Les compagnies pétrolières sont engagées dans une « course contre la montre » pour éviter la disparition d’une grande partie de leur business au cours des 25 prochaines années, car la baisse du coût des énergies renouvelables et la demande croissante de véhicules électriques va « tuer » le marché de l’essence et du diesel.

Telle est la conclusion inattendue d’une analyse décapante publiée récemment par BNP Paribas Asset Management, une filiale de la plus grande banque française, spécialisée dans la gestion d’actifs. Le rapport affirme que, pour un même investissement financier, les nouveaux projets d’énergie éolienne et solaire pourront fournir aux roues d’un véhicule électrique à batterie 6 à 7 fois plus d’énergie utile que le pétrole (à 60 $ par baril) ne pourra en livrer à celles des véhicules à essence.

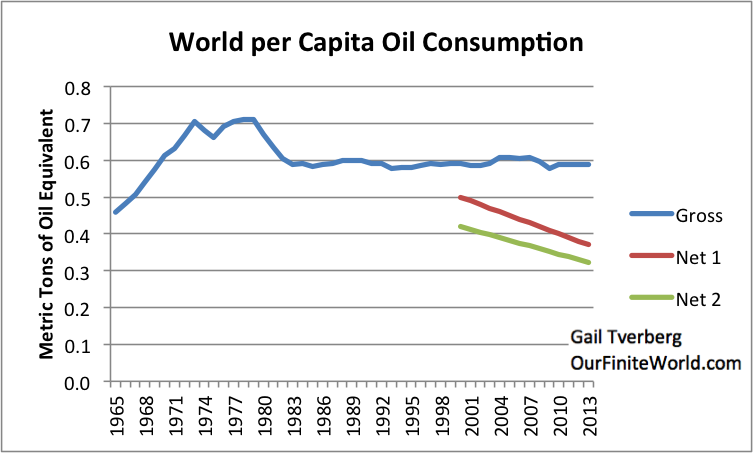

L’étude révèle que le prix du baril de pétrole devrait descendre sous la barre des 10 à 20 dollars pour rester compétitif en tant que source d’énergie pour la mobilité ; le prix actuel étant d’environ 55 dollars. Or les coûts de prospection pour la recherche de nouveaux champs, notamment dans les mers profondes ou les zones arctiques, en remplacement de ceux qui s’épuisent, ainsi que les coûts d’exploitation des pétroles non conventionnels comme les sables et schistes bitumineux ou les pétroles de roche-mère, sont sans cesse croissants.

Notons au passage que l’analyse tient compte des investissements nécessaires pour adapter les réseaux électriques à la montée en puissance de la capacité intermittente des énergies renouvelables et aux exigences de recharge des véhicules électriques. Malgré ces coûts « l’économie des énergies renouvelables écrase encore celle du pétrole », précise le document.

En conséquence, « produire du pétrole pour les voitures à essence et diesel aura, d’un point de vue financier, peu de sens lorsque, dans les prochaines décennies, les véhicules électriques alimentés par des énergies renouvelables offriront une alternative beaucoup moins chère, plus propre et plus efficace » estime Mark Lewis, l’auteur principal du rapport.

Si on en croit cet analyste, le parc actuel (qui compte près d'un milliard de véhicules fonctionnant à 99% avec des carburants issus du pétrole) va devoir s'électrifier à marche forcée

100 millions de véhicules sont vendus chaque année et 1,1 million à peine sont électriques!

25 ans, c'est un peu court pour remplacer une technologie qui représente un quasi monopole dans ces conditions

Peut être en divisant le parc mondial par 10!

Aurait on aurait trouvé un analyste financier qui anticipe un effondrement brutal dans moins de 25 ans?

Yves Cochet sort de ce corps!