https://www.nsenergybusiness.com/news/s ... t-project/Sempra and partners sign agreement for Cameron LNG phase 2

By NS Energy Staff Writer 05 Apr 2022

Phase 2 of the LNG export project in the US involves the addition of a fourth train with a production capacity of up to 6.75Mtpa as well as ramping up of the production capacity of the three operating LNG trains via debottlenecking activities

The Cameron LNG project currently has three trains with a combined capacity of 12Mtpa. (Credit: Sempra Infrastructure)

Sempra Infrastructure has entered into a heads of agreement (HOA) with affiliates of TotalEnergies, Mitsui & Co., and Japan LNG Investment for developing the Cameron LNG phase 2 export project in Louisiana.

A commercial framework has been provided by the preliminary non-binding arrangement for expanding the Cameron LNG facility with a fourth liquefied natural gas (LNG) train. The partners will also aim to ramp up the production capacity of the three operating LNG trains by taking up debottlenecking activities.

Located in Hackberry and built with an investment of $10bn, the Cameron LNG export facility achieved full commercial operations in August 2020.

Currently, the three liquefaction trains have an estimated export capacity of around 12 million tonnes per annum (Mtpa) or nearly 1.7 billion cubic feet per day of LNG. The fourth train under the proposed phase 2 project will have a maximum production capacity of 6.75Mtpa.

Sempra Infrastructure CEO Justin Bird said: “We are excited to continue advancing Cameron LNG Phase 2 with our partners.

“Today’s announcement represents the shared focus of the Cameron LNG partners to increase the supply of cleaner U.S. natural gas to global markets, while also facilitating the energy security of our allies.”

The Cameron LNG phase 2 export project is likely to incorporate some design enhancements to make it a more cost-effective and efficient facility, while bringing down the overall emissions of greenhouse gases.

Under the HOA, a stake of 50.2% is considered to be allocated to Sempra Infrastructure in the projected fourth train production capacity. The Sempra subsidiary could also get 25% of the projected debottlenecking capacity under tolling agreements, with the remaining capacity to be equally allocated to the existing customers of Cameron LNG phase 1.

Sempra Infrastructure said that before taking a final investment decision on phase 2, it intends to sell the LNG corresponding to its capacity under long-term sale and purchase agreements.

The company said that two front end engineering design (FEED) contracts have been awarded to Bechtel Energy and a joint venture between JGC America and Zachry Industrial for the Cameron LNG phase 2 export project. After the conclusion of the competitive FEED process, one of them is expected to be awarded the engineering, procurement and construction (EPC) contract for the phase 2 project.

Separately, Sempra Infrastructure has signed a memorandum of understanding (MOU) with Korea Gas Corporation (KOGAS) to explore opportunities to work together in the global energy transition to lower-carbon and zero-carbon fuels.

The MOU seeks joint collaboration focused on project development and offtake in various business areas such as LNG, hydrogen infrastructure, and carbon capture and sequestration.

Situation du GAZ continent Nord Américain

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

en relation avec ce post du 4 avril 2022 viewtopic.php?p=2340709#p2340709

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

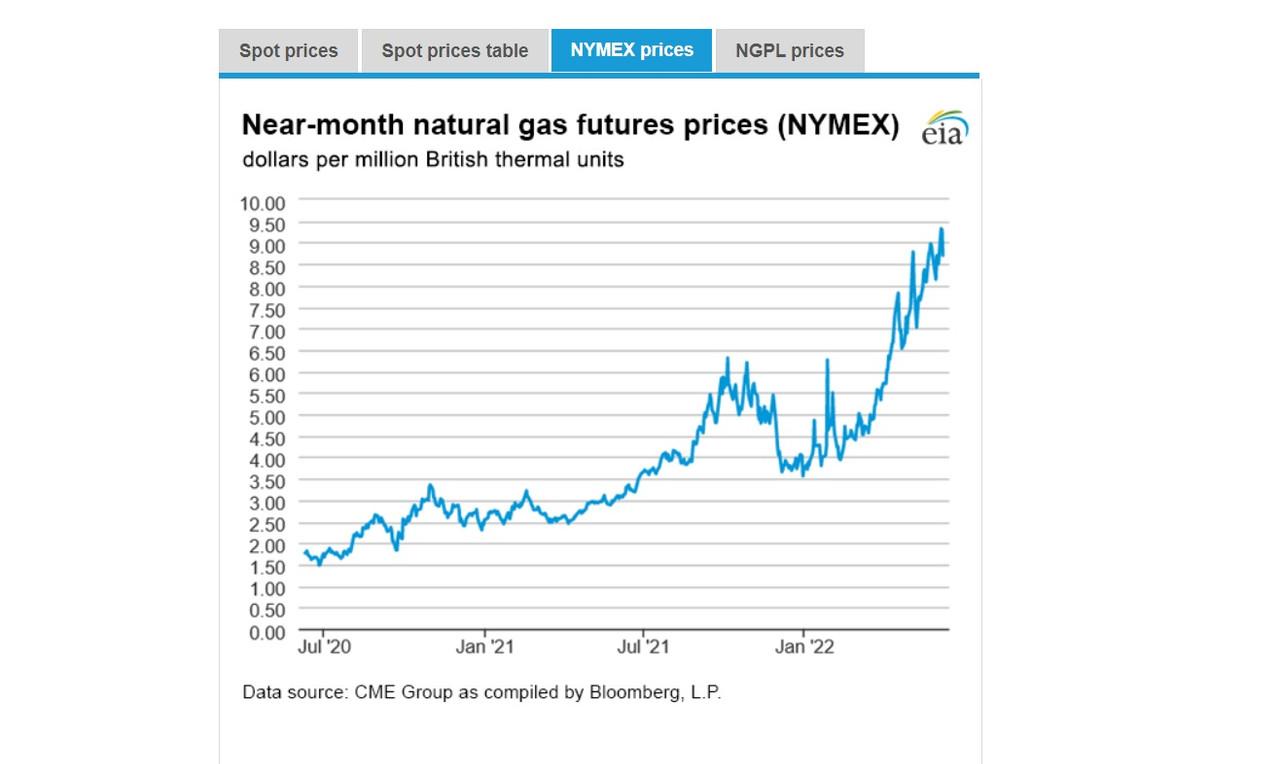

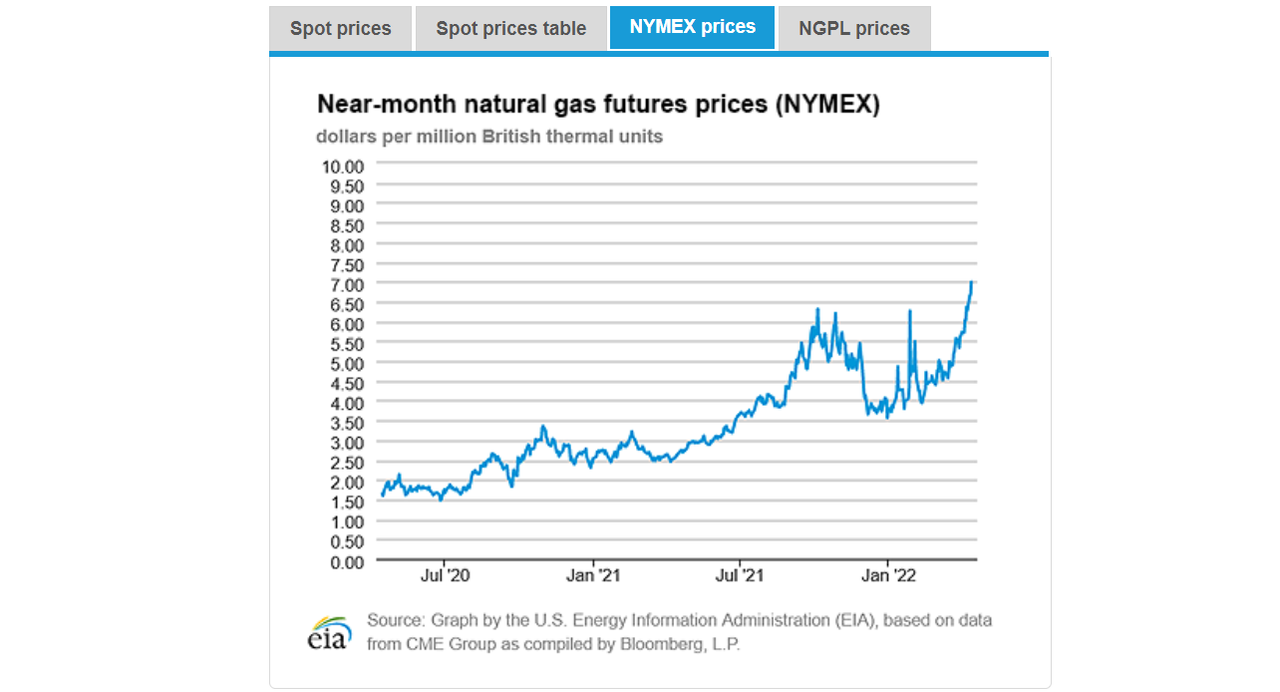

https://www.eia.gov/naturalgas/weekly/#tabs-prices-3

https://oilprice.com/Energy/Natural-Gas ... Years.htmlU.S. Natural Gas Prices Hit Highest Level In 14 Years

By Tsvetana Paraskova - Apr 18, 2022 oilprice.com

The benchmark U.S. natural gas price soared by more than 7% early on Monday to hit the highest level since the second half of 2008, as Europe races to buy non-Russian gas after Putin’s invasion of Ukraine.

At 10:18 a.m. ET, the front-month futures price at the Henry Hub had jumped by 6.37% at $7.755 per million British thermal units (MMBtu). That’s more than double the price of the U.S. benchmark compared to the start of this year.

By Tsvetana Paraskova - Apr 18, 2022,

...............

“Below normal temperatures and strong exports driving the current tightness with stockpiles now almost 18% below the usual level,” Hansen noted.

Higher demand for heating and record LNG exports left U.S. natural gas in storage at the end of the winter at its lowest level in three years, the Energy Information Administration (EIA) said on Friday.

Because of the higher withdrawals, by the end of March, the U.S. had the least amount of natural gas in underground storage in the Lower 48 states since 2019.

A colder January 2022 and record-high U.S. LNG exports led to more withdrawals even though domestic production of natural gas increased, the EIA said.

The U.S. is exporting record volumes of LNG as the United States looks to help European allies with non-Russian gas supply.

In another bullish factor for natural gas prices, immediate demand in the United States is expected to be strong Monday through Wednesday, as chilly late-season weather systems track across the Midwest and Northeast with rain and snow showers, as well as cooler than normal lows of 20s and 30s, NatGasWeather.com noted on Monday.

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://lngprime.com/americas/nextdecad ... enn/47943/NextDecade inks long-term Rio Grande LNG supply deal with China’s ENN

By LNG Prime Staff April 6, 2022

NextDecade, the developer of the Rio Grande LNG export plant in Texas, said it has signed a deal to supply liquefied natural gas to a unit of Chinese independent gas distributor ENN.

Under the 20-year sales and purchase deal, ENN LNG would buy 1.5 mtpa of LNG indexed to Henry Hub on a free-on-board basis, according to a statement by NextDecade.

The LNG supply would come from the first two trains of the planned Rio Grande LNG terminal in Brownsville, Texas.

NextDecade expects to start commercial operations at the first train in 2026.

The firm first aims to build two liquefaction trains with a capacity of 11 mtpa while the full project would include five trains with a capacity of 27 mtpa.

This deal follows a contract NextDecade announced last week. Under that 20-year HoA, NextDecade would supply up to 1.5 mtpa of LNG indexed to Henry Hub to Guangdong Energy Group Natural Gas.

However, NextDecade still needs to take a final investment decision on the project.

Assuming the achievement of further LNG contracting and financing, NextDecade anticipates making a positive FID on a minimum of two trains of the Rio Grande LNG export project in the second half of 2022, the firm confirmed on Wednesday.

FIDs of the remaining three trains would follow thereafter, it said.

“This SPA underscores the strength of NextDecade’s differentiated offering. The commercial momentum at RGLNG is accelerating and we believe the company is well placed to benefit from the strengthening LNG market,” Matt Schatzman, NextDecade’s CEO, said.

“This agreement secures additional volume for our LNG portfolio and helps ensure we can meet the growing demand for secure, flexible, and cleaner energy for our customers in the future,” Zheng Hongtao, president of ENN Natural Gas,said.

c'est avec cette installation que ENGIE à signé un contrat d'approvisionnement long terme à partir de 2026 , voir ce post viewtopic.php?p=2342493#p2342493

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://oilprice.com/Energy/Natural-Gas ... -2008.htmlU.S. Natural Gas Prices Hit $9 For The First Time Since 2008

By Tsvetana Paraskova - May 25, 2022

> High LNG exports and warmer weather are the driving forces behind the rally in U.S. natural gas.

> U.S. natural gas prices have surged by more than 130% since the beginning of the year.

> The price is currently 3.3 times above the five-year average.

U.S. benchmark natural gas prices jumped to above $9 per million British thermal units (MMBtu) early on Wednesday, driven by high LNG exports, warmer weather, and volatile trade ahead of the prompt-month contract expiry.

As of 9:15 a.m. EST on Wednesday, the front-month natural gas futures at the Henry Hub, the U.S. benchmark, had jumped to $9.168/MMBtu, up by 4.93% on the day.

The June contract expires on Thursday, while options expire on Wednesday.

U.S. natural gas prices have surged by more than 130% since the beginning of the year, due to strong demand for LNG, especially in Europe, which is scrambling to replace as much Russian gas as soon as possible. In addition, early heat waves in the U.S. at the start of May boosted demand for air conditioning and power generation, while supply growth is struggling to catch up with demand. Moreover, working natural gas stocks are 17% lower than the year-ago level and 15% lower than the five-year average for this week, according to the EIA’s latest Weekly Natural Gas Storage Report released on May 19.

Record LNG exports and unseasonably high demand for electricity have combined in recent weeks to push U.S. gas prices considerably higher than they normally are at this time of the year. And this may only be the beginning. Warmer than usual spring weather, expectations of a hotter summer, and record LNG exports to help Europe reduce dependence on Russian gas could send the U.S. benchmark natural gas prices to above $10/MMBtu in the coming weeks, analysts say.

“US #natgas spikes with hotter weather expected to boost already strong demand with limited production growth to counter,” Ole Hansen, Head of Commodity Strategy at Saxo Bank, tweeted on Wednesday.

The price is currently 3.3 times above the five-year average, while EU gas, at 5.3 times above five-year average, traded early on Wednesday at pre-war levels with stocks closing in on normal levels, Hansen added.

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://www.nsenergybusiness.com/news/t ... -contract/Technip, Samsung appointed as lead project contractor for Texas LNG project

By NS Energy Staff Writer 25 May 2022

The two firms will handle the engineering, construction coordination, start-up, and commissioning of the 4MTA liquefaction facility

A consortium of Technip Energies USA and Samsung Engineering has been appointed as the lead project contractor by Texas LNG Brownsville for the Texas LNG project in South Texas, US.

Texas LNG is a liquefied natural gas (LNG) facility to be built at the Port of Brownsville in Brownsville, near the US–Mexico border. The project is located at the mouth of the Gulf of Mexico.

Artistic impression of the Texas LNG project. (Credit: Texas LNG)

It has a permitted capacity for producing four million tonnes per annum (MTA) of liquefied natural gas (LNG).

The project’s holding company, Texas LNG Brownsville, is majority owned by Glenfarne Group. Samsung Engineering is an indirect minority stakeholder in Texas LNG Brownsville.

Glenfarne CEO and founder Brendan Duval said: “We’re proud to have selected such preeminent businesses as Technip Energies and Samsung Engineering to build our Texas LNG export facility.

“With the help of these partners, Texas LNG will be one of the cleanest LNG export facilities in the world, powered by renewable energy and providing access to secure energy supply for economies across the world.”

Technip Energies and Samsung Engineering will handle all aspects of the delivery of the liquefaction facility. These include engineering, construction coordination, start-up, and commissioning, all under a project financeable structure.

The Texas LNG project is expected to reach a final investment decision this year. The two-train project is targeted to begin commercial operations in 2026.

Each of the two trains will have a capacity of 2MTA and will use the standard Air Products liquefaction technology. The project has authorisation from the US Department of Energy to export the produced LNG to free trade agreement (FTA) and non-FTA countries.

Technip Energies gas and low carbon energies SVP Loic Chapuis said: “We’re looking forward to supporting Texas LNG in its promise to provide environmentally-responsible, clean natural gas using our all electric, emissions free, SnapLNG design to its customers around the world.

“Our team of world-class LNG project engineers, working jointly with Samsung Engineering, will ensure that the facility will be capable of safe, reliable, and efficient natural gas export to global markets.”

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://oilprice.com/Latest-Energy-News ... ummer.htmlNatural Gas Futures Hit 13-Year High As Traders Expect "Blistering Hot Summer"

By Tom Kool - Jun 06, 2022, 4:09 PM CDT

Natural gas futures have hit an 13-year high on higher temperatures to come in the next week combined with lower production levels.

On Monday, Henry Hub natural gas futures were up nearly 10% at a 13-year high.

At 5:00pm EST, Henry Hub prices for July contracts sat at $9.368, up 9.91%. August contracts were at $9.350, up 9.87%.

A key reason for the sudden surge is heat, with temperatures expected to rise significantly in the middle part of this month, with production declining and demand threatening to exceed supply.

........................

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://www.connaissancedesenergies.org ... ole-22061414 juin 2022

Les opérateurs ont aussi répercuté l'annonce de l'arrêt prolongé du terminal gazier de la société Freeport LNG, à Quintana Island, non loin de Houston.

Frappé par une explosion, puis un incendie, ce terminal qui est aussi une usine de liquéfaction du gaz naturel, sera finalement à l'arrêt durant 90 jours, soit beaucoup plus que les trois semaines annoncées initialement par Freeport LNG.

En outre, le site, qui assure en temps normal l'exportation de près de 60 millions de mètres cubes de gaz naturel liquéfié (GNL) par jour, ne retrouvera sa pleine capacité qu'en fin d'année.

La nouvelle a provoqué l'effondrement des cours du gaz naturel aux Etats-Unis, qui ont perdu jusqu'à 18,5% mardi. Le marché a ainsi encaissé le fait que les volumes non exportés allaient être disponibles pour le marché américain.

En Europe, c'est le phénomène inverse qui s'est produit. Le TTF néerlandais, référence du marché européen du gaz naturel, a ainsi bondi jusqu'à 100 euros le mégawattheure (MWh), pour la première fois depuis trois semaines, et fini en hausse de 13%.

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

suite de ce post du 12 mars 2022 : viewtopic.php?p=2339080#p2339080

Décision finale d'investissement pour la phase3 du projet LNG de Corpus Christi :

Décision finale d'investissement pour la phase3 du projet LNG de Corpus Christi :

https://www.nsenergybusiness.com/news/c ... 3-project/Cheniere reaches positive FID on Corpus Christi Stage 3 liquefaction project

The Corpus Christi Stage 3 liquefaction project is expected to have more than 10 million tonnes per annum capacity, with the first exports expected to start in 2025

By NS Energy Staff Writer 23 Jun 2022

Cheniere Energy has made a positive Financial Investment Decision (FID) to advance the development of the LNG Corpus Christi Stage 3 Liquefaction project (CCL Stage 3) in Texas.

The expansion project is expected to have more than 10 million tonnes per annum capacity, with the first exports expected to start in 2025. It will entail an investment of $8bn, reported Reuters.

In addition, Cheniere has notified Bechtel Energy to proceed with construction at CCL Stage 3, which started earlier this year under limited notice to proceed.

Bechtel is a US-based engineering, procurement, construction (EPC), and project management company.

The project will strengthen its LNG infrastructure platform, provide LNG to the global markets by the end of 2025, and create value for its stakeholders, said the company.

Cheniere president and chief executive officer Jack Fusco said: “Reaching FID on Corpus Christi Stage 3 represents an important milestone for Cheniere as we move forward on this significant growth project.

“I would like to recognise the Cheniere team, our financial partners, our EPC partner Bechtel and our long-term customers for their demonstrated teamwork, commitment and execution, all of which were critical elements in the successful commercialisation and financing of CCL Stage 3.

“CCL Stage 3 is supported by a truly global portfolio of long-term customers and reflects the call for investment in natural gas infrastructure around the world to support environmental priorities and long-term energy security.”

...........................

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://www.usinenouvelle.com/article/a ... e.N2023857A Cameron LNG, TotalEnergies investit pour décarboner sa production de gaz naturel liquéfié

TotalEnergies et ses partenaires envisagent la construction d’un quatrième train de liquéfaction sur l’usine américaine de Cameron LNG, en Louisiane (Etats-Unis). L’opération va permettre d’améliorer le bilan carbone du site de gaz naturel liquéfié (GNL), dont les émissions vont par ailleurs être séquestrées dans un aquifère salin.

Antoine Vermeersch 08 Juillet 2022 Usine Nouvelle

Le quatrième train de liquéfaction de Cameron LNG sera équipé non plus de turbines à gaz naturel mais de moteurs électriques pour entraîner les compresseurs de liquéfaction.

Les experts en gaz naturel le savent, produire du gaz naturel liquéfié (GNL) avec une empreinte carbone réduite requiert l’électrification des trains de liquéfaction et la séquestration du carbone émis. TotalEnergies l’a bien compris, même si cela nécessite des investissements importants dans un secteur déjà intensif en capital. Avec ses partenaires Sempra Infrastructure, Mitsui & Co. et Mitsubishi Corporation, l’énergéticien français a pour projet d’améliorer le bilan carbone de l’usine américaine de liquéfaction de gaz naturel Cameron LNG, implantée en Louisiane au milieu des marécages.

Dans le cadre d’un projet d’extension dont la décision finale d’investissement est prévue en 2023, l’usine va être dotée d’un quatrième train de liquéfaction d’une capacité de production maximale de 6,75 millions de tonnes de GNL par an (Mtpa). Les trois trains existants, chacun doté d’une capacité de 4,5 Mtpa, vont être boostés de 5% «par dégoulottage». «Le projet comprendra également des améliorations de conception visant à réduire les émissions du site», promet le communiqué de TotalEnergies, qui détient 16,6% de l’entreprise.

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

https://www.rigzone.com/news/us_gas_out ... 0-article/U.S. Gas Output To Hit Record High By End-2022. More Growth In 2023.

by Bojan Lepic|Rigzone Staff|Tuesday, July 19, 2022

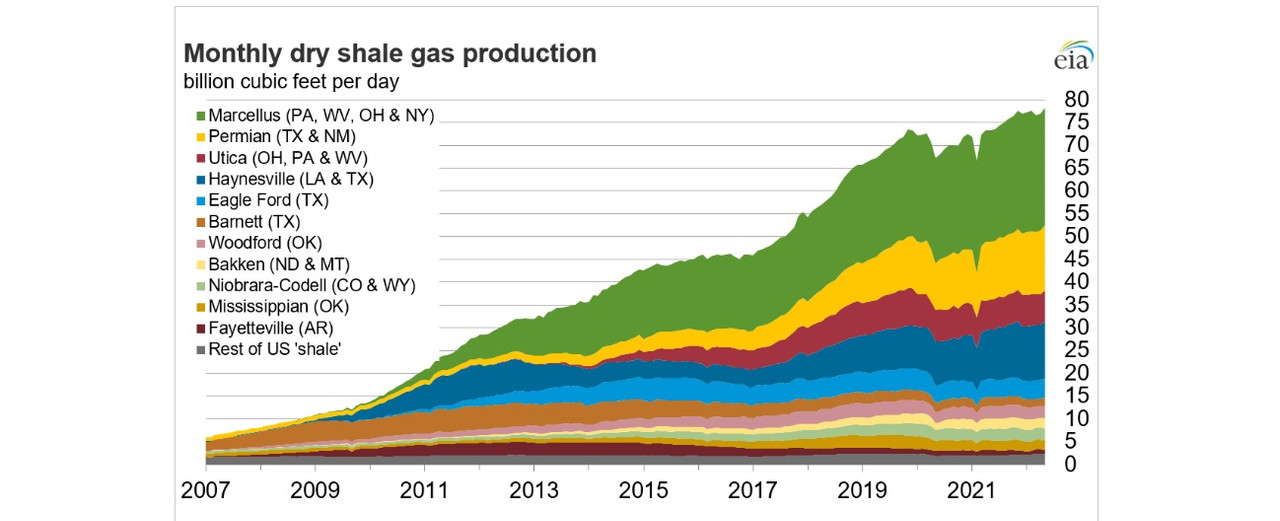

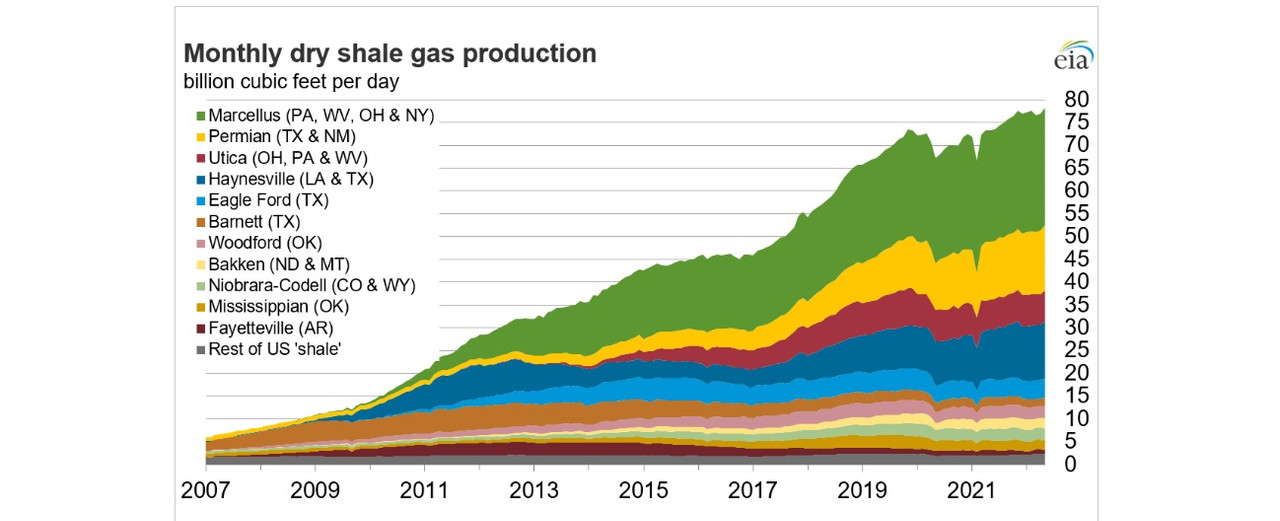

US natural gas production is forecast to hit an all-time high in the coming months, racing past 100 billion cubic feet per day (Bcfd), helping feed global demand as the world faces a severe supply shortage.

Rystad Energy’s analysis shows that production growth from the major US gas-producing basins of the Haynesville and Appalachia, in addition to associated gas volumes from the Permian, will solidify the country’s position as the world’s largest gas producer, stretching its lead over Russia, and surpassing the official growth expectations of the EIA.

..........................

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

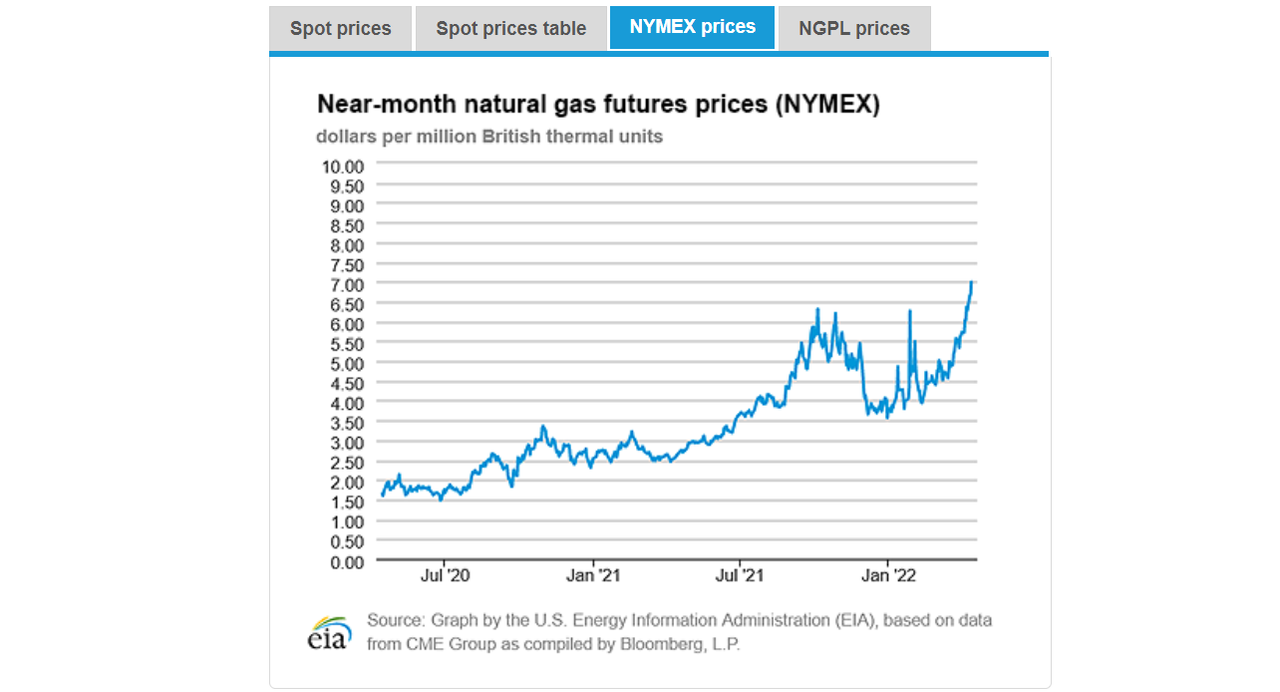

update de la courbe du 2 fev 2022 viewtopic.php?p=2336443#p2336443

https://www.eia.gov/naturalgas/weekly/#tabs-prices-2

https://www.eia.gov/naturalgas/weekly/#tabs-prices-2

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 90069

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

Cheniere Energy veut encore grossir son Stage 3 project.

Le projet prévoit 7 trains de liquéfactions et ils voudraient ajouter les trains 8 et 9 plus une grosse cuve de 220 000 m3.

Le projet prévoit 7 trains de liquéfactions et ils voudraient ajouter les trains 8 et 9 plus une grosse cuve de 220 000 m3.

https://www.rigzone.com/news/cheniere_e ... 5-article/Cheniere Energy Expanding Corpus Christi Complex

by Bojan Lepic|Rigzone Staff|Tuesday, August 30, 2022

The biggest U.S. exporter of liquefied natural gas Cheniere Energy has revealed its plans to expand its complex on the Texas coast.

Cheniere said submitted a letter to the Federal Energy Regulatory Commission (FERC) requesting a pre-filing review for the proposed Corpus Christi Liquefaction Midscale Trains 8 & 9 Project. According to the company, the proposed project would expand the previously approved liquefaction project and Stage 3 project facilities.

Namely, the company is seeking to add two midscale production lines – otherwise known as trains – as well as a 220,000-cubic-meter storage tank at its Corpus Christi plant. It also wants to add a refrigerant storage facility, appurtenant connecting facilities and piping, and an increase in Corpus Christi’s previously approved ship loading rates.

Cheniere plans to file a formal application with the agency in February 2023 upon completion and approval of the commission’s mandatory 6-month pre-filing process. Construction would begin in October 2024 with a projected in-service date during the second half of 2031.

This request to the FERC comes some two months after the company reached a final investment decision for the Stage 3 expansion of Corpus Christi LNG.

Stage 3 is supposed to be a 10+ million ton per annum project that consists of up to seven midscale trains bringing Corpus Christi’s total nominal capacity to approximately 25 mtpa.

Cheniere’s 1,000+ acre Corpus Christi Liquefaction facility is in the Corpus Christi Bay in San Patricio County, Texas, where energy infrastructure and estuaries coexist. It currently has three fully operational liquefaction units, all of which were completed ahead of schedule and within budget, and each train is designed to produce around 5 million tons per annum of LNG.

The first two LNG trains, along with the first two LNG tanks and wharf facilities, were completed in August 2019, while the third train and tank and a second berth were finished in March 2021.

It is worth noting that Cheniere signed six LNG supply deals since May as Europe and Asia continue to compete for tight global supplies.