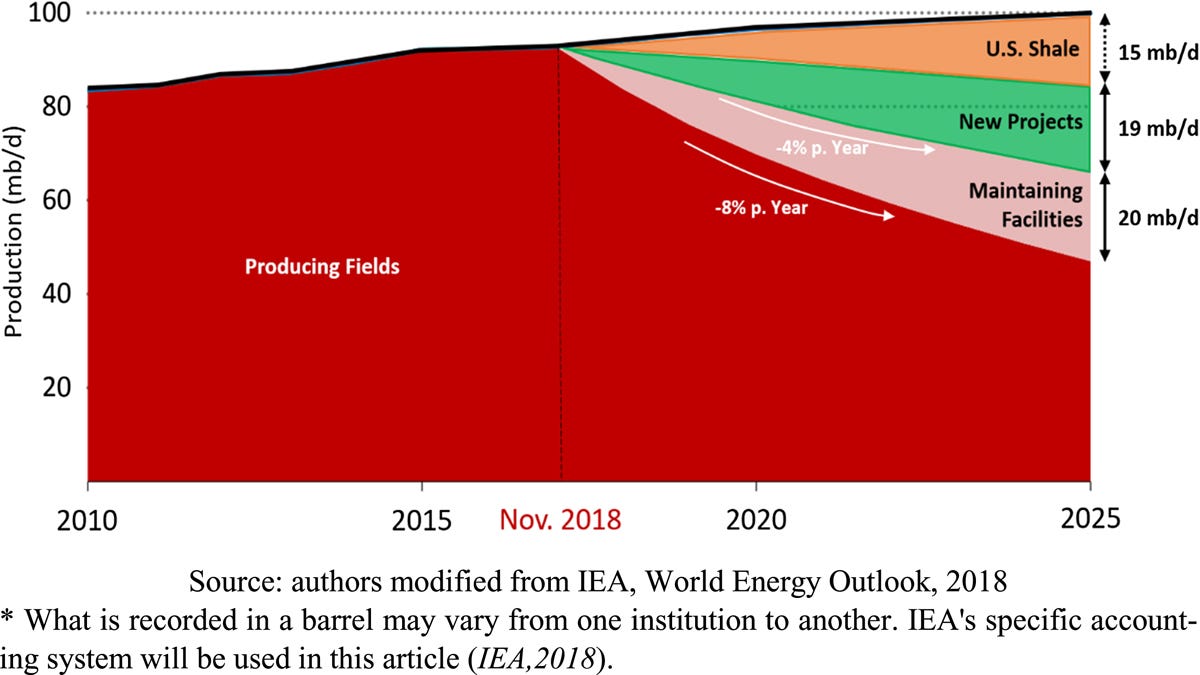

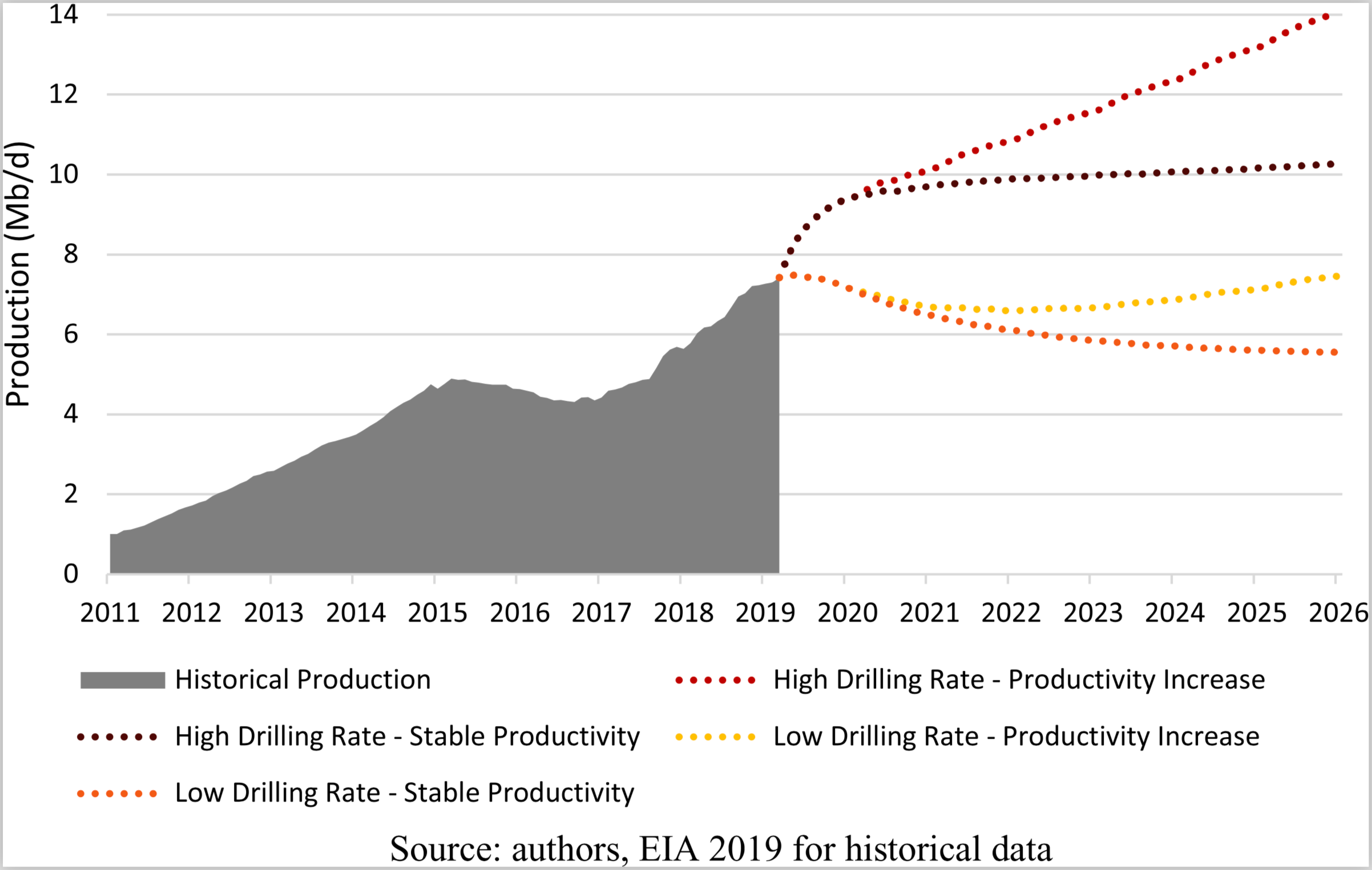

Thanks to the shale oil revolution, for the first time since the 1940s, the United States exported more oil than it imported last September. In that month, U.S. exports of crude oil and refined products exceeded imports by 89,000 barrels a day, according to EIA statistics. This marks a significant turning point, for only a decade ago, American imports exceeded exports by a hefty 12 million barrels a day. Commenting on this change, Bob McNally, a former energy consultant to President George W. Bush and president of the consulting firm Rapidan Energy Group, said, “the U.S. return to being a net exporter serves to remind how the oil industry can deliver surprises -- in this case, the shale oil revolution -- that upend global oil prices, production, and trade flows.”

The International Energy Agency (IEA) believes the U.S. is on track to become a sustained net oil exporter in either late 2020 or early 2021. It forecast an increase in U.S. exports of crude and refined products from 550,000 b/d in October 2019 to average 750,000 b/d in 2020. This uptick will have a positive impact on the U.S. trade balance. In 2018, the U.S.petroleum trade deficit stood at $62 billion or 10 percent of the country’s trade balance according to Rystad Energy. Thanks to the ongoing growth in shale tight oil, the U.S. could enjoy a petroleum trade surplus in 2020.

The shale oil revolution also has geopolitical consequences, not least in that it will weaken the influence of America’s traditional Middle Eastern oil suppliers, such as Saudi Arabia, United Arab Emirates and Kuwait, on Washington’s foreign policy.

Drivers behind such a shift

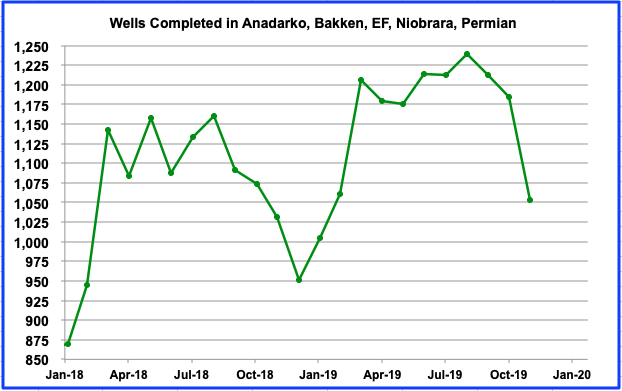

A number of factors contributed to this development, of which the most significant was burgeoning production from shale oil fields, especially those in West Texas and New Mexico. Improvements in fuel economy of modern cars limited petrol demand, even as road travel recovered from recession. The resulting domestic supply glut was punctured by the ending of the crude oil export ban in 2015.

Why the US still imports oil

Despite ample supplies of domestic crude, the United States continues to import crude from Canada, Columbia, Brazil and before sanctions, Venezuela. This is because, although oil is seen as a commodity, it is nevertheless differentiated by its sulphur content -- which determines whether oil is sweet or sour -- and its density, which determines whether it is light or heavy. And this matters for refiners.

For example, refineries in the North Eastern Seaboard of the U.S., for example, are equipped to process light oils originating in the Middle East and West Africa rather than the heavier domestic produced oils. Whereas U.S. Refineries along the Gulf of Mexico typically refine heavy crude oil from Mexico because the country lacks refining capacity. Consequently, Mexico’s oil is processed by U.S. refineries into petroleum products such as diesel and jet fuel, heating oil, petrochemical feedstocks, waxes, lubricating oils and asphalt, which are then returned to Mexico. For example, in 2018 Mexico imported 517 Mb/d of petrol and 279 Mb/d of diesel from U.S. refineries.

Two factors could directly affect the level of U.S. crude exports. First, is the outcome of a debate on the size of the country’s strategic petroleum reserve, which traditionally stands at 90 days of net imports. A cut of whatever amount could give a one-off boost to U.S. crude exports. Second, given the world surplus in crude oil, even with future OPEC + production cuts, it remains to be seen if U.S. shale oil producers will be able to attract the scale of investment needed to maintain, let alone increase production going forward.