https://www.nsenergybusiness.com/news/l ... o-project/Lithium Chile estimates capex of $823m for Salar de Arizaro project

The PEA has reported a 25,000tpa commercial-scale operation to produce battery-grade lithium carbonate equivalent at the Argentine project

By NS Energy Staff Writer 09 Aug 2023

Canada-based Lithium Chile said that its Salar de Arizaro lithium brine project located in Argentina will require an initial capital cost (capex) of $823m, based on the findings of a preliminary economic assessment (PEA).

Engineering firm Ausenco Chile Limitada prepared the PEA for the Argentine lithium brine project located in the Salta Province.

The estimated capital cost comprises the initial investment and sustaining capital for a lithium concentration plant which can produce 25,000 tonnes of lithium carbon equivalent (LCE) per annum. It also includes a contingency of $190m.

Lithium Chile said that the total operating costs for the Salar de Arizaro lithium brine project will be $130m per year.

The PEA has reported the potential of a 25,000 tonnes per annum (tpa) commercial-scale operation to produce battery-grade lithium carbonate chemicals at the Arizaro project.

The lithium brine project is currently in its phase two exploration and development programme to expand the resource of 3.32 million tonnes of LCE.

Lithium Chile president and CEO Steve Cochrane said: “The filing of this technical report is another important milestone. These results support our view that the Arizaro Project has the potential to be a world class producer of Lithium Carbonate.

”We are excited about continued advancement of this project – a continuing journey of near-term enhancement opportunities that have already been identified.”

Lithium Chile also said that the Salar de Arizaro project is estimated to bring an annual cash flow of $229m over 19.1 years of life of mine.

The PEA estimates a post-tax net present value (NPV) of $1.1bn for the Argentine lithium brine project.

It also projects a post-tax internal rate of return of 24.1% for the Salar de Arizaro project with an after-tax payback period of 3.6 years.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

- mobar

- Hydrogène

- Messages : 19951

- Inscription : 02 mai 2006, 12:10

- Localisation : PR des Vosges du Nord

Re: Le lithium, une flambée en perspective?

La flambée, c'était il y a quelques années aujourd'hui le cours du Lithium s'effondre, à force de trouver sans cesse de nouveau gisements, la consommation fini par ne plus pouvoir suivre!

https://www.numerama.com/vroom/1312252- ... iques.html

https://www.numerama.com/vroom/1312252- ... iques.html

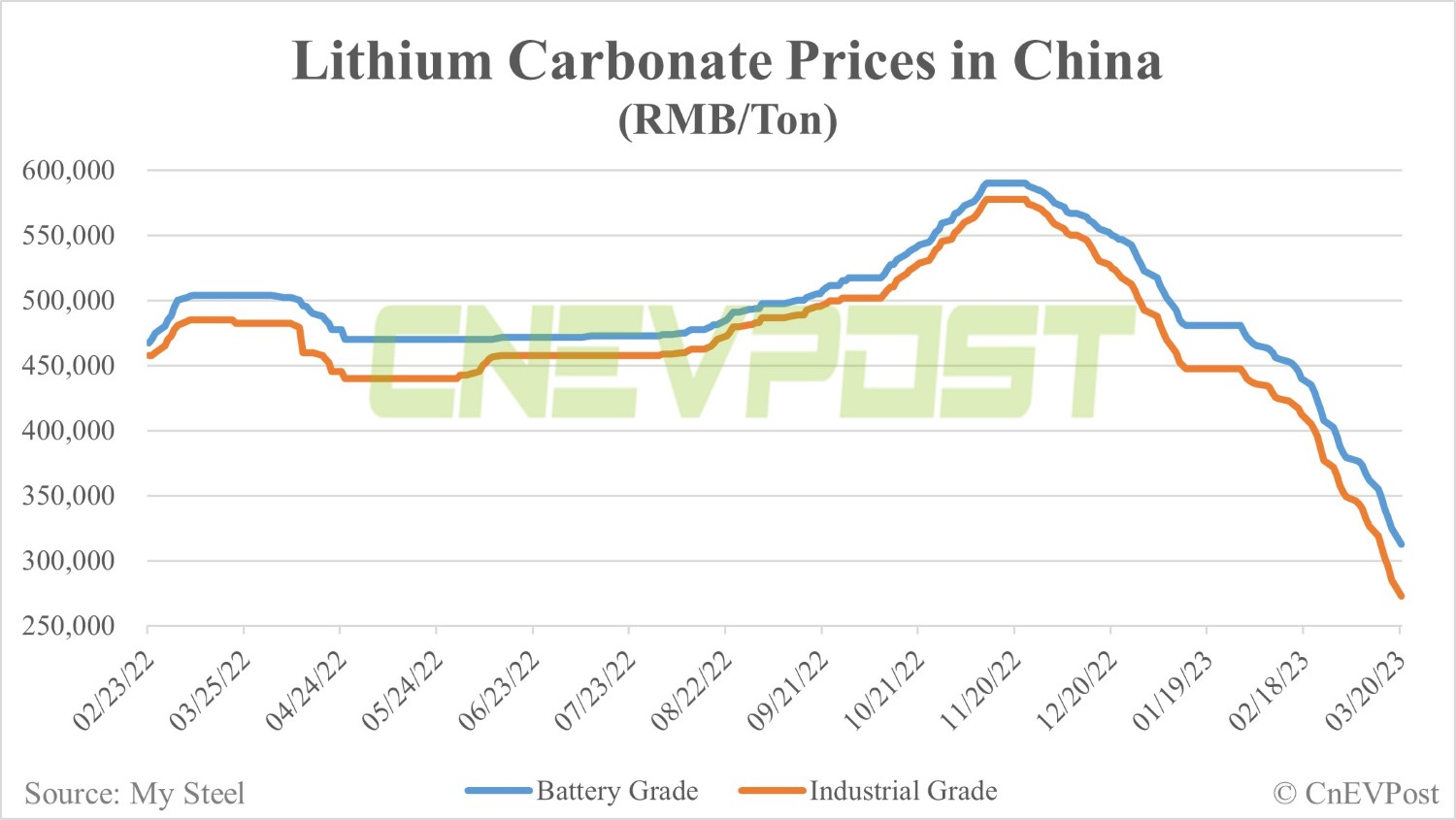

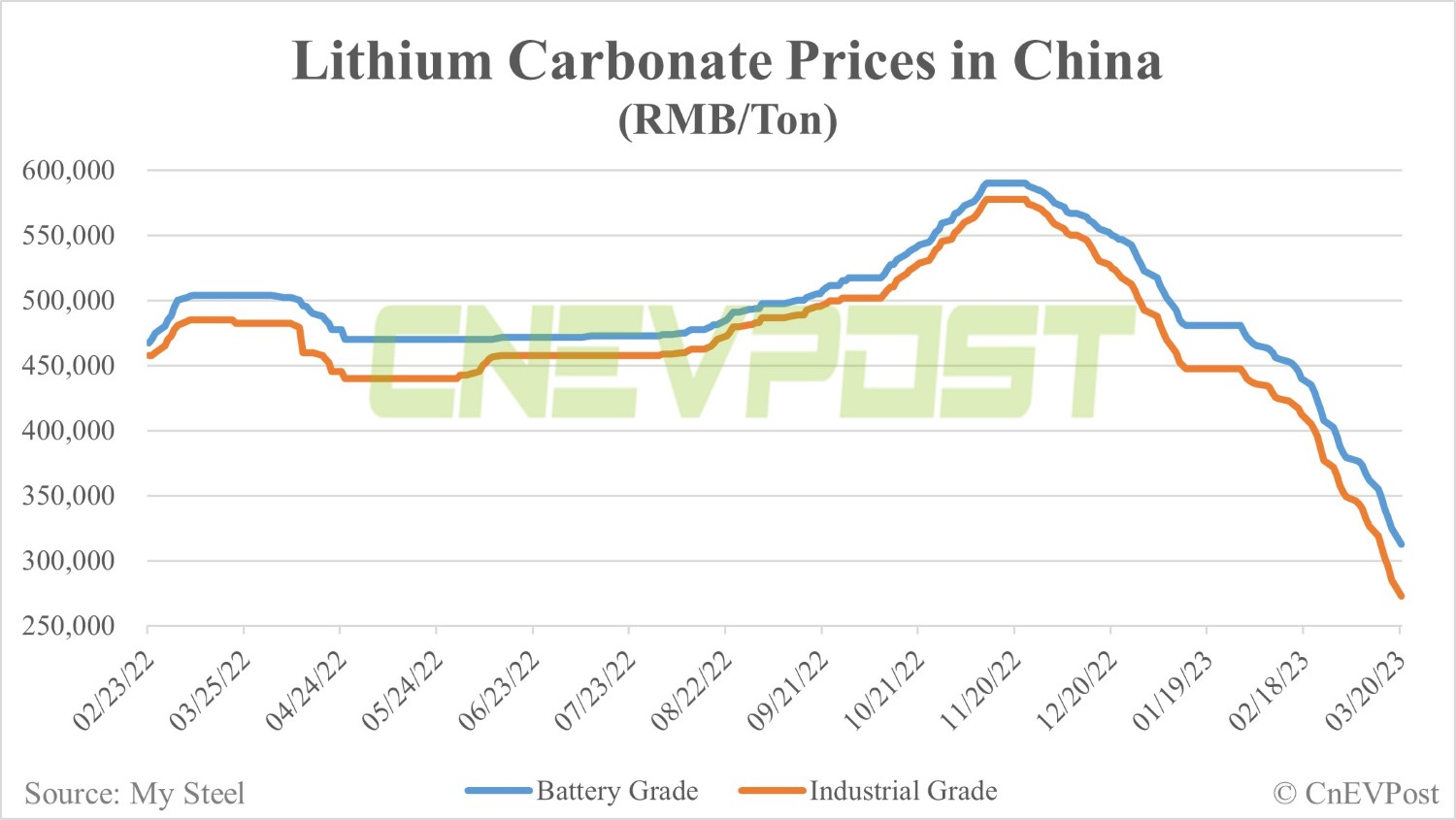

Après une forte flambée mi-2022, le prix moyen du lithium de qualité batterie chute depuis le mois de décembre. Cela pourrait encore se poursuivre. C’est une bonne nouvelle pour le coût de production des batteries des voitures électriques, ou au moins pour les marges des constructeurs.

Le prix moyen du lithium atteignait un pic de 80 000 euros la tonne, en novembre 2022. Depuis, le prix a rapidement baissé : il a même quasiment été divisé par deux en quelques semaines, selon le suivi de cnevpost.com, publié le 20 mars 2023. Il reste bien supérieur au cours du lithium de 2020, qui l’affichait alors à un peu plus de 5 500 euros la tonne. Cela reste une bonne nouvelle pour le secteur de la voiture électrique, au sein duquel on va certainement espérer que cette chute se poursuivre.

Le lithium n’est pas le seul élément composant les batteries automobiles qui a vu son cours baisser. Le cobalt, le cuivre et d’autres métaux sont également concernés. C’est un signal positif que l’on espère voir se répercuter sur le prix des batteries un peu plus tard dans l’année. En espérant que la demande chinoise ne fasse pas repartir à la hausse trop rapidement le cours des échanges mondiaux.

https://youtu.be/0pK01iKwb1U

« Ne doutez jamais qu'un petit groupe de personnes bien informées et impliquées puisse changer le monde, en fait, ce n'est jamais que comme cela que le monde a changé »

« Ne doutez jamais qu'un petit groupe de personnes bien informées et impliquées puisse changer le monde, en fait, ce n'est jamais que comme cela que le monde a changé »

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 11 sept 2022 viewtopic.php?p=2352227#p2352227

https://www.mining-technology.com/news/ ... nvestment/Cornish Lithium receives $67m for UK project development

The company aims to produce 8,000 tonnes per year of lithium once in commercial production.

August 10, 2023

UK miner Cornish Lithium has received £53m ($67m) of investment to support the development of the UK’s lithium supply chain.

The investment package came from the UK Infrastructure Bank, US private equity fund the Energy & Minerals Group (EMG) and critical minerals investment company TechMet. The $67m is part of a larger funding package, worth as much as $210m, of potential second-stage financing.

Cornish Lithium will utilise the funding to progress towards the commercial production of lithium. Currently the company aims to produce 8,000 tonnes per year (tpa) of battery grade lithium from its “globally significant” lithium grades in deep geothermal waters.

“Cornish Lithium has found it essential to secure funding from institutional investors with the financial muscle to bring our projects into commercial production,” said Cornish Lithium CEO Jeremy Wrathall. “This funding will enable us to progress our Trelavour hard rock lithium project to a construction-ready status as well as completing the engineering design work required to build a demonstration-scale geothermal waters extraction facility.”

In September 2022, the company revealed that it had received government funding to build the hydrometallurgical section of the demonstration processing plant for the Trevalour hard rock project.

The company in 2020 revealed that tests had indicated it has among the “world’s highest grades of lithium and best overall chemical qualities encountered in published records for geothermal waters anywhere in the world”. The company also intends to mine lithium from onshore hard rock formations.

Cornish Lithium hopes to capitalise on a global lithium boom, with reports suggesting the global lithium market could be worth as much as $19bn by 2030, owing to its role in the global energy transition.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

encore un beau prospect au Canada : James Bay Lithium Project

https://www.listcorp.com/asx/ake/allkem ... 08612.htmlJames Bay Mineral Resource increased by 173% to 110.2 million tonnes

Allkem Limited is pleased to provide an updated Mineral Resource Estimate (“MRE”) for its James Bay Lithium Project in Québec, Canada.

HIGHLIGHTS

•The updated Mineral Resource of 110.2 Mt @ 1.30% Li2O includes 54.3 Mt @ 1.30% Li2O in the Indicated category, and an additional 55.9 Mt @ 1.29% Li2O in the Inferred category, solidifyingthe status of the James Bay Lithium Deposit in Québec as a tier-1 lithium pegmatite mineral resource and long-life asset

•The maiden Inferred Mineral Resource in the NW Sector remains open along strike and at depthwith excellent growth potential

•A significant campaign of infill and extensional drilling is planned during the Canadian winter to test for along-strike and down-dip extensions of the pegmatite dykes beyond the area included in this MRE

......................

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 2 avril 2023 viewtopic.php?p=2366309#p2366309

augmentation de 36 % de la ressource en Lithium de Pilgangoora en Australie :

Pilgangoora deviendrait donc la plus grosse mine de Lithium de hard rock au monde.

augmentation de 36 % de la ressource en Lithium de Pilgangoora en Australie :

https://smallcaps.com.au/pilbara-minera ... m-project/Pilbara Minerals reports 109Mt resource increase at Pilgangoora lithium project

By Imelda Cotton August 7, 2023

Australian lithium producer Pilbara Minerals (ASX: PLS) has announced a 109 million tonne boost to the resource at its wholly-owned Pilgangoora operation in Western Australia.

The company reported a 36% increase in the project’s total measured, indicated and inferred resource to 413.8 million tonnes grading 1.15% lithium oxide, 112 parts per million tantalum pentoxide and 0.53% ferric oxide, for 4.75Mt of lithium oxide and 101.8 million pounds of tantalum pentoxide.

There has been a 64% increase in the total measured and indicated resource to 337.3Mt grading 1.17% lithium oxide, 103ppm tantalum pentoxide and 0.53% ferric oxide, for 3.94Mt of lithium oxide and 80.9 million pounds of tantalum pentoxide.

Overall confidence is believed to have been enhanced with 82% of the project’s resource now classified as measured and indicated.

The updated mineral resource will underpin an ore reserves update due for release in the September quarter.

World’s largest operation

Managing director Dale Henderson said the new resource reinforces Pilgangoora’s position as one of the world’s largest hard-rock lithium operations.

“This upgrade is consistent with a strategy to grow our operating base and maximise value by achieving full potential from this world-class operation,” he said.

“We have added 109Mt of resources at a direct exploration cost of only 13 cents per tonne which is an outstanding result.”

Drilling campaign

The resource upgrade includes results from a 153-hole exploration and development drilling campaign for a total 46,904 metres to test down-dip extensions of key domains in the Central and Eastern deposits.

The campaign started in November and comprised 39,627m of reverse circulation drilling and 7,277m of diamond drilling.

It aimed to upgrade inferred and unclassified resources to the indicated category within the unconstrained pit shell in the near mine areas, and drill test the most prospective exploration targets within the Pilgangoora area.

Significant exploration upside remains within the project boundaries, with mineralisation remaining open along strike and at depth to the immediate north west of the Central and East pits.

Follow-up drilling has been planned for the new year to further test targets in this area.

Pilgangoora deviendrait donc la plus grosse mine de Lithium de hard rock au monde.

https://www.australianresourcesandinves ... hium-mine/The world’s new largest lithium mine

TIM BOND August 8, 2023

Pilbara Minerals’ Pilgangoora mine has dethroned Greenbushes to become the largest hard-rock lithium mine in the world.

Located in Western Australia, the Pilgangoora lithium mine is 100 per cent owned by Pilbara Minerals.

The company recently completed its financial year 2023 drilling program, with the findings bumping the mineral resource by 109,000 tonnes, or a 36 per cent increase, to the total measured resource.

A total of 82 per cent of the mineral resource is considered measured and indicated.

This puts the total resource tonnage of Pilgangoora ahead of Greenbushes, which is jointly owned by Tianqi Ltihium and Albemarle. However, the Greenbushes resource boasts a higher lithium oxide grade.

.....................................

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

en relation avec ce post du 11 juillet 2021 viewtopic.php?p=2322360#p2322360

https://www.msn.com/fr-fr/finance/econo ... 9e8&ei=146Stellantis annonce un investissement de 100 millions de dollars pour sécuriser du lithium américain

Le constructeur automobile Stellantis va débourser plus de 100 millions de dollars pour acquérir 650.000 tonnes de lithium américain, essentiel à la fabrication de batteries électriques, a-t-il annoncé jeudi dans un communiqué.

Controlled Thermal Resources, une société américaine, doit fournir à partir de 2027, et pour 10 ans, 65.000 tonnes d'hydroxyde de lithium monohydraté à Stellantis chaque année, contre 25.000 initialement prévus dans un accord signé en juin 2022.

Grâce à cet approvisionnement, les véhicules électriques du groupe, qui possède entre autres les marques Jeep, Peugeot et Fiat, pourront être éligibles aux primes à la consommation de la loi américaine sur la réduction de l'inflation (IRA).

Adoptée en 2022, cette dernière stipule que pour être éligibles à une prime de 3750 dollars, les batteries des véhicules électriques doivent contenir au minimum 40% de minerais extraits ou traités aux Etats-Unis. Ce taux doit grimper chaque année jusqu'à atteindre 80% à partir de 2027.

Le lithium vendu par Controlled Thermal Resources sera extrait d'une saumure captée dans les sous-sols californiens "à partir d'énergie renouvelable et de vapeur dans un processus intégré en boucle fermée", précise Stellantis dans son communiqué.

Baptisé "Hell's Kitchen", le site californien de Controlled Thermal Resources aura, à terme, une capacité de production annuelle de 300.000 tonnes de lithium. La construction de l'usine de production a été lancée début janvier.

En Europe, Stellantis s'est associé à l'australien Vulcan Energy pour deux projets d'extraction de lithium, en Allemagne et en Alsace.

Le constructeur ambitionne de ne vendre que des voitures électriques en Europe à partir de 2030. Les véhicules de tourisme à batterie devraient représenter 50% de ses ventes aux Etats-Unis à la même date, a-t-il également prévu.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

J'avais donc raté la construction de l'usine de Controlled Thermal Resources.

voici leur communiqué de presse de juin2023 au sujet de ce projet d'usine à 1 milliard de dollars :

voici leur communiqué de presse de juin2023 au sujet de ce projet d'usine à 1 milliard de dollars :

https://www.cthermal.com/latest-news/ct ... californiaCTR selects Aquatech for its US$ 1 billion Lithium Hydroxide Facility in California.

> Controlled Thermal Resources has engaged Aquatech as its technology partner to deliver the purification process plants for the company’s Stage 1 Lithium Hydroxide Facility.

> Aquatech is a recognized global leader in end-to-end process solutions to produce technical and battery-grade lithium hydroxide, lithium carbonate, and lithium salts.

> CTR’s US$ 1 billion Lithium Hydroxide Facility will be the world’s first fully integrated renewable power and lithium extraction facility - producing “green” battery-grade lithium hydroxide product from CTR’s geothermal brine resource.

> The facility is expected to produce 25,000 tonnes of battery-grade lithium hydroxide monohydrate each year to support battery production for approximately 415,000 standard-size electric vehicles annually.

Imperial County, California. June 16, 2023

Controlled Thermal Resources Holdings Inc. (CTR) is pleased to announce it has engaged Aquatech as its technology partner to deliver the engineering and process plants for the conversion of lithium chloride intermediate product to battery-grade lithium hydroxide monohydrate at the company’s Stage 1 Lithium Hydroxide Facility.

Aquatech will utilize a high-purity lithium chloride ‘eluate’ recovered via Direct Lithium Extraction (DLE) from CTR’s geothermal lithium brine resource. The production plant will include multiple process plants that integrate advanced membrane, evaporation, and crystallization technology for the production of refined crystalline lithium hydroxide monohydrate product.

CTR’s Hell’s Kitchen project, located in Imperial County, California, is the largest and most sustainable lithium and power development in the world today, with a projected resource capacity to produce 1,100MW of baseload renewable power and an estimated 300,000 metric tons of lithium carbonate equivalent (LCE) products each year – enough to support the production of over 5 million standard-sized electric vehicles annually.

“We are very pleased to engage Aquatech for this exciting new project phase,” CTR's Chief Executive Officer, Rod Colwell, said. “Aquatech is a global leader in their field with well-established process systems and technologies to produce lithium products that will meet our client’s rigorous specifications for high energy density battery cathode manufacturing. These efforts will support our client’s transition to electric mobility and greatly accelerate a secure and genuinely sustainable supply of lithium hydroxide in North America.”

CTR and its technology partners recently completed a US$ 60 million brine optimization program that operated for six months from November 2022 until April 2023. The company’s engineering team improved several process stages, including optimization of the brine preparation unit to recover a high-purity lithium chloride ‘eluate’ efficiently. The optimization plant, which operated at a steady state for approximately 3,000 hours, was constructed at a 1/10th commercial scale. The Direct Lithium Extraction (DLE) unit achieved a 95-97% lithium recovery rate. CTR will utilize Aquatech’s innovative process technology for the final lithium conversion and purification process stage.

Aquatech is a premier process technology leader delivering comprehensive end-to-end solutions for battery-grade lithium production facilities. Aquatech’s services encompass applied testing and development, all the way to project delivery, offered through their ICD Process Technologies division. With a steadfast commitment to long-term sustainability, Aquatech prioritizes achieving the lowest carbon and water footprint, resulting in minimal environmental impact.

“Aquatech is excited to have commenced work on this landmark project fully supporting CTR’s vision of establishing the largest and most sustainable integrated lithium and renewable power facility,” said Venkee Sharma, Executive Chairman at Aquatech. “By joining forces, we are not only advancing the goals of U.S. energy security and the clean energy transition but also revolutionizing the industry through CTR’s groundbreaking geothermal energy utilization at the Salton Sea. This collaboration will pave the way for sustainable critical mineral recovery, battery manufacturing, and recycling.”

The Hell’s Kitchen Lithium and Power project is a positive industry disrupter. It uses a closed-loop, direct lithium extraction process to recover lithium sustainably from geothermal brine. This method also integrates renewable power and steam into the process to produce battery-grade lithium products with a near-zero carbon footprint. The process requires no open pit mining, evaporation ponds, process tailings, clay leaching pits, or hazardous landfill waste.

CTR intends to commence construction of its Stage 1 Lithium Hydroxide Facility in 2024, with the first lithium hydroxide products due for delivery in 2025.

The construction effort will create approximately 480 construction jobs, and the facilities will employ upwards of 100 full-time employees, including production technicians, operations managers, and engineering roles to support ongoing plant maintenance and optimization.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 23 juillet 2023 viewtopic.php?p=2374132#p2374132

Attribution d'un autre trés gros contrat de chantiers pour la construction de la mine de Lithium Kathleen en Australie.

Attribution d'un autre trés gros contrat de chantiers pour la construction de la mine de Lithium Kathleen en Australie.

https://www.nsenergybusiness.com/news/l ... y-project/Liontown to award $640m contract to Byrnecut for Kathleen Valley project

As per the terms of the contract, Byrnecut Australia will cover all aspects of underground construction at the Australian lithium project for a period of four years

By NS Energy Staff Writer 17 Aug 2023

Battery minerals company Liontown Resources has issued a letter of award for an underground mining services contract worth A$1bn ($640m) at the Kathleen Valley lithium project in Western Australia to Byrnecut Australia.

Under the terms of the contract, Byrnecut Australia will cover all aspects of underground construction at the Australian lithium project for a period of four years.

It includes significant early capitalised development and production across the Mt Mann and Northwest Flats orebodies to support the initial plant throughput capacity of three million tonnes per annum (mtpa).

The total contract value includes operating costs, sustaining capital, and early enabling works for the planned 4mtpa expansion as part of the underground mine’s longer-term operation.

The contract mining company plans to invest over A$125m ($80m) in new equipment to deliver the underground mining services.

Byrnecut Australia aims to commence mobilising to the site throughout the September quarter in line with the on-schedule conclusion of open pit mining activities at Mt Mann.

According to Liontown Resources, Mt Mann will serve as the central location for the future portals into the underground operations, with development scheduled to begin in the December quarter. There will be six portals in total.

Liontown managing director and CEO Tony Ottaviano said: “At around A$1 billion this is the largest contract to be awarded by Liontown and is reflective of operational requirements, external factors and the four-year duration.

“We remain on track for first production from Kathleen Valley by mid-2024 and I look forward to partnering with Byrnecut for the next stage of our project development.”

Byrnecut Australia’s award of the underground mining services at the Kathleen Valley project is subject to the finalisation of a binding full-form contract.

Last month, Liontown Resources awarded a spodumene and DSO haulage contract at the Kathleen Valley lithium project to integrated logistics solutions provider Qube.

https://www.mining-technology.com/news/ ... t/?cf-view...............

The Kathleen Valley high-grade lithium-tantalum project is estimated to hold mineral resources of 156mt at 1.4% Li₂O and 130ppm Ta₂O₅.

Liontown has signed deals for lithium supply from the Kathleen Valley mine to Tesla, LG Energy Solutions and Ford.

The Kathleen Valley project is scheduled to be commissioned by mid-2024.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 3 juillet 2023 viewtopic.php?p=2372680#p2372680

https://www.mining-technology.com/news/ ... y/?cf-viewVulcan begins commissioning of lithium extraction plant in Germany

By using direct absorption-type lithium extraction method, Vulcan plans to produce 24,000tpa of lithium hydroxide.

August 18, 2023

Vulcan’s lithium extraction optimisation plant in Germany. Credit: Vulcan Energy Resources Limited.

ASX-listed Vulcan Energy Resources has started commissioning of its lithium extraction optimisation plant (LEOP) in Landau at Upper Rhine Valley in Germany.

Considered to be a milestone for Vulcan, the plant will extract, purify and increase the concentration of lithium chloride from brine. This phase is said to be a major step forward for the company and its zero-carbon lithium project.

The start of the plant will enable the domestic supply independence of lithium, a critical raw material that is used in the production of electric vehicle (EV) batteries.

Vulcan stated that the commissioning phase will continue until October, which is also when the first brine will be introduced into the plant to begin the lithium extraction process.

Construction on the project began last year and was designed for optimisation, operational training and product qualification facility to provide commercial readiness by the end of 2025.

Vulcan CEO Cris Moreno said: “By 2030, Europe is likely to face a significant lithium shortage, which could have serious implications for the European battery and automotive industries if domestic supplies are not realised. Vulcan is gearing up to be the first to produce lithium from Europe, for Europe, but also to be the first company worldwide to produce carbon-neutral lithium.

“The start of the commissioning of our LEOP facility is a key step toward the implementation of phase one of our Zero Carbon Lithium™ Project, and in enabling a secure and independent European supply chain for lithium.”

The initial phase of commercial operations at the plant aims to have a production of 24,000tpa of lithium hydroxide production, which will be supplied to off-takers in Europe.

For lithium extraction from brine, Vulcan will use adsorption-type direct lithium extraction (A-DLE), which is claimed to have been commercially proven.

The method can be deployed for low operating costs, more time efficiency and reduced carbon footprint compared to legacy industry methods for producing lithium. It will be powered using renewable heat instead of gas.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 1er juillet 2023 viewtopic.php?p=2372570#p2372570

https://www.agenceecofin.com/mines/2108 ... m-du-ghanaAtlantic vise 2025 pour l’entrée en production de la première mine de lithium du Ghana

Agence Ecofin 21 aout 2023

Alors que le Mali devrait devenir en 2024 le premier producteur ouest-africain de lithium, le Ghana compte lui emboiter rapidement le pas. Les ambitions du pays qui ne veut pas exporter son lithium à l’état brut, sont portées par l’australien Atlantic Lithium, aidé par l’américain Piedmont.

Le producteur américain d’hydroxyde de lithium Piedmont Lithium a sécurisé 22,5 % d’intérêts dans les projets ghanéens d’Atlantic Lithium. C’est l’annonce faite le 17 août par la compagnie minière australienne qui confirme aussi l’investissement de son partenaire dans les travaux de construction devant permettre l’entrée en production d’Ewoyaa, la première mine de lithium du Ghana, en 2025.

Après avoir déjà investi 17 millions de dollars, Piedmont entre en réalité dans la troisième phase d’un accord stratégique conclu en 2021 avec Atlantic Lithium. Cette phase l’oblige dans un premier temps à financer à hauteur de 70 millions de dollars les travaux de construction de la mine. Les deux sociétés apporteront ensuite à parts égales le reste des fonds nécessaires pour voir aboutir le projet.

« Nous pensons que cet engagement pour la prochaine étape de développement reflète la forte confiance de Piedmont dans Ewoyaa, réduisant davantage les risques du projet et nous rapprochant de la première production de concentré de spodumène au Ghana », a commenté Neil Herbert, président exécutif d’Atlantic Lithium.

Selon une étude de faisabilité publiée plus tôt cette année, Ewoyaa nécessite un investissement de 185 millions de dollars pour entrer en service. La mine pourra livrer 3,6 millions de tonnes de concentré de spodumène sur 12 ans et générer 6,56 milliards de dollars de revenus sur la période.

Le permis minier, dernier obstacle à franchir

Avec le financement de la mine quasi bouclé et une étude de faisabilité prometteuse, Atlantic Lithium a franchi la plupart des obstacles avant le début des travaux de construction de sa mine. Il lui reste cependant à achever les négociations sur les termes d’une convention minière avec les autorités locales afin d’obtenir le permis minier. Ces discussions se déroulent dans un contexte où le gouvernement a approuvé fin juillet un document de politique relatif aux minéraux verts.

Le texte qui doit être adopté par le Parlement d’ici la fin de l’année, matérialise l’ambition des autorités de tirer le meilleur profit des métaux nécessaires à la transition énergétique disponibles dans le pays, le lithium en tête. Le ministre des Terres et des Ressources naturelles, Samuel Jinapor, a notamment indiqué que le pays n’exportera pas son lithium à l’état brut et cette interdiction pourrait affecter les ambitions des deux sociétés présentes à Ewoyaa.

« Le projet Ewoyaa est un élément clé du portefeuille global de Piedmont, et nous sommes confiants dans les progrès réalisés par nos partenaires, tant dans l’étude de faisabilité définitive que dans les discussions avec la Commission des minéraux du Ghana au sujet de la concession minière d’Ewoyaa », a néanmoins déclaré Keith Phillips, PDG de Piedmont Lithium.

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

Un prospect USA dont j' ai pas encore parlé : Superbird lithium

https://www.nsenergybusiness.com/news/p ... kansas-us/Pantera to acquire 35% stake in Superbird lithium project in Arkansas, US

By NS Energy Staff Writer 24 Aug 2023

Pantera will acquire a stake in the Superbird lithium project, which covers around 5,325 acres of leased lithium brine prospective ground in the ‘Smackover Formation’, a known high-grade brine formation, with a further 7,000 acres under negotiation

Australia-based Pantera Minerals has signed a $2m convertible note facility with Daytona Lithium to acquire a 35% interest in the Superbird lithium project located in Arkansas, US.

With the purchase of a 35% stake Superbird project, Pantera enters the Smackover Formation, one of the hottest brine formations in the US.

The Superbird project covers around 5,325 acres of leased lithium brine prospective ground in the Smackover Formation, a known high-grade brine formation in the Arkansas region.

Pantera said that the Smackover Formation is home to several lithium brine explorers and producers.

The Superbird project is located close to several lithium projects, such as the Exxon lithium brine project, Lanxess project, and South-West Arkansas project, among others.

Pantera CEO Matt Hansen said: “With Pantera’s 35% investment into Daytona Lithium, the Company enters one of the most significant and emerging brine plays in the USA. Daytona holds highly prospective lithium brine leases in the Smackover Play located in Arkansas, USA.

“Daytona’s project area directly abuts Exxon’s Smackover Lithium Brine Project, Standard Lithium

.................................

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 26 mars 2023 viewtopic.php?p=2365761#p2365761

Le projet Corvette au Quebec retardé à cause des incendies de foréts.

Le projet Corvette au Quebec retardé à cause des incendies de foréts.

https://www.nsenergybusiness.com/news/p ... ec-canada/Patriot Provides Operations Update for its Corvette Property, Quebec, Canada

By NS Energy Staff Writer 21 Aug 2023

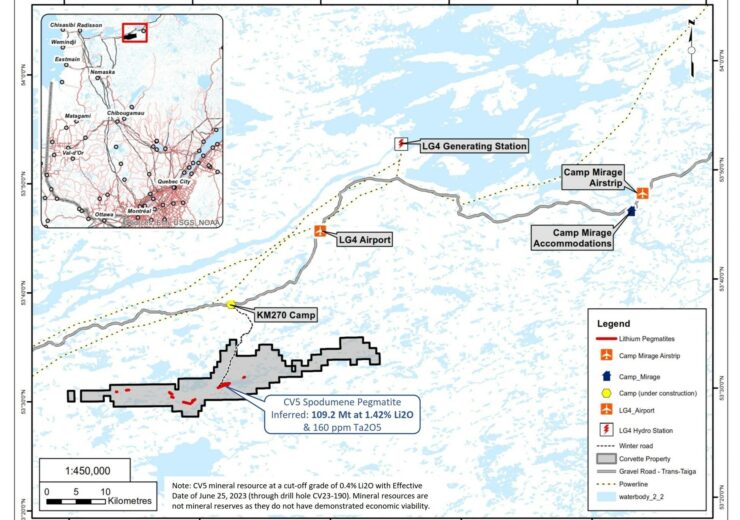

Patriot Battery Metals Inc. is a hard-rock lithium exploration company focused on advancing its district-scale 100% owned Corvette Property located in the Eeyou Istchee James Bay region of Quebec, Canada

Patriot Battery Metals Inc. is pleased to provide an operations update on the mineral exploration and development of its Corvette Property (the “Property”), host to the CV5 Spodumene Pegmatite. The CV5 Spodumene Pegmatite, the 8th largest lithium pegmatite in the world, is located approximately 13.5 km south of the regional and all‑weather Trans-Taiga Road and powerline infrastructure corridor, and within 50 km of the La-Grande 4 (LG4) hydroelectric dam complex.

Corvette Property and regional infrastructure (Credit: CNW Group/Patriot Battery Metals Inc)

.....................

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

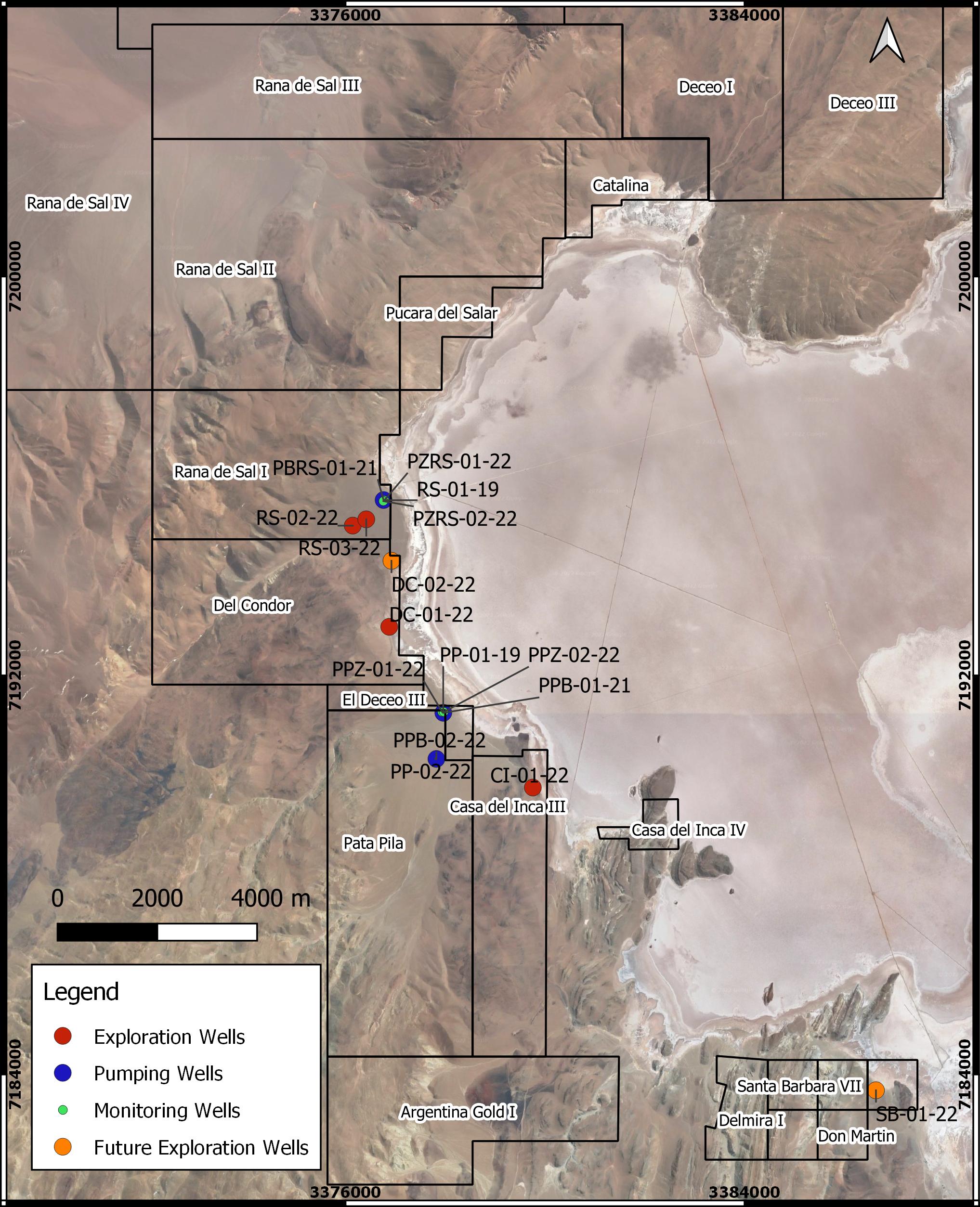

https://www.mining-technology.com/news/ ... t/?cf-viewGalan begins construction at Argentina lithium project

The Hombre Muerto West (HMW) lithium brine project is expected to have an annual production of 20ktpa of lithium chloride.

August 21, 2023

ASX-listed lithium exploration company Galan Lithium has started full phase one pond construction at its flagship Hombre Muerto West (HMW) lithium brine project in the province of Catamarca in Argentina.

The company will begin lithium chloride production at the project in the first half of 2025, as the first batch of earthmoving equipment for the ponds’ construction has already started working on the project site.

Further equipment is expected to arrive in the last week of this month. Other construction activities to upgrade essential services, including camp, diesel storage and water supply, have also started.

The first milestone of the pond construction, which includes building, lining and filling with brine of the first pond, is expected to take place in the first quarter of next year. The pond uses an evaporation technique with an area of 205,000m².

Galan Lithium managing director Juan Pablo Vargas de la Vega said: “This is the beginning of our construction journey to production. I would like to congratulate the global Galan team for their continued support to make this happen. This is also testimony to our desire to work locally with the community and contractors whilst receiving full support from the provincial government of Catamarca, Argentina.

“We have come a long way since our early days, considering Galan only obtained the original Hombre Muerto assets just over five years ago and with all the delays experienced during Covid-19. This feels more real than ever for everyone at Galan. We will continue to give our best-focused efforts to become a new lithium producer by H1 2025.”

Phase one of the HMW definitive feasibility study (DFS) explores lithium chloride concentrate production, as governed by the production permits.

Optimisation work is over and will contribute to phase two of the DFS release next month.

The HMW project has exploration permits that span 11,600ha. It is expected to produce up to 20 kilotonnes per annum (ktpa) of lithium chloride during its more than 40 years of life.

la page sur ce projet sur le site de Galan Lithium : https://galanlithium.com.au/projects/ho ... o-project/

désertique cet endroit :

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

suite de ce post du 26 mars 2023 viewtopic.php?p=2365764#p2365764

https://www.businesswire.com/news/home/ ... ing-UpdateE3 Lithium Advances Lithium Production Testing and Provides Field Pilot Plant Commissioning Update

August 23, 2023

E3 Lithium Alberta’s leading lithium developer and extraction technology innovator, today announced it has successfully produced lithium carbonate, the last major step in a conventional process before conversion to battery quality lithium hydroxide monohydrate (LHM).

The test work used concentrate generated from brines located in E3 Lithium’s Clearwater Project Area, produced during the Direct Lithium Extraction (DLE) testing completed in preparation for the pilot plant.

E3 Lithium has engaged a major lithium refining technology and equipment vendor to develop the downstream lithium production processes in preparation for the upcoming Pre-Feasibility Study. The testing was conducted to treat a sample of concentrate, or eluate, produced by DLE technology. The test program has successfully progressed through the coarse purification and concentration phases, and the eluate has been converted into lithium carbonate. The final steps include further downstream polishing to achieve the desired purity and then conversion of the carbonate into battery-grade LHM.

As the pilot plant produces more concentrate, E3 Lithium will be creating more carbonate and LHM for commercial development purposes. Outlined in the picture below is a sample of the lithium carbonate produced during the current test program.

“Producing high quality carbonate from our Leduc brines with a major equipment vendor is an incredibly exciting milestone for the Company,” said Chris Doornbos, President and CEO of E3 Lithium. “While downstream lithium refining processes are already commercially operating, demonstrating the success of these processes on E3 Lithium’s brine provides more certainty for our commercial processes.”

The objectives of the test program are to validate the downstream flowsheet, generate data required for engineering design purposes and produce LHM for potential offtake partners. E3 Lithium will provide updates as its test program progresses.

......................

- energy_isere

- Modérateur

- Messages : 102684

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

https://oilprice.com/Latest-Energy-News ... thium.htmlSaudis Pour Money Into American Lithium

By Alex Kimani - Aug 30, 2023

Saudi Arabia-based investment company Energy Capital Group (ECG) has invested in U.S.-based Pure Lithium, a company that specializes in lithium metal batteries, for an undisclosed sum. Pure Lithium is looking to establish a fully integrated supply chain in Saudi Arabia, using its proprietary technology that extracts lithium from oil field brines.

“We are thrilled with Energy Capital Group’s investment in Pure Lithium. They recognise the value and impact we can have in the kingdom by unlocking oilfield brines to create a battery-ready electrode, eliminating 90 per cent of the current associated costs,” Emilie Bodoin, founder and chief executive of Pure Lithium, has said.

Famous as one of the leading oil and gas producers, Saudi Arabia is increasingly investing in clean energy. Recently, Saudi Aramco launched a $1.5 billion Sustainability Fund that will invest in technology supporting a “stable and inclusive” energy transition, making this among the largest-ever sustainability-focused venture capital funds in the world. The fund’s initial focus areas include carbon capture and storage(CCS), greenhouse gas emissions, energy efficiency, nature-based climate solutions, hydrogen, ammonia, digital sustainability and synthetic fuels. The fund will target investments globally.

Direct Lithium Extraction

A fleet of direct lithium extraction (DLE) technologies are being developed to tap salty brine deposits across North America, Europe, Asia and elsewhere, with the U.S. Geological Survey estimating the technology could unlock 70% of global reserves of the metal. Whereas DLE technologies vary, they are generally comparable to common household water softeners, and aim to extract ~90% of lithium in brine water vs. 50% using conventional ponds.

Their biggest draw: they can supply lithium for EV batteries literally in a matter of hours or days, way faster than 12-18 months needed to be filtered through in order to be able to extract lithium carbonate from water-intensive evaporation ponds and open-pit mines.

DLE also comes with the added bonus of offering ESG/sustainability benefits: DLE technologies are portable, able to recycle much of their fresh water and limit hydrochloric acid use.

"The world needs abundant, low-cost lithium to have an energy transition, and DLE has the potential to meet that goal," Ken Hoffman, co-head of the EV Battery Materials Research group at McKinsey & Co., has told Reuters.

"The industry is so close to a major leap forward," John Burba, who helped invent a prominent DLE technology and is IBAT's executive chairman, has told Reuters.

The DLE industry is expected to grow to more than $10 billion in annual revenue within the next decade. Commercial scale DLE projects are expected to start coming online in 2025, and could supply 13% of global lithium supply by 2030, as per projections by Fastmarkets.