https://mining.com.au/us-to-fast-track- ... m-project/US to fast track Laramide’s uranium project

Maddison Elliott 07 May, 2025

Laramide Resources’ (ASX:LAM) La Jara Mesa Uranium Project, located in the Grants mineral Belt of New Mexico, has been added to the US Federal Permitting Dashboard, which prioritises reliable supplies of critical minerals.

This inclusion falls under President Donald Trump’s executive order to increase mineral production in North America.

Laramide says the designation identifies La Jara Mesa’s “strategic importance” to domestic uranium production.

The order paves the way for the secretary of defence to include mineral production as a priority industrial capability development area under the Industrial Base Analysis and Sustainment Program, positioning uranium and other critical minerals as a national security imperative.

By developing resources for domestic minerals, the government is aiming to lower barriers to entry and mobilise existing funding to support the private sector.

The designation is designed to enhance transparency and accountability by making environmental review timelines accessible to the public.

Laramide, which has a market capitalisation of $188.85 million, says government, industry and community stakeholders will be able to monitor progress of the project and it will ensure a more efficient and coordinated permitting process.

CEO Marc Henderson says the designation is a meaningful milestone that reflects both the strategic value of uranium to US energy security and the importance of developing domestic sources of supply.

“The enhanced transparency and coordination process will facilitate an efficient path forward to advancing La Jara Mesa to production,” he says.

Laramide Resources is an exploration company focusing on the development of high-quality uranium assets in Australia and the US.

[Nucléaire] Relance du nucléaire aux USA.... ou pas ?

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 14 janvier 2024 : viewtopic.php?p=2383135#p2383135

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

un autre projet d' Uranium US de la compagnie Energy Fuels :

https://www.energyfuels.com/roca-honda-project/Roca Honda Project

One of the largest and highest-grade uranium projects in the U.S.

Adjacent to General Atomics’ Mount Taylor Mine

Within trucking distance of the White Mesa Mill

Currently in advanced stages of permitting

Up to 2.7 million pounds of annual uranium production with a 9-year mine life

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 23 nov 2024 viewtopic.php?p=2402913#p2402913

https://www.world-nuclear-news.org/arti ... ed-reactorFirst concrete for US advanced reactor

Thursday, 8 May 2025

Kairos Power has announced the start of installation of nuclear safety-related concrete marking the start of "nuclear construction" for the Hermes Low-Power Demonstration Reactor project in Oak Ridge, Tennessee.

Concrete pouring begins in the first of Hermes' 51 foundational piers (Image: Kairos)

Kairos broke ground for the scaled demonstration of its KP-FHR fluoride salt-cooled high-temperature reactor technology last July, with excavation works completed in October. Safety-related construction activities, which are subject to oversight from the US Nuclear Regulatory Commission (NRC), formally began on 1 May, with the start of work on the piers that will form part of the building's foundation. Hermes will have 51 such piers, which are six feet (just under 2 metres) in diameter and will extend about 40 feet below ground, anchoring the building to bedrock.

Kairos Power CEO and co-founder Mike Laufer described the first safety-related concrete pour for a US advanced reactor under an NRC construction permit as a major milestone. "This achievement reflects the value of our iterative development process to meet the necessary nuclear quality standards and provide crucial real cost information that gives confidence to our customers. It is a testament to the hard work of our dedicated team and represents an enormous amount of learning and progress," he said.

A large auger is used to drill the pier shafts (Image: Kairos)

The concrete pour was the culmination of several months of preparation, Kairos said, coming after programmes to test the drilled pier installation process and refine the company's nuclear quality assurance programme. A full-scale test pier was completed in November, and 70 piers have now been drilled for Kairos Power's ETU 3.0 non-nuclear engineering test unit, which is being built adjacent to the Hermes site as part of Kairos's iterative approach for the development of its KP-FHR technology. It says this has enabled the team, led by Barnard Construction Company, Inc, to become proficient at installing piers using quality control checklists similar to those that will be used for Hermes.

Quality checking rebar for the pier (Image: Kairos)

The Hermes reactor will use tri-structural isotropic (TRISO) uranium fuel and a mixture of lithium fluoride and beryllium fluoride salts known as Flibe as its coolant. This combination yields robust inherent safety while simplifying the reactor's design, Kairos said.

Hermes, which is supported by risk reduction funding from the US Department of Energy's Advanced Reactor Demonstration Program, is the first non-light-water reactor to be permitted in the USA in more than 50 years. It will not produce electricity, but Hermes 2 - a two 35 MWt-unit plant for which the US Nuclear Regulatory Commission issued a construction permit in November - will include a power generation system. The commercial deployment of the reactor is supported by a master plant development agreement signed with Google in October 2024, for power from a fleet of up to 500 MW of capacity by 2035.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 21 janvier 2024 : viewtopic.php?p=2383729#p2383729

https://www.miningweekly.com/article/sc ... 2025-05-06Scoping study confirms robust economics for Tallahassee uranium project

6th May 2025 By: Mariaan Webb

ASX-listed Global Uranium and Enrichment (GUE) has released a scoping study for the Hansen deposit, part of its Tallahassee uranium project in Colorado, US, confirming a technically viable and economically attractive development opportunity.

The study supports a seven-year mine life, with average production of 1.8-million pounds a year of uranium oxide (U₃O₈). The base case scenario at a uranium price of $90/lb delivers a pre-tax net present value (NPV) of $203-million and an internal rate of return (IRR) of 93%. At $110/lb, the NPV increases to $365-million and the IRR to 145%.

MD Andrew Ferrier described the Hansen deposit as a standout opportunity within the world-class Tallahassee project, which is home to one of the largest undeveloped uranium deposits in the US.

"This scoping study and the impressive results generated, highlighted by a pre-tax IRR of 93% and an NPV of $203-million at $90/lb for U₃O₈, sets out a technically and environmentally viable pathway for Global Uranium to progress its development as we continue to execute on our growth strategy of building a 100-million-pound uranium portfolio."

Pre-production capital costs are estimated at $76-million, with cash operating costs of $58.65/lb U₃O₈, based on a contract ore processing scenario. The mining target comprises 15.2-million pounds of U₃O₈ contained in 5.7-million tonnes of material grading 0.12% U₃O₈, of which 12.9-million pounds will be recovered after beneficiation.

.........................

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

https://www.world-nuclear-news.org/arti ... proceduresUtah uranium project fast-tracked under US emergency procedures

Wednesday, 14 May 2025

The US Department of the Interior has announced it will expedite the permitting review of Anfield Energy's Velvet-Wood mine in Utah under newly established emergency procedures, with a completion timeline of 14 days for an accelerated environmental review by the Bureau of Land Management.

The accelerated review is part of a strategic response to the national energy emergency declared by President Donald Trump in January, the department said, and is expected to "significantly contribute to meeting urgent energy demands" as well as addressing national energy security concerns. Velvet-Wood is the first uranium project to be prioritised under the emergency procedures.

"The expedited mining project review represents exactly the kind of decisive action we need to secure our energy future," said Secretary of the Interior Doug Burgum. "By cutting needless delays, we’re supporting good-paying American jobs while strengthening our national security and putting the country on a path to true energy independence."

Anfield acquired the Velvet-Wood uranium and vanadium mine from Uranium One in 2015. Some 4 million pounds U3O8 (1539 tU) - as well as 5 million pounds of V2O5 - were recovered from the Velvet deposit between 1979 and 1984 by previous owner Atlas Minerals. The combined Velvet and Wood historical mines are currently estimated to contain 4.6 million pounds U3O8 of measured and indicated resources and inferred resources of 552,000 pounds U3O8.

Anfield submitted a Plan of Operation for the mine to the State of Utah and the Bureau of Land Management in May 2024. It is advancing Velvet-Wood towards production-ready status concurrently with the Shootaring Canyon mill. The Plan of Operation includes specific operating actions and controls, reclamation actions, an estimate of reclamation surety based on third-party costs and technical bases for how the actions meet state and federal regulatory requirements.

Anfield CEO Corey Dias said the company was pleased that Velvet-Wood had been selected for expedited permitting. "As a past-producing uranium and vanadium mine with a small environmental footprint, Velvet-Wood is well-suited for this accelerated review," he said. "This marks a major milestone for Anfield as we look to play a meaningful role in rebuilding America's domestic uranium and vanadium supply chain and reducing reliance on imports from Russia and China."

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

https://www.revolution-energetique.com/ ... ucleaires/Google finance le développement de trois nouvelles centrales nucléaires

Par Kevin CHAMPEAU le 13 mai 2025

On connaissait l’intérêt de Google vis-à-vis des mini réacteurs nucléaires SMR. Le géant américain vient de montrer qu’il croyait également au nucléaire plus conventionnel, en finançant le développement de grandes centrales.

Google continue d’investir dans le nucléaire. Après un récent accord signé avec Kairos Power, pour l’installation de 6 à 7 mini réacteurs nucléaires SMR, le géant américain vient d’accepter de financer les premiers stades de développement de trois nouveaux sites nucléaires, portés par Elementl Power. Si aucun élément n’a été officialisé sur le montant de l’investissement, ou la localisation des trois sites, on sait que chacune des centrales aurait une puissance d’au moins 600 MW. Dans le cadre de cet accord, Google bénéficie d’une option d’exploitation commerciale une fois les sites opérationnels.

Pour l’heure, Elementl Power, qui a été fondée en 2022, n’a encore aucun site à son actif, et n’a pas annoncé de choix en matière de technologie de réacteur. L’entreprise se laisse donc la possibilité de choisir la technologie la plus avancée au démarrage de la construction. L’entreprise vise la mise en service de 10 GW de centrales nucléaires sur le réseau américain d’ici 2035.

Le nucléaire, porté par les géants de l’IA

Cette nouvelle témoigne, une nouvelle fois, de l’engouement des GAFAM pour l’énergie issue du nucléaire. Avec le développement massif de l’intelligence artificielle, les géants de la tech se sont lancés dans une course contre-la-montre pour augmenter les capacités de production d’énergie. Récemment, Jack Clark, le co-fondateur de la société Anthropic, spécialisée dans l’intelligence artificielle, a indiqué que pour suivre la croissance de l’IA, il faudrait pas moins de 50 GW de puissance électrique supplémentaire d’ici 2027.

Néanmoins, pour faire face à ces besoins grandissants, pas question d’avoir recours aux énergies fossiles. Les géants du numérique s’emploient donc, un à un, à multiplier les investissements dans la production d’énergie décarbonée, et en particulier celle issue du nucléaire. Ainsi, Microsoft vient de s’approprier la future production électrique du réacteur n° 1 de la centrale Three Mile Island, tandis qu’Amazon s’apprête à construire l’un de ses data center à proximité directe d’une centrale nucléaire, et vient d’investir 500 millions de dollars dans une startup spécialisée dans les SMR.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

https://www.rfi.fr/fr/am%C3%A9riques/20 ... orc%C3%A9eÉtats-Unis: pour alimenter l'IA, Trump veut faire renaître le nucléaire civil à marche forcée

Ce vendredi 23 mai, Donald Trump a signé quatre décrets destinés, selon un conseiller, à lancer une « renaissance » du nucléaire civil aux États-Unis, avec pour ambition de quadrupler la production d'énergie nucléaire dans les 25 années à venir. Pour le secrétaire à l'Intérieur, Doug Burgum, face à la Chine, il s'agit de « gagner le duel de l'intelligence artificielle » ; celle-ci étant une technologie particulièrement énergivore.

RFI le : 24/05/2025

« Le temps du nucléaire est venu » a déclaré Donald Trump durant un point presse. Et il a mis ses paroles à exécution. Les décrets signés ce vendredi 23 mai accélèrent d'abord les essais de réacteurs. Ceux-ci pourront désormais être construits plus facilement sur des terrains appartenant au gouvernement fédéral. Une prérogative donnée aux ministères de l'Énergie et de la Défense.

Donald Trump prévoit aussi de doper l'extraction et l'enrichissement d'uranium, que les États-Unis veulent produire à domicile depuis l'invasion russe en Ukraine. Enfin dernières mesures : l'examen d'une demande de construction d'un nouveau réacteur ne devra pas dépasser dix-huit mois et la Commission de réglementation nucléaire sera réformée.

Premiers tests d'ici janvier 2029 ?

Objectif de ces décrets : « Gagner le duel de l'intelligence artificielle avec la Chine », selon le ministre de l'intérieur Doug Burgum. Donald Trump promet des procédures « très rapides et très sûres ». Il ambitionne d' augmenter la capacité de production d'énergie nucléaire d'environ 100 à 400 gigawatts d'ici 2050. Les premiers tests et déploiements de réacteurs nucléaires pourraient avoir lieu d'ici janvier 2029.

Les Etats-Unis, écrit l'AFP, restent la première puissance nucléaire civile mondiale, avec 94 réacteurs opérationnels mais leur âge moyen croît (42 ans).

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 17 mai 2025 : viewtopic.php?p=2411513#p2411513

https://www.mining.com/web/us-approves- ... al-review/US approves Utah uranium mine after two-week environmental review

Reuters | May 23, 2025

The Trump administration approved Anfield Energy’s proposed Velvet-Wood uranium mine project in Utah on Friday after a rapid 14-day environmental review as part of a new process to fast-track permitting of energy and mining projects.

Such studies typically take years because of the large potential environmental consequences of uranium mining.

The Canadian company’s project is the first approved under an emergency process for the Interior Department to permit energy facilities on federal lands. The new procedures are in response to President Donald Trump’s national energy emergency declaration, made on his first day in office in January in an effort to boost domestic energy supplies, bring down fuel prices and bolster national security.

Anfield filed its plan of operations for the mine on April 1, according to documents on an Interior Department website.

“This approval marks a turning point in how we secure America’s mineral future,” Interior Secretary Doug Burgum said in a statement. “By streamlining the review process for critical mineral projects like Velvet-Wood, we’re reducing dependence on foreign adversaries and ensuring our military, medical and energy sectors have the resources they need to thrive. This is mineral security in action.”

Anfield was not immediately available for comment.

The Velvet-Wood mine project in San Juan County will produce uranium, used in both nuclear energy and nuclear weapons production, as well as vanadium, a metal than can be used in batteries or to strengthen steel and other alloys.

It is located at the site of a previous mining operation.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 25 dec 2023 viewtopic.php?p=2382148#p2382148

le site du minier : https://www.energyfuels.com/

il y a une vidéo de 9mn qui présente l'activité de Pinyon mine et de la concentration et extraction des terres rares et Vanadium présentes avec l' Uranium à Mesa Mill

https://www.mining.com/energy-fuels-sha ... um-output/Energy Fuels shares climb on record uranium output

Staff Writer | June 3, 2025

Energy Fuels shares rose more than 8% on Tuesday after the company reported its highest-ever monthly uranium production.

In May, the company’s Pinyon Plain mine in Arizona produced nearly 260,000 lb. of uranium oxide (U₃O₈), a new monthly record. The strong output pushed Energy Fuels’ share price to C$7.23 ($5.27), up 8.2% on the Toronto Stock Exchange, giving the company a market cap of nearly C$1.1 billion ($770 million).

So far this year, Pinyon Plain has yielded 478,384 lb. of U₃O₈ from approximately 12,461 tons of ore, averaging a grade of 1.92% U₃O₈. That translates to a five-month production rate of about 96,000 lb. per month, with output surging to over 200,000 lb. per month in April and May.

However, the company cautioned that such high production levels are unlikely to continue.

Energy Fuels cited constraints including a shortage of ore haulage trucks, compliance requirements under its agreement with the Navajo Nation, stockpile limits, and the need for further underground development and exploration to access new ore zones.

In addition to its production update, Energy Fuels released a new technical report for its Bullfrog project in Utah, currently in the permitting stage.

The report, dated May 2025, outlined an indicated resource of 10.5 million lb. in U₃O₈ equivalent at an average grade of 0.30%, and an inferred resource of 3.4 million lb. at 0.28%. Compared to the previous report from February 2022, this marks a 15% increase in the indicated category and a 70% jump in inferred.

Energy Fuels also owns the White Mesa Mill in Utah, the only fully licensed and operating conventional uranium mill in the United States.

le site du minier : https://www.energyfuels.com/

il y a une vidéo de 9mn qui présente l'activité de Pinyon mine et de la concentration et extraction des terres rares et Vanadium présentes avec l' Uranium à Mesa Mill

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

https://www.nuklearforum.ch/fr/nouvelle ... er-80-ans/États-Unis: Oconee peut fonctionner 80 ans

L’autorité de sûreté nucléaire américaine (NRC) a accédé à la demande déposée par Duke Energy Carolinas LLC concernant la prolongation de 20 ans du permis d’exploitation des tranches nucléaires Oconee 1, 2 et 3. Les trois réacteurs peuvent désormais fonctionner 80 ans, tout comme c’est déjà le cas de neuf tranches.

7 avr. 2025

Source: Duke Energy

Aux États-Unis, les tranches nucléaires bénéficient d'une autorisation initiale de fonctionnement de 40 ans – une durée qui se base sur des restrictions d’ordre économique et non technique. Le premier renouvellement (Initial License Renewal) permet de prolonger cette durée de 20 ans, et de la passer à 60 ans. Un second renouvellement (Subsequent License Renewal) passe la durée à 80 ans.

L’examen par la NRC de la Subsequent License Renewal Application de Duke Energy Carolinas s’est déroulé en deux étapes. En décembre 2022, un rapport sur l’évaluation de la sécurité avait été publié, puis en février 2025 une déclaration définitive de compatibilité environnementale. Le renouvellement des autorisations permettra de faire fonctionner Oconee 1 jusqu’au 6 février 2053, Oconee 2 jusqu’au 6 octobre 2053 et Oconee 3 jusqu’au 19 juillet 2054.

Grâce à la nouvelle prolongation du permis d’exploitation d’Oconee 1, 2 et 3 douze réacteurs nucléaires peuvent désormais produire de l’électricité durant 80 ans: (Monticello 1, Turkey-Point 3 et 4, Peach-Bottom 2 et 3, Surry 1 et 2 ainsi que North-Anna 1 et 2). Cinq Subsequent License Renewal Applications concernant dix réacteurs sont en cours d’examen par la NRC.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

L'Etat de New York lance le projet d'une nouvelle centrale nucléaire, un tournant

Connaissance des Énergies avec AFP le 23 juin 2025

La gouverneure de l'Etat de New York, Kathy Hochul, a annoncé lundi avoir initié le projet d'une nouvelle centrale nucléaire, dans un pays qui n'a plus vu de mise en chantier dans le secteur depuis 2009, une nouvelle illustration du virage pris par les Etats-Unis.

La responsable démocrate a donné mission à l'Agence de l'énergie de cet Etat de "développer et de construire une centrale nucléaire de nouvelle génération dans le nord de l'Etat de New York", a-t-elle indiqué lors d'une conférence de presse.

La décision marque une rupture avec ses prédécesseurs, en particulier l'ancien gouverneur démocrate Andrew Cuomo, aujourd'hui candidat à la mairie de New York, qui avait négocié la fermeture, en 2021, de la centrale d'Indian Point, jugée trop proche de la métropole américaine (environ 50 km).

Plusieurs opérateurs ont initié ces derniers mois la réouverture de centrales existantes inactives ou en voie de fermeture aux Etats-Unis, mais il n'était, jusqu'ici, pas encore question de construire un nouveau réacteur.

La gouverneure de New York souhaite que cette nouvelle centrale ait une capacité d'un gigawatt, équivalent de la production d'une centrale conventionnelle, sur un site encore à déterminer.

Elle n'exclut pas de bâtir d'autres réacteurs dans les années à venir.

Le groupe énergétique américain Constellation s'est dit intéressé par le projet.

La gouverneure est ouverte à un partenariat avec des investisseurs privés, tout en n'écartant pas un financement public à 100%.

Sollicités par l'AFP, ses services ont précisé que le choix de la technologie utilisée pour la nouvelle centrale n'avait pas encore été effectué, entre un réacteur unique et de petits réacteurs de nouvelle génération, les SMR (small modular reactor).

Beaucoup de ces derniers sont en cours de développement mais aucun n'a encore obtenu de permis de construire du régulateur américain du nucléaire, la NRC (Nuclear regulatory commission).

- Rater le train -

Depuis le grave incident du site de Three Mile Island (Pennsylvanie), qui a failli provoquer, en mars 1979, la rupture de la cuve d'un réacteur et la contamination radioactive de toute une région, un seul permis a été délivré aux Etats-Unis.

Il concernait les unités 3 et 4 du site Vogtle, situé près de Waynesboro (Géorgie). L'unité 3 a été mise en service en juillet 2023 et l'unité 4 en avril 2024.

Longtemps impopulaire, notamment du fait d'une série d'accidents, à Three Mile Island, Tchernobyl (1986) et Fukushima (2011), le nucléaire connaît un regain d'intérêt à travers le monde.

Ce retour en grâce s'explique par la redistribution des approvisionnements en énergie du fait de l'invasion russe en Ukraine, de la recherche d'une source d'électricité à faibles émissions, mais aussi de l'appétit insatiable de l'informatique.

Le développement de l'informatique à distance (cloud) et de l'intelligence artificielle (IA) ont démultiplié les besoins en centres de stockage et de gestion des données (data centers), très gourmands en électricité.

Les géants de l'IA, de Google à Microsoft, en passant par Meta, ont, pour beaucoup, passé des accords de fourniture d'électricité provenant du nucléaire, soit via le redémarrage de centrales soit des SMR.

"Nous avons attiré certaines des entreprises les plus innovantes au monde", a souligné Kathy Hochul. "Elles arrivent mais, maintenant, notre défi est de leur fournir l'électricité pour prospérer."

Le nucléaire "est de retour, et si nous ne montons pas à bord, le train va partir sans nous" et "ces sociétés iront ailleurs", a-t-elle martelé.

Plusieurs centres de données sont en cours de réalisation dans l'Etat, notamment à Alabama (nord de l'Etat), où le Texan Stream Data Centers prévoit de consacrer 6,3 milliards de dollars à un nouveau site.

Par ailleurs, incités par la loi IRA (Inflation Reduction Act), qui débloque des subventions et des avantages fiscaux, plusieurs grands acteurs technologiques se sont engagés à investir dans l'Etat de New York.

Le fabricant de semi-conducteurs Micron a promis de consacrer 100 milliards de dollars sur vingt ans.

Kathy Hochul a dit avoir conscience que le nucléaire avait ses opposants, mais a rappelé que la fermeture d'Indian Point avait accru la consommation d'énergie fossile de l'Etat pour assurer ses besoins en électricité.

Quant aux craintes liées aux radiations, "ce ne sera pas la centrale de vos grands-parents", a expliqué la gouverneure, mais "un modèle du XXIe siècle avec la sécurité pour priorité". "Je ne veux pas vivre dans un monde où les gens ont peur."

https://www.connaissancedesenergies.org ... ant-250623

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 20 avril 2025 : viewtopic.php?p=2410140#p2410140

https://www.world-nuclear-news.org/arti ... for-reviewThe US Nuclear Regulatory Commission has accepted for review the construction permit application from Tennessee Valley Authority for a BWRX-300 small modular reactor at the Clinch River site in Tennessee. The regulator said it expects to complete its review within 17 months.

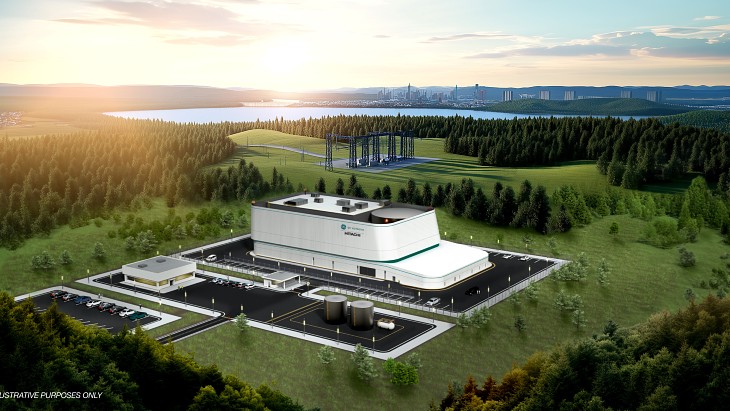

An illustration of a BWRX-300 plant (Image: GVH/TVA)

The Tennessee Valley Authority (TVA) submitted its application for Clinch River to the NRC in May, making it the first utility in the USA to submit a construction permit application for GE Vernova Hitachi Nuclear Energy's BWRX-300 technology.

"This is an exciting step to bringing the nation’s first utility-led SMR online," said TVA President and CEO Don Moul. "As the first utility in the United States to have a construction permit application under review by the Nuclear Regulatory Commission for the BWRX-300 reactor, this will create a path for other utilities to deploy the reactor - ensuring energy security and reliable electricity for all."

TVA anticipates preliminary site preparation work could begin as early as next year while the NRC reviews the company's construction permit application.

TVA has invested in the standard design of the BWRX-300 as part of a technical collaboration agreement with Ontario Power Generation, Polish company Synthos Green Energy and GE Vernova Hitachi Nuclear Energy. It is also leading a coalition of utility companies and supply chain partners that has applied for a grant of USD800 million from the US Department of Energy to accelerate construction of the USA's first small modular reactor, and a USD8 million grant to support the cost of the licence review.

Small modular reactors - SMRs - are reactors with a smaller and more modular design than the USA's currently operating commercial nuclear fleet. As well as offering safety enhancements, their smaller footprint and modular design means they can potentially be built more quickly, are easier to operate and better fit into the landscape due to their compact size, TVA said.

TVA already holds an early site permit for SMRs at the Clinch River site, certifying that the site near Oak Ridge, Tennessee, is suitable for the construction of a nuclear power plant from the point of view of site safety, environmental impact and emergency planning. It has also completed and submitted an Environmental Report for the project to the Nuclear Regulatory Commission, and says site preparation for the SMR could begin as soon as 2026.

The BWRX-300 design is a 300 MWe water-cooled, natural circulation SMR with passive safety systems that leverages the design and licensing basis of the ESBWR boiling water reactor developed by GEH. In May, the Canadian province of Ontario approved OPG to start construction of the first of four BWRX-300 units planned at the Darlington New Nuclear Project site.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

Grosses ambitions dans le nucléaire civil aux USA en particulier en Pennsylvanie :

https://www.world-nuclear-news.org/arti ... in-the-usaWestinghouse plans ten AP1000 reactors in the USA

Friday, 18 July 2025

Westinghouse plans to start construction of the first of ten new AP1000 reactors in the USA by 2030, interim CEO Dan Sumner told President Donald Trump at the inaugural Pennsylvania Energy Summit and Expo in Pittsburgh.

(Image: Westinghouse)

Four executive orders signed by President Trump on 23 May aim to support the entire US nuclear supply chain and the ambition to quadruple the nation's nuclear energy capacity by 2050. Three of the orders are firmly focused on reforms that will boost the civil nuclear energy sector. The fourth one aims to ensure the rapid development, deployment, and use of advanced nuclear technologies to support national security objectives, including AI data centres at Department of Energy facilities.

Hosted by US Senator David McCormick, the Pennsylvania Energy Summit and Expo on 15 July highlighted the state's significant role in shaping the future of AI and energy innovation. Dan Sumner, interim CEO of Pittsburgh-headquartered Westinghouse, took part in a CEO Roundtable attended by President Trump, top Administration officials, including US Energy Secretary Chris Wright, and US Secretary of the Interior Doug Burgum.

"We've taken the call-to-action under your executive order to partner with companies across our industry to mobilise a plan to deliver ten AP1000 reactors in the US with construction to begin by 2030," Sumner said. "When we deploy a fleet aligned to your vision, we'll drive USD75 billion of economic value across the United States with USD6 billion of value here in Pennsylvania. Implementing your vision will create or sustain over 55,000 jobs across the country and over 15,000 jobs in the Commonwealth alone, and these are great jobs across manufacturing, engineering and construction."

The event showcased a USD92 billion commitment to cutting-edge AI and energy initiatives.

Utility Constellation announced that it will create 3,000 jobs per year as a result of a USD2.4 billion investment to uprate the Limerick nuclear power plant by an additional 340 MWe.

"We commend state and federal leaders for helping to make these investments possible and for recognising the unique value of reliable and safe nuclear energy to power our economy and bolster our nation's energy security," said Constellation President and CEO Joe Dominguez.

"As the nation's second largest energy producer and a global nuclear power leader, Pennsylvania is uniquely positioned to deliver the abundant, affordable energy that growing AI and advanced manufacturing sectors demand," said Senator McCormick. "We have the skilled workforce to build and operate this critical infrastructure, world-class universities driving innovation, and strategic proximity to over half the country's population."

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

https://oilprice.com/Energy/Energy-Gene ... tucky.htmlGeneral Matter to Build $1.5 Billion Uranium Plant in Kentucky

By ZeroHedge - Aug 08, 2025

General Matter will build a $1.5 billion uranium enrichment facility in Kentucky, producing both LEU and HALEU for advanced nuclear reactors.

The project, backed by Founders Fund and Peter Thiel, is the largest economic development initiative in Western Kentucky and will create over 140 permanent jobs.

The initiative aligns with Trump administration efforts to reduce U.S. dependence on China for critical minerals and enhance national security.

................

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: [Nucléaire] Relance du nucléaire aux USA.... ou pas ?

suite de ce post du 10 mai 2025: viewtopic.php?p=2411063#p2411063

https://lenergeek.com/2025/08/21/google ... leaire-ia/IA : Google mise sur un réacteur nucléaire de nouvelle génération pour alimenter ses centres de données

Google va utiliser un réacteur nucléaire de dernière génération pour faire face à la demande en énergie des centres de données dédiés à l’IA.

Jean-Baptiste Giraud Publié le 21 août 2025

Développer l’intelligence artificielle (IA) demande des ressources en énergie très importantes. Face à ce constat, Google vient de prendre une décision radicale : miser sur un réacteur nucléaire de nouvelle génération pour alimenter les centres de données.

Pour développer l’IA, Google mise sur un réacteur nucléaire de dernière génération

Google vient d’officialiser un partenariat structurant avec Kairos Power et la Tennessee Valley Authority (TVA) pour alimenter ses centres de données dédiés à l’IA grâce à un réacteur nucléaire avancé baptisé Hermes 2. L’installation, située à Oak Ridge, doit injecter 50 MW sur le réseau de TVA dès 2030, énergie destinée aux data centers de Google dans le Tennessee et l’Alabama. Dans un marché électrique tendu par l’explosion de l’IA, Google parie sur la constance de la production nucléaire et sur la prévisibilité des coûts.

L’accord avec TVA et Kairos Power garantit, d’abord, une électricité « ferme » : la puissance de 50 MW sera disponible 24 heures sur 24 afin de soutenir l’activité IA. Ensuite, cette électricité proviendra d’un réacteur nucléaire de génération IV refroidi au sel fondu, un choix qui permet de fonctionner à basse pression et peut réduire les coûts de construction tout en améliorant la sûreté. Parce que Google doit concilier performance et sobriété carbone, le recours au nucléaire s’inscrit aussi dans ses objectifs climatiques : l’entreprise acquerra les attributs d’énergie propre associés afin de « verdir » ses centres de données localement, heure par heure.

Le partenariat vise une montée en puissance jusqu’à 500 MW d’ici 2035, ce qui traduit une anticipation des besoins IA à moyen terme. Cette trajectoire donne de la visibilité aux équipes d’ingénierie comme aux fournisseurs, donc elle réduit potentiellement le coût unitaire des futurs réacteurs modulaires. Ainsi, Google veut une base électrique robuste, et il investit sa demande de long terme pour catalyser une filière.

Pourquoi ce réacteur de nouvelle génération coche les cases techniques de Google

Le choix d’Hermes 2 n’est pas anodin : la Nuclear Regulatory Commission a accordé en novembre 2024 un permis de construction. Le design KP-FHR de Kairos Power utilise un sel fondu comme caloporteur et fonctionne à basse pression, ce qui peut simplifier certains éléments d’ingénierie. En outre, de nombreux réacteurs avancés, dont celui-là, envisagent d’utiliser du HALEU (uranium faiblement enrichi à haut taux), carburant permettant une compacité accrue, des cycles plus longs et moins de déchets. Cette caractéristique, bien qu’elle nécessite de structurer une chaîne d’approvisionnement, intéresse Google car elle promet une disponibilité opérationnelle élevée, donc une meilleure adéquation aux profils de charge des centres IA.

Pour Google, l’arbitrage repose sur trois réalités. Premièrement, l’IA rend la charge énergétique plus dense et plus continue. Les centres de données ont besoin d’un socle stable, complémentaire des renouvelables variables ; le nucléaire offre ce socle et l’accord de 50 MW en est le premier étage. Deuxièmement, Google veut sécuriser ses coûts : un PPA de long terme, adossé à une ressource non exposée à la volatilité météorologique. Troisièmement, Google capitalise sur un signal réglementaire positif : permis de construction obtenu en 2024 et engagement d’une grande régie publique.