https://www.mining.com/web/teck-resourc ... 2-billion/Teck Resources may raise value of Zafranal copper project in Peru to over $2 billion

Reuters | September 28, 2022

Canada’s Teck Resources is considering revising the value of its Zafranal copper project in Peru to more than $2 billion from $1.3 billion, one of its executives said Wednesday.

The initial value of the project was set in 2019, when copper prices were below their current levels, the general manager of Zafranal Mining Co, Mario Baeza, said at a conference on Peru’s mining industry.

“We are updating capex and project numbers,” Baeza said, adding that the value of the project could be raised to “more than $2 billion.”

Teck Resources owns an 80% stake in Zafranal and Japanese firm Mitsubishi Materials Corp holds the remaining 20%.

The project is waiting on approval of an environmental study.

Baeza said he expects the Peruvian government to approve the environmental impact study by the end of 2022 or “at the latest” in the first quarter of next year.

Construction could start at the end of 2024 and would take three years, he added.

The facility is expected to produce at least 1.5 million tonnes of copper over about 19 years, Baeza said.

Le Cuivre

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Un prospect de cuivre au Pérou : le projet Zafranal

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 9 juillet 2022 viewtopic.php?p=2346825#p2346825

https://www.agenceecofin.com/cuivre/051 ... moa-kakulaRDC : Ivanhoe enregistre un nouveau record de production de cuivre à Kamoa-Kakula

Agence Ecofin 5 oct 2022

Depuis son entrée en production en mai 2021, les livraisons de cuivre du complexe Kamoa-Kakula sont sur une pente ascendante. Le maintien de ce rythme pour les trois derniers mois de 2022 permettrait d’atteindre la limite supérieure des prévisions annuelles, soit 340 000 tonnes.

Au troisième trimestre 2022, le complexe de cuivre Kamoa-Kakula a livré 97 820 tonnes, ce qui constitue un nouveau record trimestriel. C’est ce qu’a annoncé le canadien Ivanhoe Mines, opérateur du projet, dans une mise à jour publiée le mercredi 5 octobre.

Cette performance porte à plus de 240 000 tonnes la production de cuivre depuis le début de l’année, ce qui place la société en bonne position pour se rapprocher de la limite supérieure de ses prévisions annuelles (290-340 000 tonnes).

« Kamoa-Kakula a véritablement doublé son taux de production de cuivre à environ 400 000 tonnes par an depuis le premier trimestre, et devrait produire à un taux annualisé de 450 000 tonnes par an d’ici le deuxième trimestre de 2023 », a ajouté Robert Friedland, fondateur et co-président exécutif d’Ivanhoe Mines.

Pour rappel, la production d’Ivanhoe Mines a atteint 143 000 tonnes au premier trimestre, soit 12 % de la production congolaise de cuivre sur la période. Selon les données de la Cellule technique de coordination et de planification minière, les mines du pays ont en effet livré 1,14 million de tonnes de cuivre pour les six premiers mois de l’année.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 14 aout 2022 viewtopic.php?p=2349249#p2349249

Le sinkhole a endommagé un aquifère. La compagnie manière va avoir de gros soucis avec le gouvernement Chilien.

Le sinkhole a endommagé un aquifère. La compagnie manière va avoir de gros soucis avec le gouvernement Chilien.

https://www.mining.com/web/chile-perman ... -sinkhole/Chile permanently closes mining areas connected to giant sinkhole

Reuters | October 7, 2022

Chile’s mining minister announced on Friday the permanent closure of mining stopes directly related to a giant sinkhole that appeared in the northern part of the country in July.

Mining minister Marcela Hernando made the announcement after meeting with union members, mine workers and technical experts studying the sinkhole

“The sector of the Gaby stopes, that are directly related to the subsidence, are closed definitively and will never be exploited again,” Hernando said, referring to the Alcaparrosa copper mine in northern Chile.

The minister added that the government is working on recovering water from an aquifer that was damaged by the sinkhole.

“We’re interested in recovering 1.3 million cubic meters of water that are currently stagnant in the depth,” Hernando said. “Our intention is to return them to the aquifer, for which we’re studying multiple alternatives.”

Chile’s SMA environmental regulator announced the charges against the Canadian-owned Lundin Mining Corp’s copper mine on Thursday for the sinkhole.

SMA filed a charge labeled as “very serious” for “irreparable environmental damage” to the aquifer, in addition to a “serious” charge for overextraction and two minor ones related to transporting minerals.

The government said it was planning to reopen parts of the mine where conditions allowed to avoid the loss of jobs.

Canada’s Lundin Mining Corp owns 80% of the property, while the remaining 20% is held by Japan’s Sumitomo Metal Mining and Sumitomo Corp.

The company could face closure, have its environmental permit revoked or be fined the equivalent of $13 million or more.

In mid-August, the SMA ordered “urgent and transitory” measures while investigating the causes of the 36.5-meter-diameter (120-foot-diameter) hole in Tierra Amarilla, some 665 km (413 miles) north of the capital.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Les mines de cuivre antiques de 1000 ans avant JC, en Israel dans leavallée du Timna avaient déjà fait des dommages à l'environnement, avec la pertes des acacias et ''white broom'' ( un cytisus) du coin

https://www.mining.com/biblical-copper- ... -this-day/Biblical copper mines’ environmental impacts last to this day

Valentina Ruiz Leotaud | October 2, 2022

Researchers from Tel Aviv University have discovered that the ancient copper industry at Timna was not managed in a sustainable manner, with overexploitation of local vegetation eventually leading to the disappearance of both the plants and the industry.

............................

In his view and that of his colleagues, this study indicates that 3,000 years ago humans caused severe environmental damage in the Timna Valley, which affects the area to this day.

“The damage was caused through overexploitation, especially of the acacia and white broom, which, as key species in the ecosystem of the Southern Arava, had supported many other species, stored water, and stabilized the soil. Their disappearance generated a domino effect of environmental damage, irreparably harming the entire area,” co-author Dafna Langgut said.

“Three thousand years later, the local environment still hasn’t recovered from the crisis. Some species, like the white broom, once prevalent in the Timna Valley, are now very rare, and others have disappeared forever.”

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.rfi.fr/fr/podcasts/chroniqu ... -le-cuivreRécession économique, la preuve par le cuivre

RFI le : 11/10/2022 Par : Marie-Pierre Olphand

Fidèle à sa réputation d'indicateur de l'économie, le cuivre témoigne de la récession qui se dessine chaque jour un peu plus, avec des cours qui sont à la baisse.

Le signal envoyé par le Dr Copper, comme le surnomment les anglophones, n’est pas bon. Avec des cours qui sont en recul, le cuivre apporte une preuve de plus de l’inquiétude qui pèse sur les marchés. Le marché du cuivre évolue au gré de son utilisation dans tous les pans de l’industrie, que ce soit l’électronique, la construction ou encore l’automobile. Or deux des trois moteurs de la croissance mondiale, la Chine et l’Europe sont en récession. En cause, la crise énergétique, doublée, pour l’Empire du Milieu, d’une politique « zéro Covid » instaurée par les autorités.

Or la Chine domine largement les activités de raffinage du cuivre, rappelle l’Ifpen, un institut de recherche français et est devenu à ce titre le premier importateur de ce minerai en provenance d’Amérique du Sud. Le moindre ralentissement de l’industrie chinoise, et donc des achats de la Chine, a inévitablement un impact sur les cours.

Exploitation minière en pleine expansion

L’érosion de la demande est aussi alimentée par la fermeté du dollar, car comme pour toutes les matières premières dont le prix est fixé dans la devise américaine, le minerai coûte plus cher aux acheteurs qui utilisent d’autres devises.

À la demande en berne, il faut ajouter une offre qui ne manque pas. « Contrairement aux idées reçues, l’exploitation minière est en expansion, et au rythme actuel, le cuivre s’oriente vers des années 2022 et 2023 excédentaires », explique Didier Julienne, président de la société Commodities and Resources.

À court terme, le marché reste baissier

La tendance peut-elle s’inverser rapidement ? « Le marché est tellement brouillé qu’il est impossible de savoir où il va », ajoute notre interlocuteur. Seule certitude, sur le court terme, le marché est orienté à la baisse avec des cours qui restent élevés, aux alentours de 7 500 dollars la tonne. La suite sera guidée par la politique chinoise et la durée de la guerre en Ukraine. À plus long terme, l’Ifpen rappelle que la transition bas-carbone, très gourmande en cuivre, fera grimper la demande.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Des attaques sur les trains qui transportent le Cuivre au Chili !

https://www.mining.com/web/a-jump-in-tr ... to-trucks/A jump in train heists has Chilean copper mines turning to trucks

Bloomberg News | October 11, 2022 |

Some of the biggest copper mines in the world are turning to different ways to get their metal to port after an increase in train robberies spurred the suspension of rail services in northern Chile.

BHP Group and Codelco said they have activated their respective contingency plans after rail operator FCAB halted services due to repeated thefts. While neither company gave details, trucking the metal would be the logical alternative.

Heists in the Atacama desert are nothing new — the police set up a special task force in 2018 to stop robbers who target trains that take the red metal from mines high in the Andes mountains to ports. But the suspension of services indicate thefts are on the rise as the economy slows and metal prices remain fairly high.

....................

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Wood Mackenzie voit un gros manque de capacité des mines de cuivre dans les 10 ans à venir.

lire https://www.mining.com/charts-almost-un ... ng-supply/“Almost unattainable” gap between green energy copper demand and mining supply

Staff Writer | October 20, 2022

A new report by Wood Mackenzie estimates that 9.7 million tonnes of new copper supply is needed over 10 years from projects that have not attracted sufficient investment, had not been approved by boards or received necessary government and environmental permits, to meet the targets set out in the Paris Climate Agreement.

To put that figure in perspective, 9.7mt is equivalent to nearly a third of current refined consumption, says Woodmac, a Verisk business (Nasdaq:VRSK). That is also the equivalent of putting a new La Escondida, the world’s largest copper mine by a country mile, into production each year.

Woodmac figures show despite historically strong copper prices, mining project approval rates have dwindled to cyclical lows. In the first half of 2022, the volume of committed copper projects totalled an average annual production of just 260,000 tonnes per year.

“Copper’s critical role in the energy transition is undisputed. It’s the significant pull on the metal’s existing and potential supplies, and the investment required that needs urgent attention,” said Nick Pickens, research director of copper markets at Wood Mackenzie.

.....................

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 22 janvier 2022 viewtopic.php?p=2335603#p2335603

First Quantum veut pousser la production de cuivre de Cobre Panama à 350-380 kt en 2023.

First Quantum veut pousser la production de cuivre de Cobre Panama à 350-380 kt en 2023.

https://www.mining.com/cobre-panama-new ... onth-govt/First Quantum wants to boost production 350,000 and 380,000 tonnes of copper next year, (at Cobre Panama) increasing to 370,000-400,000 tonnes in 2024, it said in February.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 24 juillet 2022 viewtopic.php?p=2347916#p2347916

https://www.mining.com/barrick-close-to ... -pakistan/Barrick closer to building $7bn copper project in Pakistan

Cecilia Jamasmie | October 17, 2022

Barrick Gold (TSX: ABX)(NYSE: GOLD) said on Monday it had achieve a significant legal milestone to proceed with the development of the giant Reko Diq copper-gold deposit in Pakistan, close to the borders of Iran and Afghanistan.

During a four-day visit to the country, president and chief executive Mark Bristow held discussions with several stakeholders, which finished with all the documents needed to start building Reko Diq being approved by the country’s president Arif Alvi.

Paperwork was filed on Saturday with the supreme court, Barrick said, adding that once that transaction is completed, the project will be owned 50% by Barrick, 25% by the province of Balochistan, where the asset is located, and 25% by major Pakistani state-owned enterprises (SOEs).

The Reko Diq project, which hosts one of the world’s largest undeveloped copper-gold deposits, has been on hold since 2011 due to a dispute over the legality of its licensing process.

Barrick solved the long-running dispute earlier this year, reaching a preliminary out-of-court deal that cleared the path for a final agreement on how to run the mine and profit-sharing arrangements.

The project is now seeking financing partners, with a target of 50% debt to total capitalization.

The company plans to deliver production as early as 2027-2028 from Phase 1 at a cost of around $4 billion, with Phase 2 to follow in five years and a cost of roughly $3 billion.

Two-phase development

The conceptual design calls for an open pit with a life of more than 40 years. It would be built in two phases, starting with a plant that will be able to process about 40 million tonnes of ore per annum, which could be doubled in five years.

The latest plan is double the annual throughput capacity and more than twice the investment estimated in an unpublished 2010 feasibility study.

During peak construction, the project is expected to employ 7,500 people and once in production it will create 4,000 long-term jobs during the expected 40-year life of the mine.

Some analysts believe that Pakistan’s lack of experience in mining and its political instability make this a risky deal.

Bristow, however, said in May that he had worked in challenging situations all his life and that he was “very comfortable” with the project. He added that this was the “perfect opportunity for the mining industry to demonstrate what it can bring to an economy” of a region that has been “neglected” and struggles to get access to potable water.

Barrick is setting up community development committees (CDCs) to identify priority projects and supervise their implementation.

“Our CDC model provides a transparent and accountable mechanism for tailoring development programmes to the needs of these communities with their full participation,” Bristow said on Monday.

Barrick also said it was donating an additional $150,000 to the Balochistan flood relief fund, bringing the its total contribution to $300,000.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 25 aout 2019 viewtopic.php?p=2286702#p2286702

le prospect de cuivre + molybdène de Vizcachitas (Chili) toujours en prospection (forages).

le prospect de cuivre + molybdène de Vizcachitas (Chili) toujours en prospection (forages).

https://www.mining.com/los-andes-copper ... -says-ceo/Los Andes Copper on track to deliver Vizcachitas feasibility by year-end, says CEO

Henry Lazenby | October 20, 2022

Los Andes Copper is eager to restart drilling at the flagship Vizcachitas porphyry copper-molybdenum deposit in Chile while it works in parallel to publish a pre-feasibility study on the project before year-end.

“General engineering work, infrastructure planning, plant design and environmental considerations are all on track with the plan to complete the (prefeasibility) in the fourth quarter,” CEO Michael Jones told The Northern Miner.

“The successful drilling completed in 2022 has been incorporated into the resource model, and opportunities to increase the potential project mining rate are being assessed,” Jones said in an interview.

Jones says the company is currently mobilizing drill teams after a July environmental court decision reinstating the drilling permit with certain operational conditions, including a restricted drilling plan for the first 12 months.

He underlined that the exploration and PFS workstreams could progress independently of each other, given a March court resolution asking the company to suspend drilling in an order that deals with protecting the Andean cat, a threatened species. The court order related to the impact on the habitat of the vizcachas, a small rabbit that is part of the food chain for the Andean cat, the company said at the time.

“Our drilling plan will allow the company to pursue its original program of illuminating and defining extensions of the mineralized body, which remains open,” Jones said. “Drilling is planned to resume soon to expand the resources beyond those currently considered in the (prefeasibility).” Alluding to the deposit’s growth potential, he added that large-scale intercepts of up to 1,000 metres of mineralization announced this year are still open in the deposit model.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 13 juin 2021 viewtopic.php?p=2320929#p2320929

Jetti Resources lève 100 millions de dollars pour développer ses procédés d'extraction du Cuivre.

Mike Outwin, founder and CEO, Jetti Resources. Image from Jetti.

https://www.mining.com/web/jetti-raises ... ion-value/

Jetti Resources lève 100 millions de dollars pour développer ses procédés d'extraction du Cuivre.

https://www.nsenergybusiness.com/news/j ... ing-round/Jetti Resources Completes $100 Million Financing Round

By NS Energy Staff Writer 25 Oct 2022

Jetti Resources, which has developed a breakthrough copper extraction technology, announced today that it has raised $100 million in its Series D financing. The funds will be used to continue the rapid deployment of Jetti’s technology at large copper mines.

The round was led by funds and accounts advised by T. Rowe Price Associates, Inc. and included Rothschild & Co, as well as early investors in the Company, DNS Capital, and others.

Since the completion of its Series C capital raise in June 2021, Jetti has commenced operations at its second commercial deployment with a major global mining company and has continued to deliver strong operational performance at Capstone Copper’s Pinto Valley Mine in Arizona. Jetti is focused on executing on its robust pipeline of growth projects.

This financing enables Jetti to meet the significant growth in demand for our technology by major copper mining companies. Our partners are choosing Jetti as a commercially proven and environmentally responsible technology to increase copper production at their mine sites.

The backing of existing investors, including some of the world’s leading global institutional investment funds, clearly shows the growing market support for our proven technology.

Mike Outwin, Jetti’s CEO and Co-Founder

We are delighted to invest in a groundbreaking technology that is already helping to transform the copper industry. Jetti’s technology is proven to increase copper production at commercial operations while also significantly reducing the environmental impacts of metal production. The Jetti team has built an impressive pipeline of growth opportunities and we are excited by the scale of the opportunity the technology represents.

Mike Outwin, founder and CEO, Jetti Resources. Image from Jetti.

https://www.mining.com/web/jetti-raises ... ion-value/

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 30 janvier 2022 viewtopic.php?p=2336070#p2336070

Le projet Quebrada Blanca phase 2 n'en fini pa d'étre reporté et de voir son cout prévisionnel augmenter

Le projet Quebrada Blanca phase 2 n'en fini pa d'étre reporté et de voir son cout prévisionnel augmenter

Teck Resources hikes cost of QB2 copper project in Chile again

Cecilia Jamasmie | October 28, 2022

QB2 is Teck’s most important growth project, which will extend the existing mine’s life by 28 years. (Image courtesy of Teck Resources.)

Teck Resources has raised its construction cost estimate for the Quebrada Blanca phase 2 (QB2) copper project in Chile by at least $500 million.

Canada’s largest diversified miner now expects QB2 to cost between $7.4 billion and $7.75 billion, up from a July 2022 guidance of $6.9 billion to $7 billion, and an earlier estimate of $4.7 billion.

In a call to discuss third quarter results, Teck cited current foreign exchange assumptions, as well as cost pressures relating to weather and subsurface conditions as the main reasons behind the estimate hike.

The new figure is in line with the $7.5 billion valuation given in August by Teck’s Japanese partner Sumitomo, which owns 33.33% of Quebrada Blanca.

QB2, Teck’s key growth project, has faced several delays. Initially, it was expected to begin production in 2021. The current timeline points at first copper by the end of December, but the company has said the start could be delayed into January 2023 if productivity impacts persist.

The miner sees Quebrada Blanca copper production ramping up over 2023 following commissioning of QB2, with output ranging between 170,000 and 300,000 tonnes per year from 2023 to 2025.

The fresh estimate compares with a previous forecast of 245,000 to 300,000 tonnes annually. Next year production, the company noted, will be at the lower end of the guidance range.

QB2 is the first step in Teck’s plan to grow its copper footprint and implies extending the aging deposit’s life by 28 years.

The next phase of development of QB will be the Quebrada Blanca and mill expansion (QBME). The QBME feasibility study, including all environmental baseline activities, is expected to be completed in 2023.

“QBME is expected to be a significant contributor to our near-term copper growth portfolio with first production targeted for 2026,” chief executive officer Jonathan Price, who assumed the top job at Teck earlier this month, told investors. “We’re also continuing to progress our other copper growth projects,” he said.

This project entails an increase in concentrator throughput of about 50% with the addition of one identical, semi autogenous grinding mill. Once finished, it will turn Quebrada Blanca into Chile’s second-largest copper operation, after Escondida. It will also situate it among the world’s top five copper mines.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 30 mai 2021 viewtopic.php?p=2320055#p2320055

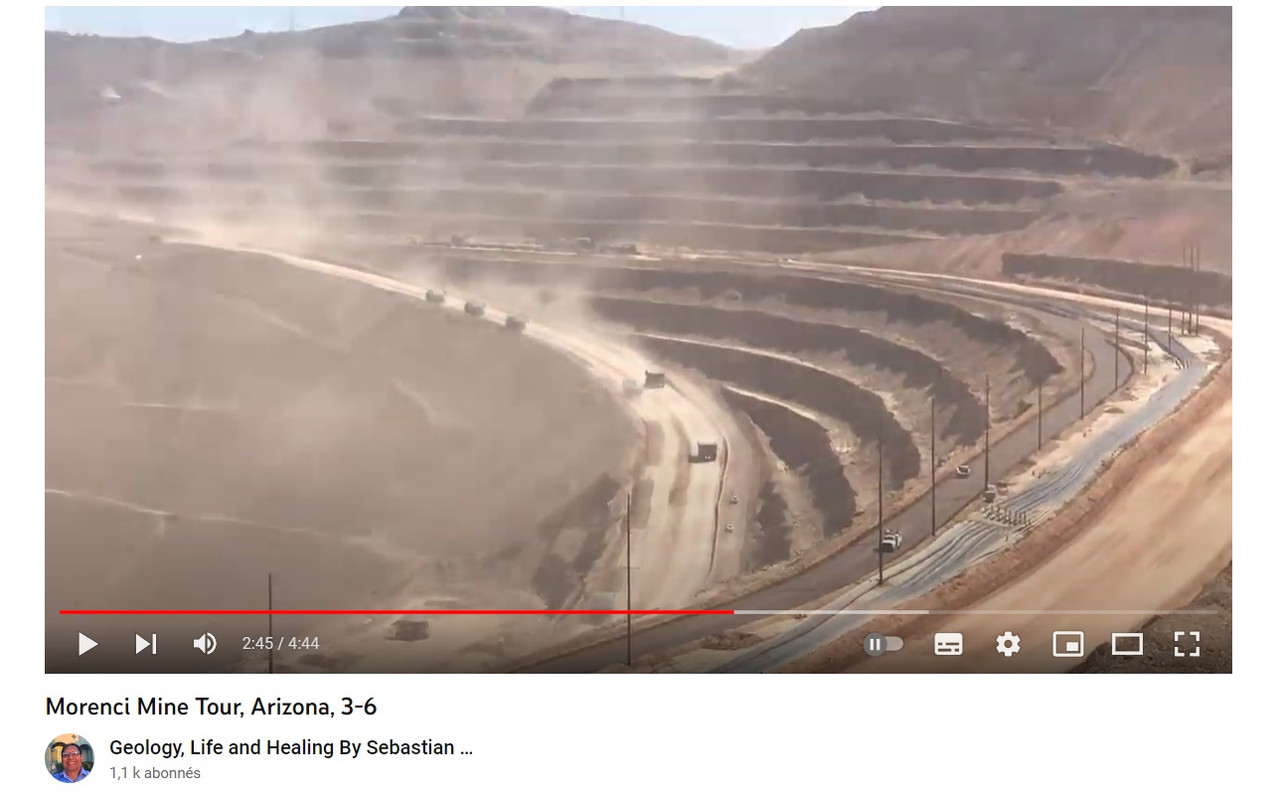

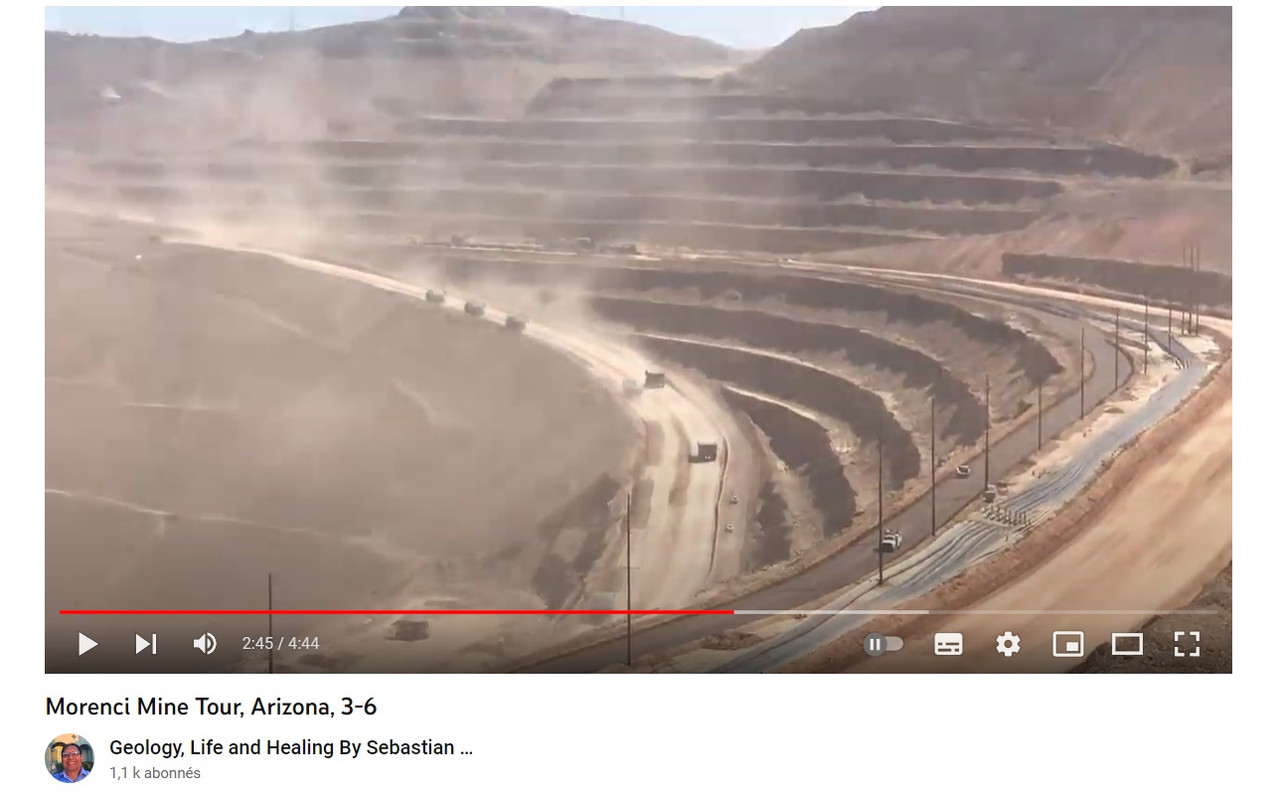

La mine de Cuivre de Morenci aux USA, qui est dans le top ten mondial que j' ai donné ici viewtopic.php?p=2356674#p2356674 RANKED: The world’s top 10 most valuable mines

La mine de Cuivre de Morenci aux USA, qui est dans le top ten mondial que j' ai donné ici viewtopic.php?p=2356674#p2356674 RANKED: The world’s top 10 most valuable mines

https://www.mining-technology.com/projects/morenci/Morenci Copper Mine, Arizona, USA

The Morenci copper mine is expected to continue mining activities until 2041.

1 September 2022

The Morenci copper mine is in Greenlee County, Arizona, in the southwestern part of the US. It is among the largest copper producers in North America.

US-based mining company Freeport-McMoRan (FCX) operates the Morenci project.

The company owns 72% of the project while the remaining 28% is held by Sumitomo Metal Mining’s subsidiaries Sumitomo Metal Mining Arizona (15%) and Sumitomo Metal Mining Morenci (13%).

The mine area spanned more than 61,700 acres as of 31 December 2021. Operations at the open-pit mine are expected to continue until 2041. The mine employs 1,706 personnel.

History of Morenci copper mine

The Detroit Copper Company started mining at Morenci, 16km south of Silver City, Arizona, in 1872. Copper Queen Consolidated Mining bought the property in 1885, with the company name changed to Phelps Dodge in 1917.

Phelps mined underground until the 1930s, converting to an open-cut operation with rail haulage in 1937.

Phelps Dodge merged with Freeport McMoRan Copper & Gold, whose principal asset is the large-scale Grasberg copper-gold mine in Indonesia, in a $25.9bn takeover by Freeport, the smaller of the two companies, in March 2007.

Freeport-McMoRan sold a 13% stake in the Morenci mine to Sumitomo Metal Mining in May 2016.

Geology, mineralisation, and reserves of the Morenci mine

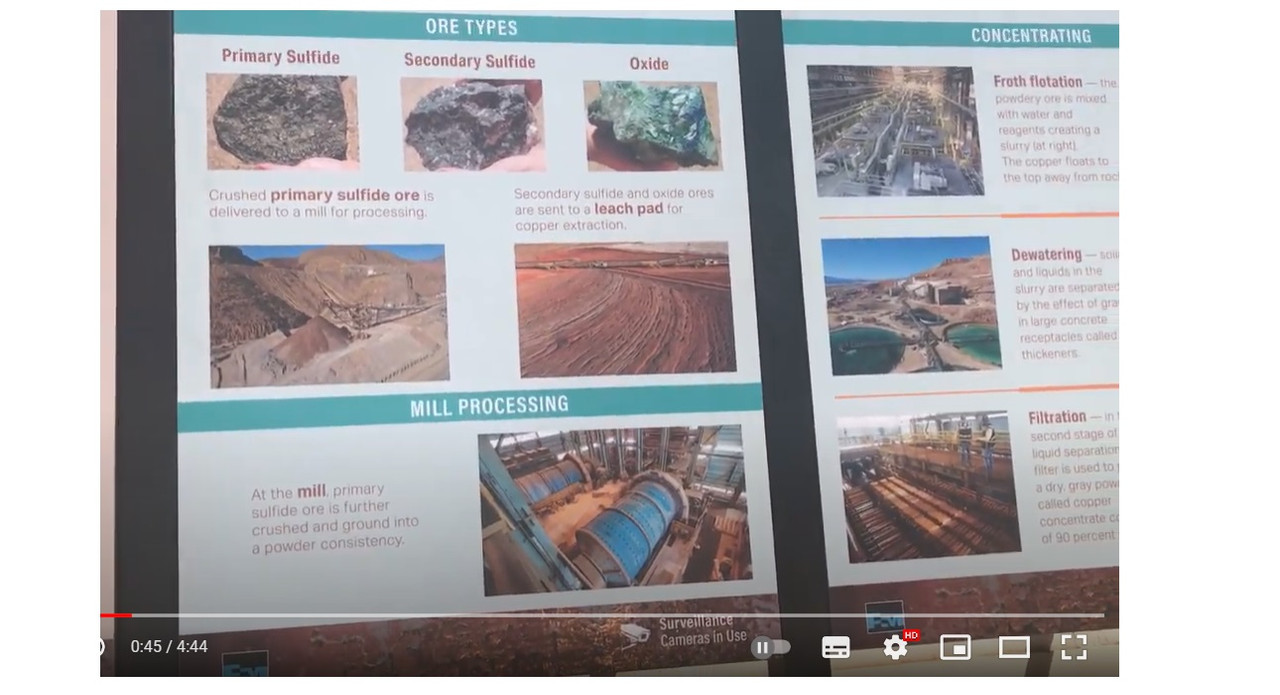

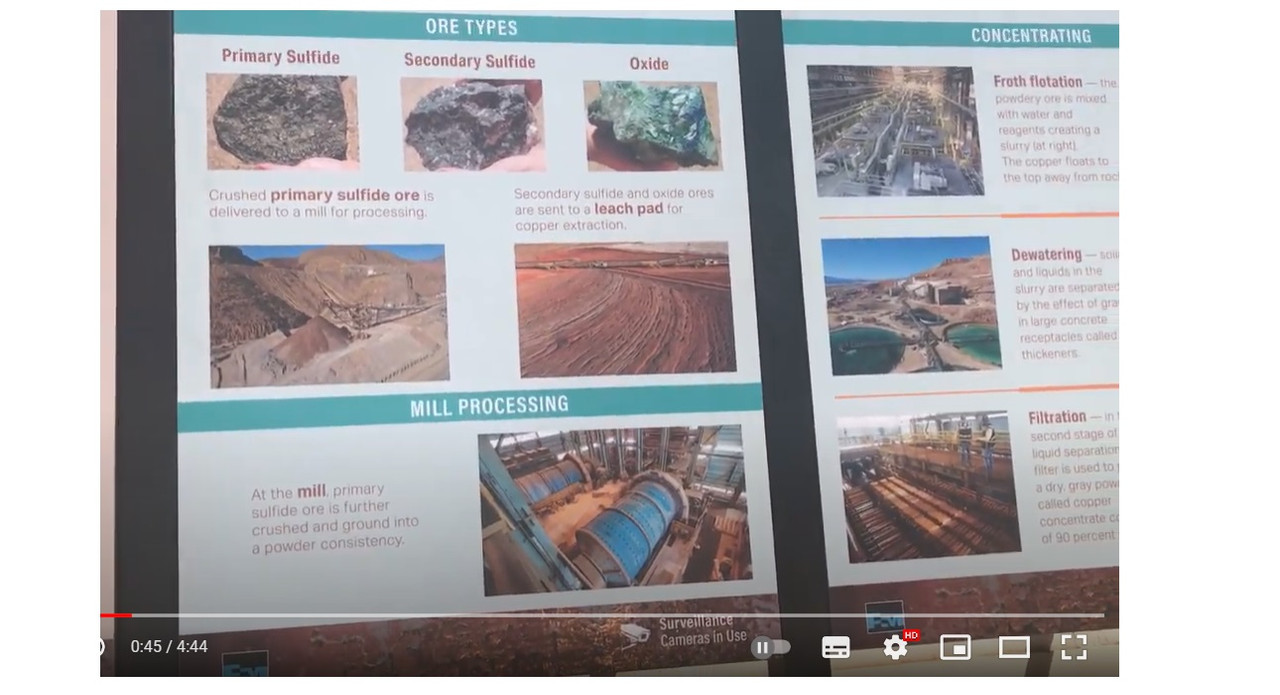

Geological findings demonstrate that Tertiary igneous intrusive rocks were deposited within Precambrian-era granite and on top of sedimentary rocks of Paleozoic and Mesozoic eras.

The porphyry copper deposit comprises copper oxide, secondary sulphide, and primary sulphide mineralisation.

Chrysocolla is the predominantly found oxide copper mineral while the most important secondary copper sulphide mineral is chalcocite. The dominant primary sulphide minerals found in the deposit are chalcopyrite and molybdenite.

The mineralisation extends 8km in a north-south direction and 6.43km in an east-west direction.

The proven and probable reserves of the mine were estimated at 11.13 billion tonnes, grading 0.24% copper, with 13 billion pounds of recoverable copper and 155 million pounds of molybdenum, as of 31 December 2021.

Mining at Morenci copper project

The Morenci mine employs a conventional open-pit, truck and shovel operation. The operation includes drilling, blasting, loading, and hauling.

The mine fleet includes 154 trucks, 14 blast hole drills, 13 electric rope shovels, and five front-end loaders.

The operations are supported by ancillary equipment such as track dozers, motor graders, wheel loaders, backhoes, and water trucks.

Processing at Morenci copper mine

Ore extracted from the Morenci mine is processed through hydrometallurgical or concentrating facilities.

The hydrometallurgical process comprises crushed and run of mine (ROM) leach pads, stacking equipment, a concentrate leach plant (CLP), four solution extraction (SX) plants, and three electrowinning (EW) facilities to produce a high-quality copper cathode.

The concentrating facilities process primary and certain secondary sulphide ores. The concentrating operation comprising two concentrators and a molybdenum processing facility produces copper and molybdenum concentrates.

Production plan details of the Morenci mine

The life of mine (LoM) plan calls for an increase in output to achieve an average mill production rate of 150,000tpd of ore by 2024 and maintain it through 2036. The production rate is expected to decrease to an average of 90,000tpd during the final years of operation.

FCX also aims to achieve an average daily crushed leach production rate of 90,000t of ore by 2023.

Infrastructure details

The paved route along US Highway 191 leads to the Morenci mine, which is located 80km north-east of Safford, Arizona. The mine site is also linked to a railway line that supports the transportation of metal products and supplies.

The property is situated at an altitude ranging between 2,750ft and 6,560ft above sea level.

A townsite at the operation features residential facilities, retail stores, restaurants, banks, schools, libraries, recreational facilities, and healthcare facilities.

The operation is supported by additional accommodation facilities for mine workers and supplies in Clifton, Tucson, Safford, and Phoenix in Arizona; and Silver City, Lordsburg, and Deming in New Mexico.

FCX subsidiary Morenci Water and Electric Company (MW&E) provides electricity to meet the power demand for the operations. Natural gas-fired turbines with a total generation capacity of 24MW are also located on-site.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

vidéo 2mn30 d'une ballade aérienne au dessus de Morenci mine https://www.youtube.com/watch?v=pxy3LSVsQHg

vidéo d'une visite de la mine Morenci : https://www.youtube.com/watch?v=J4PFKjwvwV8

vidéo d'une visite de la mine Morenci : https://www.youtube.com/watch?v=J4PFKjwvwV8

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Un prospect de Cuivre au Perou : le Llaguen deposit

https://www.mining.com/hudbay-minerals- ... t-llaguen/Hudbay Minerals provides resource estimate, exploration update at Llaguen

Staff Writer | November 3, 2022

Hudbay Minerals is providing insight on exploration and resource estimates at its Llaguen project in Peru. Initial estimates include 271 million tonnes of indicated resources at 0.42% copper-equivalent and 83 million tonnes of inferred resources at 0.30% copper-equivalent.

High-grade core within the Llaguen mineral resource includes 113 million tonnes of indicated resources at 0.60% copper-equivalent and 16 million tonnes of inferred resources at 0.52% copper equivalent.

Llaguen is a wholly owned copper-molybdenum porphyry deposit located close to the city of Trujillo in the La Libertad region in Peru, at moderate altitude and close to existing infrastructure, water and power supply. Early exploration activities at the Maria Reyna and Caballito properties, located within trucking distance of the Constancia mine in Peru, confirm the occurrence of sulphide and oxide rich copper mineralization at surface.

“The initial mineral resource estimate for our Llaguen project has confirmed the presence of a significant copper-molybdenum porphyry deposit at a higher level of geological confidence than we expected at this stage due to the continuous nature of the mineralization,” said Andre Lauzon, senior VP and COO.

“The mineral resources include a significant higher-grade component located near surface, with a low 0.9 strip ratio and the potential to be mined in the initial years of production to maximize the economics for the project,” Luzon said.