https://www.miningweekly.com/article/bh ... 2024-07-23BHP’s Canada potash mine reaches halfway mark

23rd July 2024

Diversified mining company BHP’s Jansen potash project has reached a pivotal milestone with construction surpassing the 50% completion mark for Stage 1, with Stage 2 also under way.

The project, in Saskatchewan, is on track to see first production in 2026 and be a major global producer of potash by the end of the decade.

BHP first approved the C$7.5-billion investment in Jansen Stage 1 (JS1) in August 2021. In October 2023, the group approved a further investment of C$6.4-billion for Stage 2, bringing BHP’s total investment in Jansen to about C$14-billion. This marks the largest investment in BHP’s history, as well as the biggest private investment in Saskatchewan.

“Reaching the half-way milestone for JS1 is a testament to the dedication of our Team Jansen workforce, our contractors and procurement partners, and the local and Indigenous communities surrounding the Jansen area,” said asset president for potash Karina Gistelinck.

“Building one of the largest potash mines in the world requires an all-hands-on-deck approach, and the province has really come together to make a project of this magnitude possible. Delivering Jansen safely remains our top priority as we get ready for Jansen operations in 2026,” she added.

The journey has not been without challenges – including logistical hurdles, harsh weather and a competitive labour market – but the project remains unstoppable.

.......................

La Potasse

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 21 avril 2024 http://www.oleocene.org/phpBB3/viewtopi ... 7#p2389937

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 20 mai 2024 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2391340

Le projet minier de Potasse Autazes au Brésil va chercher à se financer en rentrant à la bourse de New York.

Il cherche à lever des fonds pour le projet à 2.5 milliards de dollars.

Le projet minier de Potasse Autazes au Brésil va chercher à se financer en rentrant à la bourse de New York.

Il cherche à lever des fonds pour le projet à 2.5 milliards de dollars.

https://www.mining.com/brazil-potash-pl ... s-project/Brazil Potash plans IPO to finance $2.5bn Autazes project

Staff Writer | August 21, 2024

Autazes is expected to be the largest fertilizer mine in Latin America. (Image: Brazil Potash)

Brazil Potash, the company behind Potássio do Brasil, plans to launch an initial public offering on the New York Stock Exchange to fund its $2.5 billion project located in Brazil’s Amazonas state.

The company has filed a preliminary prospectus for the offering with the US Securities and Exchange Commission. Cantor Fitzgerald & Co, Banco Bradesco BBI, Freedom Capital Markets, Roth Capital Partners, and Clarksons Securities have been appointed to coordinate the IPO.

Details such as the number of shares to be offered, the amount to be raised, and the timing of the public offering have not been disclosed.

“The company’s choice to do an IPO on the US stock exchange is because this will give the company greater visibility to attract global investors to its operations, much more than if it opted to list its shares on the Brazilian stock market,” mining consultant Pedro Galdi told BNamericas.

“Furthermore, the scenarios for equity markets in the US and Brazil are pointing in opposite directions. In the US, there is an expectation of a reduction in interest rates in the coming months, which favors investment in shares, while in Brazil, where interest rates remain high, there is an expectation of new increases in interest rates in the coming months, in light of future inflationary pressures,” he said.

The Autazes project

The funds will cover additional engineering and essential tests on critical items like shaft sinking and power transmission lines, as well as necessary permits and applications for the company’s Autazes project.

Brazil Potash began construction in May on the Silvinita mine in Autazes after it received six more licences from the Amazonas Environmental Protection Institute, the agency responsible for environmental licensing in the state.

The project is pegged to be the largest fertilizer mine in Latin America within the Amazon rainforest.

Production is expected to start in 2026 with an initial output sufficient to cover about 20% of Brazil’s potash needs. The project capacity will be 2.2 million tonnes of potassium chloride per year, the company estimates.

The project, which could reduce Brazilian agriculture’s 90% dependence on imported potash, has been held up for years due to opposition from indigenous Mura people, who say they have not been consulted about the use of their ancestral lands.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

https://www.mining.com/web/bhp-sees-bra ... in-canada/BHP sees Brazil as major potash market for new project in Canada

Reuters | September 11, 2024

Australian mining giant BHP expects Brazil to become one of the three largest markets for the major potash project it is developing in Canada, the company’s local head told Reuters on Tuesday.

Potash, along with nitrogen and phosphate, is a primary nutrient essential for food production, and Brazil is one of the world’s largest food suppliers but imports most of its fertilizer needs.

“Brazil is expected to be one of the top three markets for BHP for potash. So it’s very, very important for us,” the miner’s general manager in Brazil, Carla Wilson, said in an interview on the sidelines of a mining conference.

The first phase of BHP’s Jansen potash project in Canada is scheduled to come online in 2026 with annual production capacity of 4.2 million metric tons, following investments of $5.7 billion.

A second phase expected to double the mine’s capacity will require an additional $4.9 billion investment, according to the company.

BHP is working on building connections with potential long-term potash buyers in Brazil, said Wilson, noting that the first phase of the Canadian project is just over 50% complete.

“At this point in time, we’re just slowly starting to build our presence and starting to build those long-term relationships with customers here,” the executive said.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

https://www.mining.com/web/bhps-fertili ... ge-rivals/BHP’s fertilizer boss bets on low-cost potash to challenge rivals

Bloomberg News | September 18, 2024

BHP Group expects its $10.6 billion potash mine in Canada to make money even with weakened fertilizer prices, says the head of the project.

Jansen mine is expected to produce potash at costs that are less than the top Canadian operations of fertilizer giants Nutrien Ltd. and Mosaic Co., according to BHP’s Karina Gistelinck. She said the massive size of the operation and BHP’s heavy investment in automation are key to keeping costs down to be more competitive than other mines in Canada, the world’s top supplier.

“The strategy is to be the most cost-effective mine possible,” she said in an interview. “Even with depressed prices, we’ll be profitable.”

BHP remains optimistic on Jansen even though potash prices have tumbled more than 60% from highs seen two years ago. Prices soared in early 2022 after sanctions on Belarus and Russia’s war in Ukraine stoked fears of supply shocks in a tight market. The two nations are among the top producers of potash and, combined with Canada, account for two-thirds of the global trade.

The world’s biggest miner had already committed $5.7 billion to building the first stage of Jansen in the western Canadian province of Saskatchewan back in August 2021. Two years later, BHP earmarked an additional $4.9 billion for an expansion due to its confidence in the potash market. The spending is on top of an earlier $4.5 billion investment in the area.

Since Jansen’s approval, flows of fertilizer from Russia and Belarus have rebounded and driven down potash prices. BHP’s flagship mine is now expected to pour millions of fresh tons into a balanced market rather than one crying out for new supplies that BHP had anticipated.

Jansen is expected to deliver 4.2 million tons of potash when the first phase starts production in 2026, adding 5% to the current global potash supply, according to Gistelinck. Output is expected to double by 2031, when the project reaches full capacity.

Gistelinck said she anticipates Jansen will produce potash for less than $140 a metric ton. Market prices are expected to range from $300 a ton — in the worst-case scenario — to as high as $450 a ton in the medium to long term, she said.

BHP plans to sell the fertilizer to distributors rather than directly to farmers. The company has already secured commitments for its full potash production, which are expected to become binding contracts next year.

The Melbourne-based company is also mulling initial discounts to gain market share, Gistelinck said.

BHP is targeting Brazil — an agricultural powerhouse that’s highly dependent of fertilizer imports — as well as Southeast Asian nations and the US as major markets for selling its potash as it seeks to reduce exposure to China, she said.

Gistelinck sees demand for the crop nutrient rising 2% annually over the next two years, tracking population growth, while external factors such as the impacts of climate change could also boost consumption.

“Catastrophic events will happen more often and for longer,” she said. “And potassium helps a lot with the resilience of agricultural products.”

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 6 juillet 2024 http://www.oleocene.org/phpBB3/viewtopi ... 8#p2394428

https://www.agenceecofin.com/potasse/15 ... nementalesMaroc : le projet de potasse Khemisset bloqué pour des raisons environnementales

Agence Ecofin 15 oct 2024

Pouvant livrer plus de 700 000 tonnes de potasse par an sur 19 ans, le projet Khemisset est piloté par Emmerson. En 2023, les autorités locales ont rejeté une demande de permis environnemental, nécessaire à la poursuite des activités de la compagnie qui a soumis une nouvelle demande cette année.

Au Maroc, la Commission régionale unifiée de l’investissement (CRUI) a émis un avis défavorable pour le permis environnemental du projet de potasse Khemisset. C’est l’annonce faite le 14 octobre par Emmerson, qui se retrouve donc bloquée depuis plus d’un an dans le développement d’une mine capable de livrer 782 000 tonnes de potasse par an sur 19 ans.

Si ce refus se confirme, il s’agira en effet de la deuxième fois que les autorités marocaines rejettent l’évaluation des impacts environnementaux et sociaux du projet. Lors du rejet de la première demande de permis en 2023, une commission ministérielle a notamment demandé à Emmerson de réduire significativement la consommation d’eau du projet. En juillet 2024, la société cotée à la bourse de Londres a indiqué avoir soumis une nouvelle étude intégrant notamment une réduction de 50 % de sa consommation d’eau sur le projet.

Pour le moment, Emmerson n’a pas fourni de détails sur les raisons du refus attendu, ou encore l’impact de cette décision sur ses ambitions sur le projet Khemisset. Sur la bourse de Londres, l’action Emmerson a enregistré une baisse de 70 % ce lundi 14 octobre, passant de 1,60 livre sterling à l’ouverture à 0,78 livre sterling au moment de la clôture.

En attendant d’en savoir plus sur les plans de la compagnie, rappelons que son projet Khemisset nécessite un investissement initial de 525 millions de dollars, selon une étude de faisabilité actualisée publiée en début d’année. Une mise à jour de l’estimation des ressources minérales est attendue d’ici la fin de l’année.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

https://www.mining.com/web/potash-suppl ... ut-output/Potash supply nears pre-war levels, pushing producers to cut output

Reuters | October 23, 2024

Global potash supply is returning to levels seen before the invasion of Ukraine, as Russia and Belarus sidestep Western sanctions by increasing shipments to Asia and South America, pressuring producers to cut output and avoid oversupply.

Potash production is expected to reach 73 million metric tons this year, with Russian exports at 12-13 million tons and those from Belarus at around 10 million tons, Julia Campbell, head of the potash pricing service at commodity price agency Argus, said.

Potash prices have started to normalize following a period of volatility following Russia’s invasion of Ukraine.

“Russian exports dropped sharply after the war in Ukraine began due to financial and logistical challenges. But these problems have since eased,” Campbell said.

Increased exports from Canada, Jordan and Laos have also boosted global supply and brought down prices, adding to the fears of possible oversupply, with a slight improvement in demand expected only in 2025.

During their half-year earnings reporting, major potash producers such as Germany’s K+S sounded optimistic about growing demand and stabilizing prices.

However, analysts have since warned the abundant global supply would put a cap on pricing, dampening the companies’ earnings prospects.

“I don’t think there’s likely to be any sort of premium pricing or any real pricing benefit as a result of the global supply shift and the global trade shift. We saw that mostly in 2022 and into 2023 when prices were still moderating,” Morningstar analyst Seth Goldstein told Reuters.

As such, Canada’s share of global potash trade increased significantly in 2022, while those of Belarus and Russia declined. Prices have since dropped below $300 a ton from a mid-2022 peak of $1,000, on weak demand, data from Argus showed.

“We are likely nearing the operational cost of production, which may force some companies to curb production,” Rabobank analyst Paul Joules said.

Canada’s Nutrien, the world’s top producer of the mineral mainly used in fertilizers, suspended its ramp-up plans for potash production in August, citing market conditions.

Rising shipments, growing concerns

Russian producers have increased shipments to China and India via new rail routes since Russia exited the Black Sea grain deal last year. This has boosted demand in Southeast Asia and South America, Morningstar’s Seth Goldstein said.

Belarusian exporters have shifted cargo from Baltic ports to Russian ones and are offering potash at a discount via these new routes bypassing sanctions, he added.

Meanwhile, Swiss-based Eurochem is expanding facilities at its Usolskiy and Volgakaliy sites in Russia.

“The MOP (muriate of potash, or potassium chloride) sector specifically, is already experiencing a period of very heavy supply,” said Humphrey Knight, an analyst at CRU London.

Farming the price drop

The fall in potash prices has improved affordability of some grains and oilseeds, fertilizer consultant Delphine Leconte-Demarsy from the UN Food and Agriculture Organization said.

“In the US, potash remains more expensive than it was before the price hike, but this is compensated by comparatively higher crop prices,” Leconte-Demarsy said.

But she added local farmers were affected differently depending on logistical costs and exchange rates.

“In China, while potash is currently more affordable than before the price hike for wheat and maize, depressed rice markets curb potash use for this crop,” she said.

In Brazil, a major exporter of agricultural products, potash prices are back to 2019 levels, boosting its use for more highly priced crops such as soybeans and maize.

Farmers will continue to reap the benefits as the tight market is expected to keep potash prices below historical averages, Rabobank’s Joules said.

($1 = 0.9215 euros)

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 5 avril 2024 viewtopic.php?p=2389246#p2389246

https://www.agenceecofin.com/fils-indus ... ue-en-2029Congo : l’entrée en production du projet de potasse Kola prévue en 2029

Agence Ecofin 21 nov 2024

Le projet Kola est piloté au Congo-Brazzaville par Kore Potash. Capable de livrer plus de 70 millions de tonnes de potasse sur 33 ans, le projet peut contribuer à accroitre la part du secteur minier dans l’économie nationale, actuellement à 1 %.

La compagnie minière Kore Potash a annoncé le 20 novembre la signature d’un contrat avec Power China pour la construction de la mine de potasse Kola au Congo. La mise en service est prévue au premier semestre 2029, sous réserve notamment de mobiliser 1,92 milliard $ pour financer les travaux et de respecter la durée de construction estimée à 43 mois.

Selon les estimations de Kore, son projet Kola peut livrer annuellement 2,3 millions de tonnes de muriate de potasse sur une durée de vie de 33 ans. Les travaux de construction devraient démarrer dans la seconde moitié de l’année 2025. La mise en service contribuera à changer le visage du secteur minier congolais, dont la contribution à l’économie nationale est d’environ 1 % actuellement, aussi bien en matière d’emplois que de recettes pour l’État.

Sur la durée de vie de la mine, la convention minière signée en 2017 entre le gouvernement congolais et Kore Potash, puis ratifiée en 2018 par le Parlement, prévoit en effet une participation de 10 % pour l’État et un taux d’imposition de 15 %. Ce taux n’est néanmoins pas applicable durant les cinq premières années à compter de la rentabilité du projet, et restera à 7,5 % durant les cinq années suivantes. Le gouvernement a aussi droit à une redevance de 3 % sur les revenus tirés de la production.

Rappelons que le financement du projet devrait être bouclé d’ici le second semestre 2025. Kore Potash a conclu en avril 2021 un protocole d’accord avec Summit Corporation, qui se propose de fournir un mécanisme de financement par emprunt et redevances pour la construction de la mine Kola.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

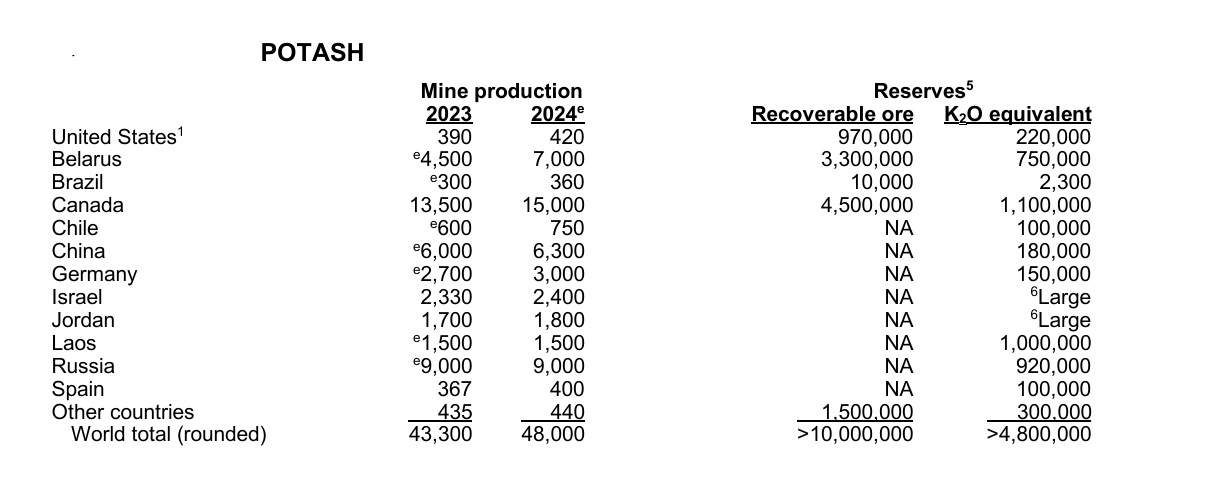

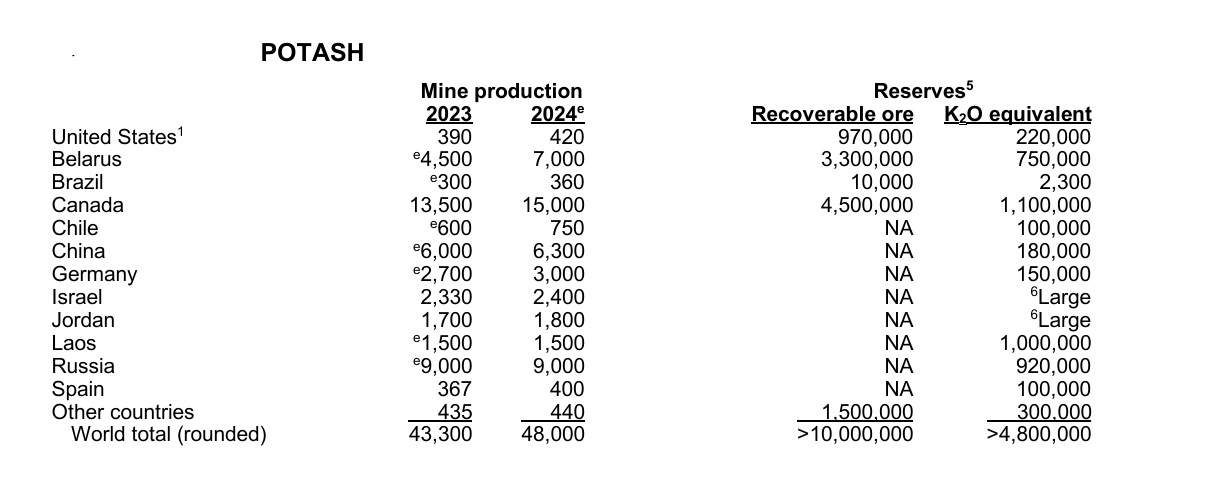

La derniére fiche de l' USGS sur la Potasse (Potash) https://pubs.usgs.gov/periodicals/mcs20 ... potash.pdf

Augmentation de 11 % de la production mondiale

Data in thousand metric tons of K2O equivalent

mon post de l' an dernier : viewtopic.php?p=2385772#p2385772

Augmentation de 11 % de la production mondiale

Data in thousand metric tons of K2O equivalent

mon post de l' an dernier : viewtopic.php?p=2385772#p2385772

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 19 oct 2024 viewtopic.php?p=2400636#p2400636

https://www.agenceecofin.com/actualites ... de-dollarsLa pénurie d’eau au Maroc bloque un projet de potasse à 2,2 milliards de dollars

Agence Ecofin 22 avril 2025

En octobre 2024, les autorités marocaines ont émis un 2e avis défavorable pour le permis environnemental du projet Khemisset. Malgré une conception annoncée comme sobre en eau, ce gisement de potasse subit les conséquences de la pénurie historique de ressources hydriques dans le royaume.

Au Maroc, le projet minier de potasse Khemisset est aujourd’hui à l’arrêt. En mars 2025, son développeur Emmerson Plc a mobilisé des fonds afin d’engager une procédure d’arbitrage contre l’État marocain, après l’échec de plusieurs tentatives pour obtenir l’autorisation environnementale nécessaire au lancement du chantier. Au cœur du blocage : la raréfaction des ressources en eau dans un pays confronté à un stress hydrique croissant.

Initialement prévue pour 2023, la construction de la mine a été retardée après un premier refus de l’autorisation environnementale par les autorités marocaines. Emmerson a revu sa copie en 2024 et soumis une version actualisée de son étude d’impact environnemental, intégrant une réduction de 50% de la consommation d’eau et l’élimination totale des rejets de saumures. Malgré ces efforts, la Commission régionale unifiée d’investissement a maintenu son avis défavorable, estimant que le projet ne garantit pas un usage soutenable des ressources en eau.

Le Maroc, qui fait face à une sécheresse depuis quelques années, connaît en effet une réduction progressive de son approvisionnement hydrique. Entre 2019 et 2022, la Direction générale marocaine de la météorologie a enregistré les niveaux de sécheresse les plus sévères depuis les années 1960, aggravés par une faible pluviométrie en 2023. Selon la Banque mondiale, la dotation annuelle en eau pourrait tomber sous la barre de 500 m3 par personne d’ici 2030, marquant ainsi une situation de très grande pénurie.

Alors que l’incertitude subsiste sur l’avenir du projet Khemisset, son blocage montre qu’au Maroc, l’accès à la ressource hydrique devient un critère décisif dans l’instruction des projets miniers. Reste à savoir si les autorités définiront un cadre plus lisible, avec des seuils clairs de consommation d’eau. En l’absence de telles balises, d’autres projets risquent de se heurter aux mêmes incertitudes.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 23 nov 2024 viewtopic.php?p=2402894#p2402894

https://www.agenceecofin.com/actualites ... e-owi-ramsPotasse au Congo : Kore veut mobiliser 2,2 milliards $ auprès du suisse OWI-RAMS

Agence Ecofin 10 juin 2025

Kore Potash développe au Congo le projet Kola qui peut livrer jusqu’à 50 millions de tonnes de potasse en 23 ans. Pour concrétiser le potentiel de ce gisement, la compagnie doit mobiliser environ 2 milliards $ pour les travaux de construction de la mine.

Kore Potash a annoncé mardi 10 juin la signature d’un protocole d’accord non contraignant avec le fonds d’investissement OWI-RAMS pour financer la construction de sa mine de potasse Kola en République du Congo. Basé dans le canton de Zoug en Suisse, OWI-RAMS devrait mobiliser environ 2,2 milliards de dollars par le biais d’un mélange de dette et de financement par redevances.

Dans le détail, Kore recevra un prêt garanti de 1,53 milliard $, structuré selon la finance islamique, rémunéré à un taux fixe à déterminer entre 6,8 et 9,3 % l’an. Une période de grâce d’environ quatre ans couvrira la construction et la montée en puissance de la mine avant le début du remboursement. Les 655 millions $ restants prendront la forme d’un financement par redevances non remboursable.

Ce dispositif accordera à OWI-RAMS 14 % des recettes du projet jusqu’au remboursement complet du prêt de 1,53 milliard $, puis 16 % des recettes pour le reste de la durée de vie de la mine. Le bailleur de fonds disposera enfin d’une option pour acheter jusqu’à 100 % de la potasse produite au prix de référence CFR Brazil, c’est-à-dire le cours international de la potasse livrée au marché brésilien, publié par des agences spécialisées.

La signature de ce protocole d’accord intervient après celle en novembre 2024 d’un contrat d’ingénierie, d’approvisionnement et de construction (EPC) avec Power China. Le coût total des travaux est évalué à 2,07 milliards $, pour une mine capable de 2,2 millions de tonnes de potasse par an pendant 23 ans. Le projet Kola affiche en outre une valeur actuelle nette de 1,7 milliard $ après impôts à un taux de rentabilité interne de 18 %. Il devrait enfin générer annuellement un bénéfice avant impôts (EBITDA) de 733 millions $.

Pour que ce partenariat entre OWI-RAMS et Kore Potash devienne effectif, plusieurs étapes restent néanmoins à franchir. Alors que les travaux de construction de la mine devraient commencer début 2026, les deux parties doivent finaliser la due diligence technique, juridique et financière, et faire avaliser la structure conforme à la finance islamique par des conseillers indépendants. Kore devra ensuite apporter des fonds propres et obtenir les approbations réglementaires appropriées au Congo et auprès des bourses où la compagnie est cotée.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 25 avril 2025 : viewtopic.php?p=2410367#p2410367

https://www.agenceecofin.com/actualites ... c-le-marocPotasse : dépréciation de 21 millions $ au projet Khemisset, sur fond de litige avec le Maroc

Agence Ecofin 01 juillet 2025

Initialement prévue pour 2023, la construction de la future mine de potasse Khemisset n’a toujours pas démarré au Maroc. Après avoir essuyé 2 refus d’autorisation environnementale, la société britannique Emmerson Plc a engagé une procédure d’arbitrage contre les autorités chérifiennes.

Au terme de l’exercice financier 2024, Emmerson a enregistré une dépréciation totale de 21,1 millions de dollars sur le projet de potasse Khemisset. Cela inclut 20,35 millions USD liés aux dépenses d’exploration et 0,75 million USD de TVA considérée comme irrécupérable, alors que la valeur comptable du projet situé au Maroc s’élevait encore à 20,4 millions USD au 31 décembre 2023. Selon le rapport financier annuel publié le lundi 30 juin, Khemisset ne vaudrait désormais plus rien dans les comptes de la société britannique, même si une précédente étude en estimait la valeur actuelle nette (VAN) à 2,2 milliards USD.

Conformément à la norme IFRS 6, cette dépréciation découle du rejet définitif de l’étude d’impact environnemental, qui prive pour l’heure le projet de toute perspective de mise en production. Faute de permis, les flux de trésorerie futurs sont réputés nuls, d’où l’effacement complet de la valeur comptable de Khemisset. Le blocage dure depuis 2023, les autorités marocaines refusant le permis en raison de la consommation d’eau prévue, un enjeu majeur dans un pays frappé par la sécheresse depuis 2019.

Lors de sa deuxième tentative, Emmerson a adopté le procédé multi-minéraux Khemisset (KMP), une méthode de traitement censée réduire d’environ 50% la consommation d’eau. Une initiative qui a également été jugée insuffisante. La société a depuis soumis une demande d’arbitrage au Centre international pour le règlement des différends relatifs aux investissements (CIRDI), réclamant une indemnisation complète pour le projet.

Alors qu’Emmerson entend faire avancer cette procédure en 2025, l’avenir de Khemisset demeure incertain. Les autorités du royaume chérifien n’ont à ce jour ni communiqué officiellement sur l’affaire, ni défini de balises claires concernant la consommation d’eau acceptable pour les projets miniers.

Pour rappel, la mine de Khemisset présente une capacité annuelle de 810 000 tonnes de muriate de potasse (MoP) sur une durée de vie initiale de 19 ans.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 28 juillet 2024 viewtopic.php?p=2395686#p2395686

Gros surcout pour le développement de la mine de Potasse Jansen au Canada.

Gros surcout pour le développement de la mine de Potasse Jansen au Canada.

https://www.mining.com/bhp-delays-janse ... get-by-30/BHP delays Jansen potash mine, blows budget by 30%

Cecilia Jamasmie | July 18, 2025

BHP (ASX, LON, NYSE: BHP) revealed on Friday that the first stage of its Jansen potash mine in the Western Canadian province of Saskatchewan will cost up to 30% more and come online a year later than originally planned.

The world’s largest listed miner now expects to spend between $7 billion and $7.4 billion on the first phase, up from the original $5.7 billion estimate. First production has been pushed to 2027, a full year behind schedule.

BHP cited “design and scope changes”, along with inflationary pressures and lower productivity, as the main reasons for the cost and schedule overruns.

The miner also revealed that the second stage of the Jansen project will now begin production in 2031, two years later than previously planned. BMO analyst Alexander Pearce said the delay of this key expansion, intended to double production capacity and boost returns, was “likely good for potash prices”. He warned that it also may add pressure on total project capital expenditure.

BHP has paused the planned $4.9 billion investment in the second stage and withdrawn its cost estimate, pending further study.

The delay stems from what BHP described as the “potential for additional potash supply” coming to the market in the medium term, as well as a regular review of capital project sequencing under its investment framework.

Potash, used in fertilizer and crop nutrients, is central to BHP’s long-term diversification strategy. The company expects global demand to rise alongside population growth and pressure to improve farming yields given limited land supply.

A decade in the making

BHP’s push into the potash market began in 2006 under then-chief executive Chip Goodyear, who secured the company’s first tenements in Saskatchewan.

Successive CEOs kept the momentum. In 2010, Marius Kloppers launched a failed $38.6 billion bid for the company now known as Nutrien. Andrew Mackenzie later committed $2.6 billion to early development work at Jansen. In 2021, with current CEO Mike Henry in charge, BHP signed off on the $5.7 billion investment needed to build the potash mine.

The blowouts at Jansen are significant by industry standards and mirror recent challenges at other large-scale projects. Rio Tinto’s underground expansion of the Oyu Tolgoi copper mine in Mongolia, ran nearly $1.8 billion over budget.

BHP itself has faced similar issues outside its core Australian iron ore business, such as the $670 million overrun during its $2.5 billion upgrade of the Spence copper mine in Chile.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

Un projet de 300 000 t par an de potasse aux USA :Sage Plain Potash Project

https://www.mining-technology.com/news/ ... t/?cf-viewSage Potash secures $14m USDA grant for Sage Plain Potash Project

The project in Paradox Basin, Utah, aims to produce 300,000tpa of potash.

September 3, 2025

Canada-based Sage Potash has secured approval for a $14m (C$19.32m) grant from the US Department of Agriculture (USDA) to advance its Sage Plain Potash Project in the western US.

The potash asset is situated in the Paradox Basin, Utah.

This funding is facilitated through company affiliate Sage Potash (USA). It forms a substantial part of the financial backing for the project, which aims to produce 300,000 tonnes per annum (tpa) of potash.

The USDA approved the grant under its Fertilizer Product Expansion Program, an initiative focused on enhancing the manufacturing and availability of fertilisers within the US.

The grant aligns with efforts to bolster domestic production of potash, an essential nutrient for plant growth and a key component in ensuring global food security. Currently, more than 90% of potash used in the US is imported from regions including Canada, the former Soviet Union and the Middle East.

Sage Potash stated that it is progressing with necessary permitting processes. The company is also conducting a Preliminary Economic Assessment (PEA), supported by RESPEC, which has expertise in potash deposits and mine development.

The assessment encompasses third-party reviews of economic projections, cost analyses, and summaries of cultural, environmental and ecological studies conducted to date. These studies have indicated that no mitigation measures are required.

The company expects to complete the final PEA by the end of Q3 2025.

In May 2025, potash was included as a critical mineral following an Executive Order from US President Donald Trump. Subsequently, it was added to the draft list by the Department of the Interior and US Geological Survey in August 2025.

This designation offers strategic advantages such as access to federal funding opportunities and tax credits for companies involved in potash production.

Sage Potash CEO Peter Hogendoorn said: “Sage applauds the US Federal administration’s decision to add potash to the critical mineral list and is grateful for the USDA grant.

“With this support, we are well positioned to help grow domestic potash production, derisk the foreign supply chain for American farmers and create long-term value for our shareholders.”

The Sage Plain Project has identified mineral resources within its Upper and Lower Potash Beds, Cycle 18. Specifically, inferred resources stand at 159.3 million tonnes (mt) with grades of 26.96% K2O/42.67% KCl for the Upper Bed and 120.2MMT grading 22.60% K2O/35.77% KCl for the Lower Bed.

Seismic surveys reveal continuous potash beds characterised by flat-lying formations with minimal faulting at an average depth of around 2,130m.

According to Sage Potash, the project’s geological conditions are favourable for solution mining due to optimal formation temperatures recorded at 68°C.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

suite de ce post du 14 juin 2025 : http://www.oleocene.org/phpBB3/viewtopi ... 7#p2412797

https://www.agenceecofin.com/actualites ... tasse-kolaCongo : Kore veut mobiliser 12 millions USD pour son projet de potasse Kola

Agence Ecofin 20 nov 2025

Avec le projet Kola, Kore Potash veut lancer une nouvelle mine capable de produire 2,2 millions de tonnes par an de potasse sur une durée de vie de 23 ans. Dans l’objectif de concrétiser ce potentiel, elle poursuit les initiatives afin de mobiliser le budget prévu pour la phase de construction.

Dans une note publiée ce jeudi 20 novembre, Kore Potash a annoncé son projet de lever environ 12,2 millions USD dans le cadre d’un placement d’actions auprès de certains de ses actionnaires et de nouveaux investisseurs institutionnels. Une fois l’opération bouclée, elle indique vouloir utiliser ces fonds pour faire avancer son projet de potasse Kola, en République du Congo.

Une partie des fonds servira au dernier paiement dû à PowerChina International Group, mandaté pour s’occuper des travaux d’ingénierie, d’approvisionnement et de construction (EPC) du projet. D’autres usages, notamment le financement de la mise à jour de l’étude d’impact environnemental et social (EIES) et l’alimentation du fonds de roulement, sont également prévus. Kore estime que cette levée sera suffisante pour soutenir sa stratégie de développement « pendant au moins les 12 prochains mois ».

Il faut dire que cette initiative survient à un moment où la société cherche à sécuriser le financement nécessaire pour lancer la construction de Kola. En dehors d’un protocole d’accord conclu avec le fonds d’investissement suisse OWI-RAMS, elle a annoncé plus tôt ce mois le lancement d’un processus de vente formel, qui pourrait déboucher sur son association avec deux nouveaux partenaires, dont l’identité reste confidentielle. La possibilité d’une vente de la société n’est par ailleurs pas écartée.

Selon une étude de faisabilité publiée en février dernier, l’investissement initial nécessaire au développement de Kola s’élève à 2,07 milliards USD. Il devrait soutenir la construction d’une mine capable de produire annuellement 2,2 millions de tonnes de potasse sur une durée de vie de 23 ans. Kore envisage de lancer les travaux sur le site dès 2026.

- energy_isere

- Modérateur

- Messages : 103535

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: La Potasse

https://www.agenceecofin.com/actualites ... s-du-gabonAprès le fer, le pari de la potasse pour diversifier les revenus miniers du Gabon

Agence Ecofin 15 janvier 2026

Le secteur minier représente environ 6 % du PIB gabonais, une contribution principalement portée par l’exploitation du manganèse. Le pays dispose pourtant d’autres ressources minières, comme le minerai de fer, l’or ou la potasse, autant de leviers susceptibles d’être mobilisés par les autorités.

La compagnie minière canadienne Millennial Potash Corp a annoncé le mardi 13 janvier le lancement d’une étude de faisabilité définitive pour son projet de potasse Banio au Gabon. L’initiative inscrit un peu plus cette matière première utilisée dans la fabrication d’engrais, comme l’un des produits sur lesquels Libreville peut asseoir ses efforts de diversification des revenus miniers.

Pour mener les travaux, la compagnie a engagé ERCOSPLAN, une société allemande de conseil spécialisée dans le domaine de la potasse. Elle travaillera sur un scénario de base portant sur la production annuelle de 800 000 tonnes de muriate de potasse (MOP). L’étude de faisabilité devrait être achevée au second semestre 2026, tout comme l’étude d’impact environnemental et social lancée l’année dernière. Les résultats obtenus seront intégrés à la documentation pour demander un permis d’exploitation minière aux autorités gabonaises.

Un potentiel attractif

Le financement de l’étude de faisabilité s’appuie sur un engagement de 3 millions USD de l’agence américaine International Development Finance Corporation (DFC). Il faudra en revanche attendre les résultats de cette étude pour évaluer le financement nécessaire à la construction d’une mine et les détails de la stratégie de Millennial Potash pour mobiliser les capitaux. Le potentiel du projet est néanmoins susceptible d’attirer plusieurs bailleurs de fonds.

D’après l’estimation publiée en décembre 2025, le projet Banio héberge en effet 2,45 milliards de tonnes de ressources minérales mesurées et indiquées, titrant 16,6 % de chlorure de potassium (KCl). À cela s’ajoutent des ressources inférées de 3,55 milliards de tonnes à une teneur en KCl de 15,6 %. À titre de comparaison, une étude de faisabilité publiée en 2022 pour le gisement de potasse Kola au Congo, qui héberge 508 millions t de ressources minérales mesurées et indiquées à une teneur de 35,4 % en KCl, a révélé qu’une mine pourrait livrer annuellement 2,2 millions de tonnes de MOP sur 23 ans. Durant cette période, un EBITDA (Bénéfice avant intérêts, impôts, dépréciation et amortissement) annuel moyen de 733 millions USD est anticipé.

Sur cette base, l'exploitant du projet congolais, Kore Potash, a déjà suscité l’intérêt de plusieurs investisseurs, dont la société de services financiers germano-suisse OWI-RAMS. Cette dernière a signé en juin 2025 un protocole d’accord non contraignant avec Kore Potash pour mobiliser 2,2 milliards USD, financement destiné à couvrir la totalité des coûts de construction de la mine Kola. En novembre, deux autres parties présentées comme des « acteurs du secteur de la potasse » ont soumis des offres de rachat pour Kore Potash.

Augmenter le poids du secteur minier

...........................