https://www.mining.com/web/putin-says-r ... n-lithium/Putin says Russia should speed up lithium mining plans

Reuters | February 21, 2025

President Vladimir Putin said on Friday that Russia should speed up plans to mine its deposits of lithium, a metal crucial for the production of high-capacity electric batteries, and other critical minerals, including rare earths.

Russia has large lithium reserves, estimated at about 1 million tons by the United States Geological Survey (USGS) in 2024.

But it relied on imports until they were disrupted by Western sanctions imposed over the conflict in Ukraine, prompting Moscow to press ahead with development of its own deposits.

“We still do not mine lithium. And how can we develop without it? But we can do it. And we could have done it 10 or 15 years ago,” Putin told a conference on advanced technologies in Moscow.

Russia, which aims to stop importing lithium and other rare metals by 2030, estimates it has 3.5 million tons of lithium oxide reserves. Russian forces are also closing in on one of the biggest lithium deposits in Ukraine.

Following Putin’s remarks, Russia’s Natural resources ministry said Russia in 2023 mined 27 tons of lithium as a byproduct at an emerald deposit in the Urals mountains.

Demand for lithium has surged in recent years as Russian companies work on the mass production of lithium batteries and electric vehicles.

Global attention to reserves of critical minerals has been heightened by US President Donald Trump’s proposal to Ukraine to cede control of 50% of its critical minerals, including graphite, uranium, titanium and lithium.

Putin said Russia should develop its own production of all critical minerals, including rare earth metals, which are used to make magnets that turn power into motion for electric vehicles, cell phones, missile systems, and other electronics.

Polar Lithium, a joint venture between Russian metals giant Nornickel and state-owned nuclear energy firm Rosatom, said in June it planned to speed up its only lithium production project, which was meant to come on line by 2030, by three or four years.

Polar Lithium is in the process of developing the Kolmozerskoye lithium deposit, the largest in Russia, located in the northwest.

Lithium supplies from Chile and Argentina dried up after sanctions were imposed on Moscow in 2022 and Russia has since had to rely on lithium carbonate supplies from Bolivia and China.

Polar Lithium aims to become Russia’s first-ever domestic producer of lithium-bearing raw materials and to eventually build full local production facilities for lithium-ion batteries.

The US imposed sanctions on Polar Lithium in its latest package announced on January 10.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 08 dec 2024 viewtopic.php?p=2403559#p2403559

https://www.mining-technology.com/news/ ... on-worley/Rio Tinto subsidiary Rincon selects Worley for $2.5bn lithium project in Argentina

The project plans a scalable lithium carbonate plant to produce 60,000tpa of battery-grade material from raw brine.

February 26, 2025

Rincon Mining, a subsidiary of Rio Tinto, has appointed Worley as the lead integration delivery partner (LIDP) for the Rincon full potential lithium project in Salar Del Rincón, Salta Province, Argentina.

This project, with a total investment of $2.5bn, aims to develop a scalable lithium carbonate plant with a production capacity of 60,000 tonnes per annum (tpa) of battery-grade material from raw brine.

As the LIDP, Worley will oversee the detailed design and execution of the project, coordinating with subcontractors, technology providers and construction contractors.

The services will be provided through Worley’s offices in Argentina, with support from its operations in Chile and Bogota.

The project leverages Worley’s expertise in Argentina’s lithium market and is categorised by the company as sustainable work.

.......................

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

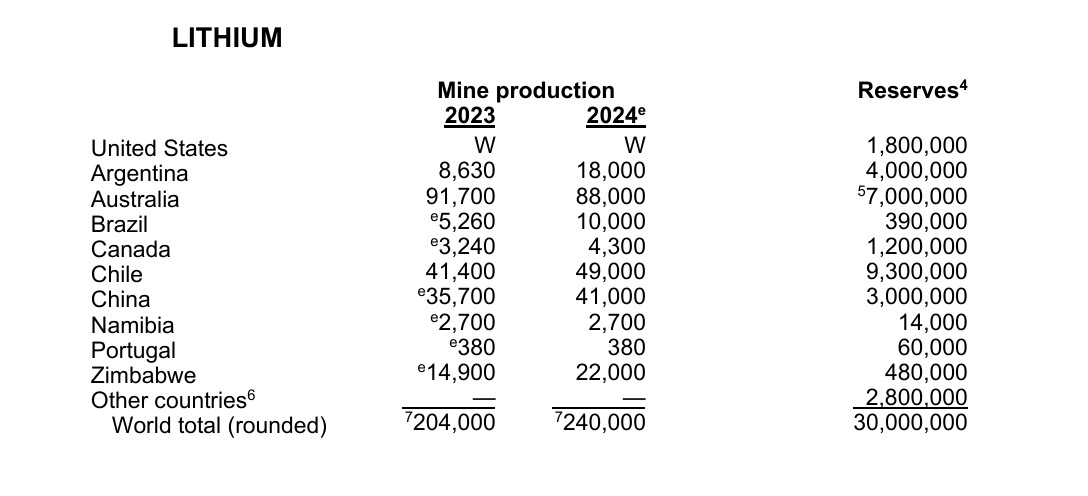

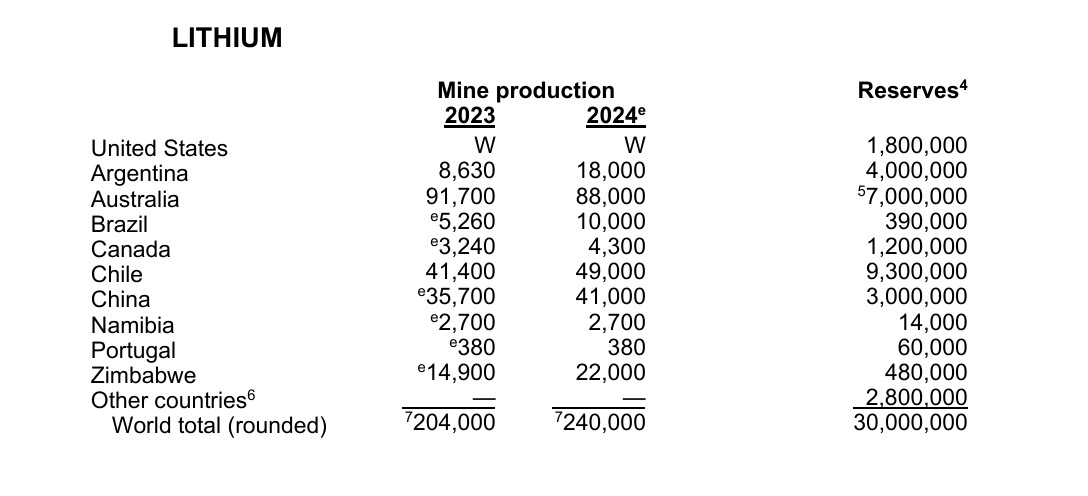

La fiche usgs 2025 pour le Lithium : https://pubs.usgs.gov/periodicals/mcs20 ... ithium.pdf

Sans surprise, 20% d'augmentation de la production.

Data in metric tons of lithium content

mon post de l' an dernier : viewtopic.php?p=2387613#p2387613

le chiffre de la production 2023 qui était de 180 000 tonnes estimé à été corrigé à 204 000 tonnes.

Sans surprise, 20% d'augmentation de la production.

Data in metric tons of lithium content

mon post de l' an dernier : viewtopic.php?p=2387613#p2387613

le chiffre de la production 2023 qui était de 180 000 tonnes estimé à été corrigé à 204 000 tonnes.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Les Chinois rois du Carbonate de Lithium

https://www.mining.com/web/chinas-2024- ... stry-says/China’s 2024 lithium carbonate output rises 45%, ministry says

Reuters | February 27, 2025 |

China’s battery-grade lithium carbonate production increased 45% from 2023 to 670,000 metric tons last year, according to a release from the Ministry of Industry and Information Technology (MIIT) on Thursday.

The most traded lithium carbonate contract on the Guangzhou Futures Exchange closed at 76,140 yuan ($10,470.87) per ton on Thursday, up 0.1% from Wednesday.

A plunge in the price of lithium, the electric vehicle battery metal, from its peak in November 2022 at nearly 600,000 yuan per ton, has forced companies to mothball mines across the world.

But market participants say those closures mean buoyant demand should outpace supply this year as China intensifies policy support to boost sales in the world’s largest EV market.

China doubled EV subsidies in July 2024 and more than 5 million cars sold as of mid-December had benefited from the incentives.

The global lithium supply glut is predicted to shrink by half to around 80,000 tons equivalent of lithium carbonate (LCE) in 2025 from nearly 150,000 last year, according to Antaike, China’s state-owned commodity data provider.

China’s production of battery-grade lithium hydroxide rose to 360,000 tons in 2024, a 26% increase year-on-year, according to MIIT.

($1 = 7.2716 Chinese yuan renminbi)

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 01 sept 2024 viewtopic.php?p=2397696#p2397696

https://www.mining.com/sigma-lithium-on ... ity-in-q4/Sigma Lithium on track to double production capacity in Q4

Staff Writer | February 24, 2025

Sigma’s Greentech plant in Brazil. Credit: Sigma Lithium

Sigma Lithium (TSXV, NASDAQ: SGML) is on track to double its production capacity in 2025, anticipating the commissioning of a second lithium beneficiation plant in Minas Gerais, Brazil, in the fourth quarter.

The lithium producer confirmed on Monday that the construction of the second-phased plant is staying on schedule and within budget. To date, all of the foundation earthworks have been completed, as well as the procurement of key equipment, which are expected to be delivered mid-2025.

The construction is being fully funded by the $100 million loan obtained from the Development Bank of Brazil last year. With the loan, Sigma said it decided to continue advancing the plant construction despite the current lithium cycle because of the low capital expenditure intensity offered by the existing infrastructure.

“As one of the world’s lowest-cost producers, Sigma Lithium is well-positioned to leverage economies of scale as we expand our capacity,” the company stated in a news release, adding that this will further enhance its cost efficiency.

Once commissioned, the new plant would allow Sigma to expand its annual production of carbon-neutral lithium concentrates from the current 270,000 tonnes to approximately 520,000 tonnes, starting in 2026. For 2025, it will add about 30,000 tonnes of production, taking the annual production to 300,000 tonnes at a cash cost of $500/tonne.

Last year, the company achieved 240,000 tonnes of production after surpassing its fourth-quarter production target.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 12 janvier 2025 viewtopic.php?p=2405220#p2405220

https://www.mining-technology.com/news/ ... 2/?cf-viewLithium Americas secures $250m investment for Thacker Pass lithium project in US

The investment is expected to close the week of 10 March 2025, subject to the satisfaction of certain closing conditions.

March 7, 2025

Lithium Americas has announced a strategic investment of $250m from Orion Resource Partners, a global investment firm, to advance the development and construction of phase one of the Thacker Pass lithium project in Humboldt County, Nevada, US.

This investment positions the company to be fully funded for construction and provides liquidity to manage corporate overheads and other expenses post-final investment decision.

Orion has committed to purchasing senior unsecured convertible notes worth $195m and entering into a production payment agreement (PPA) with Lithium Americas.

The PPA involves another $25m in exchange for payments linked to the minerals processed and the gross revenue generated by Thacker Pass.

The combined initial investment of the notes and PPA totals $220m.

Orion has also agreed to potentially purchase another $30m in notes within two years subject to certain conditions.

Additionally, Orion has expressed a non-binding interest in evaluating up to $500m of financing for phase two of the Thacker Pass project.

The investment is expected to close the week of 10 March 2025, subject to the satisfaction of certain closing conditions.

Lithium Americas president and CEO Jonathan Evans said: “Orion’s long-term investing horizon and experience with resource development makes them an excellent partner for Lithium Americas and Thacker Pass and contributes to our strong relationships with General Motors [GM] and the US Department of Energy [DOE].

“Orion’s commitment to this project highlights the strategic importance of Thacker Pass to national security and developing a domestic supply chain, as we work to reduce American dependence on foreign suppliers for critical minerals.”

Phase one of the Thacker Pass project will have an initial production capacity of 40,000 tonnes per annum (tpa) of battery-grade lithium carbonate. Completion of phase one is targeted for late 2027.

The Thacker Pass project is set to become a key supplier for GM, which invested $625m last year for a 38% stake.

Lithium Americas and GM formed a joint venture named Lithium Nevada Ventures to develop the project.

Furthermore, in March 2024, Lithium Americas obtained a conditional commitment for a $2.26bn loan from the DOE to build processing facilities at the Thacker Pass project.

The company expects the initial $220m investment by Orion to meet all remaining equity capital requirements set by the DOE and GM.

Orion managing partner Istvan Zollei said: “Thacker Pass is a world-class project, and we are committed to providing investment solutions for metals and materials critical to sustainable economic growth and the energy transition.”

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/germanys-lit ... udy-finds/Germany’s lithium reserves could sustain domestic needs for decades, study finds

Reuters | March 6, 2025

Germany could have enough lithium reserves to cover its domestic needs for several decades, a study showed on Thursday, as Berlin seeks to boost its electric vehicle production and cut dependency on critical raw material imports.

The German Raw Materials Agency estimates the country’s lithium demand at up to 0.17 million metric tons per year by 2030. Germany’s automotive industry relies on imports from Australia, Argentina, Chile and China to cover its battery production needs.

Researchers and companies have been exploring ways to extract lithium as a byproduct of geothermal energy production in Germany’s Upper Rhine Valley to boost domestic supply and renewable heating and power solutions.

A study by the Federal Institute for Geosciences and Natural Resources and Fraunhofer IEG institute found that Germany had up to 26.51 million metric tons of lithium reserves, dissolved in deep underground waters, particularly in the North German Basin and the central Thuringian Basin.

“This assessment of potential is new. When you add everything up, it turns out there could indeed be surprisingly high lithium resources lying dormant underground,” Katharina Alms, the research leader at Fraunhofer IEG, told Reuters.

In 2021, geologists estimated that the Upper Rhine Valley in the Black Forest area of southwestern Germany held enough lithium for more than 400 million EVs.

Lithium exploration has gained momentum in Germany despite concerns over difficulties of extracting it.

ExxonMobil subsidiary Esso Deutschland received four exploration licences in Lower Saxony in December. German oil firm Neptune Energy said in August it received exploration permits for the eastern state of Saxony-Anhalt.

However, Alms said extracting lithium in Germany faces several challenges as not all locations contain high concentrations, making exploration unpredictable.

Many identified lithium resources are also trapped in low-permeability rocks, making extraction technically difficult and surface extraction techniques sometimes require specialized methods that can be complex and time-consuming to implement on a large scale, she added.

Germany imported 23.7 billion euros worth of batteries in 2023, with lithium batteries accounting for 86%, according to trade group ZVEI.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/sqm-cuts-spendin ... ice-slump/SQM cuts spending amid drawn-out lithium price slump

Cecilia Jamasmie | March 5, 2025

Operations in northern Chile. (Image courtesy of SQM LinkedIn.)

Chile’s SQM (NYSE: SQM), the world’s second-largest lithium producer, is scaling back spending this year as a prolonged weakness in prices for the battery metal continues to erode margins.

The miner, which also produces fertilizers and industrial chemicals, plans to invest $1.1 billion across its businesses in 2025, with $550 million directed toward its lithium operations in Chile. An additional $350 million will go to its iodine and plant nutrition business, while the remaining $350 million will fund international lithium ventures.

Last year, SQM allocated around $1.6 billion capital expenditures, including $1.3 billion on expansion projects across its divisions.

The Santiago-based miner delivered on Wednesday another sharp drop in earnings for the fourth quarter of 2024, with profits plunging nearly 41% to $120 million from $206 million a year earlier.

Full-year revenues from lithium and derivatives totalled $2.2 billion, marking a steep 56.7% decline from the $5.2 billion recorded in 2023.

Fourth-quarter revenues for lithium alone fell almost 33% to $532 million from $792 million recorded for the fourth quarter of 2023.

Despite the downturn, chief executive Ricardo Ramos struck an optimistic tone, citing a 25% increase in market demand in 2024. He anticipates that global demand could grow around 17% this year, driven by electric vehicles (EV) sales and increased adoption of battery energy storage systems.

“We believe that prices will remain relatively stable throughout this year, and remain optimistic about a positive trend starting in 2026,” Ramos said.

Underproduction?

SQM also expects a 15% increase in lithium sales compared to 2024, including about 10,000 tonnes of lithium carbonate equivalent (LCE) from the Mt. Holland operation in Australia. Ramos highlighted progress at the Kwinana refinery, which remains on track to begin operations by mid-2025.

On the flip side, the company anticipates lower average realized lithium prices this year, with first-quarter prices slightly below those recorded in the final quarter of 2024.

BMO analyst Joel Jackson noted that SQM’s 2025 lithium guidance suggests the company will underproduce relative to its capacity, signalling potential efforts to exercise supply discipline. However, he does not expect prices to improve this year.

The lithium market has been battered by the prolonged slump, driven by weaker-than-expected demand for EVs. In response, many lithium producers have scaled back operations and slashed spending to protect margins.

The latest to take action was Sibanye-Stillwater (JSE: SSW)(NYSE: SBSW), which opted in February not to proceed with its Rhyolite Ridge lithium-boron project in the US state of Nevada.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 07 avril 2024 viewtopic.php?p=2389279#p2389279

https://www.mining.com/surge-battery-ap ... m-project/Surge Battery approved for expanded exploration at Nevada lithium project

Staff Writer | March 5, 2025

Nevada North lithium project. (Image: Surge Battery Metals)

Surge Battery Metals (TSXV: NILI) announced on Wednesday that its expanded exploration plans for the Nevada North lithium project (NNLP) have been approved by the Bureau of Land Management (BLM). Shares of the lithium junior rose.

The approval, says Surge, represents a “significant permitting milestone” for NNLP as it expands the amount of disturbance allowed for exploration drilling and other activities to 250 acres from the current five acres. The decision allows the company to begin construction of new roads and cross-country trails and drill pads.

Exploration activities being planned drilling to expand the current resource at NNLP, as well as bulk sampling, test pitting, and hydrogeologic and geotechnical studies.

In early 2024, Surge announced an initial resource estimate for NNLP that confirmed it as “one of the highest-grade lithium clay deposits worldwide.” The inferred resource was shown to be 4.7 million tonnes of lithium carbonate equivalent (LCE) grading 2,839 parts per million (ppm) lithium. This was later expanded to 11.24 million tonnes grading 3,010 ppm lithium in September.

The current NLLP resource was based on three rounds of drilling (28 drill holes) completed between 2022 and 2024 that identified a strongly mineralized zone of lithium-bearing clays occupying a strike length of more than 4,300 metres and a known width of greater than 1,500 metres.

Based on this resource, Surge has been looking to complete a preliminary economic assessment for NNLP. To support the study, further drilling is being planned for this year, pending BLM approval of the company’s exploration plan, which has now been obtained.

“We have developed our spring/summer drill plan for 2025 and are looking forward to the drilling season and updating our mineral resource estimate later in Q4,” chief executive Greg Reimer said in a press release.

Shares of Surge Battery Metals rose 11.4% to C$0.39 apiece, near the midpoint of its 52-week range, by 11 a.m. ET following the BLM approval. The Vancouver-based explorer has a market capitalization of C$63.4 million ($44 million).

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.ft.com/content/bc0c6df8-229 ... 0961715070US-backed miner TechMet seeks to develop Ukraine lithium site

Dobra project could be one of first built under minerals deal between Washington and Kyiv

March 15 2025

TechMet chief executive Brian Menell said lithium resources at the Dobra project in central Ukraine were “very significant”, and the company had been looking at the site since 2023. The US government is a shareholder.

Washington and Kyiv are working to sign a minerals deal in coming days, and representatives from the US are in Saudi Arabia this week for talks over ending the Russia-Ukraine war.

TechMet’s interest in the Dobra project was not dependent on the minerals deal, said Menell. “However, if the minerals deal were to happen, it would certainly enhance our interest, and would create a framework that would justify doing more, bigger, quicker,” he added.

TechMet’s investment partner in the Dobra lithium project is Ronald Lauder, a billionaire friend of US President Donald Trump. Lauder has also been a big advocate of US efforts to buy Greenland.

Part-owned by the US government, TechMet is a Dublin-based mining investment vehicle valued at $1.2bn, whose other investors include the Qatar Investment Authority, Mercuria and Lansdowne Partners.

....................

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.msn.com/fr-fr/actualite/fra ... 872&ei=127Bas-Rhin. Une commune s’oppose à un projet d’exploitation de lithium

15 mars 2025 Ouestfrance

Une consultation publique a eu lieu à Soufflenheim entre les habitants du village et la société Lithium de France. Dans un climat houleux…

Vent de révolte à Soufflenheim dans le Bas-Rhin. Les habitants de cette petite commune de 4 775 habitants, s’opposent à la société Lithium de France, qui a déposé une demande d’autorisation environnementale pour un site de forage « exploratoire », en vue d’une potentielle future exploitation de lithium. Ce métal, dont la demande mondiale explose, est essentiel pour la production de batteries électriques notamment.

400 personnes présentes à la consultation publique

Pétition en ligne, groupe Facebook, banderoles déployées sur le site du forage potentiel, présence en force lors de la première réunion publique, qui s’est tenue vendredi 14 mars… La mobilisation enfle, comme le rapportent France 3 Grand Est et les Dernières Nouvelles d’Alsace .

Dans un climat houleux, plus de 400 personnes ont pu faire part de leurs préoccupations lors de cette consultation publique. Au premier rang d’entre elles, la proximité immédiate du site et de certaines habitations. Avec le risque de nuisances sonores et visuelles, mais surtout de secousses sismiques liées à l’activité de géothermie. La consultation du public doit se dérouler jusqu’au 11 juin 2025.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.nsenergybusiness.com/news/r ... 0/?cf-viewRussia unveils plans to initiate large-scale lithium production in 2030

Russian Ministry of Natural Resources has granted exploration permits for three significant lithium deposits- Kolmozerskoye and Polmostundrovskoye in the Murmansk region, and Tastygskoye in the Tuva region.

Aninda Chakraborty 18th Mar 2025

Russia has announced plans to commence large-scale lithium production by the end of this decade, amid efforts to reduce its dependence on imports and strengthen its position in the electric battery market. The government intends to produce a minimum of 60,000 metric tonnes of lithium carbonate annually in 2030, Reuters reported quoting Russian Ministry of Natural Resources.

The country’s lithium ambitions align with global trends, as demand for the metal—crucial for electric vehicle (EV) batteries—continues to rise. Notably, lithium oxide and lithium carbonate are key forms of the metal, containing approximately one-third and 20% pure lithium, respectively.

According to the US Geological Survey, Russia has the world’s 14th largest lithium reserves, estimated at around 1 million tonnes in 2024.

Plans to expedite the mining of lithium deposits were backed by Russian President Vladimir Putin last month, as the country seeks to boost its domestic production of lithium batteries and EVs.

“The country has traditionally imported lithium, and it is now crucial to launch facilities swiftly and increase the extraction and processing of this strategically important resource for the economy,” the news agency quoted the ministry as saying.

The ministry has granted exploration permits for three significant lithium deposits-Kolmozerskoye and Polmostundrovskoye in the Murmansk region, and Tastygskoye in the Tuva region near Mongolia.

Kolmozerskoye, home to a quarter of Russia’s lithium reserves, is managed by Polar Lithium—a joint venture between Nornickel and Rosatom. Arctic Lithium oversees Polmostundrovskoye, while Rostech subsidiary and Elbrusmetall-Lithium holds the Tastygskoye licence.

These sites, along with their adjacent production facilities, are expected to become operational by the decade’s end.

In 2023, Russia produced 27 tonnes of lithium, extracted as a byproduct from an emerald mine in the Ural Mountains.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

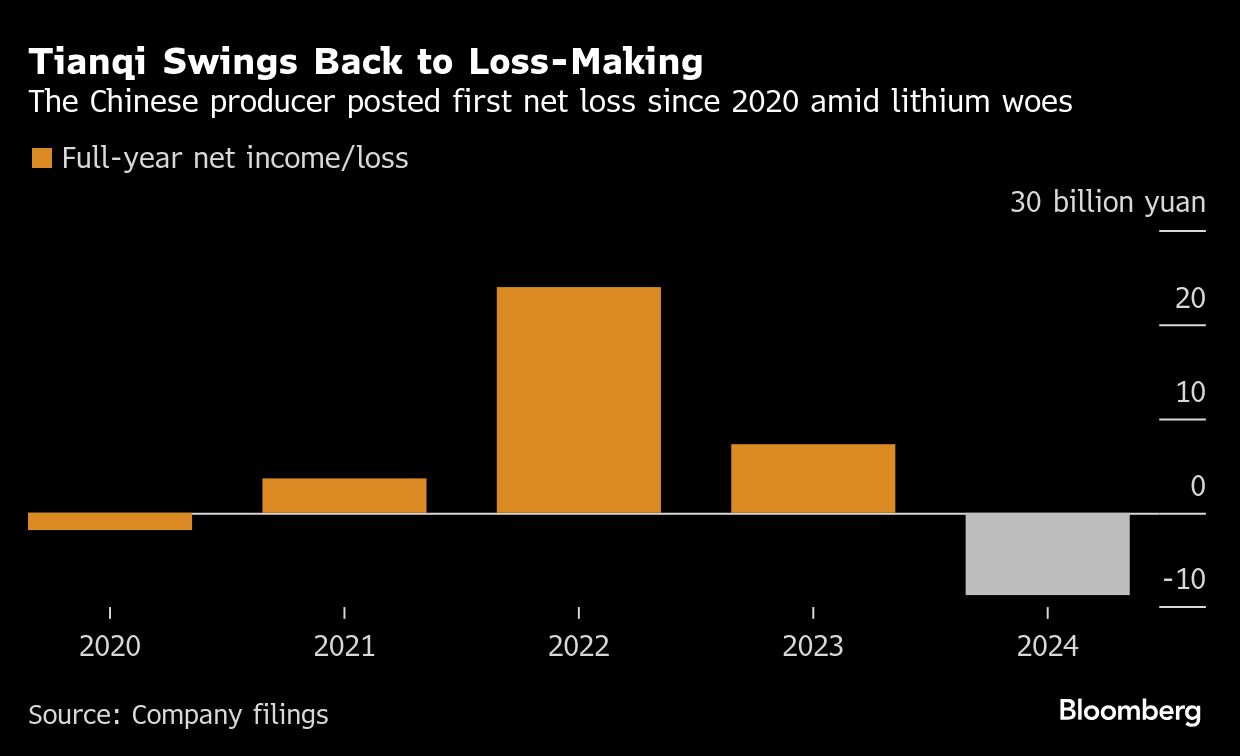

Tianqi Lithium fait 1.1 milliards de dollars de pertes sur l'exercice 2024 :

https://www.mining.com/web/tianqi-lithi ... etal-rout/Tianqi Lithium returns to loss on prolonged battery metal rout

Bloomberg News | March 26, 2025

Tianqi Lithium Corp. warned volatility in lithium product prices and growing geopolitical risks may cloud its outlook as it swung to a first full-year loss since 2020 amid a prolonged battery metal rout.

The Chinese lithium giant posted a net loss of 7.9 billion yuan ($1.1 billion) in 2024, citing weaker prices and impairment due to changes in constructions plans, according to a filing to the Shenzhen Stock Exchange. That compared with a net profit of 7.3 billion yuan the year before.

Although Tianqi’s production and sales volumes of lithium compounds and derivatives increased year-on-year in 2024, the price of lithium products experienced a “significant decline” due to market volatility, the company said in the statement. That pushed gross profit from the products sharply below 2023 levels, it added.

“The recent international environment and macro economic situation including the policy aspect did result in a bit of pressure or changes,” Tianqi chairwoman Jiang Anqi said at a briefing on Thursday. “But we think governments around the world are still supportive toward the development of the new energy vehicles and energy storage industries.”

The company’s shares closed down 0.8% in Shenzhen on Thursday.

Tianqi’s loss shows the struggle faced by the battery metals industry, with lithium prices collapsing almost 90% from a peak in 2022. The supply glut, accompanied by disappointing demand growth for electric vehicles, is driving companies worldwide to rein in spending and cut output.

Meanwhile, the company also flagged the rising trend of trade protectionism in the industry globally amid the increasing strategic importance of lithium.

“Some countries are adopting measures such as subsidies and tariff barriers to support domestic enterprises. Such actions may pose challenges to Chinese companies’ overseas investments and operations,” the company said.

In January, Tianqi halted construction of a refinery expansion in Western Australia that already cost a preliminary investment of 1.4 billion yuan, saying it wasn’t “economically viable.” The company had said at the time that it plans to keep the first phase of the Kwinana project running and called for support from the government.

Meanwhile, lower income from Tianqi’s investment in Chilean producer Sociedad Química y Minera de Chile also contributed to its steep loss. SQM earlier this month said it expects average prices in 2025 to be slightly lower than last year, while it reported a full year loss of $404 million.

Tianqi’s 2024 net loss was at 8.7 billion yuan on IFRS accounting standards due to additional impairment provisioning, it said.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.reuters.com/markets/commodi ... 025-03-28/Rio Tinto in talks with Congo to develop lithium deposit, Bloomberg News reports

By Reuters March 28, 2025

Rio Tinto, opens new tab has held talks with the Democratic Republic of Congo about developing one of the world's biggest hard rock lithium deposits, Bloomberg News reported on Friday, citing people familiar with the matter.

The discussions, which are in the preliminary stages, focus on Rio Tinto getting involved in transforming the Roche Dure resource into a lithium mine, the report added.

The world's largest iron-ore miner has been shifting its focus to critical minerals and battery metals like lithium, capitalizing on a price plunge caused by oversupply.

- energy_isere

- Modérateur

- Messages : 103451

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 09 mars 2025 : viewtopic.php?p=2408020#p2408020

Ca y est, la décision finale d'investissement pour la phase1 de la mine de Lithium de Thacker Pass est prise !

Ca y est, la décision finale d'investissement pour la phase1 de la mine de Lithium de Thacker Pass est prise !

https://www.nsenergybusiness.com/news/l ... n/?cf-viewLithium Americas confirms Thacker Pass Phase 1 FID, closes investment from Orion

The company has completed funding for Thacker Pass Phase 1 construction, with project completion targeted for late 2027

Swagath Bandhakavi 2nd Apr 2025

Lithium Americas Corporation has confirmed the final investment decision (FID) for the first phase of its Thacker Pass lithium project in Humboldt County, Nevada.

The decision follows the closure of a $250m investment by Orion Resource Partners, finalising the equity requirements to support the project’s construction and development.

The investment from Orion Resource Partners comprises $195m in senior unsecured convertible notes and a $25m payment tied to future mineral production and gross revenue from the site.

An additional $30m in convertible notes has been committed through a delayed draw facility, contingent upon specified conditions being met.

These funds complete the equity financing needed to satisfy the requirements under a previously announced $2.26bn loan facility extended by the US Department of Energy (DOE).

General Motors and Lithium Americas, the joint venture (JV) partners for Thacker Pass, made the FID simultaneously with the funding closure. The former contributed $100m to the joint venture, while Lithium Americas provided $192m in cash.

The financial contributions align with the terms of the equity support required to unlock the full DOE loan under the Advanced Technology Vehicles Manufacturing Loan Program.

Lithium Americas president and CEO Jonathan Evans said: “Today marks another important milestone in our journey to bring Thacker Pass to production.

“With our JV Partner, GM, we announced FID for Phase 1 alongside our other exceptional partners – the US DOE and Orion. Together, we will develop a US-produced lithium supply chain to reduce American dependence on foreign suppliers for critical minerals.”

Lithium Americas has now secured full project-level and corporate-level funding for Phase 1 construction activities at Thacker Pass. The company is targeting completion of the first phase by late 2027.

Thacker Pass began initial construction in March 2023 following receipt of a Record of Decision from the US Bureau of Land Management in January 2021. The site, located at the southern edge of the McDermitt Caldera, lies approximately 96.6km northwest of Winnemucca in northern Nevada.

The project is expected to be developed over five phases, each contributing 40,000 tonnes per year of battery-grade lithium carbonate capacity.

At full scale, Thacker Pass is anticipated to achieve a nominal production rate of 160,000 tonnes per year. The total projected mine life is 85 years.

General Motors has secured an offtake agreement for all production from Phase 1 for a 20-year period. The agreement also includes 38% of Phase 2 production volumes over the same duration, along with a right of first offer on the remainder of Phase 2 output.