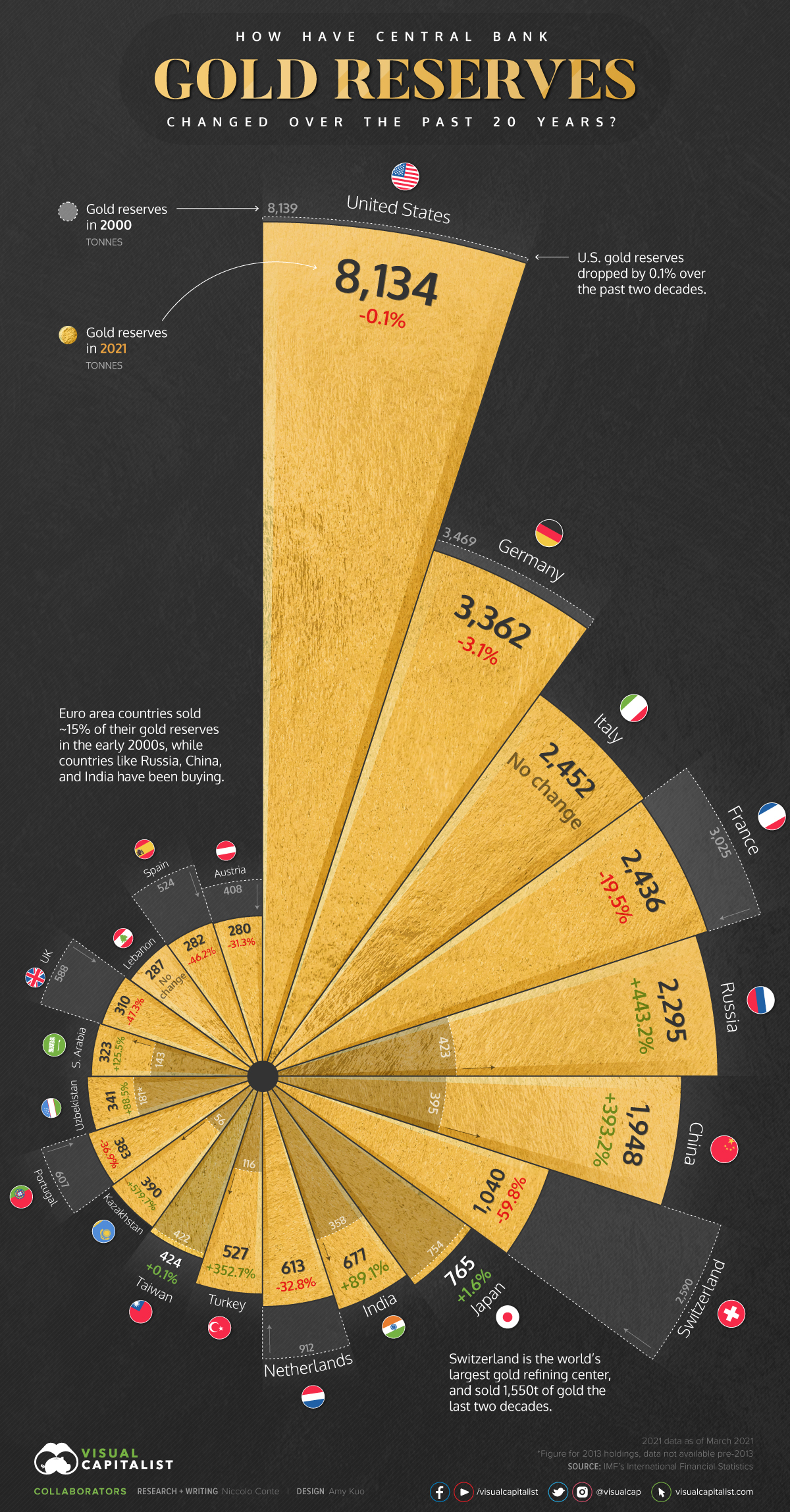

https://www.mining.com/web/visualizing- ... e-changes/Visualizing two decades of Central Bank gold reserve changes

Nicollo Conte - Visual Capitalist | May 5, 2021 |

Modérateurs : Rod, Modérateurs

https://www.mining.com/web/visualizing- ... e-changes/Visualizing two decades of Central Bank gold reserve changes

Nicollo Conte - Visual Capitalist | May 5, 2021 |

https://www.mining.com/web/brazil-to-de ... ld-miners/Brazil to deploy special force to protect the Yanomami from wildcat gold miners

Reuters | June 14, 2021 | 11:15 am News Latin America Gold

The Brazilian government on Monday authorized the employment of the National Security Force (FNS) to protect the Yanomami indigenous people and their reservation lands for 90 days in the northern state of Roraima bordering Venezuela.

The measure by the Justice Ministry published in the official gazette follows increasing attacks with firearms by illegal wildcat gold miners who have invaded Yanomami lands on Brazil’s largest reservation.

More than 20,000 miners are illegally prospecting on the reservation and polluting rivers with mercury used to separate gold from ore.

Since the beginning of the year, there have been at least eight attacks by miners on Yanomami communities.

.......

https://www.agenceecofin.com/dossier/25 ... r-aurifereLe Soudan met le cap sur l’industrialisation du secteur aurifère

Agence Ecofin 25 juin 2021

Depuis deux ans et la chute du président Omar el-Béchir, le Soudan revient lentement mais sûrement dans le « concert des nations ». À la faveur de ce renouveau, les investisseurs qui ont longtemps boudé le pays à cause des sanctions internationales et des violences, font aussi leur retour. À cet égard, le secteur minier, avec l’or en tête de pont, peut devenir l’un des principaux bénéficiaires de ce regain d’intérêt et permettre au pays d’amorcer enfin l’exploitation industrielle durable et à grande échelle de ses ressources minérales. Explications.

Un secteur aurifère largement artisanal

L’or est la principale richesse minérale exploitée au Soudan. Avec plus de 76 tonnes extraites en 2019 selon les données du World Gold Council, le pays représente d’ailleurs le troisième producteur africain du métal jaune, devancé par le Ghana et l’Afrique du Sud, mais devant d’autres producteurs importants comme le Mali ou la Tanzanie.

Le Soudan compte plus d’un million d’artisans miniers.

Si tous ces pays hébergent de grandes compagnies minières étrangères sur leur territoire, le Soudan compte principalement sur son secteur artisanal pour s’imposer. D’après les autorités, plus d’un million d’orpailleurs et de petits mineurs étaient actifs dans le secteur en 2017. Ils participent à maintenir l’économie à flot puisque l’or a représenté, avec 1,2 milliard $ de recettes, la principale source de revenus en 2018.

......................

https://www.mining.com/how-a-gold-stibn ... ply-chain/How a gold-stibnite restoration in Idaho could add antimony to US supply chain

Amanda Stutt | June 25, 2021

Perpetua Resources is expected to be included in the Russell 2000 Index after the US market opens on Monday June 28, one of the most widely cited performance benchmarks for emerging US companies.

Known as Midas Gold until February this year, the company moved its headquarters from Vancouver to Boise, Idaho, where it is restoring the historic brownfield site of its Stibnite Gold project.

The results of an independent feasibility study released last year envision the project becoming one of the largest and highest-grade open-pit gold mines in the United States with over 4 million ounces of gold in reserve —and the country’s only primary producer of antimony, a critical and strategic mineral.

..................

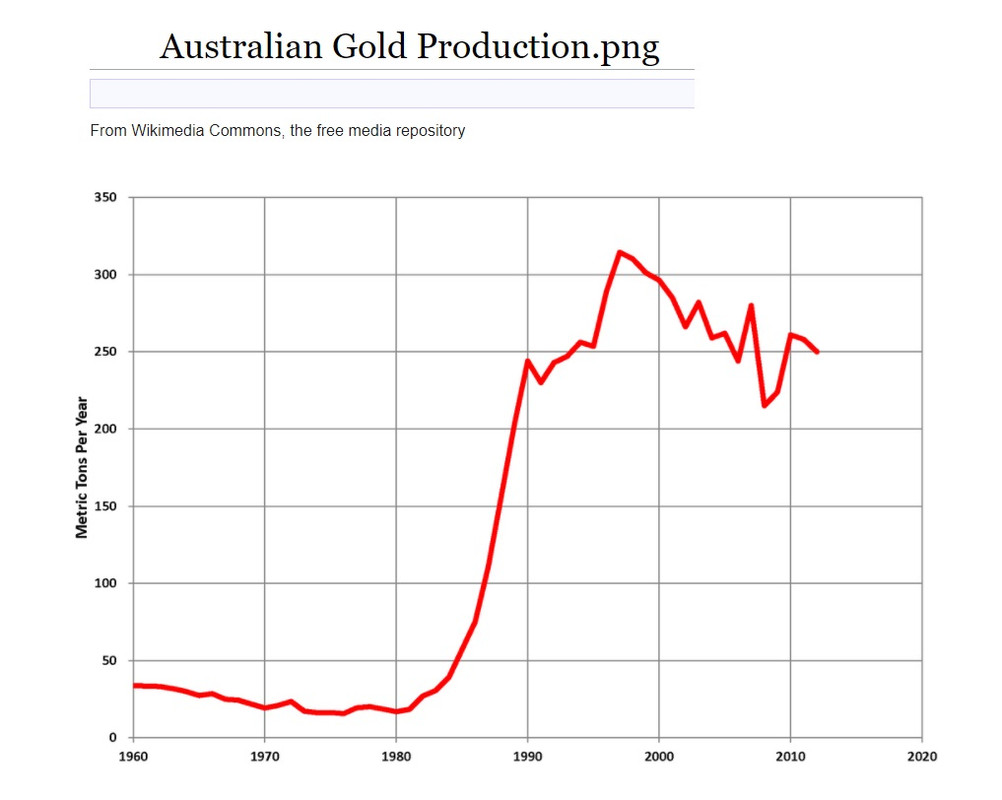

Historique pour L' Australie : la production décolle dans la décennie 80' et est multipliée par 10 !

https://www.mining.com/argonauts-magino ... outh-zone/Argonaut Gold (TSX: AR) has announced high grade results from the ongoing 25,000-metre drill program at its Magino gold project in Ontario. The drill program is taking place as construction of an open-pit mine at Magino advances toward expected first production in 2023.

...................

Magino gold property. Credit: Argonaut Gold

https://www.agenceecofin.com/or/1607-90 ... 0-millionsGhana : les dirigeants de Newmont approuvent le développement d’un projet aurifère de 850 millions $

Agence Ecofin 16 juillet 2021

Au Ghana, la contribution des mines à l’économie a chuté en 2020 en raison d’une contre-performance du secteur de l’or. Toutefois, pas de quoi s’inquiéter pour les autorités, car de nouvelles mines vont entrer en production dans le pays dans quelques années.

Le Conseil d’administration de la compagnie minière Newmont a donné son feu vert pour le développement de projet aurifère Ahafo North, au Ghana. Considéré par la société comme le « meilleur gisement aurifère non exploité » en Afrique de l’Ouest, le projet va nécessiter un investissement de 750 à 850 millions $.

« Je suis heureux d’annoncer l’approbation du financement complet du projet Ahafo North, qui élargit notre présence actuelle au Ghana et ajoute plus de trois millions d’onces d’or à la production sur une durée de vie initiale de 13 ans », a déclaré le 15 juillet, Tom Palmer, président et PDG de Newmont.

Situé à environ 30 km au nord des opérations existantes de la compagnie au Ghana, le projet Ahafo permettra de produire sur les cinq premières années d’exploitation une moyenne annuelle d’environ 275 000 à 325 000 onces d’or à un coût global de 600 à 700 dollars l’once. La construction devrait être terminée au deuxième semestre 2023. Le projet permettra de créer, apprend-on, 1 800 emplois au pic de la phase de construction et 550 emplois permanents.

Pour le Ghana, actuel leader de la production d’or en Afrique, c’est une source supplémentaire de revenus qui s’ajoute à sa base de mines. Le projet lui permettra d’augmenter ses volumes de production et de se maintenir durablement à la tête des plus grands producteurs du métal précieux du continent. Pour rappel, le pays a produit l’année dernière 4,02 millions d’onces (114 t), en baisse de 12,1 % par rapport à 2019, ce qui a réduit à 7,5 % la contribution du secteur minier au PIB, contre 8,6 % en 2019.

https://www.mining.com/bc-approves-earl ... lackwater/BC approves early construction at Artemis Gold’s Blackwater

Canadian Mining Journal Staff | July 15, 2021

British Columbia has granted a permit for early construction work at the Blackwater gold project belonging to Artemis Gold (TSXV: ARTG). This is the first step in construction of a mine, allowing for site preparations and land cleaning at the site 150 km southwest of Prince George, BC.

Blackwater is estimated to be the largest gold mine development in the Cariboo region of BC in the last decade, supporting regional employment over 25 years, including the construction period, with the potential for that to be extended through further exploration.

SIGN UP FOR THE PRECIOUS METALS DIGEST

Blackwater is to be connected to the BC Hydro grid, which is powered by hydro-electricity providing it with a sustainable source of low-carbon power, with the potential to produce gold and silver with one of the lowest GHG emissions from an open pit in the world.

The project will be developed in phases as an open pit and carbon-in-pulp processing plant. Initial capital requirements will be C$592 million ($470m) for phase one with a mill capacity of 5.5 million t/y and an annual output of 248,000 oz. of gold. Over the 23-year life of the mine, throughput will be increased to 20 million t/y with two further expansion phases.

The Blackwater gold project has an after-tax net present value (5% discount) of C$2.2 billion ($1.75bn), an internal rate of return of 35%, and a payback period of 2 years.

The deposit is estimated to contain 251 million measured and indicated tonnes grading 1.04 g/t gold and 8.3 g/t silver for 8.4 million oz. gold and 68 million oz. silver. The inferred estimate is 5.6 million tonnes at 0.79 g/t gold and 26 g/t silver, containing 142,000 oz. gold and 4.6 million oz. silver. These numbers reflect a 0.5 g/t gold cut-off.

https://www.mining.com/scientists-propo ... n-process/Scientists propose new ‘salty,’ non-toxic gold extraction process

Valentina Ruiz Leotaud | October 16, 2021

Researchers at Finland’s Aalto University published a paper in the journal Chemical Engineering where they describe a new scalable, non-toxic alternative to cyanide for gold extraction from ore.

The new process is based on the use of chloride, one of two elements in table salt, for the leaching and recovery of the yellow metal.

“With our process, the amount of gold we’ve been able to recover using chloride is as high as 84%,” Ivan Korolev, lead author of the study, said in a media statement. “In comparison, using the standard cyanide process with the same ore yielded only 64% in our control experiment.”

The novel approach is called electrodeposition-redox replacement (EDRR) and it combines electrolysis, which uses electric currents to reduce gold or other metals present in the leaching solution, and cementation, which adds particles of other metals to the solution to react with the gold.

Using copper to test it out, Korolev and his colleagues applied short pulses of electricity to create thin layers of metal on the electrode and cause a reaction that encourages gold to replace the copper layer by layer.

“The method has low energy consumption and doesn’t require the addition of any other elements,” the researcher said.

The lab work was conducted in collaboration with Finnish mining-technology giant Metso Outotec, which invited the scientists to work at its research center in western Finland.

“Collaborating with Metso Outotec allowed us to develop the method in a way that’s much closer to real-world implementation,” Korolev said. “We started with about 9% recovery, but it then grew to 25%, and soon we were hitting 70% — sometimes we even achieved close to 95%.”

According to the doctoral candidate, it is the first time that an experiment like this is conducted in a large-scale setting. Given the positive results, he expects to see mining companies interested in the technology and willing to test with their own ore on site.

“The extraction methods of the past have always left some valuable metals behind. Now, as demand for metals grows all the time, even these small amounts are important,” he said. “I think we can still increase the yield with our EDRR technology. Perhaps we cannot reach 100%, but I believe we can hit the 90% mark or more.”

https://www.nsenergybusiness.com/news/e ... ion-start/#Equinox launches full-scale construction on $1.2bn Greenstone gold mine

Over its initial 14-year mine life, the Canadian gold mine is estimated to produce more than five million ounces of gold

By NS Energy Staff Writer 28 Oct 2021

Equinox Gold and its partner Orion Mine Finance Group have launched the full-scale construction on its Greenstone gold mine in Ontario, Canada with an aim to achieve first gold pour in the first half of 2024.

Located in the Geraldton-Beardmore Greenstone Belt, the gold mine will see an initial capital cost of $1.22bn. This includes $125m for the mining fleet and $80m for water and tailings management.

According to Equinox Gold, early works at the Greenstone gold mine have been going on since March 2021. The gold project is expected to see nearly two years of construction and six months of commissioning.

The partners will also spend $121m towards pre-production, start-up, and commissioning along with $62m investment in a 46.5MW power plant and others.

Mining is targeted to begin in the fourth quarter of 2022, said Equinox Gold, which holds a stake of 60%. Its partner Orion Mine Finance Group holds the remaining stake of 40%.

Expected to become one of the largest gold mines in Canada, Greenstone is targeted to produce over 400,000 ounces of gold annually for the first five years. The mine has proven and probable mineral reserves of 5.54 million ounces grading 1.27gms per tonne gold.

Over its initial 14-year mine life, the Canadian mine is estimated to yield more than five million ounces of gold with an average of over 360,000 ounces per year.

The mine is situated in the Municipality of Greenstone, 4km south of Geraldton and nearly 275km northeast of Thunder Bay. Located in a district having active mines, the Greenstone gold project is said to have good access to transportation as well as mining-related infrastructure.

Equinox Gold CEO Christian Milau said: “Equinox Gold continues to focus on its strategy of sector-leading growth, launching Greenstone Mine development as construction at our Santa Luz mine in Brazil is nearing completion.

“Greenstone Mine is located in one of the world’s best mining jurisdictions and will be a top-tier mine, producing more than 400,000 ounces of gold per year at all-in-sustaining costs in the lowest quartile of the industry. Greenstone Mine will be a cornerstone asset for Equinox Gold and a transformative project for Northern Ontario.”

Construction on the Greenstone gold mine will involve 800 local and 1,300 regional jobs followed by 500 jobs during operations.

https://www.nsenergybusiness.com/news/r ... d-project/Russia’s Polymetal approves $447m investment in Veduga gold project

By NS Energy Staff Writer 09 Nov 2021

The project is expected to see first production in the second quarter of 2025

Russian mining company Polymetal has approved $ 447m investment to go ahead with the development of the Veduga gold project.

Located in a prolific Northern Yenisey gold belt in the Krasnoyarsk Region, the top gold producing region of Russia, Veduga is a high-grade refractory gold deposit that was discovered in 1977.

It contains four licence plots with the total area of 18km2.

Polymetal group CEO Vitaly Nesis said: “The large high-grade reserve base, robust economics, and clear execution path to significant cash flows underpinned the Board’s decision to approve Veduga.

“The management is currently planning a full consolidation of the asset in H1 2022.”

As of 1 February 2021, the updated ore reserve estimate for the deposit comprised of 31.9Mt of ore with an average gold grade of 3.9 g/t containing 4.0Moz of gold.

The Veduga mine plan assumes 10 years of conventional open-pit mining until 2031 and 12 years of underground mining using a skip shaft for hauling from 2030 to 2041.

With construction planned to begin in the third quarter of 2022, the project is expected to see first production in the second quarter of 2025.

.................