https://oilprice.com/Metals/Commodities ... -Mine.htmlChina Begins Work on Massive Afghan Copper Mine

By RFE/RL staff - Jul 25, 2024,

Chinese engineers and the Taliban government officially started work on a massive project in Afghanistan to mine the world's second-largest deposit of copper.

At the July 24 event at Mes Aynak, some 40 kilometers southeast of the capital, Kabul, Taliban officials along with Chinese businessmen and diplomats carried out a ribbon-cutting ceremony as work began on the construction of a road to the mining site.

A $3 billion deal signed in 2008 gave the Chinese state-owned China Metallurgical Group Corporation (MCC) a 30-year mining concession, but combat between NATO-led troops and Taliban insurgents at the time delayed the project from moving forward for 16 years.

With violence waning since the Taliban's 2021 takeover of power amid the withdrawal of foreign troops, the cash-strapped Taliban-installed government is eager to exploit the country's vast and lucrative mineral deposits.

"The time wasted in the implementation of the project should be recuperated with speedy work," Deputy Prime Minister for Economic Affairs Abdul Ghani Baradar said at the ribbon-cutting event.

Taliban officials said it would likely be at least two years before the first copper was extracted by MCC while Chinese diplomats praised the progress as a sign of warming ties between Beijing and Kabul.

"The economic and trade relations between the two countries are becoming increasingly close," said China's ambassador to Afghanistan, Zhao Xing.

Since it seized power, the Taliban has faced the task of undertaking the reconstruction and development of a country devastated by decades of war.

But officials have also found their economy suffocated by Western sanctions and dealing with international isolation that has cut them off from receiving financial support.

China has been an exception for the Taliban government, with Beijing vowing to pursue deeper cooperation shortly after the group took control of Kabul.

Beijing has been particularly focused on exploiting Afghanistan's extensive resource wealth, from oil and gas to rare-earth metals.

Mes Aynak remains one of the most attractive offerings for Chinese firms. The deposit is estimated to contain 11.5 million tons of copper ore, which is vital for electronics components and is surging in value due to its use in growing markets related to electric vehicles, renewable energy, and data centers.

According to a Brookings Institute report, Afghanistan sits on some 2.3 billion metric tons of iron ore and 1.4 million metric tons of rare-earth minerals, and the U.S. Geological Survey has calculated that the country is sitting on $1 trillion in untapped minerals, such as iron, gold, and lithium -- an essential but scarce component in rechargeable batteries and other technologies.

Amir Mohammad Musazai, a retired professor from the Department of Geology and Mines at Kabul Polytechnic University, told RFE/RL's Radio Azadi that mining Mes Aynak is likely to yield amounts of copper ore worth more than the $3 billion that was signed for the mining rights, given that nearby areas also hold large copper reserves that weren’t factored into the original plans.

While the groundbreaking event at Mes Aynak is a sign that Chinese resource ventures are moving forward in the country after decades of delays due to war, security concerns are still a major hurdle holding back more expansive projects, which often rely on Chinese engineers and other staff.

The July 24 ceremony was closely guarded by dozens of armed men and Taliban officials made assurances that they would protect staff at the mining project.

Chinese workers have increasingly become a target of attacks in the region, including a suicide attack that killed five Chinese enginners in Pakistan in March and a 2021 bombing that killed 13 people, including nine Chinese workers, at a dam project in the South Asian country.

In Afghanistan, at least five Chinese nationals were wounded when gunmen stormed a Kabul hotel popular with Beijing businessmen in 2022.

Le Cuivre

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 2 oct 2021 http://www.oleocene.org/phpBB3/viewtopi ... 6#p2327776

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.agenceecofin.com/energie/24 ... nergetiqueZambie : hausse des coûts de production de cuivre à cause du déficit énergétique

Agence Ecofin 24 juillet 2024

Deuxième producteur africain de cuivre, la Zambie fait face depuis quelques mois à un déficit énergétique en raison d’une sécheresse historique. Pour y faire face, le canadien First Quantum importe une partie de sa consommation électrique, avec un impact potentiel sur les coûts de production.

First Quantum prévoit une hausse de 0,06 $ du coût de chaque livre de cuivre produite en Zambie pour le reste de l’année, en raison du déficit énergétique dans le pays. La compagnie canadienne l’a annoncé le 24 juillet dans son bilan du deuxième trimestre, précisant que c’est une hausse par rapport au montant de 0,03 $ par livre (soit 25 millions $) initialement prévu.

En raison d’une sécheresse historique qui affecte la production hydroélectrique en Zambie, la compagnie nationale d’électricité a annoncé en juin une réduction de 40 % de l’approvisionnement énergétique au profit des compagnies minières. En conséquence, First Quantum a décidé d’importer de l’électricité auprès des fournisseurs de la sous-région à hauteur de 193 MW, soit 52 % de ses besoins maximaux.

Au deuxième trimestre, notons que First Quantum a produit 95 102 tonnes de cuivre en Zambie, en légère hausse par rapport aux 93 698 tonnes du premier trimestre 2024. La compagnie canadienne exploite les mines Kansanshi et Sentinel et veut produire un maximum de 400 000 tonnes de cuivre dans le pays en 2024.

Pour rappel, la Zambie est le deuxième producteur africain de cuivre.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/codelco-says ... f-of-2024/Codelco says output falls 8% in first half of 2024

Reuters | July 26, 2024

Chile’s Codelco, the world’s largest copper producer, on Friday posted a 8.4% drop in output for the first half of 2024 compared with the same period last year, to 579,785 metric tons, citing operational setbacks and difficult weather.

The company attributed the lower output to an extended truck stoppage following a fatal accident at its Radomiro Tomic mine, low contributions from El Teniente after a rock burst last year, ramp-up delays for Rajo Inca and adverse weather.

The state-owned miner said its pre-tax profit from January to June totaled $653 million, against a loss of $316 million in the same period last year.

Codelco has said this year’s output should top the 1.325 million tons produced last year, forecasting a range of up to 1.390 million tons as it expects output to pick up again in the second half of the year.

Analysts, however, say Codelco will struggle to reach that target in the coming months.

“We want to regain the ability to meet our targets in a timely and efficient manner, and these good financial results encourage us to keep up the effort,” chief executive Ruben Alvarado said in a statement.

“We are working to ensure that, starting this second half of the year, production will begin its long-term growth rate,” he said.

Codelco aims to progressively reach an output of 1.7 million tons by 2030.

The company is also spearheading an increase in state control over the country’s lithium industry, and in May finalized a deal with SQM, the world’s second-largest producer, in a tie-up that should grant SQM the ability to extract lithium in the prized Atacama salt flat through 2060.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/freeport-mcm ... hile-mine/Freeport McMoran plans $7.5bn investment to expand Chile copper mine

Reuters | July 23, 2024

The El Abra mine in northern Chile. (Credit: Consejo Minero)

US miner Freeport McMoran plans to invest around $7.5 billion to expand its El Abra copper mine in Chile, a project expected to take seven to eight years to develop due to permitting requirements, CEO Kathleen Quirk said on Tuesday.

Speaking in a call with analysts after reporting second quarter results that beat profit estimates, Quirk said Freeport planned to submit an environmental impact statement by the end of next year.

“We’re going to continue to review the economics in the context of market conditions, but believe this is a project that will be required in the future to support long-term copper demand trends,” Quirk said.

Freeport owns 51% of El Abra, with the remainder held by Codelco, one of the world’s biggest copper producers. The mine produced 98,400 metric tons of copper last year, according to data from state agency Cochilco.

Freeport chairman Richard Adkerson said Codelco was “anxious for us to move forward” and supported the company developing a relationship with Chilean President Gabriel Boric.

He noted that Boric had proven to be supportive of the mining industry.

“The tone is significantly changed from his initial election period,” Adkerson said.

Quirk added that Chile as well as Peru, home to Freeport’s copper and molybdenum mine Cerro Verde, were both interested in attracting more investment in the sector.

In Chile, she said Freeport was hopeful that the government would carry out its aim to streamline permitting for mining projects.

The expansion at El Abra calls for a new concentrator plant, pipelines for water requirements, and investments in desalinization. It would yield 750 million pounds of copper and 9 million pounds of molybdenum per year, Quirk said.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Une nouvelle mine de Cuivre à venir en Australie : Eva copper mine

sur le site du minier : https://www.harmony.co.za/operations/au ... e-project/

https://www.mining-technology.com/news/ ... r/?cf-viewQueensland Government offers $13.5m for Harmony’s Eva copper mine

The grant is contingent upon Harmony reaching a positive final investment decision (FID) on the project by January 2026.

July 31, 2024

Harmony Gold Mining has received a conditional grant of A$20.7m ($13.54m) from the Queensland Government in Australia for its Eva Copper Mine Project.

The funding forms part of the Mount Isa Mining Acceleration Programme, which was launched to expedite resource projects in the North West Minerals Province over the next five years.

It is contingent upon Harmony reaching a positive FID by January 2026.

The funds are allocated for preparatory works at the project site near Cloncurry and Mount Isa, on the traditional lands of the Kalkadoon People.

Harmony’s preparatory works funded by the grant include the construction of site access roads, an upgrade of the Burke Developmental Road intersection, fencing, accommodation facilities, and other essential services and infrastructure.

The activities are part of a broader early works programme aimed at initiating copper production.

These developments follow the Queensland Government’s designation of the Eva Copper Mine Project as a ‘prescribed project’ in March 2024, acknowledging its importance to the socioeconomic landscape of the state’s North West region.

Expected to create around 800 construction jobs and 450 jobs when in operation, the Eva copper project is expected to have a 15-year minimum operational life.

sur le site du minier : https://www.harmony.co.za/operations/au ... e-project/

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

projet de mine de Cuivre et Palladium en Ontario :

https://www.mining.com/generation-minin ... n-ontario/Generation Mining advances on permitting for PGM-copper mine in Ontario

Staff Writer | July 31, 2024

Generation Mining (TSX: GENM) has moved one step closer to building North America’s next PGM (platinum group metals) and copper mine after securing approval for construction of key infrastructures.

On Wednesday, the company announced that the federal government has approved amendments to the Metal and Diamond Mining Effluent Regulations — effectively allowing the construction of specific water management structure at its Marathon mine site in Ontario.

Sign Up for the Copper Digest

The milestone follows the approval by the Ontario government of the mine’s closure plan last November, as well as the environmental approvals obtained before that.

Receipt of the few remaining approvals and permits (provincial and federal) required for construction is expected in the coming months, Generation Mining said in a news release.

“We are now on the cusp of having one of the only permitted copper and PGM projects in North America that can be constructed and brought into operation once we obtain the requisite financing,” CEO Jamie Levy said.

“The Marathon project is one of the most advanced critical mineral projects in Canada, and this government approval represents another milestone on the path to developing Canada’s next copper and palladium mine,” Levy added.

According to a new feasibility study released this year, the Marathon project in northwestern Ontario is expected to produce an average of 166,000 oz. of payable palladium and 41 million lb. of payable copper annually over a 13-year mine life.

The study estimated an after-tax net present value (using a 6% discount rate) of C$1.16 billion, an internal rate of return of 25.8%, and a 2.3-year payback. Initial capital costs of the project are pegged at C$1.11 billion.

Generation Mining’s stock surged 11.5% by 3 p.m. ET following the latest development. This gave the company a market capitalization of approximately C$68.5 million ($49.3m).

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 15 oct 2023 viewtopic.php?p=2378392#p2378392

https://www.mining-technology.com/news/ ... a/?cf-viewDrilling campaign confirms high-grade copper at Loz Azules in Argentina

Meanwhile, McEwen Copper has commended legislation on large-scale domestic and foreign direct investment (FDI) in Argentina, which is expected to benefit the mining industry.

Claire Jenns August 9, 2024

McEwen Copper has completed drilling for the feasibility study of the Loz Azules mine in Argentina, confirming a high-grade copper zone. The feasibility study is on track for completion in early 2025, it said.

The 2023–24 drilling marked the largest campaign in the history of Los Azules and one of the largest in Argentina. It covered 70,400m and used 23 rigs, bringing the Los Azules drill hole database to 193,600m.

McEwen Copper’s study found that in much of the deposit’s footprint, mineralisation encountered at depth indicates the potential to extend further, beyond 1,000m.

Testing for extensions beyond the planned pit saw mineralisation 400m to the north and 700m to the south.

According to an updated Preliminary Economic Assessment (PEA) completed in 2023, Los Azules is expected to produce an average of 322 million pounds of copper cathode annually over a 27-year lifespan.

The project is located approximately 6km east of Argentina’s border with Chile, at 3,500m elevation in the Andes Mountains.

........................

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 17 dec 2023 http://www.oleocene.org/phpBB3/viewtopi ... 9#p2381799

https://www.nsenergybusiness.com/news/a ... t/?cf-viewArizona Sonoran estimates initial capex of $668m for Cactus copper project

The American copper project will have an average annual throughput of 29 million tonnes, resulting in the production of approximately 86,000 tonnes of copper cathodes per year

Staff Writer 8th Aug 2024

Arizona Sonoran Copper said that its fully owned brownfield Cactus copper project in the US will require an initial capital expenditure (capex) of $668m, based on the findings of a preliminary economic assessment (PEA).

The emerging copper developer and producer company said that the American copper project will have a project life of around 31 years.

Located in Arizona, the Cactus project consists of three deposits and one stockpile, including the past producing Sacaton mine. The deposits are known as Cactus East, Cactus West, and Parks/Salyer deposits.

The PEA for the Cactus project incorporates the Parks/Salyer additions from the MainSpring property as inferred mineral resources, which have been re-evaluated as an open-pit operation.

According to the study, the copper project will have an average annual throughput of 29 million tonnes, resulting in the production of approximately 86,000 tonnes of copper cathodes per year. This is expected to create a lower-risk brownfield open-pit mining operation with an extended mine life.

Copper cathodes will be produced directly onsite through heap leaching, solvent extraction, and electrowinning (SXEW), including a four-year ramp-up period.

Arizona Sonoran Copper projects senior vice president Bernie Loyer said: “The evolution of the MainSpring and Parks/Salyer open pit combination as demonstrated by this PEA presents a profound change to the Cactus Mine business case.

“That impact can be gauged in the project’s robust economics and also in the contribution that this generational asset is expected to make to our local communities for years to come.

“With the anticipated creation of more than 3,000 direct and indirect jobs and more than $2.2 billion in life of mine federal and state tax revenues, Cactus Mine is anticipated to become a cornerstone business for the local economy.”

The PEA estimates an after-tax net present value (NPV) of $2.03bn for the American brownfield copper project. It projects a post-tax internal rate of return (IRR) of 24% with an after-tax payback period of 4.9 years.

The Cactus copper project is estimated to generate a free cash flow of $7.3bn over the life of the project.

Arizona Sonoran Copper expects to complete a pre-feasibility study (PFS) in the first half of 2025 following the release of the PEA.

This will be followed by an early works programme, with a feasibility study anticipated in the second half of 2025. The company is also planning to secure a project financing for the Cactus copper project along with a potential construction decision.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Chili: une grève débute dans la plus grande mine de cuivre du monde

Les travailleurs d'Escondida, la plus grande mine de cuivre du monde située dans le nord du Chili, ont entamé mardi une grève faute d'être parvenus à un accord sur une nouvelle convention collective avec leur employeur, le groupe australien BHP, a annoncé leur syndicat.

RFI le : 14/08/2024

lire https://www.rfi.fr/fr/am%C3%A9riques/20 ... e-du-monde

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.lefigaro.fr/flash-eco/les-t ... e-20240816Les travailleurs de la plus grande mine de cuivre au monde, au Chili, suspendent leur grève

Par Le Figaro avec AFP 16 aout 2024

Les travailleurs d'Escondida, la plus grande mine de cuivre du monde située dans le nord du Chili, ont suspendu vendredi la grève qui avait débuté mardi, suite à la reprise des négociations avec le groupe minier australien BHP, a annoncé ce dernier. «Il a été convenu de suspendre la grève légale en cours», a déclaré BHP dans un communiqué. «C'est fait», a confirmé à l'AFP Patricio Tapia, le président du premier syndicat d'Escondida.

La décision a été prise après la reprise des négociations, au cours desquelles les parties «sont parvenues à un consensus sur une proposition de convention collective», selon le communiqué de la compagnie minière. Les syndicats d'Escondida, qui avaient approuvé cet appel à la grève le 1er août, réclament de longue date que 1% des dividendes que se versent les actionnaires étrangers de la mine soient distribués aux travailleurs. Ils réclament aussi une amélioration de leurs conditions de travail, notamment une augmentation de leur temps de repos et un ajustement des «primes variables».

Située dans le désert d'Atacama, la mine d'Escondida est contrôlée par l'australien BHP à 57,5%. Les autres actionnaires sont l'australien Rio Tinto (30%) et le japonais Jeco (12,5%). Elle a produit en 2023 1,1 million de tonnes de cuivre, soit 5,4% de la production mondiale et 21% de celle du Chili. En 2017, les travailleurs d'Escondida avaient observé une grève de 44 jours, la plus longue de l'histoire minière chilienne. Le mouvement avait provoqué 740 millions de dollars de pertes et entraîné une contraction de 1,3% du produit intérieur brut (PIB) du Chili cette année-là.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 21 avril 2024 http://www.oleocene.org/phpBB3/viewtopi ... 2#p2389932

https://www.mining.com/metso-signs-e200 ... d-project/Metso signs €200m equipment deal for Barrick’s Reko Diq copper-gold project

Staff Writer | August 14, 2024

Metso announced on Wednesday it has signed an agreement with Reko Diq Mining for key process equipment deliveries to the greenfield copper-gold project located in the province of Balochistan in Pakistan.

The project, jointly owned by Barrick Gold (NYSE: GOLD) (TSX: ABX) and Pakistan, is one of the largest undeveloped copper-gold deposits in the world.

The value of the Metso equipment packages under the framework agreement is €200 million. The value of the first orders, consisting of crushing and grinding equipment, is close to €100 million in total, and they are booked in the Minerals segment’s 2024 third-quarter order intake.

Metso’s scope of delivery for the crushing and grinding circuits includes Superior 6089 MKIII gyratory crushers and Nordberg MP1250 cone crushers, as well as Premier ball mills with 51MW installed power, equipped with gearless mill drive technology and Metso’s failsafe polymer hydrostatic shoe bearing systems, significantly increasing reliability and reducing maintenance costs. The mills will be equipped with Metso’s metallic mill linings.

Orders for the TankCell mechanical flotation cells and high-intensity Concorde Cell units, HRT thickeners, Vertimill and HIGmill regrind mills, mill reline equipment, concentrate filters, and automation equipment included in the frame agreement are expected to be signed and booked in the Minerals segment’s order intake later in 2024 and 2025.

“Reko Diq will substantially expand Barrick’s strategically significant copper and gold portfolios and benefit all its Pakistani stakeholders for generations to come. We are pleased to partner with Metso in this project where sustainable concentrate processing is one of the key drivers for plant design and operation,” Barrick CEO Mark Bristow said in a news release.

It is anticipated that Reko Diq will have a mine life of approximately 40 years as a truck-and-shovel open pit operation, with construction expected in two phases and providing a combined processing capacity of circa 90 million tonnes per annum. The first production is targeted for 2028.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 10 sept 2023 http://www.oleocene.org/phpBB3/viewtopi ... 9#p2376689

https://www.mining.com/ivanhoe-electric ... r-project/Ivanhoe Electric acquires full ownership of mineral rights at Santa Cruz copper project

Staff Writer | August 13, 2024

Santa Cruz copper project. (Image courtesy of Ivanhoe Electric | Twitter.)

Ivanhoe Electric (NYSE American: IE) (TSX: IE) has gained full ownership of the mineral rights comprising its Santa Cruz copper project in Arizona after making the final payment under a purchase option.

In May 2023, the company acquired nearly 6,000 acres of surface title and associated water rights for approximately $116 million. The transaction included an option to purchase the mineral rights contiguous with the acquired lands.

On Tuesday, the US-focused copper developer made the final $10 million payment to acquire a 100% interest in these mineral rights, and therefore has secured 100% of the surface and mineral rights for the Santa Cruz project.

“Completing our option agreement and securing 100% ownership of the mineral rights at our Santa Cruz copper project in Arizona is an important milestone for our company,” Ivanhoe Electric CEO Taylor Melvin said in a news release.

“We have now completed the consolidation of surface and mineral rights ownership at one of the largest and highest grade undeveloped copper resources in the United States that is located entirely on private land.”

Ivanhoe’s Santa Cruz project contains 26.7 million tonnes of indicated resources grading 1.24% total copper (2.8 million tonnes of contained copper) and 149.0 million tonnes of inferred resources grading 1.24% total copper (1.8 million tonnes of contained copper).

An initial assessment of the project in 2023, focusing only on a small surface footprint for an underground copper mine, had total copper production estimated at 1.6 million tonnes over a 20-year mine life with cash costs of $1.36/lb. of copper.

The project is also designed to minimize surface land disruption. The IA base case assumes that 70% of the electric power required for the project will be generated by onsite renewable energy infrastructure to minimize carbon dioxide equivalent emissions.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Un projet de mine de Cuivre au Mexique : Santo Tomas

https://www.nsenergybusiness.com/news/o ... t/?cf-viewOroco estimates initial capex of $1.1bn for Santo Tomas porphyry copper project

The PEA estimates an after-tax NPV of around $1.5bn for the Mexican porphyry copper project and a post-tax IRR of 22.2% with an after-tax payback period of 3.8 years

Staff Writer 21st Aug 2024

Oroco Resource disclosed that the Santo Tomas porphyry copper project in Mexico will require an initial capital expenditure (Capex) of $1.1bn, based on the findings of a preliminary economic assessment (PEA).

The sustaining and expansion capital for the Mexican porphyry copper project is estimated to be $1.73bn.

Prepared by Ausenco Engineering USA South, the PEA is based on a staged open pit mine and processing plant achieving a production rate of 60,000 tonnes per day in the first year of the project.

The Canadian mineral exploration company said that the Santo Tomas project will have a total life of 23.5 years. It includes one year of pre-stripping and one final year of stockpile rehandling at the mill.

Phase 2 of the project, which marks the expansion of the porphyry copper project to 120,000 tonnes per day, will start in the eighth year of operation.

Located in Sinaloa State, the Santo Tomas property includes 9,034ha of mineral concessions covering significant porphyry copper mineralisation in northern Sinaloa and southwest Chihuahua.

The PEA estimates an after-tax net present value (NPV) of $1.48bn for the Mexican porphyry copper project. It projects a post-tax internal rate of return (IRR) of 22.2% with an after-tax payback period of 3.8 years from the first concentrate production.

Oroco Resource CEO Richard Lock said: “When we completed the initial PEA in December 2023 it was clear there was additional value to be unlocked at Santo Tomas.

“Upon careful analysis, a staged approach to the mine expansion and a focus on exploiting the higher-grade near surface material in the early years of mining has unlocked a considerable increase in value.

“We have established a plan that invokes a very efficient use of capital and establishes a rapid post-tax payback of 3.8 years. The plan starts with the use of smaller equipment to provide rapid entry to the mineralised material and maintains a higher-grade feed profile to delay the requirement of an expansion until year 8.”

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 29 juin 2024 http://www.oleocene.org/phpBB3/viewtopi ... 4#p2393864

https://www.agenceecofin.com/cuivre/230 ... -tonnes/anRDC : la capacité de production de la mine Kamoa-Kakula augmente à 600 000 tonnes/an

Agence Ecofin 23 aout 2024

Premier producteur de cuivre d’Afrique et l’un des leaders de la production mondiale, la RDC tire d’importants revenus de ce secteur où les prix sont en hausse depuis plusieurs mois. Elle peut compter sur Kamoa-Kakula, plus grande mine de cuivre du continent, pour continuer d’accroitre ses recettes.

Ivanhoe Mines a annoncé cette semaine l’entrée en production commerciale du troisième concentrateur de cuivre de son projet Kamoa-Kakula, en RDC. Cette nouvelle usine de traitement porte la capacité de production du complexe minier de 450 000 tonnes à plus de 600 000 tonnes.

L’information intervient quelques semaines après la publication du bilan opérationnel du premier semestre 2024 dans lequel la compagnie rapporte une production de 186 925 tonnes sur la mine. Si cette performance représente une baisse en glissement annuel de 5 %, la compagnie devrait corriger le tir au deuxième semestre grâce au démarrage de la production commerciale du nouveau concentrateur.

« Le concentrateur de la Phase 3 devrait produire à lui seul environ 150 000 tonnes de cuivre par an. En plus des concentrateurs des Phases 1 et 2, la capacité totale de production de cuivre à Kamoa-Kakula devrait dépasser les 600 000 tonnes par an, ce qui en ferait la troisième plus grande opération minière de cuivre au monde », a déclaré Robert Friedland, coprésident exécutif d’Ivanhoe Mines.

Selon les données relayées par Africa Finance Corporation qui a financé à hauteur de 150 millions de dollars l’extension de la capacité de production de Kamoa-Kakula, le projet a contribué à hauteur de 4 % au produit intérieur brut (PIB) de la RDC. Pour le pays d’Afrique centrale, il représente un atout majeur pour maintenir sa place de deuxième producteur mondial de cuivre dans un contexte de hausse des prix du métal rouge. La hausse de la production et des prix a ainsi permis au pays d’augmenter ses recettes minières de 2018 à 2028, selon le FMI.

- energy_isere

- Modérateur

- Messages : 103080

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

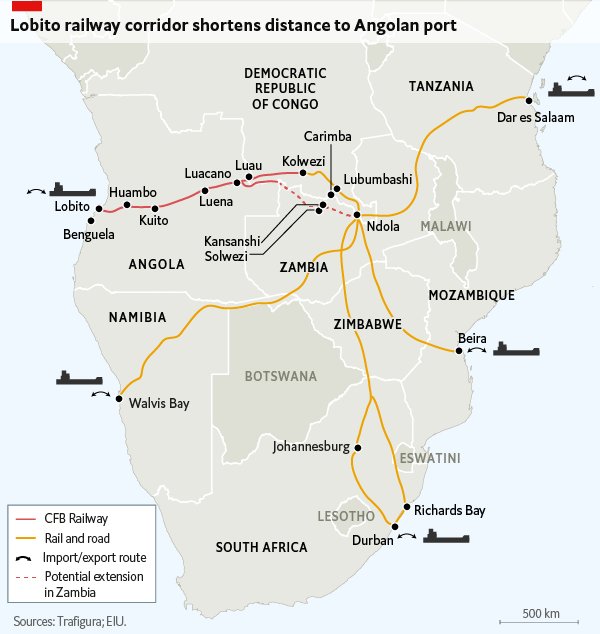

https://www.agenceecofin.com/transport/ ... etats-unisCorridor de Lobito : la RDC lance les exportations de cuivre vers les États-Unis

Agence Ecofin 23 aout 2024

Pays quasiment enclavé, la RDC exporte son cuivre vers les marchés internationaux en s’appuyant sur d’autres pays africains. Alors que l’expédition via les ports en Tanzanie et en Afrique du Sud entraine des délais relativement longs, l’Angola peut s’imposer comme une alternative plus rapide.

En Angola, une première cargaison de cuivre congolais a quitté cette semaine le port de Lobito pour les États-Unis. C’est l’annonce faite le 22 août par le groupe Trafigura, membre du consortium qui a obtenu la concession du corridor ferroviaire et du port de Lobito.

Selon les détails fournis par Trafigura, la cargaison de cathodes de cuivre à destination du port américain de Baltimore est initialement arrivée au port de Lobito, six jours après son expédition depuis Kolwezi. Cela confirme le statut du corridor de Lobito comme la voie d’exportation la plus rapide pour le cuivre congolais. En comparaison, atteindre le port de Dar es Salaam en Tanzanie ou celui de Durban en Afrique du Sud peut prendre respectivement 14 et 25 jours, depuis les mines de cuivre en RDC.

Avant les États-Unis, notons que le cuivre congolais a déjà été expédié ces derniers mois vers des ports d’Europe et d’Extrême-Orient, à travers le corridor de Lobito. Il faut souligner que l’Union européenne et les États-Unis soutiennent financièrement le développement du corridor, dans le cadre des efforts visant à contrer la domination chinoise dans l’approvisionnement en cuivre à partir de la ceinture de cuivre d’Afrique centrale. Alors que cette ceinture se compose principalement de la RDC et de la Zambie, des négociations sont en cours pour étendre le corridor de Lobito jusqu’en Zambie.