https://www.mining.com/us-supreme-court ... tion-mine/US Supreme Court rejects Apache appeal to block Rio Tinto’s Resolution mine

Staff Writer | May 27, 2025

The US Supreme Court declined on Tuesday to hear an appeal by the Apache Stronghold seeking to block the development of the Resolution Copper mine in Arizona. The mine is a joint venture between Rio Tinto (ASX, LON, NYSE: RIO) and BHP (ASX: BHP).

The advocacy group, comprising members of the San Carlos Apache tribe of southeastern Arizona and conservationists, challenged a 2024 lower court decision that permitted a federal land swap allowing the mining companies to acquire land considered sacred by the Apache for the mine project.

A federal judge in Arizona had temporarily halted the land transfer on May 9, pending the outcome of the Supreme Court appeal.

The Resolution Copper project is 55% owned by Rio Tinto and 45% by BHP, with Rio serving as the operator.

The companies have so far invested over $2 billion into the project, which is poised to become North America’s largest copper mine. It contains the third-largest known copper deposit globally, and could meet over a quarter of US copper demand for decades.

Apache Stronghold first filed suit in 2021, claiming the project violates constitutional and statutory protections for religious freedom. They argue the mine would destroy the Oak Flat, known as Chi’chil Biłdagoteel in the Apache language, a sacred site where Western Apaches have conducted ceremonies for generations, including a traditional four-day coming-of-age ritual for young women.

The group also says the mine would violate an 1852 treaty in which the US government promised to protect Apache lands and ensure the tribe’s “permanent prosperity and happiness.”

Congress authorized the land swap as part of a 2014 defense spending bill signed by then-President Barack Obama. The legislation allowed Rio Tinto and BHP to exchange private lands for Oak Flat, located about 70 miles (113 km) east of Phoenix.

The transfer was contingent on the completion of an environmental impact statement, which was released in January 2021, during the final days of the first Trump administration. However, in March 2021, the Biden administration withdrew the statement, halting the transfer temporarily.

The US Forest Service is expected to reissue the environmental report, potentially allowing the land swap to proceed as early as June 16.

Copper ambitions

Rio Tinto is ramping up its copper portfolio to meet growing global demand, which analysts predict will soon outpace supply.

The company’s Oyu Tolgoi mine in Mongolia began underground production in 2023 and is projected to become the world’s fourth-largest copper mine by 2030.

In Peru, Rio Tinto has partnered with Chile’s state-owned Codelco and Canada’s First Quantum Minerals to develop the La Granja project, one of the world’s largest untapped copper deposits.

Rio is also investing in cleaner extraction technologies, including Nuton—a bioleaching process developed with Arizona Sonoran Copper (TSX: ASCU)—to recover copper from tailings and low-grade ores.

Le Cuivre

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 29 sept 2024 viewtopic.php?p=2399517#p2399517

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/peru-expects ... this-year/Peru expects $4.8B in mining investment this year

Reuters | June 3, 2025

Peru’s Energy and Mines Minister Jorge Montero expects mining investment in the world’s third-largest copper producer to reach $4.8 billion this year, and output of the red metal to be 2.8 million metric tons, he said on Tuesday.

Peru in 2024 produced about 2.7 million tons of copper, lightly less than the prior year.

Speaking at a press conference, Montero also noted a concerning increase of informal and illegal mining in two key copper production areas, referring to the Apurimac and Arequipa regions of southern Peru.

Top copper mine Las Bambas, controlled by China’s MMG, is located in Apruimac, while Canadian miner Teck is developing the Zafranal copper project in Arequipa in partnership with Mitsubishi Materials.

The rise of artisanal copper mining has created a much-needed income for impoverished Andean Peruvians, despite bringing them into conflict with major miners.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/bhp-backed-s ... ing-plant/BHP-backed startup delivers first copper at Chile leaching plant

Bloomberg News | June 3, 2025

A Chilean startup backed by BHP Group has delivered its first copper cathodes from a demonstration plant at a mine site in northern Chile as the industry looks to squeeze out more metal from lower quality ore.

Ceibo extracted the metal from sulfide ores at a mine owned by Cia. Minera San Geronimo, or CMSG, using a proprietary leaching process, the two companies said in a statement Tuesday.

Ceibo and firms such as Jetti Resources LLC and Rio Tinto Group’s Nuton venture are looking to roll out catalysts for liberating copper from low-grade ore that miners previously saw as too expensive and difficult to process.

With new deposits getting harder to find and develop, leaching offers a way to boost and extend output at existing mines at a time when the industry is scrambling to meet an expected surge in demand.

Ceibo’s process extracts copper from sulfide ores using existing plants, with electrochemical reactions bolstering recovery rates in shorter cycles. The company is also working with Glencore Plc on a leaching process at the latter’s Lomas Bayas mine in Chile.

BHP Ventures and Energy Impact Partners participated in Ceibo’s 2023 financing round, joining Khosla Ventures as investors.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.agenceecofin.com/actualites ... -septembreRDC : le lancement de la fonderie de cuivre de Kamoa-Kakula prévu pour septembre

Agence Ecofin 13 juin 2025

Ivanhoe Mines opère Kamoa-Kakula, la plus grande exploitation industrielle de cuivre en RDC. La compagnie canadienne a lancé en 2021 la construction d’une fonderie sur le site, lequel devrait à terme présenter une capacité annuelle de 500 000 tonnes de concentré.

En République démocratique du Congo, Ivanhoe Mines prévoit de mettre en service la fonderie de cuivre du complexe cuprifère Kamoa-Kakula au début du mois de septembre 2025. C’est l’annonce faite le jeudi 11 juin par la compagnie canadienne, qui précise que la première production d’anodes sur le site est attendue pour octobre.

En construction depuis 2021, la fonderie devrait disposer à terme d’une capacité de traitement annuelle de 500 000 tonnes de concentré de cuivre, ce qui en ferait le plus grand projet du genre en Afrique. Elle produira du cuivre blister, un produit intermédiaire dans la fabrication d’anodes, avec une pureté d’environ 99%. Une fois inaugurée, l’installation devrait d’abord fonctionner à une capacité réduite de 50%, soit environ 250 000 tonnes de concentré traitées par an.

Avec ce projet, Ivanhoe Mines peut ainsi renforcer sa position dans la chaîne de valeur du cuivre en captant une plus grande valeur ajoutée pour la production de Kamoa-Kakula. Notons que la société a déjà signé des accords commerciaux pour vendre 80% de la production de la fonderie aux groupes chinois Zijin Mining et CITIC Metal, pour une période de trois ans.

En prélude de cette mise en service, Ivanhoe travaille aussi à sécuriser un approvisionnement énergétique stable sur le site. Plus tôt cette année, la compagnie a signé un accord visant à porter à 100 MW la puissance d’énergie hydroélectrique dédiée au complexe, portant la capacité électrique disponible à 150 MW, en tenant compte des 50 MW fournis par le réseau national. Cette capacité devrait encore augmenter d’ici octobre 2025, avec la mise en service attendue de la turbine N°5 du barrage Inga II (178 MW).

Le lancement de la fonderie surviendra toutefois dans un contexte de production baissière à Kamoa-Kakula. En raison des conséquences d’un récent incident sismique survenu dans la mine souterraine de Kakula, Ivanhoe a en effet ajusté ses prévisions pour 2025 à une fourchette de 370 000 à 420 000 tonnes de cuivre, contre 520 000 à 580 000 tonnes initialement prévues.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Un nouveau prospect/projet de Cuivre : Cobreorco au Pérou.

https://www.mining.com/condor-teck-proj ... -approval/Condor-Teck copper project in Peru receives environmental approval

Staff Writer | June 13, 2025 mining.com

Condor Resources (TSXV: CN) says its Cobreorco project in central Peru has passed an “important” permitting milestone following the approval of its environmental impact statement, moving the project closer to the drilling stage.

The permitting process is being carried out by Teck Resources (TSX: TECK.A/TECK.B; NYSE: TECK), which entered the project in late 2023 through an option and joint venture agreement with Condor.

Under that agreement, Teck can earn a 55% interest in Cobreorco over three years following the permit issuance by spending $4 million on exploration and paying another $500,000 in cash. The Canadian miner would also take over technical, social and environmental programs at Cobreorco.

Upon exercising this option, the companies will then form a joint venture, after Teck can increase its stake in the project further to 75% by spending an additional $6 million in exploration and making another cash payment of $600,000.

.......................

Condor’s geologists also compared the mineralization to that at Las Bambas, the large copper porphyry with skarn overprinting 50 km to the east.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.mining.com/web/nevada-coppe ... -interest/Nevada copper project draws $896 million US financing interest

Bloomberg News | June 10, 2025

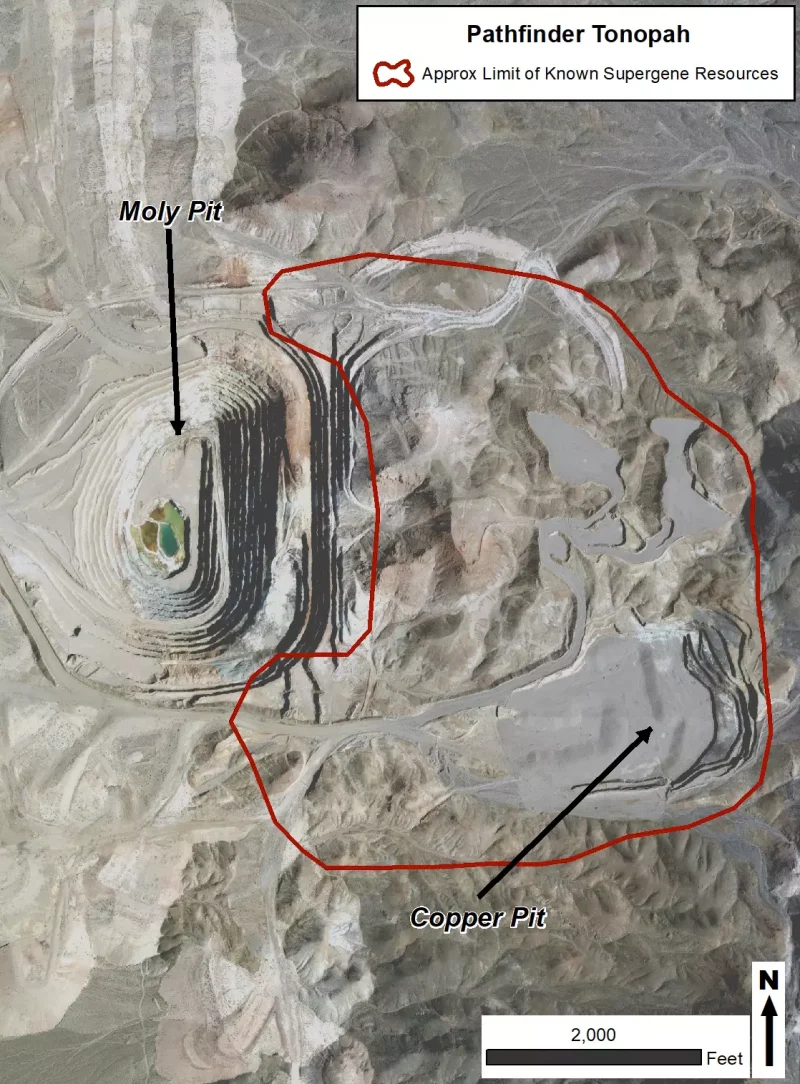

Credit: Pathfinder Tonopah

A Nevada mining project has attracted the attention of the Export-Import Bank of the United States, which is showing interest in offering $896 million to support a company seeking to build a copper and molybdenum mine.

Pathfinder Tonopah, a closely held Nevada-based mining company, said on Tuesday it had received the non-binding indicative letter of interest from Ex-Im, the official export credit agency of the US. The company said the financing would support the construction of a mining and processing facility to produce copper cathode, molybdenum concentrate and other products on the Tonopah, Nevada, site, which has existing infrastructure, including water rights, power connections, and paved road access.

The deposit is Pathfinder Tonopah’s sole mining project, a former mine where previous owners extracted molybdenum in the 1980s and 1990s. The company has completed a preliminary economic assessment for the new project and is now seeking permits to build the mine.

The letter of interest from the US government bank comes as the Trump administration seeks to revive domestic mining of copper, a ubiquitous metal used in everything from home wiring to solar equipment. The Trump administration has sought to fast-track mining projects across the country and has weighed tariffs on copper imports to spur domestic production.

la page de Pathfinder sur ce projet : https://pathfindertonopah.com/the-project/

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 16 mars 2025 viewtopic.php?p=2408367#p2408367

https://www.mining.com/web/first-quantu ... e-restart/First Quantum takes small steps in long road to Panama mine restart

Bloomberg News | June 19, 2025

First Quantum Minerals Ltd. is receiving some encouraging signs for its shuttered mine in Panama, though the nation’s president warned there’s a long way to go before reaching a deal to restart.

The Canadian company has begun preparations to ship out 120,000 metric tons of semi-processed copper stranded since the mine shut in late 2023, according to people with knowledge of the matter.

Franco-Nevada Corp., which has a supply agreement for metals from the mine, agreed to halt its arbitration case against Panama — another small step forward given dropping such action was a government prerequisite for negotiations. President Jose Raul Mulino said Thursday that the slate is now clean to start talks about a potential restart.

Mine workers and providers, as well as members of other unions and some local communities, announced a Sunday march to push for a resumption. That would give some counterweight to public protests against mining that led to its closure.

Taken together, the actions offer some progress for a $10 billion mine that once accounted for 1% of global mined copper. First Quantum’s flagship asset was ordered closed by the government about 18 months ago after mass protests in the Central American nation.

The jury is still out on whether the government will be able to navigate lingering anti-mining sentiment in order to resume an operation that would give a much-needed boost to the local economy, as well as to a copper market disrupted by a string of supply setbacks.

Mulino acknowledged how tricky the process will be in comments to reporters in Panama City, which were framed in nationalist rhetoric. Any restart options would bypass Congress, he said.

“It will be evaluated and decided on as a function of national interest,” he said. “It will be an agreement with the state, exercising its legitimate right as a country over its land and right to exploit its natural resources.”

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Projet de prolongation d'une vingtaine d'année avec investissements de la plus grande mine de cuivre du Canada :

https://www.mining.com/teck-lands-permi ... ine-in-bc/Teck lands permit to extend life of copper mine in British Columbia

Cecilia Jamasmie | June 18, 2025

Teck Resources (TSX: TECK.A, TECK.B)(NYSE: TECK) has secured an environmental assessment certificate to extend the life of its Highland Valley Copper (HVC) mine in British Columbia, keeping Canada’s largest copper operation running into the mid-2040s.

The Vancouver-based miner expects the expansion to support an average annual production of 137,000 tonnes of copper over the mine’s remaining lifespan. Construction preparation will begin shortly, with a final investment decision expected from Teck’s board in the third quarter of 2025, president and chief executive officer Jonathan Price said in a statement.

Price noted the project will help strengthen North America’s critical minerals supply chain while contributing to job creation and economic activity. He said the expansion will create about 2,900 construction jobs and support 1,500 positions once operational.

To speed up approval for what BC authorities have called a “priority critical minerals project”, the province’s Environmental Assessment Office (EAO) worked with key ministries to enable a single, consolidated application covering both the environmental assessment and major permits. This marks the first fully integrated review under BC’s 2018 Environmental Assessment Act.

The process included input from Indigenous governments, local communities, and stakeholders. Price thanked participants for their “thoughtful assessment” and continued engagement.

The HVC expansion is part of Teck’s broader plan to invest up to $3.9 billion over the next four years, aiming to boost its total copper production to about 800,000 tonnes annually by 2030.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Nouveau projet au Brésil : Bacaba

https://www.mining.com/vale-obtains-pre ... r-project/Vale obtains preliminary license for Bacaba copper project in Brazil

Staff Writer | June 16, 2025

Vale SA (NYSE: VALE) said on Monday that it has obtained a preliminary environmental licence for its Bacaba copper project in Brazil’s Pará state.

The Bacaba project is designed to extend the operational life of the nearby Sossego mining complex, contributing an average of approximately 50,000 tonnes of copper per year over eight years of operation, with production scheduled to begin in the first half of 2028.

The miner expects to invest about $290 million during the project’s implementation phase.

“This is the first in a series of copper projects that Vale intends to develop in the Carajás mineral province, as part of a strategic plan to double its copper production capacity over the next decade,” the company said in a statement.

Following the news, Vale’s New York-listed shares jumped 3.4% to $9.77, giving the company a market capitalization of approximately $42 billion.

The Brazilian miner currently owns 90% of Vale Base Metals, which groups together its nickel and copper assets globally. Manara Minerals, a joint venture between Saudi Arabian miner Ma’aden and Saudi Arabia’s Public Investment Fund, acquired the remaining 10% stake in 2024.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 21 avril 2025 : viewtopic.php?p=2410168#p2410168

https://www.mining.com/new-study-gives- ... -4b-value/New study gives Ivanhoe Electric’s Santa Cruz copper project $1.4B value

Blair McBride - The Northern Miner | June 23, 2025

A new preliminary feasibility study (PFS) for Ivanhoe Electric’s (TSX, NYSE: IE) Santa Cruz copper project in Arizona gives the proposed mine an after-tax net present value (NPV) of $1.4 billion at initial costs of $1.24 billion. Shares rose.

The underground mine could produce 72,000-tonnes of copper cathode annually during the first 15 years of a 23-year life and has an internal rate of return (IRR) of 20% at a base case of $4.25 per lb. copper, Ivanhoe said Monday. The NPV rises to $1.9 billion at the current Comex high-grade copper price of $4.83 per lb. and the IRR to 24%.

“Santa Cruz will mine the largest high-grade copper oxide orebody in America (…) which will be processed on-site by a new generation of skilled and highly paid American workers,” Ivanhoe Electric executive chair Robert Friedland said in a release.

“Santa Cruz will produce an LME Grade A 99.99% pure copper cathode product that will be ready for immediate sale to American industry from our mine gate.”

Santa Cruz, the company’s most advanced project, would help supply the green energy transition’s rising demand for copper, a critical mineral essential for electrical wiring.

Ivanhoe shares gained 4.1% to C$11.32 apiece on Monday morning in Toronto, for a market capitalization of C$1.08 billion ($790 million). The stock has traded in a 12-month range of C$6.45 to C$16.50.

136M reserve tonnes

The PFS includes a significant enhancement to Santa Cruz’s resources, with probable reserves totalling 136 million tonnes grading 1.08% copper for 1.5 million contained tonnes, based on almost 120,000 metres of drilling across 149 holes.

Exclusive of reserves, Santa Cruz hosts 182.8 million indicated tonnes grading 0.81% copper for 1.4 million tonnes contained copper and 422 million inferred tonnes at 0.79% copper for 3.3 million contained tonnes.

Mine construction could start in the first half of next year, first copper cathode production in 2028 and full production in 2029, the company said. The PFS envisions the mine would use heap leach processing.

Production costs would amount to about $17,000 per tonne of copper, with global first-quartile cash costs of $1.32 per lb. over the mine’s life.

Located in Casa Grande, about 77 km south of Phoenix, Santa Cruz comprises 24.2 sq. km of private land, including its associated water rights. Last June, Ivanhoe secured approval to zone over half of the property for industrial use, a major permitting milestone for the proposed copper mine.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.geo.fr/geopolitique/les-eta ... 0raffinage.Les États-Unis possèdent plus de cuivre que la Chine... Mais personne ne peut le raffiner

Malgré des réserves colossales, les États-Unis peinent à tirer parti de leurs réserves de cuivre.. Faute d’infrastructures de transformation, le marché mondial reste dominé par la Chine, grand maître du raffinage.

Par Marie Lombard, geo.fr le 26 juin 2025

ess is more" ("moins c'est plus") disent les anglophones, et dans le cas du cuivre américain, le dicton se vérifie. Selon les dernières données de l’US Geological Survey, les réserves des États-Unis atteignent 47 millions de tonnes — plaçant le pays au 7e rang mondial des producteurs, devant la Chine. Et encore : plusieurs projets américains pourraient, en théorie, ajouter 1,5 million de tonnes à la production annuelle, selon GEM Mining Consulting, cité par Bloomberg. De quoi couvrir presque toute la demande nationale.

Une aubaine pour l'Amérique de Donald Trump, en pleine guerre commerciale, qui multiplie les revendications de production nationale et scande "America First" au nez du super-exportateur chinois. Il y aurait là de quoi s'assurer une production par les États-Unis, et pour les États-Unis, n'en déplaise à Pékin.

Le cuivre américain en déclin

Problème : les raffineries et fonderies du pays ne sont pas assez nombreuses pour traiter les quantités gargantuesques de cuivre dans les entrailles américaines, forçant le traitement de la matière à se délocaliser à l'étranger. L’industrie du cuivre est en déclin outre-Atlantique. Son pic, rappelle Bloomberg, remonte à 1997 avec 1,9 million de tonnes produites par 35 mines et 11 fonderies. De cela aujourd'hui ne reste que 25 mines et deux fonderies traitant le minerai : Miami et Kennecott (Rio Tinto) dans l’Utah, ainsi qu'une troisième dédiée aux anodes et rebuts.

Les infrastructures d'autrefois ont cédé à la pression économique exercée par un flot de fonderies chinoises neuves, poussant l’industrie américaine à réduire sa voilure dans les années 2000 et 2010 alors que la demande diminuait. Aujourd’hui, la demande est de retour : dans un monde en transition énergétique accélérée, le cuivre s'impose comme un matériau clé pour les batteries de véhicules électriques, les réseaux électriques intelligents, les infrastructures militaires ou encore les équipements électroniques.

Mais, comme dans de nombreux autres secteurs, le Made in USA traîne des pieds, au grand agacement de Donald Trump. Et, la nature ayant horreur du vide, cette place de marché revient à la Chine, dont la filiale américaine se retrouve dépendante. En 2024, les exportations de cuivre des États-Unis vers la Chine ont atteint 2,94 milliards de dollars, selon la base de données COMTRADE des Nations Unies, rapporte Trading Economics.

La Chine, incontournable acteur du cuivre

À ce jour, la Chine produit environ 13 fois plus de cuivre raffiné que les États-Unis. Elle dispose du plus grand nombre d’installations de traitement au monde, résultat d’un projet national lancé dans les années 1990 pour répondre à la demande en construction, électronique et industrie. En fait, Pékin a désormais une telle capacité que les frais de traitement et de raffinage, qui fixent le prix du minerai brut, sont devenus négatifs.

"Nous n’avons ni subventions massives ni absence de régulation environnementale comme en Chine", déclare à Bloomberg James Stewart, directeur des affaires environnementales, gouvernementales et communautaires chez les fonderies Asarco (filiale de Grupo México), près de Phoenix. "C’est un secteur vraiment difficile", abonde Kathleen Quirk, PDG de Freeport, dans l'Arizona. "On a constamment des problèmes liés aux conditions internes d’une fonderie, et sa rentabilité est faible."

Le secteur est sous-exploité, et construire une nouvelle fonderie coûterait aujourd’hui environ 3 milliards de dollars, selon Simon Jowitt, directeur du Bureau des mines et de la géologie du Nevada. Une lacune qui questionne la souveraineté industrielle américaine, dans une chaîne d’approvisionnement critique.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

https://www.rfi.fr/fr/podcasts/chroniqu ... -du-cuivreLa crainte de taxes américaines fait grimper les cours du cuivre

RFI le : 04/07/2025

C'est une des conséquences de la guerre commerciale initiée par Donald Trump : il y a de moins en moins de cuivre sur le marché, les acheteurs de cuivre peinent à s'approvisionner, mais aux États-Unis, depuis plus d'un an, les stocks ne font que grossir.

Il y a eu un appel d'air très fort aux États-Unis, avec des transferts de gros volumes, grâce à des primes payées Outre-Atlantique incitatives. Tous ceux qui pouvaient, ont fait rentrer du cuivre sur le sol américain, par précaution, avant que le métal rouge ne soit éventuellement taxé.

Résultat, les stocks nationaux ont augmenté pour la seizième semaine consécutive et ont plus que doublé depuis mi-février. Ils sont plus fournis que ceux de la bourse aux métaux de Shanghai et de Londres (LME) réunis, une première, selon Saxo Banque.

Plus précisément les stocks du LME ont baissé des deux tiers en quelques mois et sont aujourd'hui à leur plus bas niveau depuis deux ans alors que les stocks chinois sont en baisse depuis février et oscillent depuis mi-mai entre 80 et 110 000 tonnes, peinant à redécoller au-delà malgré une augmentation de la prime à l'achat par les opérateurs chinois.

Production ralentie

L'approvisionnement est aussi perturbé par des difficultés de production dans plusieurs pays. On peut citer les inondations au mois de mai dans la grande mine de Kamoa-Kakula en République démocratique du Congo, et des barrages routiers érigés par les mineurs artisanaux au Pérou qui ont fait obstacle ces derniers jours au transport du minerai.

Un minier canadien est aussi en difficulté au Panama. La mine de First Quantum Minerals a été fermée, il y a un an et demi, par le gouvernement, suite à des protestations de la population. Les 120 000 tonnes de cuivre semi-transformé attendent de quitter le site.

Pression sur les prix

À plus de 10 000 dollars la tonne, les prix ont atteint cette semaine, à Londres, leur plus haut niveau depuis trois mois. Preuve du stress qui règne sur le marché, les prix immédiats sont plus élevés que ceux pour une livraison dans trois mois, alors que c'est l'inverse dans un marché normal.

Au vu de la demande en cuivre qui se profile, les perspectives de long terme sont celles d'un marché en tension car « le rôle du cuivre en tant que conducteur industriel le plus efficace devient de plus en plus vital, rappelle l'analyste en chef du département matières premières de Saxo Banque. La demande d'énergie liée à l'IA, le déploiement de véhicules électriques, les infrastructures de recharge, la relocalisation industrielle aux États-Unis et la demande croissante de refroidissement soulèvent des vents arrière de la demande ».

À court terme, les prix pourraient rester élevés, tant que l'administration Trump n'aura pas clarifié sa position sur les taxes douanières, car d'ici là, la prime américaine pour le cuivre devrait rester élevée, selon Saxo Banque, ce qui confortera les flux vers les États-Unis au détriment d'autres pays alors que les besoins américains ne représentent que 8% de la demande mondiale.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

suite de ce post du 22 juin 2025 viewtopic.php?p=2413343#p2413343

https://www.mining.com/web/copper-conce ... govt-says/Panama ships part of stockpiled copper out of closed First Quantum mine

Reuters | June 30, 2025

More than a quarter of the copper concentrate stockpiled at First Quantum Minerals’ Cobre Panama mine since it was closed in late 2023 has been shipped from the site, Panamanian officials said on Monday.

The removal of 33,000 metric tons out of a total of 120,000 tons left at the site appears to end uncertainty over the stuck copper, and signals a possible thawing of the relationship between the Canadian company and President Jose Raul Mulino’s government.

First Quantum declined to comment.

Panama’s prior administration had ordered the closure of the mine, which accounted for about 1% of global copper supply, following public protests over environmental concerns.

Panama’s trade and industry ministry said the removal of the stockpiled copper was gradual, without providing a date for the full quantity to be extracted, or further details about the shipment.

“More than 33,000 tons have already been shipped. This operation to remove the concentrate is gradual and depends on technical, logistical, and weather-related factors,” the ministry said in a statement to Reuters.

It said the ministry, along with Panama’s maritime, customs and environmental authorities, were supervising the process.

First Quantum in March said it agreed to discontinue arbitration proceedings over the mine, paving the way for talks to resume with the government.

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

Première estimation de ressource au prospect de cuivre Kodiak au Canada

https://www.newsfilecorp.com/release/25 ... ld-ProjectKodiak Reports Initial Mineral Resource Estimate on Four of Seven Mineralized Zones at the MPD Copper-Gold Project

June 25, 2025 Source: Kodiak Copper Corp.

Vancouver, British Columbia--(Newsfile Corp. - June 25, 2025) - Kodiak Copper Corp. (TSXV: KDK) (OTCQB: KDKCF) (FSE: 5DD1) (the "Company" or "Kodiak") today reports the first part of its initial Mineral Resource estimate at the Company's 100%-owned MPD copper-gold project in southern British Columbia, which comprises four of seven mineralized zones.

Highlights

Sizable copper- gold initial Mineral Resource estimate ("MRE") delineated for four of seven mineralized zones outlined to date at MPD: Gate, Ketchan, Man and Dillard. Figure 1

Indicated Mineral Resource: 56.4 million tonnes (Mt) grading 0.42% copper equivalent (CuEq) for 385 million pounds (Mlb) of copper (Cu) and 0.25 million ounces (Moz) of gold (Au). Table 1

Inferred Mineral Resource: 240.7 million tonnes (Mt) grading 0.33% copper equivalent (CuEq) for 1,291 million pounds (Mlb) of copper (Cu) and 0.96 million ounces (Moz) of gold (Au). Table 1

The MRE is defined using open pit design shells to constrain the Resource models and a cut-off grade of 0.2% CuEq. Sensitivity cases using lower cut-of grades have significantly higher tonnages and metal contents. Table 2

Mineralization remains open for expansion within and beyond the MRE pit shells, in multiple directions and at depth.

The full MRE for MPD is planned for completion in Q4 with the addition of three further mineralized zones (West, Adit and South), where confirmation and infill drilling is currently under way as part of the Company's 2025 exploration program (see news release June 18, 2025).

- energy_isere

- Modérateur

- Messages : 102184

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le Cuivre

source LinkedinNexMetals rises on strong copper-nickel hits

NexMetals Mining Corp (TSXV: NEXM) reports 13.5m at 1.13% Cu and 1.25% Ni from Selebi North, Botswana. Ongoing drilling aims to expand resources and test mineralization continuity.

“The results from drill holes 184 and 185 continue to demonstrate the impressive step-out success and the broader scale of mineralization beyond the boundaries of the current resource,” NexMetals CEO Morgan Lekstrom said.