Situation du GAZ continent Nord Américain

Modérateurs : Rod, Modérateurs

- kercoz

- Hydrogène

- Messages : 12971

- Inscription : 18 nov. 2007, 21:46

- Localisation : SUD GIRONDE GRAVE DE GRAVE

Re: Situation du GAZ continent Nord Américain

Une bonne affaire qd même cette guerre pour ricains.

L'Homme succombera tué par l'excès de ce qu'il appelle la civilisation. ( Jean Henri Fabre / Souvenirs Entomologiques)

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

Dans le sud des Etats-Unis, l'industrie gazière grignote les zones côtières

AFP le 09 oct. 2022

"Ils nous prennent notre vie". Sur le seuil de sa maison en Louisiane, Travis Dardar pointe du doigt un imposant terminal d'exportation de gaz... et le terrain qui pourrait bientôt en accueillir un deuxième, le forçant à quitter sa maison et son activité de pêcheur.

Ce projet est "bien pire qu'un ouragan", après lequel, au moins, "on peut reconstruire", juge celui qui se voit comme une victime collatérale du développement de l'industrie gazière américaine, que la crise du gaz russe a rendue primordiale.

"Si c'est construit, il n'y aura pas de retour en arrière possible."

Dans cette région côtière entre le Texas et la Louisiane, la récente démultiplication des projets de terminaux d'exportation de gaz naturel liquéfié (GNL), immenses édifices posés sur des plateaux de béton qui grignotent peu à peu les zones naturelles, irrite les habitants, qui les jugent trop polluants.

Le terminal envisagé près de chez Travis Dardar et sa femme Nicole ne serait qu'à quelques centaines de mètres de leur domicile. Cela ne leur laisserait d'autre choix que de plier bagages - en espérant que leur terrain soit racheté à un prix raisonnable.

Un autre est en projet à l'endroit où ils pêchent. Le couple Dardar risque donc de devoir aussi abandonner son activité de pêche de crevettes et d'huîtres dans la zone, ultime déracinement.

"On ne sait pas ce qu'on va faire ensuite. On sait une chose: on ne peut pas vivre ici", regrette Travis Dardar.

- Ukraine -

En mars dernier, quelques semaines après le début de l'invasion russe de l'Ukraine, le président Joe Biden s'est engagé à augmenter les livraisons de GNL à l'Europe, trop dépendante du gaz russe.

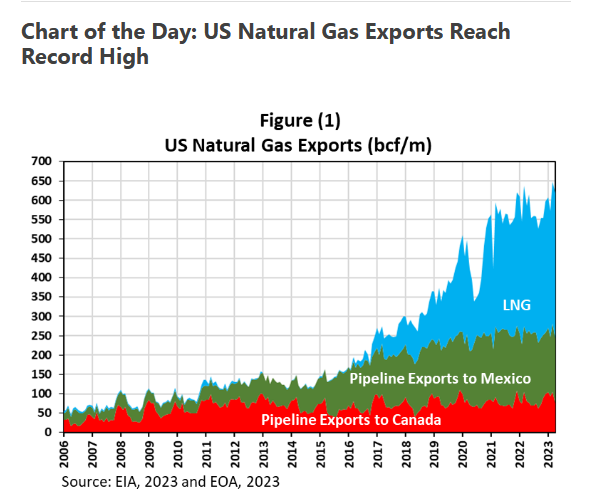

44,6 milliards de mètres cubes y ont déjà été exportés en 2022, contre 26 en 2020, rapporte le Centre pour le GNL, qui regroupe des entreprises du secteur.

Les Etats-Unis sont devenus le premier exportateur mondial de GNL, une industrie qui ne peut qu'être attirée par le Golfe du Mexique, avec ses infrastructures et sa situation stratégique.

À elle seule, la zone compte 5 des 7 terminaux d'exportation américains en activité et 22 des 24 projets soumis aux autorités.

Une activité qui, en retour, lui apporte "de nombreux emplois", promet Charlie Riedl, directeur exécutif du Centre pour le GNL.

Selon lui, tant que les projets de construction de terminaux respectent les critères environnementaux, le gouvernement doit "les autoriser sans délai".

- Bruit, lumière et pollution -

Mais ces côtes de Louisiane et du Texas sont "sacrifiées", assure John Allaire, un autre habitant.

"Vous avez le bruit, la lumière, la pollution de l'air et plusieurs dizaines d'hectares de marécages bétonnés" se désole-t-il, assis dans sa barque, en désignant le nouveau terminal d'exportation de GNL, tout près de chez lui.

Dépité, John Allaire observe les vagues causées par les immenses méthaniers éroder la côte et les boues de dragages qui couvrent sa plage.

Il s'inquiète aussi des conséquences sur la faune. Le projet prévu sur le terrain qui longe sa propriété se situe sur un marécage abritant une espèce d'oiseaux menacée, le râle noir.

"C'est horrible de voir cette administration (Biden, NDLR) (...) qui disait qu'il y avait une urgence climatique, approuver ce genre d'installations", se désole Kelsey Crane, en charge des politiques publiques à l'association Earthworks.

- Fissures -

De l'autre côté du fleuve Sabine, la ville texane de Port Arthur compte déjà de nombreuses installations pétrochimiques.

Près du terminal de Cheniere Energy - qui a payé l'an dernier près de 1,5 million de dollars d'amende pour des fissures dans ses réservoirs - le militant John Beard guide un "toxic tour" de la région, en compagnie d'associations écologistes.

En juin, une explosion a provoqué la fermeture temporaire du terminal GNL de Freeport, plus au sud, rappelant aux habitants les risques immédiats posés par ce voisinage si particulier.

Mais John Beard, à la tête du Port Arthur Community Action Network, dénonce aussi les effets à long terme sur la santé d'habitants largement issus des minorités.

A Port Arthur, la population est majoritairement afro-américaine ou hispanique, et un quart d'entre elle vit sous le seuil de pauvreté, selon le bureau de recensement américain.

Dans le comté, le taux de mortalité du cancer est 25% plus élevé que dans le reste de l'Etat, d'après le Texas Cancer Registry.

John Beard pense que les industriels n'ont pas choisi cette zone par hasard: "ils prennent le chemin où la résistance est la moindre, celui des pauvres, de ceux qui n'ont pas accès à des avocats, qui n'ont pas l'éducation ou le savoir".

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

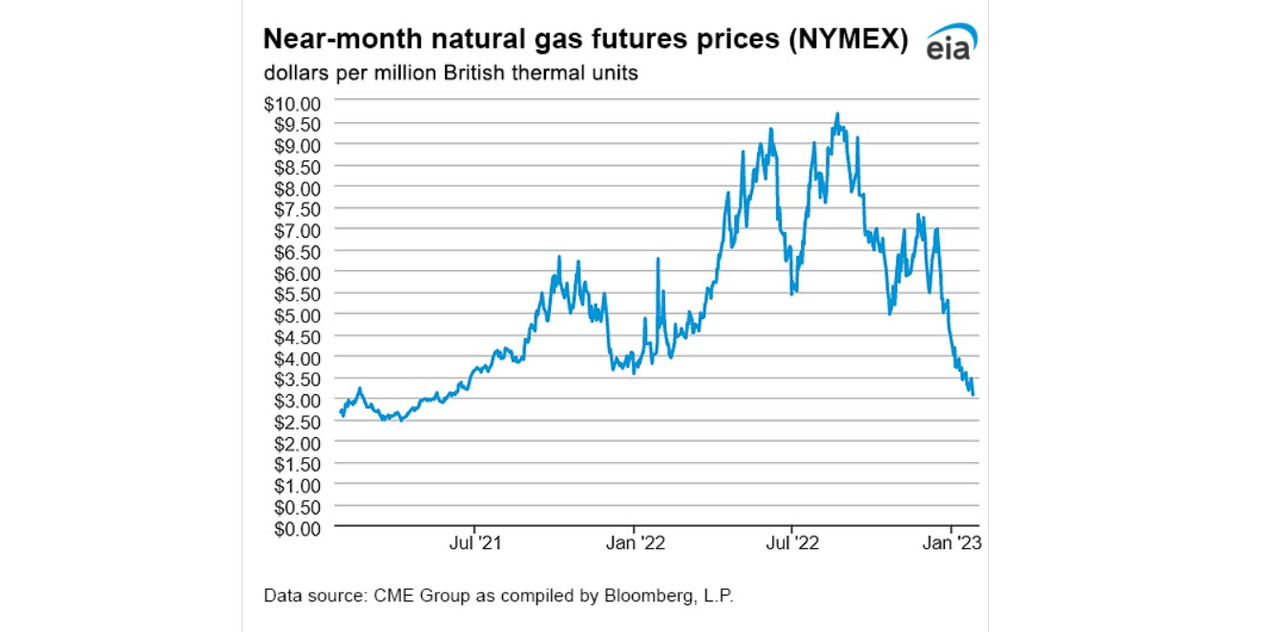

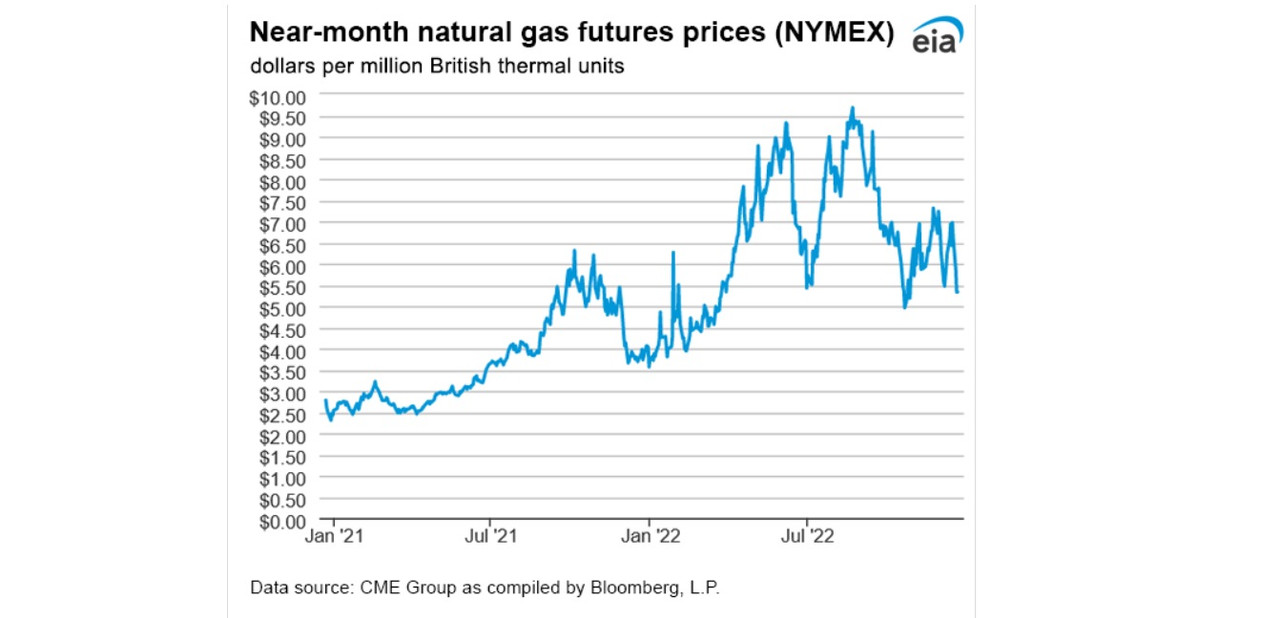

suite de ce post du 18 Aout 2022 viewtopic.php?p=2349530#p2349530

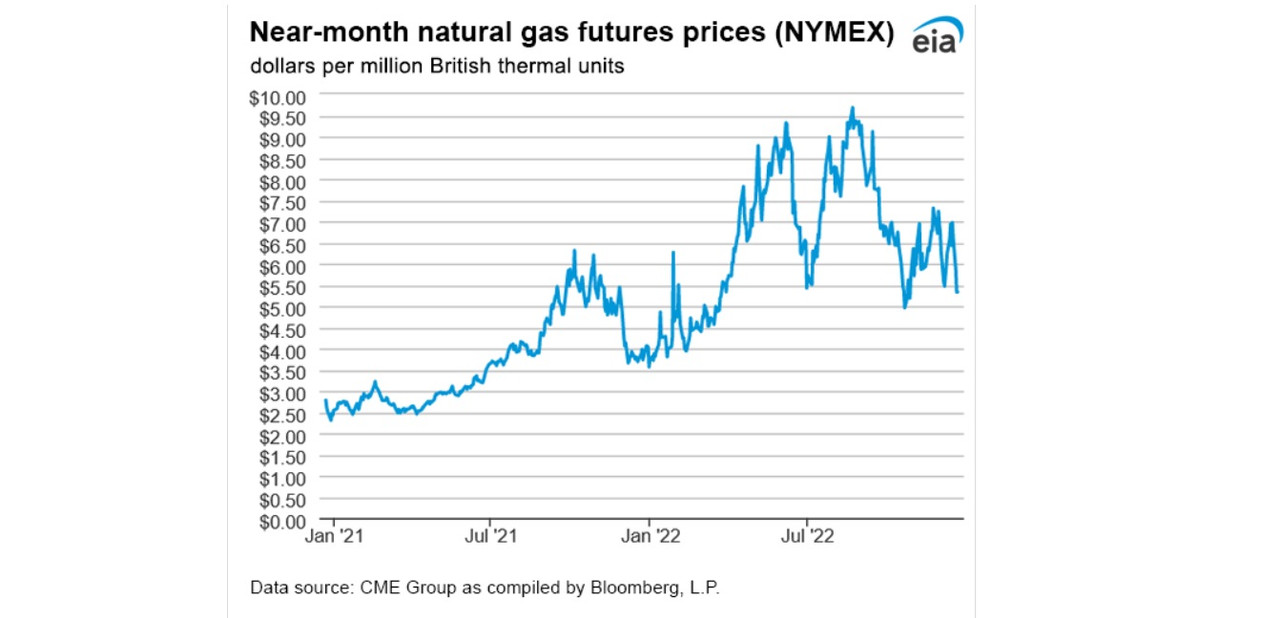

https://www.eia.gov/naturalgas/weekly/#tabs-prices-1

https://www.eia.gov/naturalgas/weekly/#tabs-prices-1

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

La carte présentant les installations de LNG et les projets :

source https://www.eia.gov/naturalgas/weekly/#itn-tabs-2

source https://www.eia.gov/naturalgas/weekly/#itn-tabs-2

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

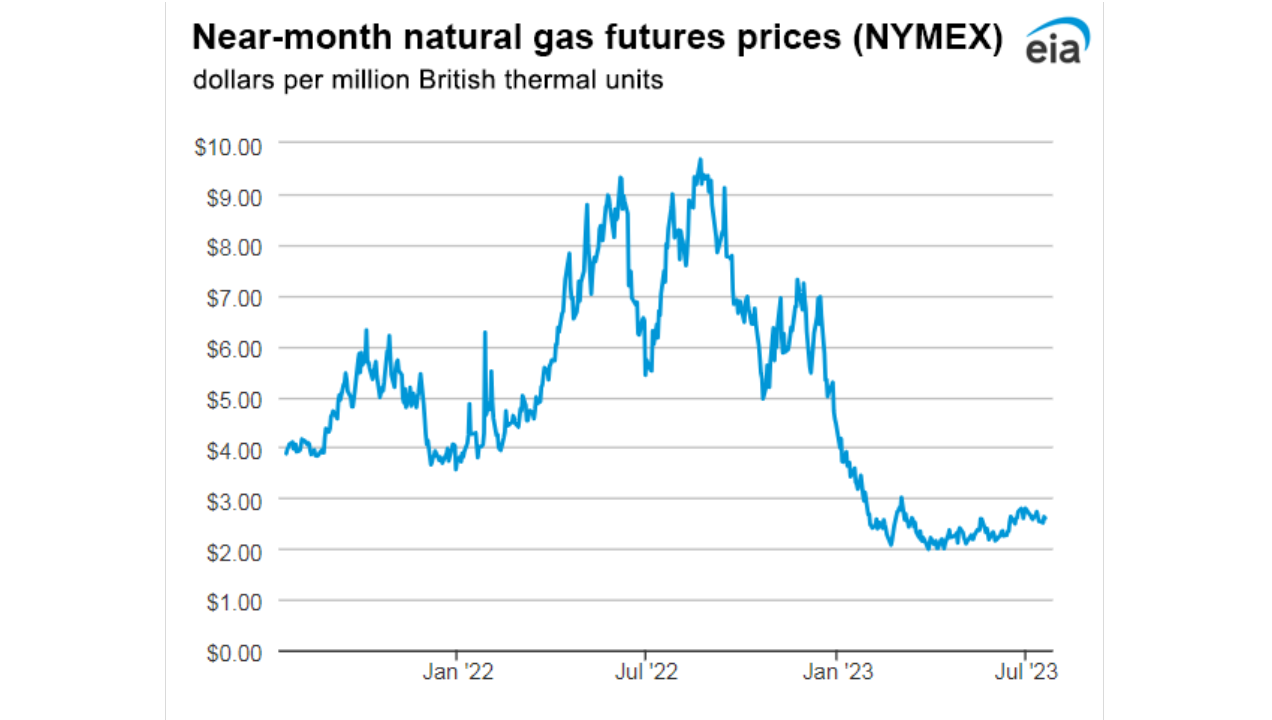

extrait de https://oilprice.com/Energy/Crude-Oil/P ... -Year.htmlThe EIA has predicted that the U.S. will export 11.8 and 12.6 billion cubic feet of LNG per day in 2023 and 2024, respectively, up from 10.6 billion cubic feet per day in 2022. However, natural gas prices are expected to remain muted, averaging $3.40 and 4.04/MMBtu in 2023 and 2024, down from $6.42/MMBtu in 2022.

Last year, the United States overtook Qatar and Australia to become the world’s top LNG exporter, and appears set to cement its lead. Once again, the Permian will play a pivotal role, with the basin preparing to unleash a torrent of gas and gas projects to meet exploding LNG and nat. gas demand

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

Nouvelle expansion des installation de Sabine Pass à mettre en chantier :

https://www.nsenergybusiness.com/news/c ... n-project/

Cheniere begins permitting process for Sabine Pass expansion project

The proposed Sabine Pass Stage 5 expansion project will be located near the existing six-train liquefaction project in Cameron Parish

By NS Energy Staff Writer 24 Feb 2023

Cheniere Energy has initiated permitting process for expanding the liquefied natural gas (LNG) export capacity at its Sabine Pass liquefaction project in Louisiana, US by nearly 20 million tonnes per annum (mtpa).

An announcement in this regard was made by the company’s subsidiary Cheniere Energy Partners, stating that some of its subsidiaries have started the pre-filing review process under the National Environmental Policy Act with the Federal Energy Regulatory Commission (FERC).

The proposed Sabine Pass Stage 5 expansion project (SPL Expansion Project) will be located near the existing liquefaction project in Cameron Parish.

Currently, the liquefaction project has six fully operational liquefaction units with a combined capacity of around 30mtpa of LNG.

The expansion project will see the addition of up to three large-scale liquefaction trains. Each of the trains is planned to have a production capacity of around 6.5mtpa of LNG.

The trains will each have a boil-off-gas (BOG) re-liquefaction unit with a production capacity of around 0.75mtpa of LNG along with two LNG storage tanks with each having a capacity of 220,000m3.

According to Cheniere Energy Partners, the LNG expansion project will accommodate waste heat recovery and carbon capture from acid gas removal units.

The company has appointed Bechtel Energy to undertake a front-end engineering and design (FEED) study of the Sabine Pass expansion project.

Cheniere Energy Partners chairman, president, and CEO Jack Fusco said: “The SPL Expansion Project is being designed to leverage the infrastructure platform we’ve built at Sabine Pass to deliver economically advantaged incremental LNG capacity in a safe and environmentally responsible manner.

“We are committed to developing the SPL Expansion Project utilising the same rigorous and financially disciplined approach to project development and capital investment that’s become synonymous with the Cheniere brand.”

Cheniere Energy Partners said that the project’s development and any essential supporting infrastructure is conditional on obtaining all necessary regulatory approvals and permits. It will also be contingent on adequate commercial and financing arrangements before making a final investment decision (FID).

https://www.nsenergybusiness.com/news/c ... n-project/

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

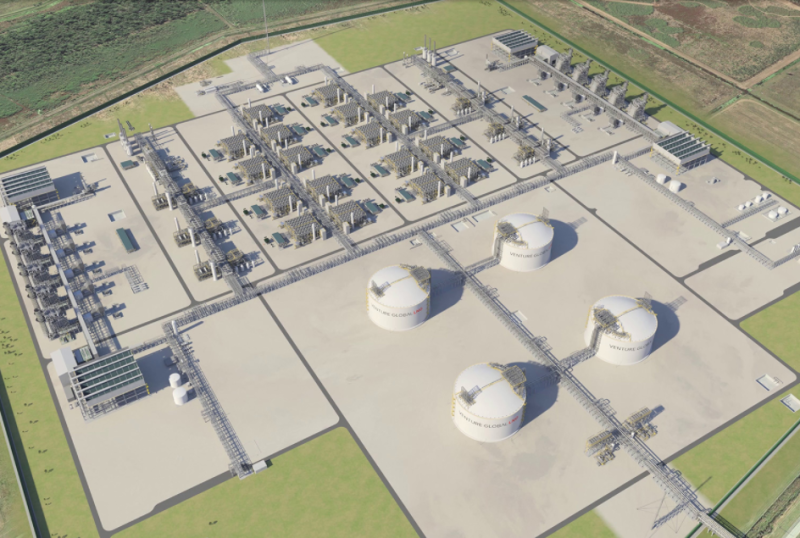

Le chantier de l'usine de liquéfaction du projet Plaquemines LNG (Louisiane) avance bien. Projet à 13.2 milliards de dollars.

Montée du toit du premier gros reservoir de 200 000 m3.

Et des contrats de livraison du futur gaz de ce terminal sont engagés :

Montée du toit du premier gros reservoir de 200 000 m3.

Et des contrats de livraison du futur gaz de ce terminal sont engagés :

https://jpt.spe.org/venture-global-bags ... a-projectsVenture Global Bags Multiple LNG Contracts for Pair of Louisiana Projects

More than 2.0 mtpa of LNG to come from Plaquemines LNG and CP2 LNG facilities.

March 1, 2023 By Jennifer Presley JPT

US liquefied natural gas (LNG) exporter Venture Global has finalized multiple 20-year supply and purchase agreements as global demand for LNG continues to drive major projects across the US Gulf Coast.

Venture Global said on 28 February that it will supply 0.7 mtpa of LNG to Houston-based Excelerate Energy for a 20-year period from its Plaquemines LNG facility located in Plaquemines Parish, Louisiana.

Steven Kobos, president and chief executive of Excelerate, said that the partnership with Venture Global “supports our efforts to enhance energy security and accelerate the energy transition by delivering natural gas to our customers worldwide.”

Kobos called the agreement an important milestone for the company, citing that the partnership allows the company to “offer more flexible and cost-effective products to existing and new customers in downstream markets.”

The deal comes less than a week after Venture Global announced on 23 February that it had signed two 20-year LNG supply and purchase agreements with China Gas.

Under the deals, China Gas will buy 1.0 mtpa of LNG from Plaquemines LNG and another 1.0 mtpa from the CP2 LNG export facility. The CP2 LNG terminal will be adjacent to the company’s Calcasieu Pass LNG facility located in Cameron Parish, Louisiana.

“As a major participant in China’s energy market, we are committed to providing reliable and low-carbon LNG to Chinese customers. These two SPAs increase additional volume for our LNG portfolio and strengthen China Gas’s supply ability,” said Liu Minghui, chairman and president of China Gas. “We look forward to working with Venture Global over the coming years to help further reduce greenhouse gas emissions.”

An artistic rendering of the Venture Global Plaquemines LNG facility located in Plaquemines Parish, Louisiana.Source: Venture Global

Roof Raising

Construction of the Plaquemines LNG facility is advancing quickly, with Venture Global announcing on 27 February the successful raising of the roof of the first LNG storage tank at the facility.

This major project milestone was completed ahead of schedule and comes 9 months after the project’s final investment decision in May 2022.

According to Venture Global, this is the first tank of four in total for the facility. When operational it will be capable of storing 200,000 m3 of LNG. The roof weighs in at 900 tons and has a diameter of 294 ft. The tank dome was raised in 85 minutes using 0.3 psi of pressure underneath the roof. It was raised from ground level to top of the wall height of 130 ft, the company said.

“Eventually, the tank will have an inner tank made from 9% nickel alloy and outer wall and outer roof made from concrete to provide full containment of the LNG and provide the maximum level of resilience and safety,” the company said.

The $13.2-billion Plaquemines LNG project was the second project for the Virginia-based LNG exporter in Louisiana to be sanctioned. The first, Calcasieu Pass LNG facility located in Cameron Parish, Louisiana, shipped its first cargo of LNG in March 2022.

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

suite de ce post du 15 juin 2022 : viewtopic.php?p=2345231#p2345231

Le terminal LNG de Freeport va pouvoir redémarrer le 3iéme train de liquéfaction aprés les réparations consécutive à l'incendie l'an dernier :

Le terminal LNG de Freeport va pouvoir redémarrer le 3iéme train de liquéfaction aprés les réparations consécutive à l'incendie l'an dernier :

https://www.rigzone.com/news/freeport_l ... 0-article/Freeport LNG Gets Go Ahead to Restart Final Train

by Andreas Exarheas|Rigzone Staff|Friday, March 10, 2023

Freeport LNG Development, L.P. has announced that it has received regulatory approvals from the Federal Energy Regulatory Commission (FERC) and the Pipeline and Hazardous Materials Safety Administration (PHMSA) to restart Train 1.

This is the final train of Freeport LNG’s three train liquefaction facility to receive restart authorization, the company highlighted in a statement posted on its website. Freeport LNG noted in the statement that Trains 2 and 3 returned to full commercial operation “in recent weeks” and revealed that they had reached production levels “in excess of 1.5 billion cubic feet per day”.

“As the recommissioning of Freeport’s liquefaction facility continues and trains are restarted, changes in feed gas flows and production rates are to be anticipated, given the duration of the plant’s outage,” Freeport LNG said in the statement.

.......................

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

Lancement par Sempra d'un projet de nouveau terminal LNG à Port Arthur, Texas.

Projet de 13 milliards de dollars pour une capacité annuelle de 13 millions de tonnes de LNG.

Projet de 13 milliards de dollars pour une capacité annuelle de 13 millions de tonnes de LNG.

https://www.euro-petrole.com/sempra-lau ... -n-i-25321Sempra Launches Port Arthur LNG Project

le 22/03/2023

Sempra Launches Port Arthur LNG Project

- Finalizes Joint Venture with ConocoPhillips

- Closes Non-Recourse Project Financing

- Announces Equity Participation by KKR

- Issues Final Notice to Proceed to Bechtel

Sempra announced that its 70%-owned subsidiary, Sempra Infrastructure Partners, LP (Sempra Infrastructure), reached a positive final investment decision (FID) for the development, construction and operation of the Port Arthur LNG Phase 1 project in Jefferson County, Texas.

Sempra Infrastructure closed its joint venture with an affiliate of ConocoPhillips (NYSE: COP), as well as announced an agreement to sell an indirect, non-controlling interest in the project to an infrastructure fund managed by KKR. Additionally, Sempra Infrastructure announced the closing of the project's $6.8 billion non-recourse debt financing and the issuance of the final notice to proceed under the project's engineering, procurement and construction agreement.

"At Sempra, we believe bold, forward-looking partnerships will be central to solving the world's energy security and decarbonization challenges," said Jeffrey W. Martin, chairman and chief executive officer of Sempra. "With strong customers, top-tier equity sponsors in ConocoPhillips and KKR and a world class contractor in Bechtel, this project has the potential to become one of America's most significant energy infrastructure investments over time, while creating jobs and spurring continued economic growth across Texas and the Gulf Coast region."

"Sempra's selection of Port Arthur as the location for a new natural gas liquefication and export terminal is a strategic decision that will cement Texas' position as the energy capital of the world," said Texas Gov. Greg Abbott. "With a highly skilled workforce and business-friendly climate, and as a national leader in LNG exports, Texas is the prime location to expand LNG operations to unleash the United States' full economic potential in such a critical industry. Expanding LNG is imperative to American energy security, and the State of Texas looks forward to working alongside Sempra to advance this mission and bring more jobs and greater opportunities to hardworking Texans."

The Port Arthur LNG Phase 1 project is fully permitted and is designed to include two natural gas liquefaction trains, two liquefied natural gas (LNG) storage tanks and associated facilities with a nameplate capacity of approximately 13 million tonnes per annum (Mtpa). Total capital expenditures for the Port Arthur Phase 1 project are estimated at $13 billion.

The long-term contractable capacity of approximately 10.5 Mtpa is fully subscribed under binding long-term agreements with strong counterparties —ConocoPhillips, RWE Supply and Trading, PKN ORLEN S.A., INEOS and ENGIE S.A., all of which became effective upon reaching FID. Sempra Infrastructure is also actively marketing and developing the competitively positioned Port Arthur LNG Phase 2 project, which is expected to have similar offtake capacity to Phase 1.

..........................................

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

suite de ce post du 29 mars 2019 viewtopic.php?p=2282280#p2282280

Approbation pour un futur méga projet de LNG en Alaska. 36 milliards de dollars d' investissements !

le gazoduc de diamétre 42 inches (106 cm) fera 807 miles de long soit 1298 km de long, entre la cote Nord (le North slope) et le terminal à Nikiski au Sud.

vu sur le site du projet : https://alaska-lng.com/

https://alaska-lng.com/project-overview/pipeline/

3.1 billion cubic feet per day --> soit 87.7 millions de m3 par jour, ou 32 milliards de m3 de gaz par an.

Approbation pour un futur méga projet de LNG en Alaska. 36 milliards de dollars d' investissements !

https://maritime-executive.com/article/ ... ng-projectBiden Administration Reapproves Massive Alaska LNG Project

PUBLISHED APR 13, 2023 10:24 PM BY THE MARITIME EXECUTIVE

Courtesy Alaska LNG

Affirming a decision made by the Trump administration in 2020, the Department of Energy has issued an order approving gas exports from the Alaska LNG plant, the linchpin of a massive $39 billion megaproject that would pipe gas all the way from the North Slope to a liquefaction plant on the Gulf of Alaska. The green light from DOE puts Alaska LNG closer than ever to fruition - and new litigation.

If built, Alaska LNG would be among the most ambitious infrastructure projects undertaken in the United States in recent memory. A 3.5 billion cubic foot per day pipeline would cross the tundra of the North Slope and the mountains of central Alaska on its way to Cook Inlet. (For comparison, this distance is approximately the same as Missouri to New York, with subzero winter temperatures and rough terrain.) At Cook Inlet, the bulk of the gas would be chilled, liquefied, loaded onto LNG carriers and shipped to customers in Asia.

The cost and risk involved in constructing Alaska LNG are considerable, as well as the commercial challenges of competing with exporters on the Gulf Coast, who do not need to build state-spanning pipelines. Given these hurdles, project partners BP, ExxonMobil and ConocoPhillips decided to step aside in 2016 and let the State of Alaska take the lead on finding customers. The Alaska Gasline Development Corporation has been the lead party pursuing the project ever since, with strong support from the state's goveror and congressional delegation.

The Biden administration has signaled its support for the project as well. Last year, U.S. Ambassador to Japan Rahm Emanuel led a summit in Tokyo to promote the benefits of Alaskan natural gas as a secure alternative to Russian LNG. Japan sources about 5-10 percent of its natural gas supply from Russia, and energy security is at top of mind amidst the disruption caused by the Russian invasion of Ukraine.

Alaska LNG secured a key export permit from the Federal Energy Regulatory Commission in 2020; the permit has been contested in court by a consortium of environmental groups, including the Sierra Club and Earthjustice, which have pledged to file suit against DOE's newly-announced approval order as well.

“Over its 30-year minimum lifespan, DOE’s own numbers confirm that the [Alaska LNG] will contribute over two billion tons of greenhouse gas emissions, which will undercut many of the gains the Biden administration has proposed to curb emissions, and could emit as much as ten times more carbon into the air than the massive Willow Project," said Moneen Nasmith, senior attorney on Earthjustice’s national climate team.

The order also includes a new amendment that requires Alaska LNG to attest that there has been no byproduct CO2 venting from its activity during the prior month; however, the reporting requirement has a broad exclusion for CO2 venting needed for "emergency, maintenance or operational" purposes, and it does not cover methane venting. According to Nasmith, this loose prohibition may reduce Alaska LNG's GHG emissions at the margins, but represents a "small fraction of the overall emissions the project will cause."

le gazoduc de diamétre 42 inches (106 cm) fera 807 miles de long soit 1298 km de long, entre la cote Nord (le North slope) et le terminal à Nikiski au Sud.

vu sur le site du projet : https://alaska-lng.com/

https://alaska-lng.com/project-overview/pipeline/

3.1 billion cubic feet per day --> soit 87.7 millions de m3 par jour, ou 32 milliards de m3 de gaz par an.

- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Situation du GAZ continent Nord Américain

Gros projet de LNG avec 3 trains de liquéfaction (=phase 1) + terminal d'exportation au Texas. Cout de 18.6 milliards de dollars.

TotalEnergies est associé au projet.

TotalEnergies est associé au projet.

https://www.rigzone.com/news/nextdecade ... 7-article/NextDecade Greenlights Texas LNG Export Facility

by Andreas Exarheas|Rigzone Staff|Thursday, July 13, 2023

NextDecade Corporation (NASDAQ: NEXT) has announced that it has made a positive final investment decision to construct the first three liquefaction trains at its 27 million ton per annum Rio Grande LNG (RGLNG) export facility in Brownsville, Texas.

In a statement posted on its website, the company said it executed and closed a joint venture agreement for Phase 1 of RGLNG, which it noted included approximately $5.9 billion of financial commitments from Global Infrastructure Partners, GIC, Mubadala Investment Company, and TotalEnergies.

NextDecade highlighted in the statement that it committed to invest approximately $283 million in Phase 1, including $125 million of pre-FID capital investments, and that it closed senior secured non-recourse bank credit facilities of $11.6 billion, consisting of $11.1 billion in construction term loans and a $500 million working capital facility. The company also closed a $700 million senior secured non-recourse private placement notes offering, it pointed out.

In the statement, NextDecade said the $18.4 billion project financing for RGLNG Phase 1 is the largest greenfield energy project financing in U.S. history “and underscores the critical role that LNG and natural gas will continue to play in the global energy transition”.

The company outlined in the statement that Phase 1 has 16.2 million tons per annum of long-term binding LNG sale and purchase agreements with TotalEnergies, Shell NA LNG LLC, ENN LNG Pte Ltd, Engie S.A., ExxonMobil LNG Asia Pacific, Guangdong Energy Group, China Gas Hongda Energy Trading Co., Galp Trading S.A., and Itochu Corporation.

In conjunction with making a positive FID, RGLNG issued the notice to proceed (NTP) to Bechtel Energy Inc. to begin construction of Phase 1 under its lump-sum turnkey engineering, procurement, and construction contracts, NextDecade said in the statement, adding that the final EPC cost at NTP is approximately $12.0 billion.

The remaining expected project costs to be covered by the recently closed financing comprise owner’s costs and contingencies of approximately $2.3 billion, dredging for the Brazos Island Harbor Channel Improvement Project, conservation of more than 4,000 acres of wetland and wildlife habitat area and installation of utilities of approximately $600 million, and interest during construction and other financing costs of approximately $3.1 billion, NextDecade revealed in the statement.

A Landmark Event

“Achieving FID and issuing NTP on RGLNG Phase 1 is a landmark event reflecting years of hard work and dedication by NextDecade’s employees, shareholders, construction partners, equipment suppliers, and customers,” Matt Schatzman, NextDecade’s Chairman and Chief Executive Officer, said in a company statement.

“I want to specifically recognize the Rio Grande Valley community, the Port of Brownsville and the countless leaders and officials at the local, state, and federal levels that have supported us throughout the development of RGLNG Phase 1,” he added.

“Now our focus turns to safely constructing Phase 1 on time and on budget and progressing commercial negotiations on RGLNG Train 4 and Train 5 to further expand our LNG platform and grow NextDecade shareholder value,” he continued.

Bayo Ogunlesi, the Chairman and Chief Executive Officer of Global Infrastructure Partners, said, “achieving FID is an important milestone in NextDecade’s mission of becoming a reliable supplier of low-carbon LNG that will replace coal with a cleaner source of energy”.

“Our investment in RGLNG affirms GIP’s commitment to promoting decarbonization, energy security and energy affordability,” Ogunlesi added.

Patrick Pouyanné, the Chairman and CEO of TotalEnergies, said, “we are delighted with this final investment decision that enables us to launch the construction of this new LNG liquefaction plant in the United States, to which TotalEnergies will contribute its expertise in the development of major LNG projects”.

“This project gives TotalEnergies access to competitive LNG thanks to its low production costs. LNG from this first phase will boost TotalEnergies U.S. LNG export capacity to over 15 MTPA by 2030, and thus our ability to contribute to European gas security, and to provide customers in Asia with an alternative form of energy that is half as emissive as coal,” he added.

Khaled Abdulla Al Qubaisi, the Chief Executive Officer of Mubadala’s Real Estate & Infrastructure Investments platform, said the FID announcement “marks a pivotal milestone in Mubadala’s enduring partnership with NextDecade in the development of RGLNG”.

“Mubadala is delighted to welcome GIP, GIC, and TotalEnergies into the partnership as RGLNG enters its next phase of development,” he added.

Paul Marsden, the President of Bechtel Energy, noted, “NextDecade is on a mission to produce lower-carbon intensive LNG for its customers, and we’re honored to be their partner”.

“As we commence engineering, procurement, and construction on the first phase of this project, we reaffirm our commitment to the community through quality jobs, training, and support for the supply chain and small businesses,” he added.

- phyvette

- Modérateur

- Messages : 12344

- Inscription : 19 janv. 2006, 03:34

Re: Situation du GAZ continent Nord Américain

Quand on a un javelin dans la main, tous les problèmes ressemblent à un T-72.

Quand on a un javelin dans la main, tous les problèmes ressemblent à un T-72.- energy_isere

- Modérateur

- Messages : 89886

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :