https://www.miningweekly.com/article/wo ... 2024-12-02Wolfsberg lithium project shifts into fast lane with EIA exemption

2nd December 2024 By: Creamer Media Reporter

The Wolfsberg lithium project in Austria has taken a big step forward as ECM Lithium (ECM), a wholly owned subsidiary of Nasdaq-listed Critical Metals, received confirmation from the Carinthian state government that an environmental impact assessment (EIA) is not required.

This exemption from the EIA process will fast-track the Wolfsberg project’s approval, potentially positioning it as a key player in the European supply chain for critical minerals.

The regulatory decision stems from new provisions for underground mining projects, where if the surface area is expected to cover less than 10 ha, an EIA is not necessary under Austrian law.

“This is an extraordinary achievement for Critical Metals Corp and our Wolfsberg project, as we chart a path forward for the production of critical minerals in Europe. This decree makes the Wolfsberg project the first new mining project within the EU that is able to pave the way into the fast-track approval process for new mining projects in the critical minerals sector. This is a significant milestone towards sustainable production of lithium from Austrian mining extraction in an integrated European supply chain located in the heart of Europe,” said European Lithium chairperson Tony Sage.

Australia-based European Lithium holds a 74.30% stake in Critical Metals, amounting to 66.42-million shares. Based on Critical Metals' closing share price of $6.81 a share on November 29, the company’s investment is valued at $452.3-million.

Wolfsberg is expected to be the first licensed lithium mine in Europe.

The definitive feasibility study (DFS) proposes an average mine production rate of 780 000 t/y, peaking at 840 000 t/y over the life-of-mine (LoM), which is based on an ore reserve of 11.48-million tonnes, mined over 14.6 years.

The DFS envisages two integrated operations, a mining and processing operation, to produce a lithium concentrate (spodumene), and a hydrometallurgical plant to convert the spodumene into battery-grade lithium hydroxide monohydrate (LHM).

The hydrometallurgical plant is expected to produce 8 800 t/y of LHM, with a total production of about 129 000 t of LHM over the LoM.

Total spodumene concentrate production is estimated at 90 000 t, coarse feldspar at 1.95-million tonnes, fine feldspar at 587 000 t, total coarse quartz at one-million tonnes and total fine quartz at 164 000 t.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 03 mars 2024 viewtopic.php?p=2387162#p2387162

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.connaissancedesenergies.org ... bie-241210Berlin lorgne sur les réserves de lithium de la Serbie

AFP le 10 décembre 2024

Le chancelier allemand s'est entretenu mardi de projets d'extraction de lithium avec le président serbe, dont le pays compte les plus grandes réserves connues en Europe de ce métal crucial pour l'avenir de l'industrie automobile en crise.

Le lithium est "un élément très important" pour les batteries les voitures électriques, a rappelé Olaf Scholz dans un discours en recevant Aleksandar Vucic lors d'une visite à Freiberg en Saxe, dans l'Est de l'Allemagne.

"Si la conversion à la propulsion électrique doit réussir, il doit y avoir suffisamment de Lithium pour notre industrie et il doit être disponible, il en va du bien-être de nos pays", a ajouté le chancelier allemand, en mentionnant les réserves de Lithium de Jadar en Serbie, dans l'exploration desquelles l'UE souhaite s'associer.

Belgrade doit commencer à les exploiter à partir de 2028. Plus grand gisement européen de lithium connu, la mine de Jadar pourrait permettre de fabriquer un million de véhicules électriques par an.

Cette matière première, aujourd'hui importée massivement par les Européens, est très convoitées par les constructeurs automobiles qui doivent dans l'UE achever leur conversion à l'électrique avant 2035.

Les Européens sont aujourd'hui pour l'"or blanc" très dépendants de l'Australie, du Chili et de la Chine, principaux extracteurs de la ressource.

Le Vieux Continent ne possède qu'une petite fraction des réserves de lithium mondial, principalement en Allemagne, en Serbie et en République Tchèque.

L'extraction du lithium a été âprement débattue en Serbie pour son impact environnemental: d'importantes manifestations en 2022 ont contraint le gouvernement à retarder le projet.

En Allemagne, dans l'ancienne ville minière de Freiberg, l'entreprise Zinnwald a présenté mardi au chef du gouvernement allemand et au chef de l'Etat serbe un projet d'extraction de 15.000 tonnes annuelles d'hydroxyde de lithium en Saxe en 2028.

pour ce qui est du projet Zinnwald à la fin du texte, j'en ai parlé ici en juillet : viewtopic.php?p=2394993#p2394993

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.connaissancedesenergies.org ... ium-241212La Bolivie à la peine au sein du « triangle du lithium »

AFP le 12 décembre 2024

Au cœur du "triangle du lithium", entre Chili, Argentine et Bolivie, se joue une bataille à l'échelle mondiale autour de ce métal essentiel à la transition énergétique. Si les deux premiers pays s'imposent comme des acteurs clés, la Bolivie peine à trouver sa place.

60% des ressources mondiales réparties entre 3 pays

Indispensable à la fabrication des batteries pour véhicules électriques, le lithium est au centre des efforts pour verdir le secteur automobile.

Le Chili, l'Argentine et la Bolivie occupent une position majeure dans ce marché crucial. Ensemble, ils détiennent 60% des ressources mondiales de lithium, selon l'Institut de géophysique américain (USGC).

Cependant, la Bolivie n'a jusque-là lancé que quatre projets pilotes et une usine opérant à faible régime. En 2023, le pays a produit 948 tonnes de lithium, selon son ministère des Mines, soit un dixième de la production de l'Argentine et 46 fois moins que celle du Chili, deuxième producteur au monde après l'Australie, d'après des données du gouvernement américain.

L'image du "triangle du lithium prête à confusion, car elle donne l'impression qu'il s'agit d'une région homogène (...) Or, elle diffère fortement selon les pays et les régions", souligne Martin Obaya, chercheur à l'Université nationale de San Martin, en Argentine.

Débat sur une « fenêtre d'opportunité »

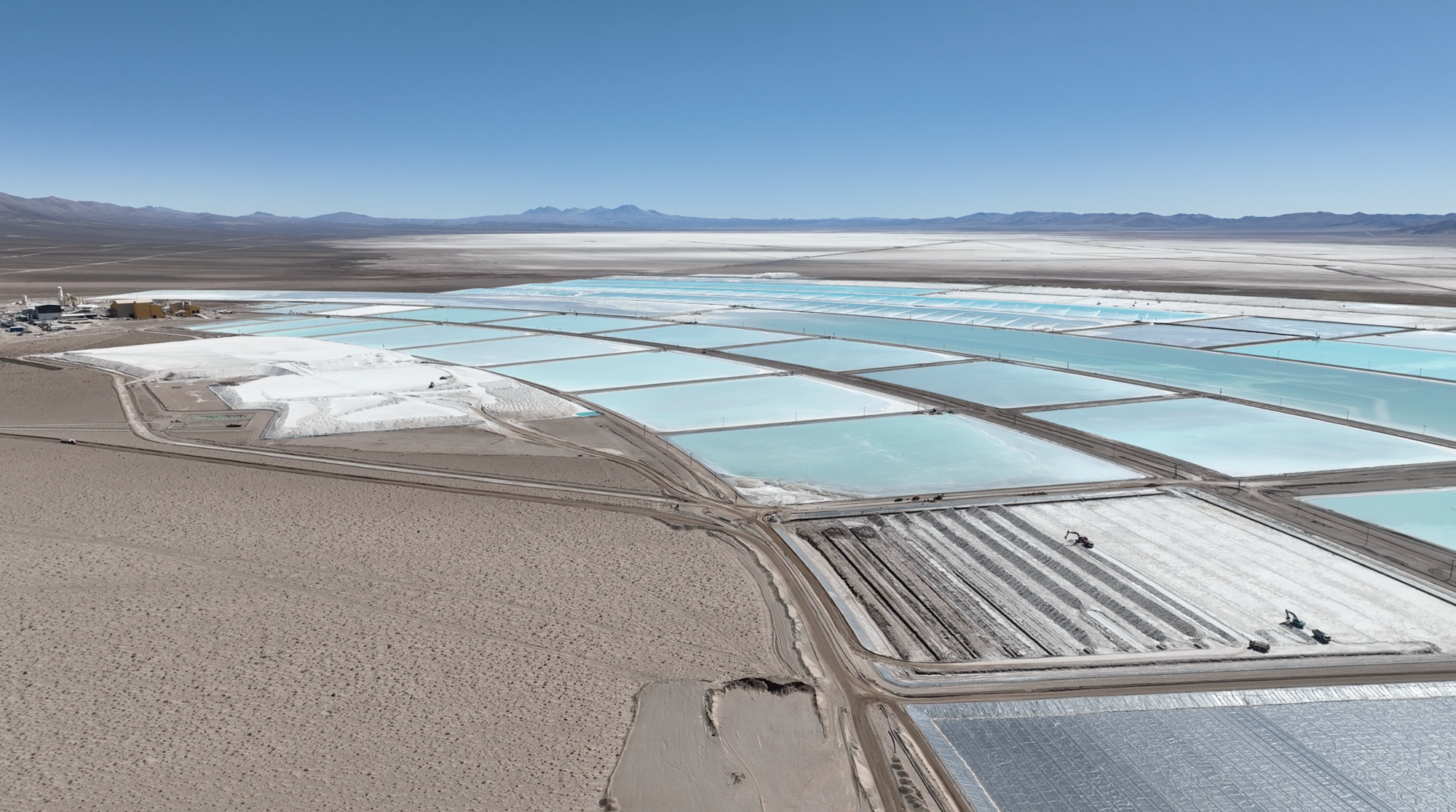

En Amérique du Sud, ce métal se trouve dans les salines. La méthode la plus économique pour l'extraire consiste à pomper l'eau salée souterraine dans des bassins à ciel ouvert, où elle s'évapore laissant apparaître au fil du temps les composés de lithium.

Mais si dans le salar chilien d'Atacama, il est possible de forer à plusieurs dizaines de mètres de profondeur, celui d'Uyuni, en Bolivie, est limité à 11 mètres. Au-delà, le sol est trop compact, explique Gonzalo Mondaca, chercheur au Centre de documentation et d'information bolivien (Cedib).

En outre, les conditions climatiques, avec la présence de pluies, ne favorisent pas une évaporation optimale dans ce salar situé à 3 600 mètres d'altitude. L'usine inaugurée fin 2023 ne fournit ainsi que 20% des 15 000 tonnes qu'elle était censée produire.

"Il y aura toujours un débat pour savoir si nous sommes face à une fenêtre d'opportunité qui est sur le point de se refermer. Mais les résultats du projet sont frustrants par rapport aux attentes", note M. Obaya.

Procédé d'extraction directe de lithium

Récemment, la Bolivie a ravivé les espoirs en signant deux contrats pour la construction d'usines utilisant le procédé novateur d'extraction directe de lithium (DLE), qui recourt à des technologies chimiques ou électrochimiques. Le procédé, plus efficace et moins gourmand en eau, s'avère toutefois plus coûteux.

Selon la société publique Yacimientos de Litio Bolivianos (YLB), le coût de production d'une tonne de lithium dans le salar d'Uyuni varie entre 4 000 et 8 000 dollars, contre 2 500 à 4 000 dollars au Chili.

Un accord a été signé avec la société russe Uranium One pour construire une usine d'une capacité de 14 000 tonnes par an, un autre avec une filiale de CATL, plus grand producteur mondial de batteries, pour deux usines totalisant 35 000 tonnes.

Les deux accords doivent cependant encore être approuvés par les députés, dans le cadre d'un processus qui pourrait s'enliser en raison des profondes divisions au sein de la majorité du parti au pouvoir.

La « propagande », réussite du gouvernement bolivien

De plus, aucune réglementation n'encadre pour l'heure cette industrie naissante, signale M. Mondaca. Des propositions sont sur la table depuis deux ans, mais n'ont pas encore été débattues. "Le pays n'est pas prêt (...) au niveau des capacités techniques, réglementaires et institutionnelles", assure l'expert bolivien.

Pour Gustavo Lagos, professeur à l'université catholique du Chili, dans deux ou trois décennies, "la Bolivie pourrait éventuellement produire beaucoup de lithium. Mais nous n'en sommes pas encore là".

Le pays de 11 millions d'habitants affirme détenir les plus grandes "ressources" de lithium au monde avec 23 millions de tonnes. Mais, le volume de ses "réserves", c'est-à-dire ce qui peut effectivement être extrait, n'a pas encore été officiellement annoncé.

"Si le gouvernement bolivien a réussi dans un domaine, c'est celui de la propagande. Il a alimenté les attentes pendant plus de 15 ans", déplore M. Mondaca, dont l'organisation a eu accès aux documents annexés au contrat signé avec Uranium One, où l'État confirme la faisabilité de l'extraction de seulement... 10% des ressources du salar d'Uyuni.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 8 dec 2024 viewtopic.php?p=2403559#p2403559

https://www.connaissancedesenergies.org ... ine-241212Lithium: Rio Tinto annonce un investissement de 2,5 milliards de dollars en Argentine

AFP le 12 décembre 2024

Le géant minier anglo-australien Rio Tinto a annoncé jeudi un investissement de 2,5 milliards de dollars pour augmenter sa production de carbonate de lithium en Argentine, qui possède la troisième plus grande réserve mondiale, passant de 3.000 à quelque 60.000 tonnes par an.

"Rio Tinto a approuvé 2,5 milliards de dollars pour l'expansion du projet Rincón, en Argentine", a déclaré le groupe dans un communiqué jeudi.

Le projet prévoit d'accroître la capacité de production de l'usine existante dans la province de Salta (nord-ouest), actuellement de 3.000 tonnes, à 60.000 tonnes.

Le métal blanc est essentiel à la transition énergétique, en particulier dans le secteur automobile, car il est clé pour la fabrication de batteries électriques.

L'agrandissement de l'usine devrait commencer en 2025 et atteindre sa pleine capacité en 2028.

Le directeur général de l'entreprise, Jakob Stausholm, a salué les "politiques économiques favorables de l'Argentine" et "l'environnement favorable à l'investissement", à la suite des réformes économiques du président Javier Milei.

Il a notamment mentionné l'approbation d'un nouveau régime d'investissement qui vise à promouvoir l'arrivée de capitaux étrangers grâce à des avantages fiscaux, douaniers et de change pendant 30 ans, pour des investissements dépassant 200 millions de dollars.

En 2023, l'Argentine s'est classée au quatrième rang mondial des producteurs de lithium, selon les données du service géologique des États-Unis.

Elle fait partie, avec la Bolivie et le Chili, du "triangle du lithium", une région qui pourrait contenir plus de la moitié des réserves mondiales de ce métal, selon les experts.

C'est pourquoi de nombreux projets liés au lithium se développent dans le nord-ouest de l'Argentine, où se trouvent la majorité des réserves, comme celui inauguré en juillet par le groupe minier français Eramet et son partenaire chinois Tsingshan, également à Salta, avec un investissement de 870 millions de dollars.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 6 octobre 2024 :viewtopic.php?p=2399928#p2399928

https://www.mining.com/web/savannah-res ... m-project/Savannah Resources gets temporary land access for Portuguese lithium project

Reuters | December 12, 2024

London-listed Savannah Resources has secured temporary land access to a large chunk of its future lithium mining site in northern Portugal, allowing it to conduct fieldwork and begin the second phase of drilling, the company said on Thursday.

But Savannah, which is keen to supply Europe’s electric vehicle (EV) sector with its lithium mine in the Barroso region, is expected to continue to face opposition from locals and environmentalists in the form of protests, legal challenges and refusals to sell land.

Sign Up for the Battery Metals Digest

The company has said Barroso’s deposit of spodumene, a lithium-bearing mineral, is the most significant in Europe and has estimated reserves of 28 million metric tons of high-grade lithium needed for electric car batteries.

It requires around 840 hectares for its four-mine project in Barroso, but according to data from September 2023, it had acquired or was in the process of acquiring just 93 hectares.

Savannah said in May this year it had acquired over 100 plots. It was unclear how many hectares that represents.

Private owners hold around 24% of the land needed, while 75% is made up of the traditional “baldios”, or common land.

Savannah has said it would, if necessary, ask Portugal’s government to authorize compulsory land acquisitions in the public interest.

In a statement on Thursday, Savannah said it had been granted by the government access to the project’s C-100 mining lease, which covers over 520 hectares of land, for a year.

“All relevant stakeholders and landowners have been informed, more than half of the total compensation fees have been paid already, and the required notice has been published in the government’s official gazette,” the company said.

Savannah said it would continue commercial negotiations on land purchases and leases.

Locals’ association United in Defence of Covas do Barroso said the decision was unacceptable as common land belonged to the population and some of the plots were used for agriculture, putting farmers at risk.

“The Directorate-General for Energy and Geology, once again, positions itself as an institution serving private interests, despite the concerns of the local population,” the group said.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 06 oct 2024 viewtopic.php?p=2399930#p2399930

https://www.mining.com/liontown-ships-f ... -customer/Liontown ships first cargo from Kathleen Valley to long-term customer

Cecilia Jamasmie | December 11, 2024

Australia’s Liontown Resources (ASX: LTR) said on Thursday it had sent the first cargo of spodumene concentrate from the Kathleen Valley lithium mine under a long-term offtake agreement.

The shipment, totalling about 33,000 wet metric tonnes (wmt), departed the Port of Geraldton on Wednesday. Of this, 11,000 wmt were delivered to LG Energy Solution, a major supplier of lithium-ion batteries, with the remainder allocated to a short-term customer. The concentrate boasts a weighted average grade of 5.2% lithium oxide.

This marks Liontown’s fourth shipment and its largest since production began in July at the company’s flagship Kathleen Valley lithium operations.

“We have now shipped one cargo per month since our first cargo in September, generating revenue and demonstrating continued progress on our ramp up toward becoming a reliable, major supplier of lithium to the global market,” managing director and chief executive Tony Ottaviano said in the statement.

Rough times

Last month, the Perth-based lithium producer trimmed its production plans, announced cutting measures, and deferred expansion efforts in response to low lithium prices.

The mine came online amid a severe slump in global lithium prices, which has led to the closure of other operations in Australia, including Arcadium Lithium’s Mt Cattlin, which is in the process of being bought by Rio Tinto (ASX: RIO), and Core Lithium’s (ASX: CXO) Finniss project.

Liontown now targets a production rate of 2.8 million metric tonnes per annum by the end of the 2027 fiscal year, down from its initial goal of 3 million tonnes by the first quarter of 2025.

Global lithium markets are grappling with an oversupply, as rapid production growth outpaces demand for the battery metal. This imbalance coincides with a slowdown in electric vehicle sales growth, further pressuring the market.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 27 oct 2024 viewtopic.php?p=2401183#p2401183

https://www.mining.com/eramet-produces- ... argentina/Eramet produces first lithium from Centenario plant in Argentina

Staff Writer | December 27, 2024

Centenario Ratones lithium project being advanced by France’s Eramet in Argentina. (Image by Argentina’s Minister of Economy, Twitter.)

Eramet has delivered first production of lithium carbonate from its newly commissioned Centenario plant located in Argentina’s Salta province, making it the first European company to do so at an industrial scale.

Christel Bories, chair and CEO of Eramet, said the start of lithium production at Centenario represents a “key milestone” for the group’s diversification into metals for the energy transition. The start of production was achieved less than three years after Eramet started the construction of the first plant.

The Centenario plant currently uses Eramet’s direct lithium extraction (DLE) technology that it says is capable of producing “sustainable and highly efficient lithium carbonate suitable for electric vehicle battery applications.”

The drainable mineral resources of the Centenario-Ratones salar amount to more than 15 million tonnes of lithium carbonate equivalent, with an average concentration of 407 mg/L of lithium contained in the brine.

This world-class resource, said Eramet, would be large enough to support long-term growth optionality for production capacity to above 75,000 tonnes of LCE of year.

The plant at is Centenario designed to initially extract and produce 24,000 tonnes of battery-grade lithium carbonate a year, and at full capacity should be positioned in the 1st quartile of the lithium industry cost-curve, Eramet said.

On Oct. 24, the French miner announced it had regained full ownership of its flagship lithium business in Argentina after buying out the 49.9% share of its Chinese partner Tsingshan for $699 million.

The Centenario project was attractive despite a drop in lithium prices, and full ownership would let Eramet decide how to pursue a planned second production facility, Bories said at the time of the deal.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 9 nov 2024 viewtopic.php?p=2402045#p2402045

https://www.mining.com/ganfeng-begins-p ... e-in-mali/Ganfeng begins production at Goulamina lithium mine in Mali

Staff Writer | December 26, 2024 |

China’s Ganfeng Lithium said it has commenced production from the first phase of its Goulamina spodumene project in Mali.

Goulamina represents one of the largest lithium mines in Africa. Ganfeng — China’s largest lithium producer — acquired Australia’s Leo Lithium’s 40% stake in the project for $342.7 million in May.

The deal followed a new mining code introduced in 2023, which stipulated that the Malian government was entitled to a 10% free carry stake and could also acquire an additional 25%.

The initial phase aims for an annual output of 506,000 tonnes of lithium concentrate, expanding to 1 million tonnes in the second phase.

It is estimated that Goulamina could be explored for more than 23 years, producing 15.6 million tonnes of spodumene concentrate over that period.

Mali recently announced a plan to acquire a 35% stake in the Goulamina mine. Once completed, Ganfeng will indirectly hold a 65% stake in the project, with the remainder going to the Malian government.

As reported by the South China Morning Post, Mali’s transitional President Assimi Goita said the lithium mine is extremely important for the West African nation, and the launch of the processing plant “marks a significant step forward in the exploitation of the country’s natural resources.”

Chinese Ambassador to Mali Chen Zhihong, who attended the inauguration ceremony, described the Goulamina mine as “a new example of win-win cooperation.”

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 13 oct 2024 viewtopic.php?p=2400265#p2400265

Rio Tinto s'offre Arcadium Lithium au prix fort :

Rio Tinto s'offre Arcadium Lithium au prix fort :

https://www.mining.com/web/arcadium-sha ... rio-tinto/Arcadium shareholders approve $6.7bn sale to Rio Tinto

Reuters | December 23, 2024

Olaroz project in Northern Argentina. Image: Arcadium.

Arcadium Lithium said on Monday its shareholders have voted in favor of a $6.7 billion sale to Australian mining giant Rio Tinto.

Shares of Arcadium Lithium rose about 7% in extended trading after the company said that about 98% of its shareholders had voted in favor of the sale.

Arcadium Lithium investors sue miner over Rio Tinto takeover

The deal, expected to close in mid-2025, will catapult Rio Tinto to the world’s third-largest lithium miner position, just behind Albemarle and SQM.

Arcadium is facing legal hurdles, as some shareholders have filed lawsuits against it alleging misrepresentation, concealment and negligence regarding the takeover deal, the company revealed in a regulatory filing earlier this month.

Earlier this year, Rio Tinto said it would pay $5.85 per share in cash for Arcadium, nearly a 90% premium to the stock’s closing price on Oct. 4, the day Reuters exclusively reported a potential deal.

The Australian miner will gain access to Arcadium’s lithium mines, processing facilities and deposits in Argentina, Australia, Canada and the United States as well as customers including Tesla, BMW and General Motors.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

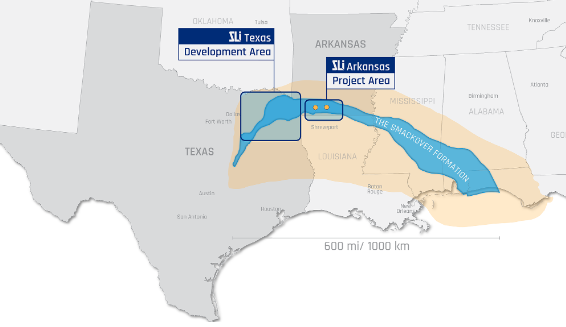

Exxon Mobil a des projets d' extraction de Lithium de saumures du Smackover en Arkansas, ( ce post du 29 juin 2024 viewtopic.php?p=2393895#p2393895 ) et l' USGS à indiqué fin oectobre des ressources très importantes dans cette formation :

https://investingnews.com/smackover-for ... -reserves/USGS: Smackover Formation Lithium Could More Than Meet Global 2030 Demand

Giann Liguid Oct. 24, 2024

Using machine learning, the USGS created predictive models estimating total lithium concentrations in Smackover Formation brines.

The US Geological Survey (USGS) released findings on Monday (October 21) indicating that Southwestern Arkansas may contain substantial lithium reserves, estimated between 5 million and 19 million metric tons.

This assessment was made possible through an innovative approach that combined water testing with machine learning techniques, enabling a new understanding of the lithium potential in the region.

The study, a collaboration between the USGS and the Arkansas Department of Energy and Environment, primarily focuses on the Smackover Formation, a geological structure dating back to the Jurassic period.

The formation, historically recognized for its oil and bromine deposits, has emerged as a potential source of lithium found in the brines associated with oil and gas extraction. It is characterized by its porous limestone structure, and is wide ranging, spanning parts of Arkansas, Louisiana, Texas, Alabama, Mississippi and Florida.

David Applegate, USGS director, emphasized the importance of lithium as a critical mineral in the energy transition, saying that increased US production could mitigate reliance on foreign imports and improve supply chain stability.

"This study illustrates the value of science in addressing economically important issues," he remarked.

Katherine Knierim, the study’s principal researcher, pointed out that the research marks the first estimate of total lithium present in the Smackover brines of Arkansas, noting the potential to satisfy US lithium demands. “We estimate there is enough dissolved lithium present in that region to replace US imports of lithium and more,” she said.

The current global shift toward electric vehicles and renewable energy technologies has significantly increased demand for lithium, an essential component in battery production for these sectors.

According to industry projections, lithium demand is expected to rise as the transition from fossil fuels intensifies. The US currently relies on imports for over 25 percent of its supply, highlighting the importance of domestic resources.

The USGS states that the lower estimate of 5 million metric tons in the Smackover Formation could cover more than nine times the projected global demand for lithium used in electric vehicle batteries by 2030, as outlined by the International Energy Agency. However, it remains to be seen whether the material in the area is commercially recoverable.

Using machine learning, a subset of artificial intelligence, the USGS was able to create predictive models estimating total lithium concentrations in Smackover Formation brines. The resulting models can predict lithium concentrations across areas of the formation, including regions that lack direct sampling.

Knierim highlighted the collaborative effort behind the research in the organization's release.

"The USGS — and science as well — works best as a partnership, and this important research was possible because of our strong partnership with the Office of the Arkansas State Geologist," she said.

As part of its mission to provide scientific information on mineral resources, the USGS has been monitoring lithium production, demand and imports in the US since the passage of the Energy Act of 2020. This law mandates that the USGS maintain a comprehensive list of critical minerals, including lithium.

https://gbc1.net/index.php/2024/10/26/u ... echnology/US Poised for Lithium Boom Thanks to Huge Discoveries and Green Mining Technology

26 October 2024

Over the past few years, several firms announced having discovered substantial #lithium deposits in the region surrounding the Texas-Arkansas border. The consecutive discoveries seem to indicate the presence of a lithium vein which has been dubbed as the Smackover Formation.

As luck would have it, a native Texan John Burba filed a patent for Direct Lithium Extraction (#DLE), a novel technique which improves efficiency and decreases environmental impact as far back as 1995. At the time, his invention did not find any applications in the USA. But little did he know that his invention would be brought back from the dead some three decades later.

In July 2023, during its investor conference, ExxonMobil (XNYS: XOM) CEO Darren Woods announced that the company is ‘actively pursuing business in new green energy sector.’ This declaration is backed by the recent acquisition by ExxonMobil of the lithium mine — which is part of the Smackover formation — in Arkansas for USD 100 million.

In October 2023, Standard Lithium reported that its drilling hit ‘significant concentrations amounts of high-grade lithium brine.’ The concentration level was measured at 806 mg/L, setting a new record for North America.

Southwest Arkansas and Northeast Texas are adjacent to each other. Based on these discoveries, the region is poised to become the ‘Ground Zero’ for lithium production in the USA. Given the excitement around lithium, Texas is turning out to be focal point of the new ‘Gold Rush’ in the 21st century.

In October 2024, the United States Geological Survey (USGS) released its latest study which estimates that the Texas-Arkansas border region may contain between 5 to 19 million tonnes of lithium. If proven and produced, the amount would be equivalent to nine times the projected global demand for lithium through the year 2030.

Already, International Battery Metals announced its first operational lithium mine using DLE back in July 2024. ExxonMobil has also already entered into an offtake agreement with SK On, a South Korean manufacturer of lithium-based batteries for electric vehicles.

It seems abundantly clear that there is a potential for the Smackover lithium vein to play a key role in realizing the objective of the US to diversify and derisk the supply chains for #CriticalMinerals in the broader context of the cut-throat race to dominate the global #EV market.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://oilprice.com/Energy/Energy-Gene ... rough.htmlChina Becomes Global Lithium Powerhouse After Major Breakthrough

By Alex Kimani - Jan 09, 2025

China is now home to the world’s second-largest lithium reserves, behind only Chile, thanks to a spate of big discoveries. According to the China Geological Survey, China's breakthrough in lithium exploration has boosted its global share of lithium reserves from 6% in 2020 to 16.5% currently, placing it ahead of Australia, Argentina and Bolivia. Since 2021, the country has stepped up efforts in lithium exploration, helping to uncover 30 million metric tons of new lithium ore in places such as Sichuan, Qinghai and Jiangxi provinces.

China has identified more than 14 million tons of lithium in salt lakes, making it the world's third-largest salt lake lithium resource hub. Further, the China Geological Survey says that a technological breakthrough in extracting lithium from lepidolite will help unlock the 10 million tons of newly discovered lithium resources that can be extracted at a lower cost and higher utilization efficiency.

Thankfully, traders will have little trouble partaking in China’s burgeoning lithium sector: In 2023, China’s Guangzhou Futures Exchange launched its first-ever lithium carbonate futures contracts, making it the fourth exchange worldwide to offer such contracts. The introduction of these trading instruments is intended to stabilize prices of raw materials to promote the EV industry's sustainable development. In that short period of time, Guangzhou Futures Exchange's new lithium carbonate business gained more market activity than competitors such as the London Metal Exchange and Singapore Exchange, thanks to China’s dominance in the global lithium supply chain. Maybe that was not too surprising considering that China is the largest lithium consumer in the world.

China’s lithium discoveries come at a perfect time when its electric vehicle sector is really taking off considering that lithium is a key component of batteries that power electric vehicles as well as a plethora of consumer electronic devices. China’s 10 millionth EV rolled off the production line in October, beating the 2023 production seven weeks before the year’s end amid growing worries of overcapacity. Chinese EV makers delivered 9.75 million units to mainland buyers between January and October, good for a robust 34% Y/Y increase. Helped by government subsidies of up to $2,800 apiece for trading in older cars for EVs as well as more fuel-efficient cars, China Passenger Car Association (CPCA) secretary-general Cui Dongshu has predicted that China’s EV revolution will continue undeterred by a faltering economy. Sales of new energy vehicles (NEVs) in China overtook conventional auto sales for the first time ever in July, and now account for more than half of all units sold during the month.

“As EVs outsell conventional petrol cars, more existing production facilities and workers will become redundant. Demand for petrol cars will weaken in the coming years,” Phate Zhang, founder of Shanghai-based EV data provider CnEVPost, told South China Morning Post

.......................

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Suite de ce post du 20 oct 2024 : viewtopic.php?p=2400697#p2400697

Les tazus ont pleins de pétrole et gaz, et aussi plein de Lithium :

Les tazus ont pleins de pétrole et gaz, et aussi plein de Lithium :

https://www.mining-technology.com/news/ ... t/?cf-viewLithium Americas reports larger reserves at Thacker Pass project in Nevada

The project economics for an 85-year life of mine and an optimised production scenario for the first 25 years have also been outlined.

January 8, 2025

Lithium Americas has announced an increased mineral resource and reserve estimate for the Thacker Pass lithium project in Humboldt County, Nevada.

This development includes the release of an independent National Instrument 43-101 (NI 43-101) technical report and an independent S-K 1300 technical report, both dated effective on 31 December 2024.

The project is indirectly owned by Lithium Nevada Ventures, a joint venture where Lithium Americas holds a 62% stake and General Motors Holdings 38%.

The highlights of the updated estimates include a proven and probable (P&P) mineral reserve of 14.3 million tonnes (mt) of lithium carbonate equivalent (LCE) at an average grade of 2,540 parts per million (ppm) lithium (Li).

This represents an increase of 286% since the November 2022 feasibility study and supports an expansion of up to five phases.

The measured and indicated (M&I) mineral resource estimate stands at 44.5mt of LCE at an average grade of 2,230ppm of Li, reflecting a 177% increase since the previous study.

The project economics for an 85-year life of mine and an optimised production scenario for the first 25 years have also been outlined.

Lithium Americas president and CEO Jonathan Evans said: “We are excited to release the results of our Thacker Pass Technical Report that demonstrates the multigenerational opportunity for transformational growth the project creates.

“Thacker Pass is now the largest measured lithium reserve and resource in the world and has the potential to become an unmatched district, generating American jobs and helping the US regain independence of its energy supply. We are committed to safely and sustainably developing Thacker Pass while engaging with our stakeholders to increase domestic production of critical minerals.”

Capital cost estimates for phase one are $2.93bn, while phase two is estimated at $2.33bn, phase three at $2.74bn, and phases four and five together at $4.32bn. These estimates are based on costs from the second quarter of 2024 and include a 15% contingency.

Phase one is targeted for completion in late 2027, with the company aiming to announce the final investment decision for this phase in early 2025.

Bechtel has been appointed as the engineering, procurement and construction management contractor for phase one.

Construction of phase one commenced in early 2023, and the company has issued limited full notice to proceed to Bechtel and other major contractors to mitigate risks in the construction schedule, continuing to target completion in late 2027.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 29 oct 2023 viewtopic.php?p=2379128#p2379128

https://www.mining.com/web/zijin-expect ... r-of-2026/Zijin plans lithium production in Congo from 2026

Bloomberg News | January 7, 2025

China’s Zijin Mining Group Co. aims to start producing lithium in the Democratic Republic of Congo early next year from one of the world’s largest deposits of the battery metal.

Zijin is accelerating activity at a site in southeast Congo that’s still claimed by AVZ Minerals Ltd. The Australian firm has initiated arbitration proceedings against the African nation’s government as part of its efforts to recover an exploration license.

The Manono project is expected to start production during the first quarter of 2026, a Zijin spokesperson said by email. That would make it the first operating lithium mine in Congo, the world’s second-largest copper producer and biggest source of cobalt.

Chinese companies including Zijin are investing heavily in Africa’s lithium resources from Mali to Zimbabwe, even after prices slumped almost 90% from a peak in 2022. They are seeking to lock down feedstock for refineries at home in anticipation of soaring future consumption of the metal.

While the current supply glut will likely continue in the short term, there is still “room for demand from the global new energy vehicle and energy storage industries” over a longer horizon, Zijin said in September. The company’s other lithium projects are in China and Argentina.

Zijin – which has copper, gold, lithium and zinc mines across five continents – is developing Manono in a joint venture with the Congolese state and was granted a full mining license four months ago. The asset is “sizable,” with an average grade of 1.51% lithium oxide, the spokesperson said.

Legal dispute

Explorer AVZ has said the wider area is “the world’s largest hard rock lithium deposit.”

Perth-based AVZ has accused Congo of acting illegally by taking over its whole permit and then awarding the northern portion to a unit of Zijin in September 2023. AVZ said arbitration tribunals have ordered Zijin’s state-owned partner to halt any move to develop the contested permit area until they hear the cases. The government is “in blatant violation of several injunctions,” an AVZ spokesperson said by email.

AVZ said last month that the Australian Federal Police searched its premises concerning allegations of bribery related to the Manono lithium project. The company has denied any wrongdoing.

A 2020 study by AVZ – which aspired to develop the entire Manono deposit – envisaged building a lithium mine that would be eclipsed by only a few giant projects in No. 1 producer Australia, such as Albemarle Corp.’s Greenbushes, and the recently opened Goulamina in Mali, said Thomas Matthews, battery materials analyst at CRU Group.

Previous studies indicate Manono should be profitable even at current weak prices, he said.

Zijin is “in full compliance” with all legal and regulatory requirements in Congo, the spokesperson said. “We are very pleased to have received the Manono exploitation permit and our priority now is to proceed with developing it,” the spokesperson said.

The Chinese company declined to say what output level it’s targeting, but intends to commission the processing plant in phases. While the joint venture will begin by manufacturing and exporting lithium concentrate and sulfate, Zijin will consider doing additional refining in Manono when there’s a reliable power supply, the spokesperson said. A subsidiary has already rehabilitated a nearby hydroelectric facility.

Zijin also has interests in two copper mines in Congo, including a 39.6% stake in the giant Kamoa-Kakula complex, which is a partnership with Ivanhoe Mines Ltd.

Congo’s mines ministry didn’t respond to questions sent by Bloomberg, while Cominiere – which owns 39% of Zijin’s Manono project – declined to comment.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 28 janvier 2024 viewtopic.php?p=2384268#p2384268

https://www.nsenergybusiness.com/news/a ... 25m-award/Arkansas Lithium project finalised $225m award

The project’s design is being updated from its original Preliminary Feasibility Study

Refna Tharayil 17th Jan 2025

he U.S. Department of Energy (DOE) finalized the Standard Lithium and Equinor USD 225 million grant for the South West Arkansas (SWA) lithium project.

In May 2024, Equinor entered a strategic partnership with Standard Lithium acquiring a 45% share in two lithium companies in Southwest Arkansas and East Texas.

USD 225 million funding from the DOE’s Office of Manufacturing and Energy Supply Chains will support construction of a processing facility for the SWA project, which in Phase 1 is targeting an annual production of 22,500 tonnes of lithium carbonate for use in battery production.

“The U.S. Department of Energy’s support demonstrates the project’s maturity and strengthens its financial robustness as we work towards a final investment decision. We look forward to working with Standard Lithium and alongside the local community to enhance the US lithium supply chain by deploying innovative technology,” says Hege Skryseth,executive vice president for Technology, Digital & Innovation in Equinor.

Lithium is an essential mineral and is required to meet the projected growth in electric vehicles and broader battery energy storage. Direct Lithium Extraction (DLE) is a method of producing lithium from lithium-rich saltwater typically from deep underground reservoirs which cannot be used for drinking or agriculture purposes.

The project’s design is being updated from its original Preliminary Feasibility Study (PFS). The target is now a larger total output of 45,000 tonnes per annum of lithium carbonate, to be developed in two phases of 22,500 tonnes each. A Definitive Feasibility Study (DFS) and Front-End Engineering Design (FEED) study are currently underway to mature the project towards a final investment decision (FID).

The SWA project’s facilities are planned to be located in Lafayette County, approximately 7 miles south of Lewisville, Arkansas and the brine unit that will source lithium-bearing brine for the project facilities spans Lafayette and Columbia counties. Pending a positive investment decision, the project is expected to create up to 300 construction and 100 direct jobs. The project could further benefit the local community through infrastructure improvements, healthcare initiatives, educational partnerships, and workforce development programs.

- energy_isere

- Modérateur

- Messages : 103056

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 27 nov 2024 viewtopic.php?p=2403097#p2403097

https://www.pv-magazine.com/2025/01/16/ ... companies/Bolivia’s YLB signs lithium deals with Russian, Chinese companies

The agreements provide for the installation of carbonate industrial plants in the department of Potosí, which will receive royalties and investments of around $2 billion.

January 16, 2025 Luis Ini

State-owned Bolivian company Yacimientos de Litio Bolivianos (YLB) has announced the signing of two contracts with Russia's Uranium One Group and China's CBC for the establishment of lithium carbonate industrial plants in the department of Potosí.

Confirming the agreements, YLB CEO Omar Alarcón said in a statement that they guaranteed royalties for the department of Potosí, He added that the contracts would likely be adjusted “when the Plurinational Legislative Assembly approves the Lithium and Evaporite Resources Law.”

Bolivia's Ministry of Hydrocarbons and Energy (MHE) said that Uranium One and CBC would “invest more than $2 billion, covering 100% of the construction cost and assuming full financial risk,” as per the contracts.

The industrial plants will be located south of the Salar de Uyuni salt flat and use the Direct Lithium Extraction (DLE) method, “which allows for the recovery of more than 80% of the available lithium, consumes less water and energy, and is much more efficient compared to the traditional evaporation pool method, whose yield does not exceed 30%,” the MHE added.

The contract between YLB and Uranium One provides for the implementation of an industrial plant for the production of 14,000 metric tons per year of lithium carbonate in three phases, with an investment of more than $975 million.

As part of its deal, CBC will invest $1.03 billion for the implementation of two industrial plants, each in two phases, one with a capacity of 25,000 metric tons per year and another of 10,000 metric tons per year.