https://www.mining.com/critical-metals- ... ompletion/Critical Metals (NASDAQ: CRML) says the bankable feasibility study (BFS) for its proposed 500,000-tonne-per-annum rare earth operation in southern Greenland is now 70% complete, placing it on track for submission in the fourth quarter this year.

The BFS forms a key part of the company’s development plans for its Tanbreez project, recognized as one of the biggest rare earth projects globally. The resource is estimated at nearly 45 million tonnes, of which 27% are categorized as “heavy” rare earths — minerals highly sought after by Western suppliers for their use in clean energy, defense and other high-tech applications.

............................

Terres rares : Exploration et production miniére

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite du post au dessus.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de ce post du 11 aout 2024 : viewtopic.php?p=2396245#p2396245

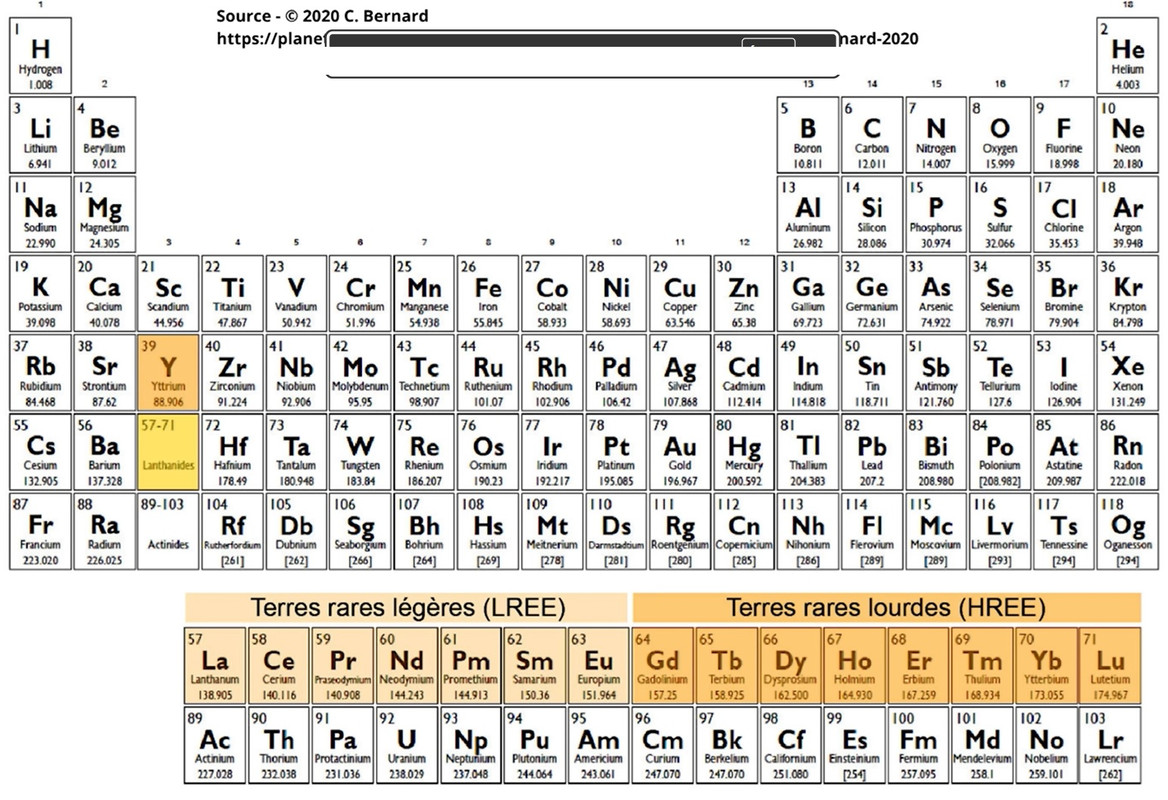

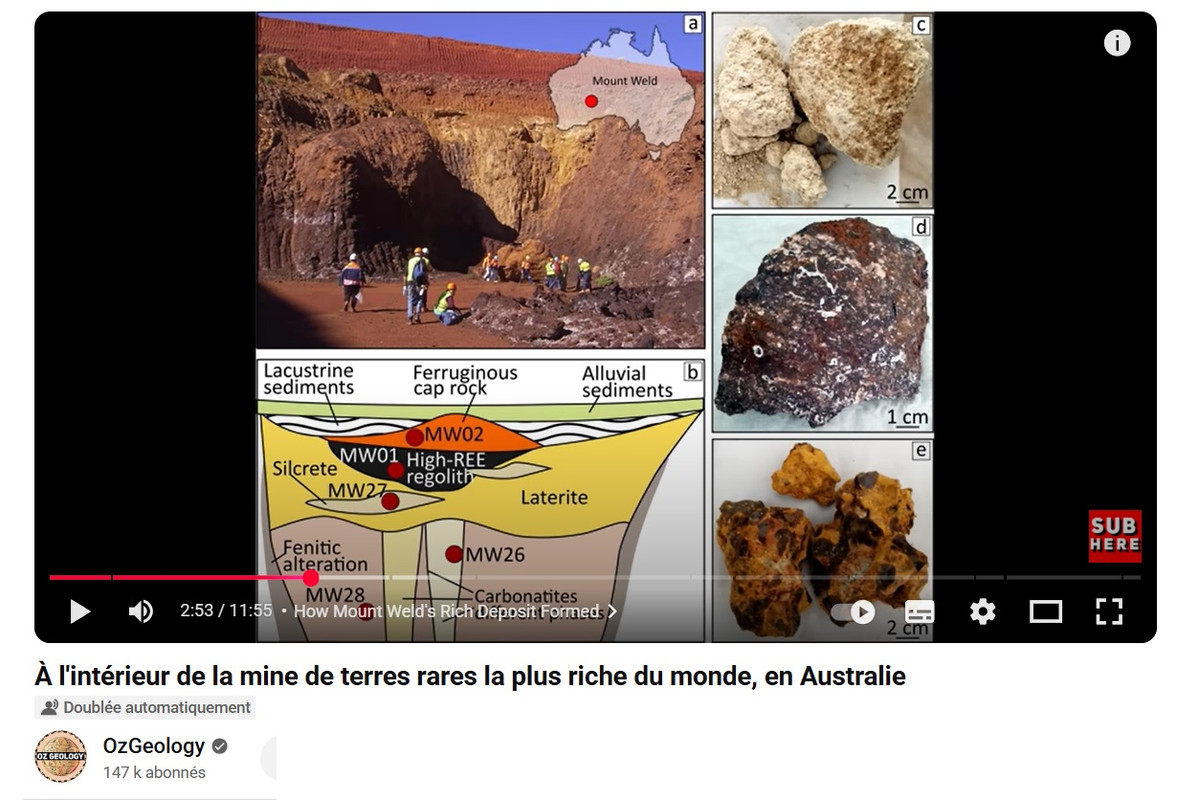

vidéo de 11 mn sur le gisement de terre rare de Mount Weld en Australie https://www.youtube.com/watch?v=c3Z_k2jfnfo

la page de Lynas sur cette mine de Mount Weld : https://lynasrareearths.com/mt-weld-wes ... stralia-2/

vidéo de 11 mn sur le gisement de terre rare de Mount Weld en Australie https://www.youtube.com/watch?v=c3Z_k2jfnfo

la page de Lynas sur cette mine de Mount Weld : https://lynasrareearths.com/mt-weld-wes ... stralia-2/

Mt Weld, Western Australia

The Mt Weld rare earths deposit sits in a two billion year old volcanic plug. Our Mt Weld mine is one of the world’s most valuable rare earths deposits, favoured by its high grade and long life. The Mt Weld deposit contains both Light and Heavy Rare Earth elements.

Mt Weld’s high grade and close to surface mineralised zone mean that the mine itself is relatively small and shallow compared to many other mines.

In keeping with our approach to sustainability, Lynas aims to utilise as much of the ore that is removed from the mine pit as possible. Our product range includes over 15 different products and we invest in research and development into new products and new market applications for our products.

Ore mined from the Mt Weld deposit is trucked to our on-site concentration plant. The ore goes through a number of processes – including crushing, grinding, flotation, and filtration – to produce a mixed rare earths concentrate.

The rare earths concentrate is transported in half height containers (called rotainers) to our Kalgoorlie Processing Facility for initial processing or shipped to the Lynas Malaysia refinery for processing and production of finished rare earths products. Read about our Kalgoorlie and Malaysia rare earth processing facilities here (link to Kalgoorlie and Malaysia pages).

Resource and Reserve

On 5 August 2024, Lynas announced a Mt Weld Mineral Resource and Ore Reserve Update*. This included a 92% increase in Mineral Resources^ and a 63% increase in Ore Reserves^^, with a significant increase in contained Heavy Rare Earth mineralisation. As noted in the FY24 Annual Report, the Ore Reserve update will support:

a >35 year mine life at production rates for sufficient concentrate feedstock for production capacity of 7,200 tpa NdPr (Neodymium Praseodymium) oxide finished product; and

a >20 year mine life at expanded production rates for sufficient concentrate feedstock for production capacity of 12,000tpa of NdPr oxide finished product in line with Mt Weld expansion capacity (currently under construction).

The Mt Weld Rare Earth Mineral Resources estimate is now 106.6 million tonnes at an average grade of 4.12% Total Rare Earth Oxide (TREO) for a total of 4.39 million tonnes of contained TREO. A Mineral Resource cut-off grade of 2.5% TREO was applied.

................

Mt Weld Expansion Project

In August 2022, Lynas announced an approximately $500m capacity expansion project at the Mt Weld mine and concentration plant to meet accelerating market demand for rare earth materials. You can read the announcement here.

The project will expand Mt Weld’s capacity to produce the feedstock concentrate required for 12,000 tonnes per annum of NdPr finished product in 2024. It includes upscaled processing equipment, efficiency improvements, enhanced sustainability and will provide a platform for further capacity increases. In addition, Lynas will conduct a 2-year exploration program of the Mt Weld resource.

Formal approval of the Minor and Preliminary Works application was received from the Environmental Protection Authority (EPA) in March 2023.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

Du Scandium en Australie au projet Syerston :

selon Copilot :

https://www.mining.com/friedland-backed ... australia/Friedland-backed Sunrise Energy doubles scandium resource in Australia

Staff Writer | September 10, 2025

Robert Friedland-backed developer Sunrise Energy Metals’ (ASX: SRL) has nearly doubled the scandium resource at its Syerston project in New South Wales, positioning it among the largest and highest-grade scandium projects in the world.

The revised estimate, using a cutoff grade of 300 parts per million (ppm) scandium, now stands at 45.9 million measured and indicated tonnes grading 414 ppm for 19,007 tonnes of contained scandium, representing a 98% increase in metal content compared to the previous update released at the start of the year. At a higher 600-ppm cutoff, the contained scandium grew by 161% to 1,155 tonnes.

The project’s initial resource was released in 2016. Syerston is about 450 km west of Sydney.

“Global supply remains tight since China’s export controls were imposed in April 2025, positioning Syerston as a strategically important source for future scandium supply,” Sunrise CEO Sam Riggall said in a release. “Our focus now turns to completing the feasibility study and evaluating various financing options for the project.”

Sunrise shares jumped by 13% to A$2.25 apiece on Tuesday in Sydney, giving the company a market capitalization of about A$265 million — its highest in nearly three years.

China’s scandium hold

The resource expansion comes at a pivotal moment for the scandium market.

In April, China imposed new export licensing restrictions on the metal, a critical input in lightweight aerospace alloys, semiconductors, and advanced manufacturing.

Total world scandium production was less than 40 tonnes in 2022. Demand, meanwhile, is tipped to surpass 110 tonnes a year by 2026. Over 90% of global demand comes from the US, for both civilian and defence applications. Most supply is controlled by China.

‘Rebuilding supply chains’

“The Syerston scandium project will bolster the supply of one of the most important rare earth metals at a time when supply disruptions are becoming the norm,” Friedland said in the release. “Geopolitical competition over key technologies using these metals requires a complete rebuilding of the world’s metal supply chains.”

Sunrise is positioning Syerston as a reliable Western source of scandium oxide. Australia currently has no scandium production or processing.

selon Copilot :

En septembre 2025, le prix du scandium métal (pureté ≥99,99%) tourne autour de 3 166 EUR/kg TTC, soit environ 2 802 EUR/kg HT. En dollars américains, cela équivaut à environ 3 163 USD/kg pour le marché d’Asie du Nord-Est.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

https://www.nsenergybusiness.com/news/a ... ths-mines/Aclara Resources plans to invest $1.3bn in rare earths mines

The company plans to allocate between $150m (C$208.46m) and $170m to a project in Chile and around $600m to a mine in Brazil.

25th Sep 2025

Canadian rare earths company Aclara Resources is reportedly planning to invest $1.3bn across rare earth mines in South America and processing plants in the US.

The company’s executive vice-president, Jose Augusto Palma, revealed the investment details during a mining industry conference, reported Reuters.

Aclara Resources, a Toronto-listed miner, intends to allocate between $150m and $170m to a project in Chile and around $600m to a mine in Brazil.

Additionally, Aclara Resources will allocate $300m–400m for a separation plant and $400m for a metallisation facility.

Palma noted that feasibility studies for the Brazilian and Chilean projects are expected to conclude by mid-2026.

This timeline positions the projects for construction in the same year, with operations expected to commence by 2028.

Earlier this month, the US International Development Finance Corporation committed up to $5m to support the feasibility study for Aclara’s Brazil project.

The company is positioning its mine-to-magnet strategy as a way to build a geopolitically independent supply chain for permanent magnets, which play a critical role in applications such as electric vehicle motors, wind turbines, robotics and advanced defence systems.

Rare earth elements (REEs), a group of 17 metals with distinctive magnetic, optical and conductive properties, are increasingly in demand for technologies ranging from consumer electronics to renewable energy equipment.

In July, Aclara disclosed ongoing discussions with US Government agencies about potential financing for its $1.5bn plan to mine rare earths in Latin America.

In April, the company also inaugurated its semi-industrial heavy rare earths pilot plant facility in Aparecida de Goiania, Goias, Brazil.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

Prospect de Gallium dans le Montana

https://www.mining.com/us-critical-mate ... roduction/US Critical Materials, GreenMet form alliance for gallium production

Staff Writer | September 26, 2025

..............

US Critical Materials holds the highest-grade reported gallium deposit in the country, with concentrations averaging 300 parts per million at its Sheep Creek deposit in Montana. It also reported rare earth samples from 125 feet underground that exceeded the grades of any other domestic rare earth resource.

...............

Since early 2024, Phase I Cooperative Research and Development Agreement (CRADA) researchers have confirmed the high concentrations of gallium and rare earth elements in the Sheep Creek orebody.

US Critical Materials, led by former US Geological Survey rare earth commodities specialist Jim Hedrick, said it will prioritize gallium as one of the first minerals to be processed under its Phase II CRADA with Idaho National Laboratory (INL).

......................

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de ce post du 30 aout 2025 : viewtopic.php?p=2415836#p2415836

https://www.agenceecofin.com/actualites ... aq-en-2026Pensana, l’opérateur du projet terres rares Longonjo en Angola, prévoit une cotation au Nasdaq en 2026

Agence Ecofin 01 octobre 2025

Avec Longonjo, Pensana veut développer l’une des rares sources de production de terres rares hors Chine. Entrée en phase de construction en mai dernier, cette future mine devrait à terme livrer annuellement 20 000 tonnes de concentré de terres rares.

Pensana Rare Earths envisage de s’inscrire sur la bourse américaine Nasdaq d’ici le premier trimestre 2026. Ce plan dévoilé dans une note publiée le mardi 30 septembre, est principalement motivé par le fort intérêt suscité par le projet de terres rares Longonjo que la société minière britannique développe actuellement en Angola.

« Compte tenu de l'intérêt suscité par le projet Longonjo aux USA et des partenaires potentiels qui y sont présents, le Conseil d'administration étudie actuellement une éventuelle cotation de Pensana sur le Nasdaq aux États-Unis, en complément de la cotation de la société à la Bourse de Londres. Par conséquent, et afin de préparer la société à satisfaire aux exigences de cours minimum pour une cotation aux USA d'ici le 1er trimestre 2026 […], les administrateurs ont l'intention de proposer une résolution visant à consolider le capital social […] » peut-on lire dans le communiqué.

Considérée comme la future première mine de terres rares d’Angola, Longonjo devrait à terme produire annuellement 20 000 tonnes de MREC (un concentré de terres rares), avant d’atteindre les 40 000 tonnes après une phase d’extension. Un potentiel qui a déjà attisé l’intérêt de plusieurs acteurs comme l’américain ReElement, dans un contexte où Washington cherche à réduire sa dépendance à l’offre chinoise, laquelle domine largement ce marché.

Avec une cotation au Nasdaq, deuxième place boursière au monde derrière le NYSE, Pensana peut accroître la visibilité du projet auprès des investisseurs américains. De quoi lui donner accès à un marché à capitaux plus large, alors que la phase de construction de la mine a déjà démarré, avec une entrée en production prévue début 2027. Pour autant, il faut rappeler que la société a déjà conclu des accords avec le fonds souverain angolais (FSDEA), l’AFC et la Banque sud-africaine Absa pour mobiliser les 268 millions USD nécessaires au développement du projet.

Les modalités relatives à cette éventuelle cotation devront encore être abordées le 3 décembre prochain apprend-on, lors de l’Assemblée générale annuelle des actionnaires. Notons aussi que les USA ne constituent pas la seule partie intéressée par Longonjo. Le projet est également suivi de près au Japon, où Toyota Tsusho et Hanwa ont signé des protocoles d’accord avec Pensana dans l’optique de s’approvisionner en terres rares provenant de cette mine.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de ce post du 09 juillet 2022 : viewtopic.php?p=2346829#p2346829

https://www.agenceecofin.com/actualites ... -au-malawiTerres rares : après l’Europe, Washington mise sur le projet Songwe Hill au Malawi

Agence Ecofin 29 sept 2025

Selon Mkango Resources, son projet de terres rares Songwe Hill peut livrer 8425 tonnes de carbonate de terres rares par an sur 18 ans. Un potentiel qui a déjà permis à cet actif situé au Malawi de figurer sur la liste des projets de minéraux critiques bénéficiant de l’appui de l’Union européenne.

L’agence américaine International Development Finance Corporation (DFC), a signé un accord pour injecter 4,6 millions $ dans le projet de terres rares Songwe Hill au Malawi. L’annonce a été faite le lundi 29 septembre par Mkango Resources (MKAR), propriétaire canadien de l’actif qui avait déjà obtenu, il y a quelques mois le soutien de l’Union européenne pour le même projet.

Le financement sécurisé par Mkango, ne devra être remboursé que si sa filiale Mkango Rare Earths Limited, en charge de Songwe Hill, parvient dans les dix ans à réunir les fonds nécessaires pour lancer la construction ou l’exploitation d’une mine. En attendant, les fonds de la DFC serviront notamment aux études d’ingénierie préliminaire (FEED).

« La DFC reconnaît le potentiel de développement révolutionnaire du projet et ce financement initial ouvre la voie à MKAR pour obtenir le financement à long terme nécessaire au développement de Songwe Hill et positionner le groupe Mkango comme l’un des rares acteurs clés de la chaîne d’approvisionnement mondiale en terres rares », souligne Alexander Lemon, président et directeur fondateur de la compagnie.

Bien que la contrepartie de cet appui n’ait pas été précisée, il s’inscrit dans une stratégie plus large de la DFC en Afrique. À travers subventions, prêts et protocoles d’accord, l’institution structure depuis quelques années sa présence aux côtés de compagnies actives sur des minéraux considérés comme critiques par les États-Unis.

Qu’il s’agisse de graphite en Ouganda et au Mozambique ou de terres rares au Malawi, Washington cherche à sécuriser ainsi l’accès à des gisements pouvant réduire sa dépendance à la Chine, principal fournisseur de ces produits.

Selon une étude de faisabilité publiée en 2022, Songwe Hill peut livrer annuellement 8425 tonnes de carbonate de terres rares sur 18 ans. L’Union européenne suit également ce projet de près, comme en témoigne l’inscription de l’usine de séparation de terres rares prévue par Mkango en Pologne sur la liste européenne des projets stratégiques de minéraux critiques. Cette usine doit notamment permettre la transformation des terres rares de Songwe Hill.

Alors que Pékin reste dominant dans les minéraux critiques, même en Afrique, des analystes jugent les initiatives européennes et américaines encore insuffisantes pour contrer cette influence chinoise. Pour l’European Council, les entreprises européennes brillent par leur faible présence dans le secteur minier africain, notamment en raison d’un soutien insuffisant de Bruxelles, ce qui limite leur capacité à mobiliser des financements à la hauteur des enjeux.

Selon l’Agence internationale de l’énergie, l’Afrique devrait capter 50 milliards $ d’investissements dans la production de minéraux critiques entre 2024 et 2040. Là où les appuis européens et américains annoncés jusqu’ici se résument généralement à quelques millions de dollars, les groupes chinois soutenus par leur gouvernement consacrent chaque année des milliards à l’acquisition de projets afin d’orienter la future production vers l’empire du Milieu.

En attendant un changement de paradigme à Bruxelles et Washington, notons que l’accord signé avec Mkango donne à la DFC le droit « d’organiser directement le financement ou l’investissement du projet à des conditions commerciales sensiblement comparables ou meilleures que celles des autres options de financement disponibles ».

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

https://www.nsenergybusiness.com/news/r ... roduction/ReElement announces Noblesville refinery expansion for rare earth production

This expansion enables the facility to refine more than 200tpa of separated defence elements and rare earth oxides.

29th Sep 2025

ReElement Technologies, a rare earth element (REE) and critical mineral refining company, has announced the expansion of its Noblesville facility by 141%.

This expansion increases the critical mineral refining facility’s size to more than 16,500ft², offering an immediate refining capacity in excess of 200 tonnes per annum (tpa).

Noblesville focuses on producing ultra-pure separated defence elements and rare earth oxides with a purity ranging from 99.9% to 99.999%.

This expansion enables ReElement to supply essential defence minerals including antimony, dysprosium, gadolinium, gallium, germanium, samarium, terbium and yttrium, alongside traditional magnet elements like neodymium and praseodymium.

This investment bolsters the supply to defence and advanced technology sectors in the near term, while the company’s Marion Supersite continues to develop further large-scale production capabilities.

ReElement recently received nine additional separation columns for the expanded production facility and other key equipment including an ICP-MS machine to support consistent commercial output of 99.999% pure products. The company is executing the build-out while maintaining full daily operations at the facility.

In parallel, more than 60% of the equipment for Marion’s initial contracted growth phase has been ordered, identified, or is being installed, aiming for large-scale refining capacity for magnet-grade rare earths battery materials, antimony and additional defence elements.

ReElement Technologies COO Jeff Peterson said: “This expansion of our Noblesville facility showcases the flexibility and scalability of our refining platform and positions us to lead in meeting the growing yet complex demands of both the defence and commercial markets.

..................

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de ce post du 4 mai 2025 : viewtopic.php?p=2410716#p2410716

https://www.webdisclosure.fr/article/ac ... Rm7aUavv04Aclara Resources Updates Carina Project's Mineral Resource Estimate

le 01/10/2025

Aclara Resources Inc. has announced a significant update to the mineral resource estimate (MRE) for its Carina Project, situated in Goiás, Brazil. This revision marks a progression from inferred to indicated mineral resources, now totaling 236 million tonnes (Mt) of indicated resources alongside 48 Mt of inferred resources. Previously, the 2024 Resource Statement reported 297 Mt in inferred resources.

The upgrade is underpinned by a comprehensive drilling campaign, expanding from 4,104 meters over 363 drillholes to 24,564 meters across 1,682 drillholes. The results reflect stable grades of magnetic rare earths like dysprosium and terbium oxides. A robust geo-metallurgical database supports the project's process, analyzed from 14,001 samples compared to 3,789 previously.

Aclara's Chief Operating Officer, Hugh Broadhurst, emphasized the importance of this upgrade in preparation for the pre-feasibility study (PFS), essential to unlocking the full economic potential of the Carina deposit.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de ce post du 7 sept 2025 : viewtopic.php?p=2416147#p2416147

https://www.mining.com/critical-metals- ... -tanbreez/Critical Metals surges on second US rare earth offtake deal for Tanbreez

Staff Writer | October 8, 2025

Critical Metals Corp. (NASDAQ: CRML) has signed a letter of intent with US-based rare earth processor REalloys for a ten-year offtake agreement covering 15% of production from its Tanbreez rare earth project in southern Greenland.

This deal follows an August agreement with Ucore Rare Metals for 10% of Tanbreez’s output, bringing its total committed offtake to 25% of expected production.

REalloys — which operates a full-cycle rare earth processing and magnet manufacturing facility in Ohio and is preparing to list on the Nasdaq — also owns the Hoidas Lake rare earth project in Saskatchewan.

“The Tanbreez project presents a remarkable opportunity for REalloys, given its rich, long-life deposits of heavy rare earth elements — vital to the defense industrial base of the United States and our allied nations,” REalloys CEO Lipi Mainheim said in a statement. “REalloys and Critical Metals share a common commitment to reducing China’s dominance in the global rare earth supply chain.”

The companies plan to finalize definitive agreements following due diligence, negotiation of final commercial terms, and regulatory approvals.

Critical Metals’ Tanbreez project in Greenland is one of the world’s largest heavy and medium rare earth deposits. The New York-based company also owns the Wolfsberg lithium project in Austria, which it describes as Europe’s first fully permitted lithium mine.

.....................

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

https://www.mining.com/web/china-expand ... tor-users/China expands rare earth restrictions, targets defence, semiconductor users

Reuters | October 9, 2025

China dramatically expanded its rare earths export controls on Thursday, adding five new elements and extra scrutiny for semiconductor users as Beijing tightens control over the sector ahead of talks between Presidents Donald Trump and Xi Jinping.

The world’s largest rare earths producer also added dozens of pieces of refining technology to its control list and announced rules that will require compliance from foreign rare earth producers who use Chinese materials.

The Ministry of Commerce’s announcements follow US lawmakers’ call on Tuesday for broader bans on the export of chipmaking equipment to China.

They expand controls Beijing announced in April that caused shortages around the world, before a series of deals with Europe and the US eased the supply crunch.

“The White House and relevant agencies are closely assessing any impact from the new rules, which were announced without any notice and imposed in an apparent effort to exert control over the entire world’s technology supply chains,” a White House official told Reuters on Thursday.

The new curbs come ahead of a scheduled face-to-face meeting between Trump and Xi in South Korea at the end of October.

“This helps with increasing leverage for Beijing ahead of the anticipated Trump-Xi summit in (South) Korea later this month,” said Tim Zhang, founder of Singapore-based Edge Research.

China produces over 90% of the world’s processed rare earths and rare earth magnets. The 17 rare earth elements are vital materials in products ranging from electric vehicles to aircraft engines and military radars.

Exports of 12 of them are now restricted after the ministry added five – holmium, erbium, thulium, europium and ytterbium – along with related materials.

Foreign companies producing some of the rare earths and related magnets on the list will now also need a Chinese export licence if the final product contains or is made with Chinese equipment or material. This applies even if the transaction includes no Chinese companies.

The regulations mimic rules the US has implemented to restrict other countries’ exports of semiconductor-related products to China.

It was not immediately clear how Beijing intends to enforce its new regime, especially as the US, the European Union and others race to build alternatives to the Chinese rare earth supply chain.

“We’re likely entering a period of structural bifurcation — with China localizing its value chain and the US and allies accelerating their own,” said Neha Mukherjee, a rare earths analyst with Benchmark Mineral Intelligence.

In a nod to concerns about supply shortages, the ministry said the scope of items in its latest restrictions was limited and “a variety of licensing facilitation measures will be adopted”.

China’s latest restrictions on the five additional elements and processing equipment will take effect on November 8, just before a 90-day trade truce with Washington expires.

The rules on foreign companies that make products using Chinese rare earths equipment or material are to take effect on December 1. Shares in China Northern Rare Earth Group, China Rare Earth Resources and Technology and Shenghe Resources surged by 10%, 9.97% and 9.4%, respectively, on Thursday.

Shares in US-based rare earths companies jumped as well after New York markets opened, with Critical Metals Corp gaining 17%, Energy Fuels adding 11%, and MP Materials and USA Rare Earth each up 6%.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

Des terres rares en Turquie :

https://www.mining.com/web/turkey-eyes- ... alks-slow/Turkey eyes US rare earths deal after China, Russia talks slow

Bloomberg News | October 6, 2025

Turkey is discussing developing rare earth reserves in western Anatolia with the US, marking a shift toward its NATO ally after similar talks with China and Russia slowed amid disagreements over technology transfer and refining rights.

Ankara and Washington are exploring a potential partnership to develop a large reserve of rare earth deposits recently discovered in Beylikova, near Eskisehir in central Anatolia, according to people familiar with the matter, who asked not to be named because the talks are private. The discovery includes cerium, praseodymium and neodymium, with the quality unclear at this stage, they added.

...................

Turkey plans on building a refinery in Beylikova, which contains ore with more than 1% rare earth oxide by weight — enough to make extraction commercially viable, according to initial tests, the people said. The country is also holding talks with Canada and Switzerland on potential

cooperation, including on feasibility studies needed to advance the project, they said.

..................

https://bianet.org/haber/rare-earth-ele ... own-312426............

“The Beylikova ore—formerly called Beylikahır before the name was changed—contains rare earth elements. It also includes small amounts of thorium and uranium. Its structure is quite complex. In addition to thorium and uranium, barite and fluorite are present. REEs are particularly important for the information technology sector, space technologies, and the defense industry. Even though they are used in small quantities, they occupy a critical position.

...............

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

Un gros prospect en Australie : Goschen Project

https://www.mining.com/web/australias-v ... s-project/Australia’s VHM gets US interest of up to $200 million for rare earths project

Reuters | October 6, 2025

Australia’s VHM said on Monday it has received a letter of interest from the US Export-Import Bank (EXIM) for up to $200 million in funding to support development of its Goschen rare earths and mineral sands project.

Earlier in the day, shares of the rare earths miner rose 6.1% to A$0.26, their highest since September 25.

The letter of interest from EXIM, the official export credit agency of the US government, proposes funding with a maximum repayment term of 12 years, as Western economies work to diversify the crucial rare earths supply chain away from top producer China.

US government officials have discussed taking a stake in Critical Metals Corp, which would give Washington a direct interest in the largest rare earths project in Greenland, Reuters reported on Saturday, citing people familiar with the matter.

VHM said EXIM has identified the Goschen project as a candidate under its Supply Chain Resiliency Initiative (SCRI), which aims to support projects that strengthen secure and diversified supply chains for US industries.

“VHM is well positioned to advance the Goschen project and become a globally significant solution to the current critical minerals supply chain issues”, CEO Andrew King said.

The Goschen project, located in Australia’s Victoria, is classified as a Tier 1 integrated rare earth and mineral sands project.

https://www.mining-technology.com/proje ... a/?cf-viewGoschen Project, Australia

he Goschen project is an open-pit mining development situated in North-West Victoria, Australia. VHM, an Australian critical minerals company, is developing the project.

The definitive feasibility study (DFS) for the project was concluded in March 2022 and was updated in March 2023. The project boasts a projected mining life of 20 years.

It will be a multi-phased development with the current developments focussing on Phase 1 and Phase 1A. The commencement of Phase 2 will depend on prevailing market conditions.

Phase 1 will focus on the production of a zircon-titania concentrate, along with rare earth mineral concentrate (REMC) products. Phase 1A will introduce a hydrometallurgical (hydromet) circuit, to convert the REMC into a mixed rare earth carbonate (MREC) product.

The development of Phase 2 will see the addition of a mineral separation plant (MSP) to further refine the zircon-titania concentrate into final products such as zircon, ilmenite, HiTi rutile, and leucoxene.

Operations for Phase 1 are scheduled to begin in the first half of 2025, with an estimated investment of A$376m ($249.9m). Subsequently, Phase 1A is expected to commence in the second half of 2025, with an additional investment of A$124m ($82.4m).

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

suite de 3 posts au dessus.

https://www.usinenouvelle.com/article/t ... e.N2239442Terres rares, batteries, extraterritorialité… Cinq questions sur les nouvelles restrictions d’exportation de la Chine

Le ministère de l’Économie chinois a annoncé, le 9 octobre, de nouvelles restrictions d’ampleur concernant l’exportation de terres rares et d’autres matériaux critiques, notamment pour les batteries. Cibles, extraterritorialité, usages, alternative… Tout ce qu’il faut savoir en cinq questions sur cette annonce explosive.

Nathan Mann 13 octobre 2025

Quelles sont les nouvelles cibles ?

«C’est un élargissement marqué du contrôle de la Chine sur l'intégralité de la chaîne de valeur des aimants permanents et des batteries», résume un observateur français qui suit de près la guerre des matériaux critiques menée par Pékin. Le 9 octobre, le ministère de l’Économie chinois (Mofcom) a publié plusieurs annonces, notifiant très précisément les biens qui nécessiteront l’obtention de permis avant d’être exportés hors de Chine à partir du 8 novembre prochain.

Parmi les cibles se trouvent la plupart des machines nécessaires pour séparer et raffiner des terres rares, ainsi que produire ou recycler les aimants permanents qui les contiennent (des cuves d’électrolyses aux fours d’hydrogénation des aimants en fin de vie, en passant par les broyeurs aéroliques). Diverses pièces de rechange et réactifs chimiques (tels que les solvants de séparation, sur lesquels la Chine a beaucoup d’avance) sont aussi concernés. L’échange d’expertise et de technologies, y compris «d’assemblage, de débogage, de maintenance, de réparation et de mise à niveau des lignes de production», est aussi soumis à autorisation, dès aujourd'hui. Cinq nouvelles terres rares s'ajoutent aussi à la liste des matières premières déjà visées : l’holmium, l’erbium, le thulium, l’europium et l’ytterbium.

- energy_isere

- Modérateur

- Messages : 102910

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Terres rares : Exploration et production miniére

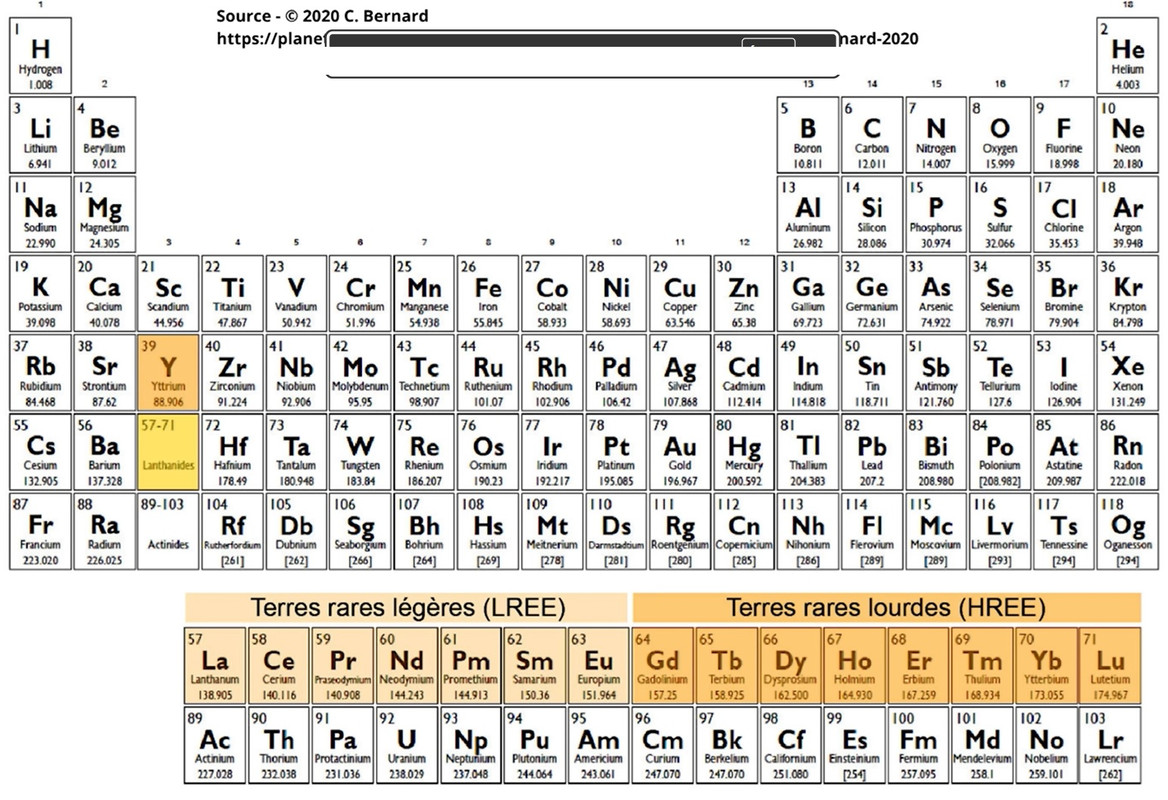

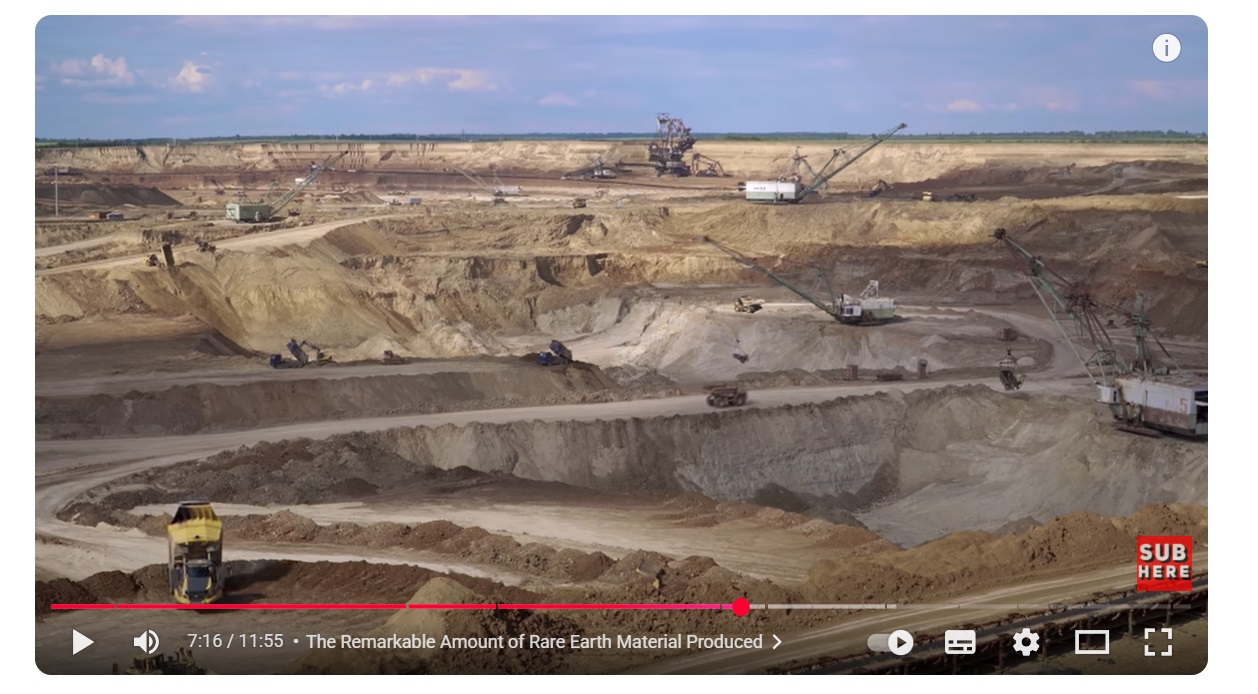

Petit rappel des terres rares dans la classification de Mendeleiv :