il vient d'arriver.

le pdf de 109 pages : https://www.bp.com/content/dam/bp/busin ... k-2022.pdf

ah ben mince, il ya plus les grands tableaux de réserves et production de pétrole gaz et charbon des différents pays.

https://oilprice.com/Energy/Crude-Oil/H ... emand.htmlIn its Energy Outlook 2022 edition, BP has revised down its forecast for global economic growth saying global GDP will only contract 1.5% by 2025 from 2019 levels compared to its earlier projection of a 2.5% contraction.

BP notes that its former grim outlook was prepared prior to the Russian invasion of Ukraine-- another black swan event--which has driven global energy prices higher and cast an uncertain shadow over Russia's oil and gas sector in recent months.

The Scenarios

In its latest report, BP offers three scenarios--all foresee oil demand surpassing pre-pandemic levels by the middle of this decade before beginning to slip to varying degrees.

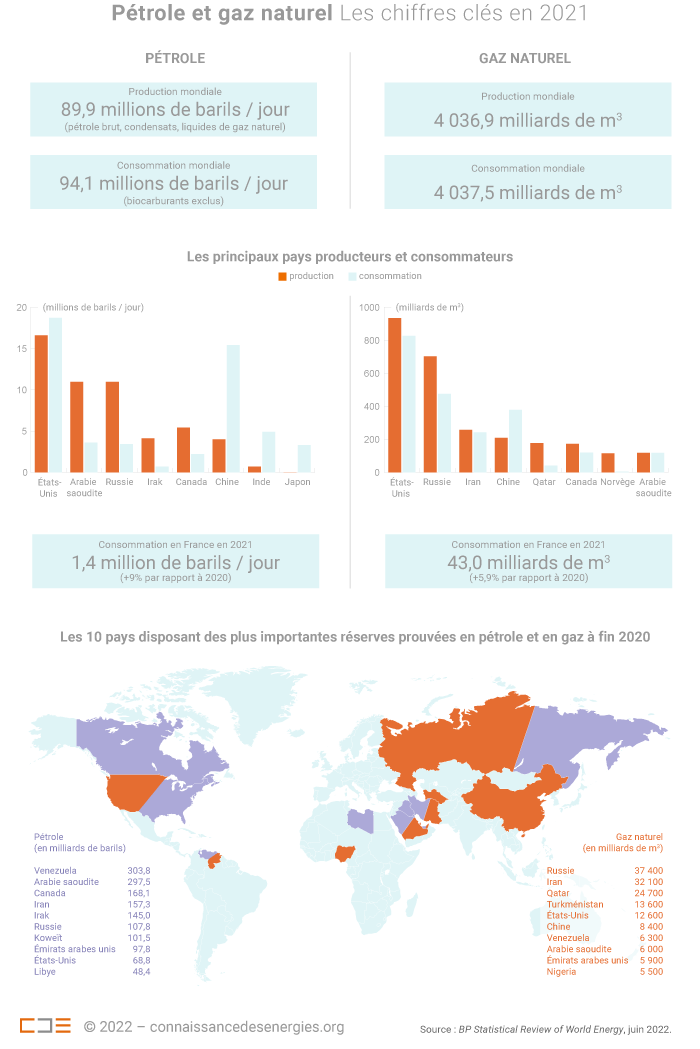

In the most bullish case for oil, BP projects that crude demand will rise to 101 million b/d in 2025 and remain flat into 2030. After that point, global demand retreats to 98 million b/d by 2035 and to 92 million b/d by 2040.

In yet another scenario that BP has termed "net-zero," which is the most aggressive in terms of global climate ambitions being achieved, the company pegs 2025 demand at 98 million b/d and just 75 million b/d by 2035. BP assumes that a 95% reduction in greenhouse-gas (GHG) emissions must be achieved for the net-zero predictions to come true.

In the middle-of-the-road scenario, BP assumes that the world will still be broadly in-line with climate goals but with a 75% reduction in GHG emissions by 2025. This picture of the future suggests that oil demand will be around 96 million b/d in 2025 and 85 million b/d by 2035.

However, recent events in the energy sector suggest that oil companies might get a leeway to grow production and even relax climate goals as long as oil and gas prices remain high.