https://www.mining.com/web/chile-says-l ... rio-tinto/Chile says lithium contract approved for state-run Altoandinos project with Rio Tinto

Reuters | August 18, 2025

Chile’s mining ministry on Monday said a lithium operating contract for the Altoandinos project, to be run by state mining company ENAMI, is ready to be signed.

EMAMI will partner with global miner Rio Tinto on the project. The mining ministry did not specify when the signing will take place.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 25 mai 2025 : viewtopic.php?p=2411790#p2411790

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 19 juillet 2025 viewtopic.php?p=2414280#p2414280

https://www.agenceecofin.com/actualites ... ium-en-rdcKoBold obtient ses premiers permis d’exploration de lithium en RDC

Agence Ecofin 28 aout 2025

En juillet 2025, la RDC a signé un accord de principe avec l’américain KoBold Metals pour développer le gisement Manono et investir plus largement dans le secteur minier congolais.

La société américaine KoBold Metals, soutenue notamment par les milliardaires Bill Gates et Jeff Bezos, vient de sécuriser sept permis d’exploration pour le lithium en RDC. Selon le site web du cadastre minier congolais, les permis de recherche couvrent aussi d’autres métaux comme l’étain, les terres rares, le coltan et l’or, dans le territoire de Manono, province du Tanganyika et le territoire de Malemba Nkulu, province du Haut-Lomami.

« Nos efforts d’exploration sur les sept nouvelles licences seront axés sur le lithium », précise néanmoins un responsable de KoBold relayé par Reuters. Il faut dire qu’au cœur des ambitions de KoBold Metals en RDC se retrouve le lithium, et plus particulièrement le lithium du gisement Manono.

Mi-juillet, KoBold a signé un accord de principe avec Kinshasa pour le développement de ce projet, ainsi que pour d’autres investissements miniers en RDC. La concrétisation de ce partenariat suppose néanmoins le règlement d’un différend de longue date entre le gouvernement congolais et la société australienne AVZ Minerals qui réclame des droits sur le projet Manono.

En attendant, KoBold pourrait lancer dans les prochains mois ses premiers travaux d’exploration en RDC. La compagnie s’est déjà attaché les services de Benjamin Katabuka comme directeur général de sa filiale congolaise.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Le cours des actions de deux miniers du Lithium en Australie en forte baisse aprés des résultats montrant de fortes pertes à cause des prix trop bas du Lithium.

https://www.mining.com/web/mineral-reso ... -weakness/Lithium shares plunge in Australia as miners swing to losses

Bloomberg News | August 27, 2025

Australian lithium miner share prices tumbled after two of the country’s biggest producers of the battery metal reported a combined $1.2 billion of first-half losses due to slumping prices.

IGO Ltd. plunged as much as 8.4% in Sydney, and Mineral Resources Ltd. was down as much as 6.1%. Even companies that didn’t report their results on Thursday were caught in the downdraft. Pilbara Minerals Ltd. fell as much as 4.3% and Liontown Resources Ltd. dropped 5.4%.

Mt Marion lithium mine in Western Australia. (Image courtesy of Mineral Resources.)

The lithium sector has been hit by writedowns and cost controls due to a supply glut and headwinds to electric-vehicle demand. Prices have plunged 86% from a record high in late 2022 and continued to drop in the first half of this year. However, they’ve revived in recent weeks after a major mine was shut in China.

Mineral Resources posted a net loss of A$904 million ($588 million) for the year to June 30, compared with a A$125 million profit the year before. IGO reported a net loss of A$954.6 million during the period, and a full impairment of its Kwinana lithium hydroxide refinery assets.

“We got the lithium price wrong, and our earnings and net debt levels have been greatly impacted,” Mineral Resources’ managing director Chris Ellison said in a statement Thursday. “Our focus of late has been on cost and performance to ensure the business is set up through the cycle.”

It appears the worst could be over for lithium miners, however. UBS Group AG this week lifted its spodumene price forecast by 9% to 32%, citing expectations for “broader and deeper” Chinese supply disruptions. It also upgraded IGO’s share price target by 20%.

The increased likelihood of supply disruptions in China in 2026 “now sees the market almost in deficit,” UBS said. However, the expected return of that supply and other idled or under-utilized capacity could see “some unwinding in 2027,” it said.

IGO chief executive officer Ivan Vella said the long-term viability of the Kwinana lithium hydroxide refinery in Australia is “challenged” but added that the company believes the market fundamentals are positive.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 11 aout 2024 : viewtopic.php?p=2396241#p2396241

https://www.mining.com/galan-lithium-pr ... a-project/Galan Lithium proceeds with $13M financing for Argentina project

Staff Writer | August 25, 2025 |

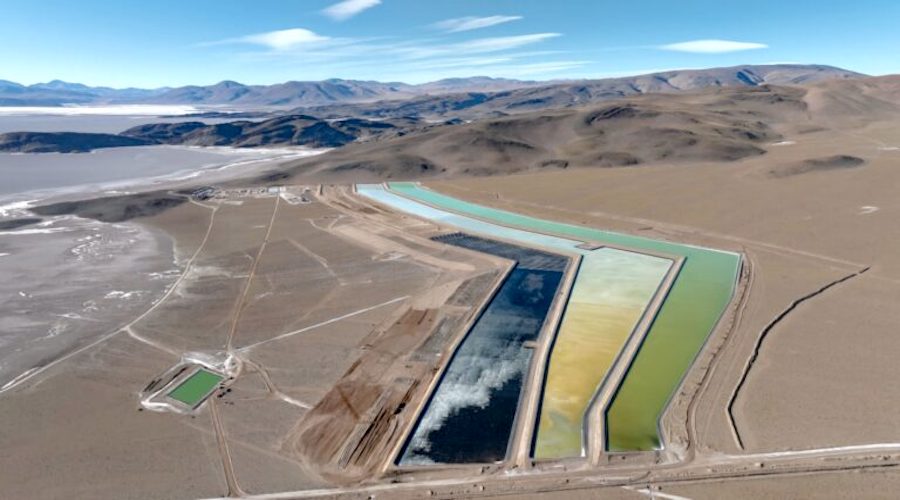

Galan’s flagship Hombre Muerto West lithium project. (Image courtesy of Galan Lithium.)

Galan Lithium (ASX: GLN) said on Monday it is proceeding with a proposed A$20 million ($13m) private placement for its Hombre Muerto West (HMW) lithium project in Argentina following the completion of due diligence by The Clean Elements Fund.

As previously announced on June 20, Clean Elements will purchase nearly 182 million of Galan’s shares at a price of A$0.11 each, representing a 21% premium at the time. The purchase will be made in two equal tranches of A$10 million, with the first closing within five business days and the second tranche closing no later than Nov. 22.

At market close Monday, the stock traded at A$0.14 apiece, giving the Australian lithium developer a market capitalization of A$135 million ($87.5m).

The proceeds are expected to fund the Phase 1 construction activities at the HMW project in Catamarca province, which is targeting a 4,000-tonne-per-annum lithium carbonate equivalent operation capable of producing a 6% lithium chloride concentrate product.

First output is scheduled for the first half of 2026, with a projected mine life of 40 years over four phases. Upon completing the ramp-up, its production capacity would rise to 6,000 tonnes per annum.

First production on track

“With the support of Clean Elements, Galan now has the funding certainty to complete Phase 1 construction at HMW and is firmly on track to deliver first lithium chloride concentrate production in H1 2026,” Galan’s managing director Juan Pablo Vargas de la Vega said in a press release.

The due diligence by Clean Elements — an existing shareholder — has confirmed HMW is “an exceptional lithium project, combining substantial scale and grade with execution capability that places it among the best globally,” he added.

Last month, the $217 million HMW project was approved for the new incentives program in Argentina known as RIGI (Régimen de Incentivo para Grandes Inversiones), which provides a reduced corporate income tax rate of 25% and fiscal stability for 30 years. It is the sixth project to be accepted into the program.

“This is a major milestone for Galan that will further strengthen HMW’s global competitive position as a future low-cost producer,” de la Vega said in a July 28 press release.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 15 fev 2025 : viewtopic.php?p=2406952#p2406952

https://www.mining.com/kodal-secures-ex ... hium-mine/Kodal secures export permit for Mali lithium mine

Cecilia Jamasmie | September 4, 2025 |

CEO Bernard Aylward holding first spodumene concentrate from Bougouni. (Image: Kodal Minerals.)

Kodal Minerals (LON: KOD) has secured an export permit for spodumene concentrate from its Bougouni lithium mine in southern Mali, clearing a key hurdle for the project’s first shipments.

The permit authorizes exports of up to 125,000 tonnes of concentrate, pending completion of final administrative steps. It was confirmed in a letter issued by the Ministry of Mines and signed by Mines Minister Professor Amadou Keita.

“The granting of the export licence is a critical step for the development of the Bougouni project, as well as Mali’s burgeoning spodumene industry,” Kodal chief executive Bernard Aylward said. “The permit further underpins the continued support of the Mali Ministry of Mines and the government and their interest in the further development and expansion of Bougouni.”

The document also confirms pricing will be based on the Shanghai Metal Market reference price for spodumene, though authorities retain the right to verify and adjust prices. Kodal has already agreed to sell all Bougouni output to China’s Hainan Mining, with pricing linked to the SMM benchmark.

Logistics

The company has also signed a transport deal with a leading Malian logistics operator to move concentrate from the mine to port facilities in Côte d’Ivoire. Kodal said it will pay all applicable taxes, duties and levies.

Located 170 kilometres south of Bamako, Bougouni aims to produce 11,000 tonnes of spodumene concentrate per month. The mine is run by Les Mines de Lithium de Bougouni SA, a Mali-registered company in which Kodal holds a 49% stake.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/ukraine-launches ... m-deposit/Ukraine launches tender for major lithium deposit

Staff Writer | August 31, 2025 | 9:34 am Battery Metals Critical Minerals Europe Russia and Central Asia USA Lithium

Ukraine is welcoming bids for the right to develop a major lithium deposit in central Kirovohrad region as part of its minerals deal with the US, even as a legal dispute looms over ownership of the project.

The tender for lithium mining at the Dobra site was confirmed last week by Prime Minister Yulia Svyrydenko, during an announcement of Ukraine’s approved plans to tap into its vastly underexplored natural resources.

...............................

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Concentration dans le Lithium :

https://www.nsenergybusiness.com/news/p ... a-lithium/Piedmont and Sayona finalise merger to create Elevra Lithium

Elevra Lithium merges Piedmont and Sayona's projects, establishing itself as a major hard-rock lithium producer in North America.

Swagath Bandhakavi 1st Sep 2025

Piedmont Lithium has finalised its previously announced merger with Australia-based Sayona Mining, forming a new entity named Elevra Lithium.

Elevra Lithium combines the diverse project portfolios of both Piedmont and Sayona, positioning itself as one of North America’s largest hard-rock lithium producers. These assets aim to enhance their capacity in the lithium supply chain to meet increasing demand driven by global energy transitions.

The merger agreement, announced in November 2024, was executed through an all-stock deal.

As part of the transaction, Piedmont’s common stock and Chess Depositary Interests will be removed from Nasdaq and the Australian Securities Exchange.

Holders of Piedmont’s common stock will receive American Depositary Shares representing Sayona ordinary shares, while CDI holders will receive Sayona shares. Any fractional shares resulting from this exchange will be rounded up.

Elevra Lithium inherits several strategic projects from its predecessor companies. Piedmont contributes its wholly-owned Carolina Lithium project in the US and partnerships in Quebec with Sayona and in Ghana with Atlantic Lithium.

Meanwhile, Sayona brings its North American Lithium, Authier Lithium Project, Tansim Lithium Project in Quebec, Canada and a 60% stake in Moblan Lithium Project. In Western Australia, Sayona holds a large tenement portfolio for lithium and gold exploration.

Piedmont president and CEO Keith Phillips said: “This is a transformative milestone for our shareholders, employees, and partners.

“The combination with Sayona significantly strengthens our global footprint, enhances scale, and positions us to be a leading supplier of lithium resources to the growing EV and stationary storage supply chains. We are excited to move forward as a combined company with Sayona and to build long-term value for all stakeholders.”

With this consolidation, Elevra Lithium plans to streamline operations and leverage synergies across logistics and procurement to potentially reduce operating costs. The company also intends to widen its customer base and strengthen its financial position to support future growth projects.

Future strategies for Elevra Lithium involve capital-raising activities and forming strategic partnerships at the project level to secure technical expertise and funding. At the time of signing the merger deal, the parties stated that the aim is to progress with non-dilutive funding sources while maintaining a simplified corporate structure.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 04 nov 2023 : viewtopic.php?p=2379599#p2379599

https://www.agenceecofin.com/actualites ... en-namibieLe canadien ILC en lice pour acquérir 80% du projet de lithium Karibib en Namibie

Agence Ecofin 11 sept 2025

En septembre 2024, Lepidico a engagé le cabinet de conseil Jefferies International pour l’aider à maximiser la valeur de son projet de lithium Karibib en Namibie. Le plan devait alors inclure la vente du projet ou la cession d’une partie de ses intérêts, dans un contexte de marché baissier.

International Lithium Corp (ILC) a annoncé le mercredi 9 septembre l’acquisition d’une option pouvant déboucher sur la prise de contrôle des 80% de parts détenues par Lepidico dans le projet Karibib en Namibie. L’opération qui prévoit une contrepartie de 975 000 dollars canadiens (environ 702 000 USD), permettrait à cette société minière canadienne d’hériter d’un actif hébergeant 11,9 millions de tonnes titrant 0,45% d’oxyde de lithium de ressources minérales.

Dans le détail, Lepidico gère les intérêts détenus dans Karibib via sa filiale Lepidico Mauritius, les 20% restants appartenant à Huni-Urib Holdings. C’est le capital de cette entité que ILC pourrait à terme contrôler dans le cadre de la transaction annoncée, ce qui lui permettrait de détenir indirectement les 80% dans Karibib. La finalisation du deal est attendue d’ici le dimanche 30 novembre prochain, sous réserve de conclusion d’une procédure d’arbitrage en cours et impliquant Lepidico autour du projet.

ILC estime que l’exercice de cette option devrait lui permettre de se positionner « pour une reprise du marché du lithium ». Ce développement s’inscrit en effet dans un contexte de marché baissier pour cette ressource, sur fond d’excédent de l’offre. D’un pic d’environ 80 000 USD la tonne en 2022, les prix ont baissé de plus de 80% depuis lors. Les perspectives à long terme sont néanmoins positives en raison de la transition énergétique, l’AIE estimant qu’il faudra environ 55 nouvelles mines pour répondre à la demande mondiale d’ici 2035.

Notons qu’ILC n’est pas le seul acteur minier ayant manifesté un certain intérêt pour le lithium namibien, malgré l’état actuel du marché. La compagnie minière chilienne SQM, deuxième producteur mondial du métal blanc, a récemment lancé un programme d’investissement de 40 millions USD dans le projet Lithium Ridge, opéré dans le pays par Andrada Mining. L’objectif à terme est d’en acquérir 50% des parts.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 23 fevrier 2025 : viewtopic.php?p=2407383#p2407383

https://www.boursorama.com/actualite-ec ... b0f59df36eLes réserves d'un gisement de lithium dans le nord du Portugal revues à la hausse

Boursorama avec AFP •15/09/2025

Les réserves d'un gisement de lithium dans le nord du Portugal, présenté comme le plus important d'Europe, ont été revues en hausse et pourraient potentiellement permettre de construire jusqu'à 47 millions de batteries de voitures électriques, a annoncé lundi le promoteur de ce projet minier.

Les résultats d'une nouvelle série de forages ont permis d'augmenter la quantité "confirmée" de minerai de lithium de 40%, à 39 millions de tonnes au total, a indiqué la société Savannah Resources dans un communiqué.

Quant aux ressources supplémentaires estimées, elles ont quadruplé et se situent désormais dans une fourchette de 35 à 62 millions de tonnes.

"Ces chiffres signifient qu'au fur et à mesure que les travaux d'exploration progressent, le potentiel total du projet pourrait dépasser les 100 millions de tonnes de minerai de lithium, soit assez pour construire 47 millions de véhicules électriques", a conclu Savannah.

Cela devrait par ailleurs permettre d'augmenter la durée de vie de la mine, estimée jusqu'ici à 14 ans, a ajouté la société.

Avec le cobalt et le nickel, le lithium fait partie des métaux essentiels à la fabrication des batteries électriques qui doivent remplacer les moteurs thermiques automobiles contribuant au réchauffement climatique.

Le Portugal est déjà le principal producteur européen de lithium mais pour l'instant, sa production sert entièrement à la céramique et à la verrerie.

Retardée par une refonte du projet nécessaire à l'obtention en 2023 d'une évaluation d'impact environnemental favorable, la construction de la mine de lithium à Boticas devrait débuter avant la fin de l'année prochaine, a indiqué son directeur général Emanuel Proença.

Ce calendrier "est compatible avec une mise en production en 2028", a-t-il précisé la semaine dernière.

Le projet minier de Boticas devra dans un premier temps approvisionner surtout l'industrie automobile allemande, en vertu d'un partenariat scellé entre la société cotée à la Bourse de Londres et son premier actionnaire, AMG Critical Materials, qui détient 15,6% du capital.

Contesté par une partie de la population locale, y compris devant les tribunaux, le projet a jusqu'ici obtenu cinq décisions de justice favorables, a fait valoir M. Proença.

Les inquiétudes environnementales concernent l'utilisation des eaux, la biodiversité et la pollution sonore.

"Pour chacun de ces points, nous avons un dossier énorme d'informations sur la façon dont nous allons traiter ces questions, autrement nous n'aurions pas obtenu les autorisations pour avancer", a toutefois affirmé le patron de Savannah.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 28 janvier 2024 : viewtopic.php?p=2384268#p2384268

https://www.mining.com/smackover-lithiu ... s-project/Smackover Lithium’s DFS reports ‘robust economics’ for Arkansas project

Staff Writer | September 4, 2025

Smackover Lithium, a joint venture between Standard Lithium (TSX-V, NYSE-A: SLI) and Norway’s state-owned petroleum company Equinor (NYSE: EQNR), has announced results of a definitive feasibility study (DFS) for its South West Arkansas (SWA) project.

Smackover Lithium is developing a greenfield lithium extraction and chemicals production facility in the southwestern region of Arkansas. In January, the JV received a $225 million grant from the US Department of Energy to support the construction of Phase 1 of the project.

The DFS projected an initial production capacity of 22,500 tonnes per annum (tpa) of battery-quality lithium carbonate (Li2CO3). This would make SWA the first commercial lithium production in the Smackover Formation, an underground geological formation stretching from Florida to Texas filled with lithium-rich brine.

Analysts estimate that the Smackover Formation could host more than 4 million tonnes of lithium, enough to power millions of electric vehicles and other electronic devices.

DFS results

The DFS detailed a production plan with average lithium concentration of 481 mg/L, underpinning a minimum 20-year operating life with ample opportunity for significant further expansion.

The study envisions a pre-tax net present value of $1.7 billion and an internal rate of return of 20.2%, assuming a discount rate of 8% and a lithium carbonate price of $22,400/t, the average of Fastmarket’s 20-year forward pricing curve for battery-quality lithium carbonate.

The all-in capex estimate of $1.45 billion was based on an 18-month detailed front-end engineering design (FEED) process, which yielded capital definition well beyond typical DFS studies, the company said, adding that conservative adoption of pilot plant learnings used in the FEED could lead to improved capital intensity in future expansion phases.

As a result, the DFS forecasts average cash operating costs of $4,516/t over the operating life and average all-in costs of $5,924/t.

Since completion of the prefeasibility study (PFS), the JV has re-entered wells and drilled a new in-fill well to support upgrading the resource and modeling proven and probable reserves.

The total measured and indicated resource is 1,177,000 tonnes lithium carbonate equivalent (LCE) at an average concentration of 442 mg/L for 0.5 km3 of brine volume. The proven reserves are 447,000 tonnes LCE at an average concentration of 481 mg/L for 0.2 km3 of brine volume.

First commercial DLE site in US

Smackover Lithium is licensing Koch Technology Solutions’ lithium selective sorption process for the initial phase of the project, which includes performance guarantees.

Opportunity exists for further operational and cost improvement on future expansion phases with regional exclusivity for the technology in the Smackover under a joint development agreement, Standard Lithium said.

“The robust economics from our SWA project DFS confirm what we’ve known for a long time – that this is a world-class asset and opportunity,” Standard Lithium’s president and COO Andy Robinson said in a news release.

“Through years of extensive testing and development we have substantially de-risked the process technology and increased our confidence in project execution,” Robinson added. “We are well-positioned to move the project towards a final investment decision and are excited by the prospect of being a domestic champion for securing critical minerals production in the United States.”

The company is targeting first production in 2028.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite du post au dessus.

https://www.mining.com/smackover-report ... s-project/Smackover reports highest lithium-in-brine grades in North America at Texas project

Staff Writer | September 25, 2025

Drill rig at the new borehole/well location in East Texas. Credit: Standard Lithium

Smackover Lithium, a joint venture between Standard Lithium (TSXV, NYSE-A: SLI) and Norway’s state-owned petroleum company Equinor (NYSE: EQNR), has released the first inferred resource for its Franklin project in the northeast region of Texas.

The report for the JV’s first project in the East Texas region of the Smackover Formation highlights the size and quality of its brine position, the company said.

Analysts estimate that the Smackover Formation could host more than 4 million tonnes of lithium, enough to power millions of electric vehicles and other electronic devices.

Smackover said the project contains the highest reported lithium-in-brine grades in North America and marks a key step towards the ultimate goal of reaching production of over 100,000 tonnes of lithium chemicals per year in Texas through multiple phases.

The JV is planning to develop two additional projects in East Texas that roughly triples the size of the portfolio area in the state, it said.

Resource highlights

Brine mineral leasing has been ongoing since 2022 in the approximate 80,000-acre project area Over 46,000 acres have been leased to support the inferred resource.

Seismic, historic oil and gas well core and logging information, including completing three exploration wells in 2023, were used to assess the aquifer characteristics and brine chemistry. The highest reported North American lithium brine concentration to date of 806 mg/L was measured from the Pine Forest 1 well, the company said.

The resource report includes 2.16 million tonnes of lithium carbonate equivalent, 15.41 million tonnes of potash (as potassium chloride) – a newly added mineral to the US Geological Survey’s draft critical mineral list – and 2.64 million tonnes of bromide (ionized form of the commercial product bromine), contained within 0.61 km3 of brine volume underlying Smackover’s gross leased acreage.

“Our team has been working diligently for the past four years to identify the most attractive areas to secure sizeable, high-quality brine resources in North America, and the Franklin project provides a strong foundation for future, much larger production in the Smackover that will complement our South West Arkansas project,” Standard Lithium president Andy Robinson said in a news release.

“We believe East Texas to be a meaningfully underappreciated part of our total asset portfolio and expect this report to be a key initial step towards achieving more appropriate recognition for this world-class asset.”

Smackover Lithium is also developing a greenfield lithium extraction and chemicals production facility in the southwestern region of Arkansas. In January, the JV received a $225 million grant from the US Department of Energy to support the construction of Phase 1 of the project.

Standard Lithium shares were up 9.2% by market close in New York. The company has a C$1.02 billion ($73 million) market capitalization.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/lithium-arge ... n-by-2029/Lithium Argentina’s Cauchari-Olaroz aims to triple production by 2029

Reuters | September 26, 2025

Lithium Argentina’s Cauchari-Olaroz project in northern Argentina is aiming to produce 85,000 metric tons of the battery metal annually by around 2029, more than triple last year’s output, said executive vice president Ignacio Celorrio.

The site is one of six lithium projects operating in Argentina, the world’s fourth-largest exporter of the metal used in electric car batteries.

Cauchari-Olaroz, in the so-called Lithium Triangle that spans Argentina, Chile and Bolivia, is being developed by Lithium Argentina, listed in Canada and the US, along with China’s Ganfeng Lithium.

In 2024, the project produced about 25,000 tons of battery-grade lithium carbonate, and in 2025 it is expected to reach between 30,000 and 35,000 tons, Celorrio said on the sidelines of a lithium conference on Tuesday in Buenos Aires.

Currently, 80% of the project’s production is exported to China and the remainder goes to Thailand, according to off-take agreements with Ganfeng and Bangchak, a Thai bank that provided financing.

In August, Lithium Argentina and Ganfeng announced a new joint venture called Pozuelos-Pastos Grandes to consolidate three projects in the Salta province – Pastos Grandes, Sal de la Puna and Pozuelos – which will have the capacity to produce 150,000 tons of lithium annually. Lithium Argentina is working on a feasibility study and hopes to begin construction in 2026.

Both Cauchari-Olaroz and Pozuelos-Pastos Grandes will apply to Argentina’s Large Investment Incentive Regime (RIGI) by the end of the year, Celorrio said. This regime provides tax benefits and other advantages for investments exceeding $200 million, and the government hopes that it attracts much-needed foreign currency.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/anson-resour ... take-deal/Australia’s Anson signs lithium supply deal with LG Energy Solution

Reuters | September 23, 2025

Australian miner Anson Resources signed an offtake deal with South Korea’s LG Energy Solution on Wednesday for the supply of battery-grade lithium carbonate, sending its shares nearly 25% higher.

Under the agreement, the South Korean battery manufacturer will acquire up to 4,000 dry metric tons of lithium carbonate annually from Anson’s project within the Paradox Basin in southern Utah, in the United States, with supply anticipated to commence in 2028.

The agreement features an initial five-year term, with the option for a potential five-year extension.

The deal represents nearly 40% of the project’s start-up production capacity, estimated at around 10,000 tons annually, with the partnership anticipated to support Anson’s debt funding efforts at the final investment decision stage.

“This definitive offtake agreement establishes the foundation for a long-term partnership, and we are proud that we will be supplying low-cost US-made lithium from the Paradox Basin to LG Energy Solution,” Anson CEO Bruce Richardson said.

Anson’s stock surged as much as 24.7%, as of 00:45 GMT, posting its strongest intraday gain in more than two months, while the benchmark ASX 200 slipped 0.6%.

Prices of lithium, a key material in batteries for electric vehicles, have been mired in a year-long downturn due to slower-than-expected EV uptake.

The agreement is “a company-making deal for Anson, but one it was always going to strike somewhere. LG has won the race, and these commitments point to a firming of US battery manufacture”, said Michael McCarthy, CEO of Australia and New Zealand at trading platform Moomoo.

The deal, in broader terms, shows that battery technology remains a key component, McCarthy added.

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.lesechos.fr/finance-marches ... ne-2194046Lithium : Eramet et une start-up française approchés pour l'exploitation d'un gisement majeur en Allemagne

Un vaste gisement d'or blanc a été découvert outre-Rhin par Neptune Energy. Geolith et Eramet testent leur technologie d'extraction directe, un procédé vertueux. Le gisement serait assez riche pour produire jusqu'à 25.000 tonnes de métal blanc par an.

Par Thibaut Madelin, Étienne Goetz le 23 oct. 2025 lesechos.fr

La découverte d'un gisement majeur de lithium en Saxe-Anhalt, dans l'est de l'Allemagne est prometteuse. A condition de trouver la bonne technologie pour capter l'or blanc qui se trouve dans les saumures chaudes du sous-sol allemand. Selon nos informations, le groupe minier français Eramet mène actuellement des tests avec Neptune Energy, la société allemande à l'origine de la découverte. Objectif : déterminer si son procédé d'extraction directe de lithium (DLE) à partir de saumure est pertinent.

Contacté, le groupe Eramet n'a pas souhaité commenter les nombreuses rumeurs qui circulent dans le monde du lithium. Le groupe français fait néanmoins partie des rares acteurs européens disposant d'une technologie de DLE fonctionnelle. Cette technologie a d'ailleurs été déployée à échelle industrielle en Argentine avec succès. ... (abonnée)

- energy_isere

- Modérateur

- Messages : 102903

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 07 sept 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 5#p2416145

https://www.mining-technology.com/news/ ... &cf-closedKodal starts exports from Bougouni lithium project in Mali

The first shipment of spodumene concentrate is expected to be 30,000t.

October 21, 2025

West African mineral exploration and development company Kodal Minerals has begun exporting lithium spodumene concentrate from its Bougouni project in Mali.

The first truckloads are currently undergoing final customs checks before heading to the port of San Pedro in Côte d’Ivoire, marking a significant step for the Bougouni project.

Kodal plans to transport 30,000 tonnes (t) of spodumene concentrate from the project’s stockpile to the port. The initial export to Hainan is expected to take between four and six weeks.

The company said the team aims to maintain a continuous flow and intends to transport the entire existing 45,000t stockpile, ensuring a consistent supply at the San Pedro port for future shipments.

Kodal Minerals CEO Bernard Aylward said: “Following the successful construction of the Dense Media Separation plant (“DMS”) and processing of ore from the Ngoualana open pit, we are now in a position to consistently manage the exporting of Bougouni’s spodumene concentrate.”

“The first shipment of spodumene concentrate is planned to be 30,000t, with first revenue expected upon completion of loading of the vessel in the San Pedro port as agreed in the off-take agreement. Further updates on the Bougouni operation and export will be provided as developments continue.”

Situated around 180km south of Mali’s capital, Bamako, the Bougouni lithium project covers an area of 350km² in the Birimian terrain of West Africa.

The project produced the first lithium oxide (Li₂O) spodumene concentrate earlier this year following the commissioning phase of the full stage one DMS at the project.

The project is operated by Les Mines de Lithium de Bougouni (LMLB), a subsidiary of Kodal Mining UK. Kodal holds a 49% shareholding in LMLB.

Stage two at Bougouni will feature a flotation plant that is expected to operate from 2028 to 2038, with an annual forecast output of 230,000t of Li₂O.