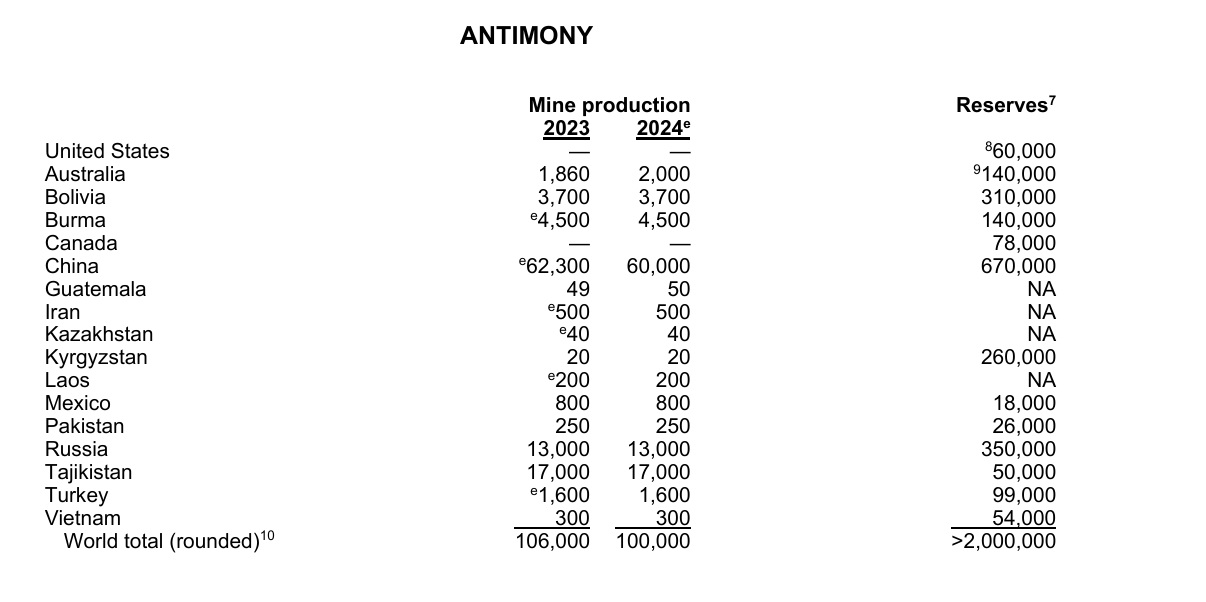

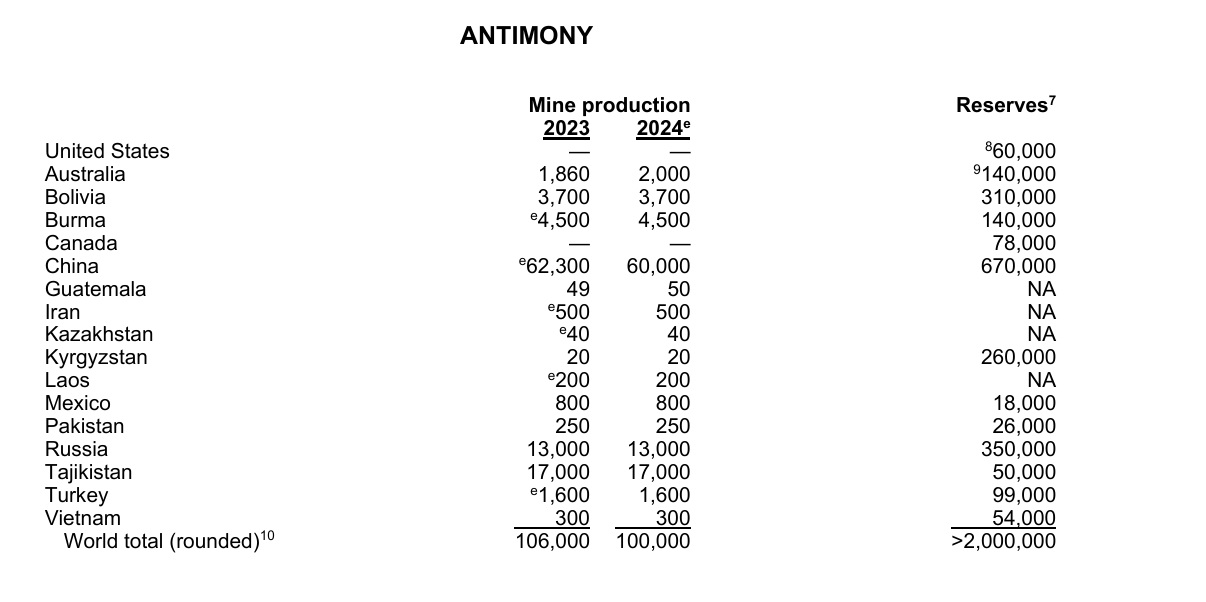

Gros réajustement de la production 2023, en particulier pour le chiffre de la Chine.

le post pour l'année d'avant : viewtopic.php?p=2396542#p2396542

Modérateurs : Rod, Modérateurs

https://www.rfi.fr/fr/podcasts/chroniqu ... -chinoisesLes prix de l'antimoine multipliés par trois après les restrictions chinoises

RFI le : 19/03/2025 Par : Marie-Pierre Olphand

L'antimoine, un métal résistant au feu et utilisé aussi bien dans les munitions que les batteries électriques, atteint des sommets. Depuis un an, rien ne semble arrêter la hausse des prix.

L'antimoine vaut aujourd'hui, en mars 2025, 54 000 dollars la tonne. C'est trois fois plus qu'il y a un an. La hausse des prix s'est accélérée ces derniers mois : mi-septembre, la Chine a décidé d'opérer un contrôle drastique sur ses exportations, puis en décembre, de les interdire.

Or, la Chine est une des sources principales d'antimoine, avec la Russie et le Tadjikistan. Officiellement, Pékin a pris cette mesure pour garantir un prix bas à ses raffineries. Mais les prix restent encore hauts dans le pays, signe que la tension est assez générale.

Risque de pénurie ?

Au printemps dernier, le déficit entre l'offre et la demande a été évalué à 10 000 tonnes. Il est parti pour durer jusqu'en 2026 au moins, selon le cabinet de conseil Project Blue, car face à une offre qui peine à suivre, la demande est importante, en particulier pour la fabrication des véhicules électriques et dans le secteur photovoltaïque.

L'autre secteur qui tire cette demande, même s'il n'est pas le plus gourmand, est celui de la défense. La guerre en Ukraine fait tourner les usines d'armement et fait grimper les besoins en antimoine, pour la fabrication des munitions. Pour ne parler que de la France, la production d'obus de 155 mm a doublé depuis le début de la guerre.

Est-ce que la reconstitution des stocks d'armement pourrait conduire à une pénurie ? C'est ce qu'avance le directeur général de la société minière, Larvotto Resources, en raison de stocks qui sont très bas. C'est a minima un facteur qui s'ajoute à une demande qui, tous secteurs confondus, reste importante.

Investissements américains

Les Américains sont, selon Project Blue, les premiers clients de la Chine pour ce qu'on appelle le trioxyde d'antimoine, une poudre dérivée du métal gris argenté qui est incorporée à divers produits pour les rendre ignifuges. Les États-Unis ont compris qu'ils allaient devoir remplacer les 10 000 à 15 000 tonnes qu'ils achetaient jusque-là en Chine. Dans cet optique, une fonderie située au Mexique et détenue par United States Antimony Corporation (USAC) a été relancée. Elle sera approvisionnée dans un premier temps en antimoine venu d'Australie.

Un projet d'extraction d'or et d'antimoine a également été validé par l'administration Biden en début d'année dans l'Idaho. Cette mine opérée par Perpetua Resources pourrait fournir un tiers des besoins annuels en antimoine des États-Unis après son ouverture, programmée en 2028.

https://www.miningweekly.com/article/hi ... 2025-05-06Hillgrove eyes 2026 production start at Australia's largest antimony mine

A definitive feasibility study (DFS) for its Hillgrove antimony/gold project in New South Wales, projecting the development into one of the Western world's foremost antimony producers.

The study outlines robust financial metrics, including a post-tax net present value (NPV) of A$694-million and an internal rate of return (IRR) of 102% under its mid-price scenario, with production slated to begin in the second quarter of 2026.

The 100%-owned Hillgrove project is expected to operate for eight years, producing an average of 85 000 oz/y gold equivalent and supplying about 7% of the world’s antimony at peak output. The DFS builds on an earlier prefeasibility study and reflects a sharp rise in confidence for the project’s economic and technical viability.

MD Ron Heeks called the publication of the DFS a “major milestone", noting the company completed it within 18 months of acquiring the project. “The DFS confirms Hillgrove as a technically sound, high-margin critical minerals project with a rapid pathway to production,” Heeks said.

At mid-price assumptions which the company describes as still conservative compared to elevated current spot prices, the project delivers average earnings before interest, taxes, depreciation and amortisation of A$250-million and post-tax free cash flow of A$128-million. The mid-case economics also reflect a total post-tax free cash flow of A$1.02-billion and an average yearly pre-tax free cash flow of A$200-million.

“The DFS delivers outstanding economics at the base case and even better at what the company firmly believes is the minimum economics that would be achieved at the mid-price commodity price scenario,” Heeks said. “These results reflect the value of the significant installed infrastructure already in place at Hillgrove and the excellent work undertaken by the Larvotto team.”

Initial capital expenditure is estimated at A$139-million, including an upgrade to the on-site minerals processing plant from 250 000 t/y to 525 000 t/y. The operation will source ore from both underground and openpit sources. Under base case pricing assumptions ($2 400/oz gold, $25 000/t antimony), Hillgrove still returns an NPV of A$280-million and an IRR of 48%, with a 26-month payback period. The mid-price case shortens that to just 11 months.

https://www.mining.com/perpetua-seeks-2 ... -in-idaho/Perpetua seeks $2 billion loan for Stibnite project in Idaho

Staff Writer | May 23, 2025

Perpetua Resources (NASDAQ: PPTA) (TSX: PPTA) has submitted a formal application to the Export-Import Bank of the United States (EXIM) for up to $2 billion in debt financing to fund construction of its Stibnite gold-antimony project in Idaho.

The request is an increase from the $1.8 billion outlined in EXIM’s 2024 non-binding letter of interest.

Perpetua attributed the higher figure to a revised estimate of job-years stemming from recent financial and engineering updates.

Earlier this week, the Boise, Idaho-based miner announced it had obtained final approval for Stibnite, a critical minerals project being fast-tracked by the Trump administration.

The Stibnite project, with its recently secured record of decision from the US Forest Service, is uniquely positioned to supply antimony, which is essential to national security and energy technology, the company said.

Antimony, classified as a critical mineral for its importance to technology, defense and energy applications, is imported into the US as there is currently no domestic production. China accounted for 60% of globally mined antimony in 2024, according to data from the US Geological Survey.

Last September, China banned exports of the metal to the US.

The Stibnite project holds the only identified antimony reserve in the US at an estimated 148 million lb. —making it one of the largest outside of Chinese control. Once in production, it could meet about 35% of US antimony demand during its initial six years of production, according to the 2023 USGS commodity summary.

Perpetua said Stibnite is also expected to host one of the highest-grade open-pit gold mines in the country, with reserves of approximately 4.8 million oz. Over the first four years of production, it is expected to produce 450,000 oz. of gold annually.

https://www.mining.com/web/nyrstar-seek ... roduction/Nyrstar seeks government funding for antimony production

Reuters | May 21, 2025

Nyrstar, owned by global commodity trader Trafigura, could potentially produce the critical mineral antimony at its South Australian processing plant but would need government support to do so, CEO of Nyrstar Australia Matt Howell said.

New supply of the strategic metal crucial to the production of ammunition, night-vision goggles, and infrared sensors is in high demand after China, the world’s biggest antimony producer, imposed export controls last year.

As part of a strategic review of Nyrstar’s Australian operations Trafigura is undertaking, Nyrstar found it would be able to produce up to 5,000 tonnes of antimony metal or antimony trioxide a year at its multi-metals processing plant in Port Pirie by adding an additional processing stage after lead smelting, the company said.

“We have the capability to produce a range of critical minerals including antimony to help meet global demand,” Nyrstar Australia CEO Howell said.

“However, it will require significant investments and support to address the unsustainable market pressures that Australian smelters are facing,” he said in a statement to Reuters on May 5.

Howell did not specify how much government funding would be necessary to support output at the Port Pirie site or when it could begin producing antimony metal.

Australia’s smelters are struggling with high domestic power costs and an oversupply of processing capacity in China that has squeezed the fees they can charge to process material.

The Australian government is offering billions of dollars in funding to support critical mineral processing.

“Antimony is defined as a critical mineral by the Australian government, which provides a pathway to access substantial government support,” a South Australian government spokesperson said. He added that complex refineries were key to the state’s economy.

https://www.mining.com/perpetua-awarded ... lot-plant/Perpetua awarded $6.9M additional funding from US Army for antimony pilot plant

Staff Writer | May 28, 2025

Perpetua Resources (NASDAQ: PPTA) (TSX: PPTA) announced Wednesday it has won up to $6.9 million in funding from the US Army via the Defense Ordnance Technology Consortium (DOTC) to support the development of its Stibnite antimony-gold project in Idaho.

This additional funding, awarded under an ordnance technology initiative agreement (OTIA) from August 2023, builds on the $15.5 million already awarded to the company by the DOTC, Perpetua said.

According to the Boise, Idaho-headquartered miner, the funding will be used for testing intended to demonstrate the feasibility of using material sourced from the Stibnite project to produce military-specification antimony trisulfide, a critical component in certain munitions and advanced defense systems.

The OTIA is intended to fund the development and delivery of a flexible, modular pilot plant to the US Army to process antimony and other materials of Department of Defense interest. The additional funding would enable Perpetua to expand material sampling and increase the scope and size of the pilot plant, the company said.

“We are honored to continue our work with the US Army to secure a domestic source of antimony trisulfide,” CEO Jon Cherry said in a press release. “Advancing America’s capabilities to process minerals critical to national defense is essential for our long-term mineral independence and resilience.”

Despite the funding, shares of Perpetua Resources traded 1.1% lower at C$19.47 apiece by 10:30 a.m. ET, for a market capitalization of C$1.4 billion ($1.01bn).

Only known US antimony reserve

The Stibnite project currently holds the only identified reserve of antimony in the US. At an estimated 148 million lb., it represents one of the largest antimony reserves outside of Chinese control.

Once built, the mine is expected to supply up to 35% of America’s antimony needs during its first six years of operations, based on the 2023 USGS commodity summary. A 2021 feasibility study projects its total antimony production to be 115 million lb. over an estimated 15-year mine life. The US currently produces no antimony and relies largely on China, which accounted for 60% of globally mined antimony in 2024.

Due to its strategic importance to the US, Stibnite was recently placed on the initial list of 10 projects selected by the newly formed National Energy Dominance Council for fast-tracked permitting. Last week, the $1.3 billion project received its final federal permit.

In addition to antimony, the project is expected to produce a significant amount of gold, totalling 4.2 million oz. during its mine life.

https://www.mining.com/perpetua-resourc ... -in-idaho/Perpetua Resources secures $400M equity financing for Stibnite project in Idaho

Staff Writer | June 11, 2025

Perpetua Resources (NASDAQ, TSX: PPTA) has entered into an agreement with the National Bank of Canada and BMO Capital Markets to purchase, on behalf of themselves and a syndicate of underwriters, approximately 22.73 million common shares of the company for $13.20 per share for $300 million.

Separately, Paulson & Co. has agreed to purchase an additional $100 million in Perpetua common shares under a private placement, bringing to total financing to $400 million.

Perpetua said it intends to use the proceeds for the development of the company’s Stibnite project in Idaho that is being fast-tracked by the Trump administration, in conjunction with the application for up to $2 billion in project financing submitted to the Export-Import Bank of the United States (EXIM) in May.

Also in May, Perpetua obtained the final federal approval required to progress the project towards construction.

Combined with the EXIM debt financing and royalty financing, the company believes that the net proceeds from the offering and the private placement will provide it with sufficient capital to fund the project construction costs of $2.2 billion, along with additional funds for cost overruns and exploration activities.

The Stibnite project, with its recently secured record of decision from the US Forest Service, is uniquely positioned to supply the critical mineral antimony, which is essential to national security and energy technology, the company said.

Stibnite holds an estimated 148-million-pound antimony reserve — the only identified antimony reserve in the US and one of the largest reserves outside of Chinese control. Once in production, it could meet about 35% of US antimony demand during its initial six years of production, according to the 2023 USGS commodity summary.

The company said it expects the remaining state permits required to commence construction to be issued by the relevant agencies in summer 2025.

Perpetua Resources was flat at Wednesday’s market close in New York, but was down 9.8% in after-hours trading. The company has a $1.1 billion market capitalization.

https://www.mining.com/united-states-an ... n-montana/United States Antimony reboots mine operations in Montana

Staff Writer | July 3, 2025 |

Layout of US Antimony’s operations. Credit: United States Antimony Corp.

United States Antimony (NYSE-A: UAMY) says it has been reacquiring mining claims next to its existing smelting operations in Montana since earlier this year, and is now ready to reboot mine operations in areas that have permits in place.

These mining claims, US Antimony said, have a history of antimony production dating back to the 1970s, and are all situated in or around its operating smelter — the only antimony smelting facility in the country.

Like with rare earths, the US has listed antimony as a mineral critical to its national and economic security. The grey-colored metal is used in a variety of high-tech and defence products, including flame-retardant materials, certain semiconductors and superhard materials. No antimony has been produced by the US on a commercial scale since 2016.

The Dallas, Texas-based company revealed on Thursday that, after a review of geological and historical records, the newly acquired claims have “sufficient” quantities of antimony to restart mining, with as many as three vein systems present on the property.

Moreover, US Antimony said it could be feasible to establish surface mining operations with minimal pre-development expenditure in addition to the prior underground operations.

The company is currently permitted to begin immediate mining operations on the five acres of the patented property, having already filed a small miners exclusion statement (SMES) with the State of Montana. It plans to file a second SMES within the next 10 days in addition to filing exploration permit applications with both Montana’s Department of Environment Quality and the US Forest Service.

US Antimony’s stock gained 4% on the NYSE American exchange, for a market capitalization of $258.5 million.

First US antimony mine in years

Chairman and CEO Gary Evans said the decision to restart mining operations next to its smelter stems from a “significant price increase” experienced for worldwide supplies of antimony ore in the wake of China’s embargos initiated last year.

China, the world’s leading producer, holds around 80% of the world’s processing capacity. The US, meanwhile, has no domestic production and is highly reliant on Chinese imports.

Due to the tense relationship between the two nations, securing a US-based supply of antimony has become a key focus under the current Trump administration. Earlier this year, it fully permitted the Stibnite project held by Perpetua Resources (Nasdaq: PPTA) (TSX: PPTA) in Idaho, which is said to host one of the largest reserves outside Chinese control.

US Antimony, too, aims to bolster the US supply chain, leveraging its antimony oxide smelter in Thompson Falls, which it estimates could produce 5 million lb. per year of antimony metal. The new mining claims in Montana, according to Evans, would make it the first company to restart US antimony production going back decades.

“Governments around the world are finally beginning to understand the need to secure their own supply chains, specifically for critical minerals. There continues to exist a worldwide shortage of this critical material necessary for our Department of Defense,” Evans stated in a press release.

In addition to its presence in Montana, the company also holds over 35,000 acres of mining claims in Alaska that could provide additional feed to the Thompson Falls smelter.

https://www.mining.com/atmy-reports-mas ... l-project/ATMY reports “massive” antimony-bearing mineralization at Bald Hill project

Staff Writer | July 2, 2025

Antimony Resources (CSE: ATMY) reported Wednesday that the first assays have been received from drilling at its Bald Hill project, including sections of “massive antimony stibnite” and “stibnite bearing breccia-filling” intersected.

The Bald Hill project is located in Canada’s New Brunswick province.

The assays comprise four of the initial holes completed as part of an expanded 2,700-meter drill program on the property.

Drill hole BH-25-04 returned 4.17% Sb (antimony) over 7.4 meters, including three zones of massive stibnite that returned 28.8%, 21.9 % and 17.9% Sb respectively. Drill hole BH-25-03 returned 2.76% Sb over 2.8 meters, including 19.0% Sb from 0.4-metre depth.

Drill holes BH-25-01 and BH-25-02 did not reach the target before the holes were abandoned.

Assays for the next set of drill holes are expected in two to three weeks, the company said.

Ten additional drill holes have been completed to date, and sections of massive antimony stibnite and stibnite bearing breccia-filling have been intersected in the drill holes, ATMY noted, adding that the antimony-bearing mineralization has been outlined in surface outcroppings over at least 300 meters beyond the original drilling.

Stibnite is commonly mined for its antimony content. The recent cancellation of antimony exports by China, combined with a substantial price increase, have driven efforts to locate and extract this critical metal in Canada and the US.

“I am very pleased with the assays returned for drill holes BH-25-03 and BH-25-04,” Antimony Resources CEO Jim Atkinson said in a news release. “The shortfall of the first two drill holes was disappointing, but we have better identified the location of the mineralization with each successive drill hole, and the surface mapping and have retargeted the area of drill holes 1 and 2 with additional drill holes to intersect the zone.”

“The results obtained in these first samples have increased our confidence in the validity of the previous drilling results and will assist in establishing the drill hole density we will need for a resource,” Atkinson added.

By market close in Toronto, Antimony Resources’ stock was down 21% with a C$6 million ($4.4m) market capitalization.

https://www.mining.com/locksley-resourc ... ply-chain/Locksley Resources forms US alliances to establish domestic antimony supply chain

Staff Writer | August 26, 2025

Locksley Resources (ASX: LKY) announced Tuesday it has engaged Washington, DC-based advisory group GreenMet to support the advancement of its antimony and rare earth elements Mojave project in Inyo County, California.

Under the terms, GreenMet will position the Mojave project within key US government initiatives under the Defense Production Act, Inflation Reduction Act and Department of Energy programs. The firm is led by Drew Horn, a former US official on strategic minerals and energy supply chain development.

The Mojave project is located next to MP Materials’ Mountain Pass mine, the only active rare earths mine in the US. It includes the Desert antimony prospect, with historic high-grade samples up to 46% antimony, and the El Campo rare earth prospect, where recent rock chip assays returned up to 12.1% total rare earth oxides.

The location, says Locksley, offers a “strategic opportunity” to secure antimony and rare earth supplies within the US.

The Australian critical minerals explorer aims to establish the first domestic mine-to-market antimony supply chain, addressing a critical gap where currently 90-95% of refined supply comes from countries outside the US alliance network.

Antimony is vital for military applications and ammunition, batteries and semiconductors. There is currently no domestic antimony source, and 90% of world supply is controlled by China and Russia, an untenable narrative when it comes to sourcing minerals crucial to North America’s supply chain.

Locksley said it has obtained Bureau of Land Management (BLM) approvals for expanded drilling programs at both Desert and El Campo, scheduled to start in September. This week, it secured $6 million cash from a heavily oversubscribed placement to fund its near-term exploration efforts at Mojave.

The company also said it struck an alliance with Houston-based Rice University to pioneer domestic antimony processing and advanced materials research in the US – a move that it believes could position its project at the heart of America’s push to rebuild its antimony supply chain from scratch.

https://www.mining.com/perpetua-secures ... -in-idaho/Idaho’s Stibnite Gold-Antimony project cleared to begin construction

Staff Writer | September 19, 2025

Perpetua Resources (Nasdaq: PPTA; TSX: PPTA) has received a notice to proceed from the US Forest Service, authorizing the construction of its $1.3 billion Stibnite gold-antimony project in Idaho.

The company secured its Record of Decision in January and received final federal approval in May, with Friday’s notice marking the last step before construction can begin once financial assurance bonds are posted.

The company expects to finalize bonding in the coming weeks, with construction slated to start by October.

Shares of Perpetua rose 1% on Friday, trading at $17.59 in New York and giving the company a market capitalization of about C$1.89 billion.

Strategic critical mineral supply

The Stibnite project is expected to begin commercial production by 2028, with a 15-year mine life that could supply more than 100 million pounds of antimony, meeting over 35% of US annual demand.

Antimony is a metal vital to defense applications, including munitions, as well as renewable technologies like solar panels. Currently, the US has no domestic production of antimony and relies heavily on imports, primarily from China.

“This is a monumental milestone,” Perpetua Resources CEO Jon Cherry said in a news release. “After eight years of review and over $400 million invested, it is finally time for the Stibnite Gold Project to deliver for America. We are ready to bring Stibnite back to life as a national strategic asset.”

The project will also produce roughly 450,000 ounces of gold annually, providing a dual revenue stream. Proven and probable reserves at the site include 148 million pounds of antimony and more than 6 million ounces of gold.

Last April, the US Export-Import Bank signaled support for the project with a letter of interest for up to $1.8 billion in financing, which remains under review.

The project has backing from billionaire investor John Paulson and has also drawn political attention in Washington, particularly after China’s decision last year to block exports of antimony to the US.

Environmental restoration and local concerns

Perpetua has emphasized the project’s dual focus on mineral production and environmental restoration. The final mine plan was redesigned to reduce the project footprint by 13%, improve stream and wetland conditions, and reconnect fish habitats.

Still, the project has faced opposition from Idaho’s Nez Perce tribe, which has raised concerns over potential impacts on salmon populations in the region.

Located in Idaho’s Stibnite-Yellow Pine district, about 222 kilometers northeast of Boise, the site was once a critical supplier of antimony during World War II.

The project hosts 104.6 million proven and probable tonnes grading 1.43 grams gold per tonne and 0.064% antimony for 4.8 million oz. gold and 148 million lb. antimony, according to the feasibility study.

https://www.mining-technology.com/news/ ... y/?cf-viewUSAC secures $245m US defence contract for antimony supply

The USAC is expected to deliver the initial orders under the contract this week.

September 24, 2025

The United States Antimony Corporation (USAC) has been awarded a contract worth up to $245m by the US Defense Logistics Agency (DLA) to supply antimony metal ingots for the national defence stockpile over the next five years.

This indefinite delivery indefinite quantity (IDIQ) agreement follows extensive negotiations concluded this year.

Antimony, a critical component in military applications such as munitions and batteries has been identified as a strategic vulnerability in the US industrial base.

The USAC operates the only two antimony smelters in North America, which have been processing the metal for decades.

The contract renews its collaboration with the Department of Defense and the DLA. According to the USAC, this partnership has strengthened significantly since late 2024.

USAC chairman and CEO Gary Evans said: “It is incredibly meaningful for all our employees to play such a strategic role in strengthening our nation’s defence readiness and having the knowledge, expertise and history that USAC can and will deliver under our contractual obligations.

“This is the kind of knowledge that is only gained through decades of execution and know-how. USAC has some of the most experienced antimony chemists/metallurgists and other professionals on its team in the global landscape.

“To put this in proper context, we have successfully won a sole-sourced long-term contract from the US Government for approximately $245m, while our total reported revenues for 2024 were $14.9m.”

The USAC is expected to deliver the initial orders under the contract this week.

The company said that its smelting facilities are equipped to meet the government’s specifications for antimony metal ingots.

It is also increasing its supply of antimony ore from global sources and developing its mineral acreage in Alaska and Montana.

Its recent mining operations in Alaska have revealed high-grade antimony deposits, which are anticipated to enhance domestic production and supply chain efficiency.

However, the USAC expressed doubt about the quality of antimony ores controlled by other sources, noting that these alternatives may not meet US military standards.

The new contract aligns with broader efforts by the US Government to strengthen domestic supply chains for strategic materials and reduce reliance on foreign sources, notably China, reported Reuters.

In May this year, the USAC executed a definitive agreement with WSP USA to provide engineering and construction services to enhance smelting operations at Thompson Falls, Montana.

https://www.boursedirect.fr/en/news/cat ... 98be04b778Dans les mines d'Asie centrale, course mondiale aux métaux rares

24/09/2025

Dans un labyrinthe de tunnels creusés dans de hautes montagnes d'Asie centrale, des mineurs s'affairent à chercher de l'antimoine au Tadjikistan, deuxième producteur mondial de ce métal critique dont la demande mondiale explose.

"Nous effectuons des travaux de forage pour déterminer quelles sont les ressources minérales souterraines", résume Imonkhassan Iorov, l'un des quelque 1.500 employés de l'entreprise tadjike Talco Gold, qui a accordé à l'AFP un rare accès sur le site de Saritag (ouest).

Fourmillant dans la cinquantaine de kilomètres de galeries souterraines, les mineurs prospectent pour trouver de l'or mais surtout, caché profondément dans la roche, de l'antimoine.

Ce métal gris argenté aux propriétés multiples est utilisé tant pour la transition énergétique, intégré aux batteries de véhicules électriques ou installations photovoltaïques, que par l'industrie de l'armement, renforçant blindages et munitions.

Des montagnes du Tadjikistan et du Kirghizstan aux steppes du Kazakhstan, en passant par les déserts d'Ouzbékistan et du Turkménistan, toute la région vibre au rythme des découvertes de métaux et terres rares.

Ces dernières années, la Russie, l'Union européenne, les Etats-Unis, des pays arabes et asiatiques se sont lancés dans la chasse aux immenses réserves centrasiatiques pour réduire leur dépendance à la Chine, dominant le secteur.

Chez Talco, chaque équipe "fore 50 mètres pour l'exploration géologique" afin de récupérer des échantillons et "creuse 54 mètres de tunnels" en une demi-journée, explique Kholmakhmad Khakimzoda, chargé des travaux souterrains de ce gisement exploité conjointement avec Pékin, très implanté en Asie centrale.

"Industrialisation accélérée"

"De très nombreux gisements d’antimoine se trouvent au Tadjikistan", dit à l'AFP Mourod Djoumazoda, directeur-adjoint de Talco Gold, qui pèse 10% du marché mondial de l'antimoine.

Selon l'Institut d'études géologiques des Etats-Unis (USGS), la Chine représente près de la moitié de la production mondiale d'antimoine, suivie du Tadjikistan (25%), avec 21.000 tonnes en 2023.

"On extrait l'antimoine aussi bien par des méthodes souterraines qu’à ciel ouvert", explique M. Djoumazoda, face à un ballet de véhicules et d'équipements neufs principalement chinois, mais aussi suédois et finlandais, concassant la roche dans des carrières.

Des ouvriers de l'entreprise Talco Gold extraient de l'antimoine dans des carrières à ciel ouvert de la mine de Saritag, dans l'ouest du Tadjikistan, le 26 août 2025 ( STRINGER / AFP )

A l'instar du tungstène, du cobalt ou du magnésium, l'antimoine fait partie des 34 matières premières classées "critiques" par l'Union européenne, craignant une pénurie causée par "la concentration d'une part importante de la production mondiale dans quelques pays" et d'un manque d'alternatives.

Ce métal est rare et cher: en 2023, 54% des importations européennes provenaient du Tadjikistan, selon Bruxelles, et son prix a atteint des records l'an passé après les restrictions d'exportations chinoises.

Pour le Tadjikistan, cette ruée soudaine vers les métaux est une aubaine pour relancer son économie, la plus fragile de l'ex-URSS, marquée par la guerre civile des années 1990.

Partout chez Talco Gold, d'immenses citations et portraits du dirigeant Emomali Rakhmon, au pouvoir depuis 1992, rappellent l'importance du secteur pour ce pays majoritairement agraire.

L'une d'elles proclame que "d'importantes réserves de matières premières permettent d’assurer une industrialisation accélérée", une "exigence" de M. Rakhmon, qui a désigné la période 2022-2026 comme étant celle du "développement industriel, quatrième objectif stratégique national".

Chine incontournable

Avant d'être exporté, le minerai extrait chez Talco est concassé dans l'usine d'enrichissement, où "5.000 tonnes sont traitées quotidiennement, broyées dans deux tambours" immenses, montre dans le vacarme Faïzoullo Safarov, l'un des responsables.

Pour extraire l'antimoine de la pierraille, "le métal est séparé du minerai à l'aide de réactifs chimiques à l’atelier de flottation", détaille M. Safarov.

Puis "le concentré est filtré et séché dans des bassins de décantation", dernière étape avant d'être emballé dans des sacs, sous forme de sable "contenant en moyenne 30% d’antimoine pur", explique le spécialiste.

Chez Talco, ces travaux ambitieux ont été lancés en 2022 grâce aux investissements de Pékin, co-détenteur du gisement de Saritag.

Ce projet reprend le flambeau de celui entamé à l'époque soviétique par Moscou: les galeries soviétiques en partie rebouchées sont toujours visibles, tout comme plusieurs mosaïques glorifiant l'extraction d'antimoine, ou un pâle portrait de Lénine, fondateur de l'URSS.

Mais Pékin, puissance incontournable en Asie centrale en passe de détrôner la Russie et son influence historique, a désormais la main.

Et c'est avec avec le dirigeant chinois Xi Jinping que s'affiche le président Rakhmon sur une pancarte les présentant comme la "clé dorée de l'amitié Tadjikistan-Chine".

Un partenariat grandissant qui profite à Talco, qui veut devenir la première entreprise mondiale, avec l'ouverture prochaine d'une usine de traitement pour purifier l'antimoine.

https://www.mining.com/united-states-an ... n-montana/United States Antimony kicks off mining operations in Montana

Staff Writer | October 17, 202

Layout of US Antimony’s operations in Montana. Credit: United States Antimony Corp.

United States Antimony Corp. (NYSE-A: UAMY) says it has begun exploration and bulk sampling operations on the former Stibnite Hill mine in Montana, having secured the necessary permits from the Department of Environmental Quality (DEQ).

The Stibnite Hill mine is situated next to USAC’s Thompson Falls smelter, which it uses to process third-party ore into various forms of antimony products as well as precious metals. According to the company, this facility is one of two smelters in North America — both owned by USAC — with a long-standing capacity to process the metal.

........................

https://www.mining.com/united-states-an ... akthrough/United States Antimony lifts revenue guidance on mining breakthrough

Staff Writer | October 30, 2025

United States Antimony Corporation (NYSE-A: UAMY) has raised its fiscal 2026 revenue guidance by 25% after success with its recent mining activities in Montana.

Earlier this month, USAC announced that it had kicked off exploration and bulk sampling on the former Stibnite Hill antimony mine, which operated for 15 years from the late 1960s to early 80s, following Montana state approval.

In an operational update issued on Thursday, USAC confirmed that the material being mined from Stibnite Hill has grades that are high enough “for a profitable operation without the long lead times and large capital investment.”

The Stibnite Hill mine site is located next to USAC’s Thompson Falls smelter, which it is currently using to process third-party ore into various forms of antimony products as well as precious metals. According to USAC, this facility is one of two smelters in North America — the other being its Madero smelter in Mexico — with a long-standing capacity to process the metal.

In its update, USAC said more than 250 tonnes of antimony ore have been hauled to a flotation mill located near Radersburg, where it will be crushed, sampled and assayed under an independent qualified person under SK-1300 regulations.

It noted that preliminary test work by the company’s metallurgical team indicates that the material can be upgraded to meet military specifications.

Presently, USAC is the only North American company approved as a sole-source supplier of antimony trisulphide to the Defense Logistics Agency meeting military specifications, the company said. Tests to ensure the Stibnite Hill material can be used in the company’s full complement of products, which includes antimony oxides and metals, remain ongoing.

USAC CEO Gary Evans called its recent mining breakthrough in Montana a “game-changer” for the company.

“When we began operations on Stibnite Hill earlier this year, we anticipated finding antimony deposits, but nothing like we are currently experiencing. We currently anticipate that profit margins mining our own antimony material will be approximately three times greater than buying from third parties,” Evans said.

USAC’s share price fell slightly by 0.9%, as a US-China handshake eased concerns over global supply of critical minerals. The Dallas, Texas-headquartered company currently has a market capitalization of $1.15 billion.

First fully integrated operation

USAC said the start of mining in Montana has made it the first company in the world to be fully integrated from mining operations to finished products of antimony.

On its website, it noted that the Thompson Falls smelter can produce approximately 15 million lb. of antimony oxide or 5 million lb. of antimony metal per year. An expansion is currently underway to boost that production capacity.

...........................