https://www.agenceecofin.com/cuivre/160 ... ivre-virgoBotswana : Arc Minerals lance l’exploration sur son projet de cuivre Virgo

Agence Ecofin 16 juin 2022

En acquérant en novembre dernier une participation de 75 % dans Alvis-Crest, filiale de l’australien Kopore Metals, Arc Minerals a par la même occasion mis la main sur deux licences de cuivre au Botswana. Ces deux permis forment le projet Virgo dont la compagnie s’active pour explorer le potentiel.

La junior minière Arc Minerals a annoncé mercredi 15 juin avoir entamé le premier programme d’exploration sur son projet de cuivre Virgo au Botswana. Elle précise qu’une étude géochimique du sol est en cours et qu’elle sera plus tard suivie d’un programme de forage.

« L’équipe a examiné les travaux antérieurs effectués dans les zones de licence respectives et a proposé notre programme d’exploration initial afin d’affiner notre compréhension géologique avant de commencer un programme de forage exploratoire », explique Nick von Schirnding, Président exécutif d’Arc Minerals.

La compagnie Arc Minerals active en Zambie également sur le cuivre, démarre ainsi ses premières activités exploratoires au Botswana. Soulignons que les licences constituant le projet Virgo (plus de 210 km2 de superficie) se situent à l’intérieur de la ceinture de cuivre du Kalahari réputée très riche.

Le Cuivre

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Le prospect Virgo au Botswana :

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Nouveau prospect de Cuivre en Australie : Taruga

https://www.nsenergybusiness.com/news/s ... r-project/State government funding secured for Taruga copper project

By NS Energy Staff Writer 17 Jun 2022

Taruga has been successful in securing $325,000 funding from the South Australian State government, to explore for Central Africa style sediment-hosted copper at its Mt Craig Project

....................

The funding covers exploration for sediment hosted copper across the entire 850km2 project, including Wyacca and Birthday Ridge

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Les prospects de cuivre Encierro et Cachorro au Chili

https://www.mining.com/antofagasta-prov ... -in-chile/Antofagasta provides resource estimates for Encierro, Cachorro deposits in Chile

Staff Writer | June 14, 2022 |

During the 2022 Prospectors and Developers Association of Canada (PDAC) conference in Toronto, Chilean multinational Antofagasta plc announced the inaugural resource estimate on the Encierro project and a resource update on the Cachorro project.

Encierro inaugural resource

Located in the Chilean High Andes, 100 km east of the city of Vallenar and 600 km north of Santiago, the Encierro project hosts a complex Miocene porphyry copper system displaying hypogene mineralization with distinct sulphide and alteration zoning.

Based on diamond drilling completed from 2016 to 2021, the company has identified a significant deposit containing 522 million tonnes of inferred resources at 0.65% copper, 0.22 g/t gold and 74 ppm molybdenum.

The Encierro project is held in a joint venture with Barrick Gold, with Antofagasta holding the majority share and acting as operator of the exploration program.

Cachorro resource update

Based on results of further infill drilling, Antofagasta has also updated the resource base for its wholly owned Cachorro project. The deposit size has increased to 155 million tonnes of inferred resources grading 1.20% copper, from the 142 million tonnes at 1.21% copper reported as of Dec. 31, 2021.

The Cachorro project is located in the western Atacama Desert in northern Chile, 100 km northeast of the city of Antofagasta and 1,100 km north of Santiago. It lies between the company’s Antucoya and Centinela operations and may benefit from the use of their facilities. The deposit consists of manto-type sulphides, mostly chalcopyrite and bornite and some oxides.

According to the company, Cachorro remains open laterally and additional drilling will be carried out during the rest of this year.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

L' Argentine veut développer son secteur minier du Cuivre et reformate le régime des taxes à l'exportation du cuivre pour attirer les miniers.

Argentina offers tax sweeteners to encourage fledgling copper sector

Reuters | June 13, 2022

Argentina said on Monday it would introduce a new optional tax regime for copper producers that could potentially lower export duties in an effort to jumpstart national production.

The measure, announced by Economy Minister Martin Guzman at a mining forum, follows conversations with provinces and companies involved in the sector, the ministry said in a statement.

“The measure is voluntary and incorporates progressivism and flexibility into the mining tax regime, providing greater certainty to investors,” the ministry said.

The regime will permit the substitution of the current 4.5% export duty for new copper investments by a variable rate with a range between 0% and 8% based on the copper price, the ministry said. It did not give further details.

Argentina’s neighbors Chile and Peru are much larger copper producers and exporters.

“Argentina has a high potential to produce and export copper, there are several projects in advanced stages that will place our country again as one of the leading producers in the world,” the ministry said.

Latin America’s third-largest economy is trying to cut its fiscal deficit and replenish depleted foreign currency reserves by boosting exports.

Argentina already has a variable rate for export duties for hydrocarbons, based on international oil prices.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

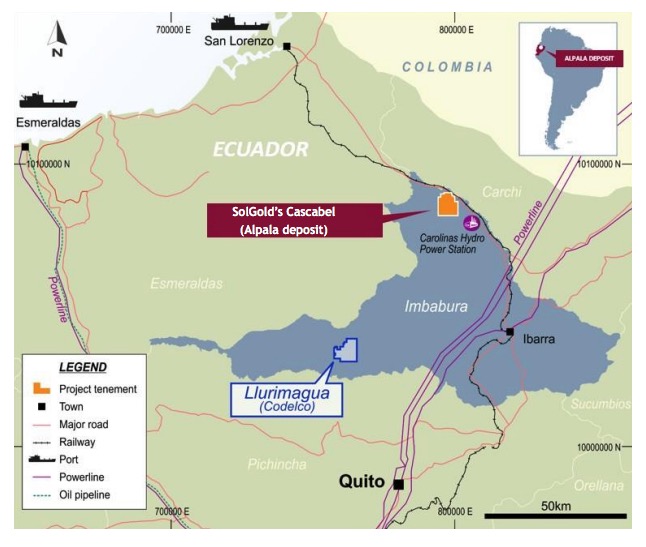

Le projet Llurimagua en Equateur .

Ca serait une association entre le minier d'état Equatorien Enami EP et le chilien Codelco.

il y a 2.5 ans :

Mais depuis le projet était dans une impasse. Ca pourrait redemarrer.

Ca serait une association entre le minier d'état Equatorien Enami EP et le chilien Codelco.

il y a 2.5 ans :

https://www.mining.com/chiles-codelco-s ... er-riches/Chile’s Codelco set to get a slice of Ecuador’s copper riches

Cecilia Jamasmie | November 20, 2019

The Llurimagua copper deposit is located about 80 km northeast of Ecuador’s capital, Quito. (Image courtesy of Chilean copper engineers)

Chile’s Codelco, the world’s No. 1 copper producer, is closer to securing a long-awaited deal with Ecuador-controlled miner Enami EP, which will allow them to jointly develop a massive project located about 80 km northeast of the country’s capital, Quito.

The 982-million-tonne Llurimagua copper project, in the northern Imbabura Province, is in the advanced exploration stage and could become the first mine the Chilean giant operates abroad.

Construction should begin shortly after the board of Llurimagua Copper Company S.A., the 51%-49% joint venture between Codelco and Enami, approves the agreement that formalizes the entity.

That announcement, local paper El Mercurio reports, is expected to come this week.

Codelco and Enami first signed a cooperation agreement about a decade ago, but the companies only began talking about Llurimagua in 2015.

According to Ecuador’s vice minister of mining Fernando Benalcázar, the project is one of the copper industry’s “crown jewels,” but its development has faced challenges, including intermittent resistance from nearby communities over environmental concerns.

“Having this deposit in our soil and partnering with the world’s number one copper company, opens the doors for development technology, employment opportunities and economic growth. This project can change the lives of Chileans and Ecuadorians,” Benalcázar said earlier this month.

“Today, the Llurimagua deposit is completely different than in 2015. The Junín target lead us to discover 1km continued mineralization,” Codelco’s exploration team leader, Angelo Aguilar, added.

Construction at Llurimagua is expected to take up to four years. Once at full tilt, the mine is expected to churn out 210,000 tonnes of copper annually over a 27-year productive life.

To date, the miner has spent about $40 million in exploration and plans to invest another $3 million by 2021. From that figure, $131 million will be designated to Llurimagua.

...................................

Mais depuis le projet était dans une impasse. Ca pourrait redemarrer.

https://www.mining.com/web/chile-and-ec ... g-impasse/Chile and Ecuador restart copper talks after yearslong impasse

Bloomberg News | June 12, 2022

After a yearslong deadlock, Ecuador and Chile have resumed negotiations over a partnership to develop a major copper deposit just as demand for the wiring metal is set to surge in a nascent clean-energy transition.

Chile’s state copper producer Codelco agreed to a request by its Ecuadorian counterpart Enami to suspend two arbitration processes over the Llurimagua copper-molybdenum exploration project in the Andean region of Imbabura, Ecuador Energy and Mines Minister Xavier Vera said.

“That suspension generated positive conditions for talks,” Vera said Sunday in an interview from Toronto, where he’s heading a delegation at the PDAC mining conference. “We have opened a line of contact with the highest executives at Codelco.”

Citing a confidentiality agreement, Vera declined to offer any details of the “excellent conversations,” or the likely timing of the project, which he said probably contains much more than the initial estimates. The project recently won a court battle over its environmental impact.

....................

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.rfi.fr/fr/podcasts/chroniqu ... 9conomiqueLe cuivre entraîné par les craintes de récession économique

RFI le : 24/06/2022 Par : Marie-Pierre Olphand

Le contexte économique morose pèse lourd sur le marché des métaux. Car la hausse des taux, telle qu'elle se précise en Europe et aux États-Unis, pèse sur la croissance et n'est donc pas favorable à la demande.

Après l'audition du directeur de la Banque centrale américaine (FED) devant le Sénat ce mercredi, le spectre d'une récession est devenu un peu plus probable dans les esprits. Et les cours du cuivre, le métal réputé pour refléter l'état de l'économie mondiale, ont sans surprise poursuivi leur baisse, entamée début juin, pour redescendre à leur niveau d'il y a 16 mois. En trois mois, la tonne de cuivre a perdu 20%.

La baisse des cours n’impacte pas la production

Cette baisse est cependant contrebalancée par la fermeté du dollar. Pour les pays exportateurs de cuivre, l'impact est limité : leurs recettes sont en dollars et leurs dépenses en monnaie locale, le change leur est favorable.

Les miniers sont plus directement touchés car l'essentiel de leurs coûts sont en dollars. Leur profit à la tonne est donc en train de diminuer. Mais aux prix actuels du cuivre qui restent très hauts, « tout le monde gagne beaucoup d'argent », explique un expert de la filière.

Les stocks chinois, la grande inconnue

La demande en cuivre ne s'est pas effondrée mais la grande inconnue chinoise plane sur les marchés. Il est impossible en effet de savoir quel est le stock de cuivre réel du pays, ni quelle sera la demande à moyen terme.

Après l'euphorie d'une forte reprise chinoise qui n'a pas eu lieu, les craintes d'un ralentissement mondial gagnent du terrain.

« On est actuellement sur des marchés "ultra-attentistes" qui essaient de comprendre l'équation économique mondiale », résume Yves Jegourel professeur au conservatoire national des arts et métiers, titulaire de la chaire Économie des matières premières. Il est donc peu probable que les cours des métaux industriels repartent rapidement à la hausse.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Le Cuivre au plus bas de 16 mois.

https://www.mining.com/copper-price-sli ... he-market/Copper price falls to lowest since March 2021 as recession fears rattle the market

MINING.COM Staff Writer | June 22, 2022

Copper prices tumbled on Wednesday to their lowest level since March 2021 as fears over a global economic slowdown dented investor sentiment.

Copper for delivery in July fell 2.6% from Tuesday’s settlement, touching a low of $3.88 per pound ($8,550 per tonne) Wednesday morning on the Comex market in New York.

The most-traded July copper contract in Shanghai ended daytime trading 1.6% lower to 67,060 yuan ($9,971.60) a tonne.

“Base metals remain pressured by a challenging demand outlook related to China’s covid-19 lockdowns and to monetary policy tightening raising recession fears over the trade-off between inflation and growth,” Standard Chartered wrote in a note.

.....................

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining-technology.com/news/ ... australia/Glencore infuses $34.6m to restart Nifty project in Australia

Glencore will take all of Phase 1 copper cathode produced at the Nifty mine, up to 120,000t.

June 28, 2022

Australian firm Cyprium Metals has signed a letter of intent (LoI) with commodities trader Glencore for an offtake prepayment facility of A$50m ($34.6m) for its Nifty Copper project in Western Australia.

The facility would help Cyprium fund the restart of the project, including contingencies, capital expenditure, working capital, and financing costs.

In exchange, Glencore will receive 100% copper cathode produced during Phase I of the Nifty Copper Project restart. The firm will receive a maximum of 120,000t.

Cyprium said the Offtake pricing of copper cathode shipments will be determined based on average market rates.

According to the exclusive LoI, the two parties will jointly work towards finalising the project’s outstanding due diligence activities, and funding documentation for execution.

Cyprium managing director Barry Cahill said: “We are very pleased to enter an exclusive Letter of Intent for a Copper Cathode Offtake Secured Prepayment Facility with Glencore. This is part of a fully funded finance package for the restart of the Nifty Copper Project.

“The restart project economics are very robust, and we have continued to make further improvements to the Nifty Copper Project during the financing process.

“We are looking forward to completing our total funding package so that we can commence executing our Nifty Copper Project restart development plans.”

La mine de Nifty avait été mise sous cocon en Novembre 2019.

lire : https://www.mining-technology.com/proje ... na%20Basin.

.......

Nifty copper mine reserves

The Nifty copper mine has total measured, indicated, and inferred resources of 47.29Mt grading 1.39% copper (Cu) and containing 658,500t of Cu, as of December 2019.

...............

Nifty copper mine history

Oxide copper at the mine was first discovered in 1981. An open-pit, heap leach operation was started in 1993, while underground mine development was commenced in 2004 to exploit the sulphide resource.

The first copper concentrate was produced in 2006 and open-pit operations were suspended in the same year.

Metals X acquired the mine through the purchase of Aditya Birla Minerals in 2016.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 10 oct 2021 viewtopic.php?p=2328266#p2328266

l'étude de faisabilité du projet de mine de Casino au Yukon-Canada (cuivre or argent Molybdène) livre ses résultats :

C'est quand même faible cette concentration de 0.19 % de Cuivre.

l'étude de faisabilité du projet de mine de Casino au Yukon-Canada (cuivre or argent Molybdène) livre ses résultats :

https://www.mining.com/western-copper-p ... r-tax-npv/Western Copper feasibility on Casino outlines $1.8 billion after-tax NPV

Staff Writer | June 28, 2022

Western Copper and Gold (TSX, NYSE: WRN) has put out a feasibility study on its flagship Casino deposit located 300 km northwest of Whitehorse, Yukon. The project is being constructed as an open pit mine, with a concentrator processing 120,000 t/d to recover copper, gold, molybdenum and silver, as well as a 25,000 t/d oxide heap leach facility to recover gold, silver and copper.

The 2022 feasibility study supersedes all previous studies, including two prefeasibility studies and a full feasibility study, and incorporates an updated mineral resource and reserve estimate as well as results of the preliminary economic assessment published in June 2021.

The Casino project currently has 2.39 billion tonnes of measured and indicated resources (both mill and heap leach), at grades of 0.14% copper, 0.19 g/t gold and 1.5 g/t silver (for 7.6 billion lb. copper, 14.5 million oz. gold and 113.5 million oz. silver), based on an updated resource block model developed during December 2021.

The FS examines the development of the Casino project, which comprises the processing of 1.43 billion tonnes of mineral reserve (1.22 billion tonnes grading 0.22 g/t gold, 0.19% copper and 0.02% molybdenum for the mill, and 210 million tonnes grading 0.26 g/t gold, 1.9 g/t silver and 0.04% copper for heap leach), with deposition of mill tailings and mine waste in the tailings management facility.

Over the 27-year project life (in the case of heap leach, 24 years), annual production would reach 163 million lb. copper, 211,000 oz. gold, 1.28 million oz. silver and 15.1 million lb. molybdenum. The base-case scenario assumes metals prices of $3.60/lb. copper, $1,700/oz. gold, $22/oz. silver and $14/lb. molybdenum.

At the base-case metals prices, the Casino project’s after-tax net present value, at an 8% discount rate, comes to C$2.3 billion (about $1.8 billion), with an internal rate of return of 18.1 %. After-tax cash flow generated by the project totals C$10 billion, including C$951 million per year over the first four years. Its initial capital investment is C$3.62 billion, taking the payback period to 3.3 years.

“The results from the feasibility study confirm the project’s robustness and ability to withstand inflationary pressures,” CEO Paul West-Sells said in a media release. “This study reaffirms Casino as one of the very few long-life copper-gold projects with robust economics in a top mining district, the Yukon.”

The company has been developing the Casino project since acquiring the property back in 2008.

Permitting of the project, which encompasses the construction of a conventional open pit mine along with a mineral processing plant and heap leach facility, will require a review of its environmental and socio-economic impacts by the Yukon Environmental and Socio-economic Assessment Board.

C'est quand même faible cette concentration de 0.19 % de Cuivre.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 7 mai 2022 viewtopic.php?p=2342741#p2342741

https://www.agenceecofin.com/cuivre/060 ... estre-2022RDC : Kamoa-Kakula a livré 87 314 tonnes de cuivre au deuxième trimestre 2022

Agence Ecofin 6 juillet 2022

Dans quelques années, Kamoa-Kakula devrait devenir le deuxième plus grand complexe minier de cuivre au monde, avec une production annuelle estimée à 800 000 tonnes. Depuis son entrée en production en mai 2021, la mine monte régulièrement en puissance.

Le complexe de cuivre Kamoa-Kakula en RDC a produit 87 314 tonnes de concentré de cuivre au premier trimestre 2022. C’est ce qu’a annoncé le propriétaire de l’actif, le canadien Ivanhoe Mines, dans une mise à jour opérationnelle datée du mardi 5 juillet.

Selon la compagnie, ce chiffre représente un nouveau record trimestriel pour la mine entrée en production en mai 2021. Une performance rendue possible par la mise en œuvre complète de la phase 2 du développement du projet fin mai, ce qui a permis d’atteindre une production mensuelle de 30 379 tonnes en juin.

« Avec les progrès rapides des usines de concentration de la phase 1 et de la phase 2 [Kamoa-Kakula se rapproche] désormais d’un taux de production de 400 000 tonnes de cuivre par an », a souligné Robert Friedland, PDG de la compagnie.

Destinée à devenir la deuxième plus grande mine de cuivre au monde dans quelques années, Kamoa-Kakula devrait déjà se hisser sur le podium d’ici fin 2024 en devenant le troisième plus grand complexe de cuivre au monde, avec une production annuelle d’environ 600 000 tonnes. Cette année, la mine est en mesure de livrer jusqu’à 340 000 tonnes de concentré de cuivre, ou au moins 290 000 tonnes, selon les prévisions d’Ivanhoe.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

CODELCO au Chili lance finalement les travaux pour l'énorme usine de désalinisation dont il a besoin pour ses mines de cuivre.

https://www.nsenergybusiness.com/news/c ... ion-plant/Codelco to resume construction on $1bn desalination plant in Chile

By NS Energy Staff Writer 08 Jul 2022

Chile’s state-owned copper mining company Codelco is planning to commence construction on a $1bn desalination plant this year to supply its large-scale operations in northern Chile.

In December 2019, the company terminated a contract it had awarded to a consortium due to certain technical adjustments to the project, which resulted in the delay of the construction.

Codelco is now advancing the plans to reduce the consumption of fresh water, amid a severe drought for more than a decade, and support the environmental objectives.

The company aims to reduce the consumption of freshwater by 60% by reusing water from tailings deposits, and seawater from the desalination plant and improve its operating processes.

The proposed desalination plant will be constructed near the northern town of Tocopilla, with an initial capacity of 840 litres per second, with the potential to expand to 1,956l/s.

The consortium will build and operate the plant, before transferring it to Codelco.

.......................

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Grèves à la mine de cuivre de Las Bambas au Pérou.

https://www.mining.com/web/peru-copper- ... -key-mine/Peru copper output drops 11.2% in May after stoppage at key mine

Reuters | July 6, 2022

Las Bambas mine in Peru. Image courtesy of MMG

Peru said on Wednesday that its copper output fell 11.2% in May from a year-ago after a stoppage at its Las Bambas mine and lower quality production in other deposits.

..................

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 27 janvier 2022 viewtopic.php?p=2335847#p2335847

couts en hausse pour la mine de Oyu Tolgoi en Mogolie :

couts en hausse pour la mine de Oyu Tolgoi en Mogolie :

https://www.mining.com/cost-of-expansio ... ise-again/Cost of expansion at Rio Tinto’s Oyu Tolgoi rises again

Cecilia Jamasmie | July 15, 2022

Rio Tinto (ASX, LON, NYSE: RIO) flagged on Friday a cost increase of $300 million for the ongoing expansion of its massive Oyu Tolgoi copper-gold mine in Mongolia.

The world’s second largest miner said the cost and schedule reforecast, completed in June, now pegs the total project cost estimate at $7.06 billion, almost $1.8 billion higher than its original estimate in 2015.

The company blamed the rise on skilled labour supply constraints caused by covid-19 and noted the new estimate, under review by Oyu Tolgoi’s board, assumes there are no further disruptions.

Rio Tinto currently controls and operates the mine, located 550 km (342 miles) south of Mongolia’s capital Ulaanbaatar, through its 66% stake in Canada’s Turquoise Hill Resources (TSX, NYSE: TRQ). The government of Mongolia owns 34%.

The mining giant is currently trying to buy all the shares it doesn’t already own in Turquoise Hill.

Rio’s chief executive Jakob Stausholm has said he believes the acquisition would simplify the ownership structure, and further strengthen the company’s copper portfolio.

The offer followed an agreement between the miner and the government of Mongolia to complete the long-delayed underground expansion.

That deal saw Rio agree to write off $2.4 billion in loans and interest used by Ulan Bator to fund its share of the development costs.

There was no update on the proposed C$34.00 per share buyout.

Turquoise Hill said in a separate statement it expected its portion of total operating cash costs at Oyu Tolgoi to increase by $50 million for this year. It means they are now expected to be in the range of between $850 million and $925 million, higher than previous guidance of $800 million to $875 million.

This was due to higher royalties and price inflation for key raw materials, especially fuel and the lower deferred stripping, the firm said.

Three-year delay and counting

The ongoing expansion of Oyu Tolgoi has been plagued by delays and costs overruns, which have triggered the Mongolian government’s ire to the point of threatening to revoke the 2009 investment agreement, which underpins the mine development.

First production, initially expected in late 2020, was rescheduled for October 2022 and later to the first half of 2023.

Rio Tinto said on Friday that technical progress has been hindered, with shafts 3 and 4 now expected to be commissioned in the first half of 2024, 15 months later than what the company estimated in 2020.

Oyu Tolgoi is Rio’s main copper growth project. Once completed, the underground section will lift production from 125,000–150,000 tonnes in 2019 to 560,000 tonnes at peak output, which is now expected by 2025 at the earliest.

According to the miner, this would make it the biggest new copper mine to come on stream in several years and, by 2030, the operation would be the world’s fourth largest copper mine.

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

MAJ de ce post du 6 mars 2022 viewtopic.php?p=2338503#p2338503

Cours du Cuivre depuis 5 ans en dollars par tonne

https://markets.businessinsider.com/com ... pper-price

Cours du Cuivre depuis 5 ans en dollars par tonne

https://markets.businessinsider.com/com ... pper-price

- energy_isere

- Modérateur

- Messages : 103082

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 17 avril 2022 viewtopic.php?p=2341593#p2341593

https://www.mining-technology.com/news/ ... ns-copper/Barrick nears final deal on Pakistan’s $7bn copper project

The Reko Diq is said to be one of the largest undeveloped copper-gold deposits in the world.

July 19, 2022

Canada-based Barrick Gold is nearing a final framework agreement with the Pakistani Government to develop the Reko Diq copper-gold deposit.

Located close to the borders of Iran and Afghanistan, Reko Diq is said to be one of the largest undeveloped copper-gold deposits in the world.

The project is planned to be developed in phases, starting with a nearly 40 million tonne per annum (Mtpa) plant. This capacity could double within five years.

The Reko Diq project is expected to cost $7bn. The first phase would require a $4bn investment for the development of the initial crush, milling and flotation circuit, according to Mining.com.

Earlier this year, the Pakistani Government, the provincial government of Balochistan, and Barrick signed an agreement in principle to restart the project.

Barrick is the planned project operator with a 50% stake while other partners include the Balochistan provincial government (25%) and Pakistani state-owned enterprises (25%).

The parties are finalising definitive agreements underlying the framework agreement.

Barrick said in a statement: “Once this has been completed and the necessary legalisation steps have been taken, Barrick will update the original feasibility study, a process expected to take two years. Construction of the first phase will follow that with the first production of copper and gold expected in 2027/2028.”

Upon completion of the updated feasibility study, Barrick plans to start copper and gold production from the first phase of the project in 2027/2028.

With an operational life of at least 40 years, the Reko Diq mine is expected to create 7,500 jobs during the construction phase and 4,000 long-term jobs once commissioned.

In 2011, the project was put on hold owing to a row over the legality of its licensing process.

It was revived with the Pakistani Government agreeing on an out-of-court agreement with Barrick and waiving $11bn worth of penalties.